The United States Food and Drug Administration (FDA) approved 45 new drugs in 2022.1 Though the number of approvals was the lowest since 2016, nearly half of them are expected to become blockbusters, meaning greater than $1 billion in annual sales.2 The approved cohort is impressive, with expectations particularly high for Bristol Myers Squibb’s psoriasis therapy, Alnylam’s ATTR polyneuropathy drug, and Gilead’s new HIV treatment. The FDA also approved a record five cell and gene therapies last year, bringing total approved cell and gene therapies to 16.3, 4 Among them, bluebird bio’s beta thalassemia gene therapy and CLS-uniQure co-developed Hemgenix for Hemophilia B stand out.

In this piece, we look ahead to 2023 and what could be more exciting developments in the biopharmaceuticals market. We highlight three companies in the Global X Genomics & Biotechnology ETF (GNOM) and the Global X Aging Population ETF (AGNG) with noteworthy drugs up for approval.

Key Takeaways:

- Eli Lilly: Extended approval for Mounjaro could lead to the most successful drug ever.

- CRISPR Therapeutics: Forging a path with exa-cel, the first gene editing treatment.

- Sarepta Therapeutics: SRP-9001 may be the first cure for Duchenne muscular dystrophy.

Eli Lilly: Mounjaro Can Tap into High-Growth Obesity Market

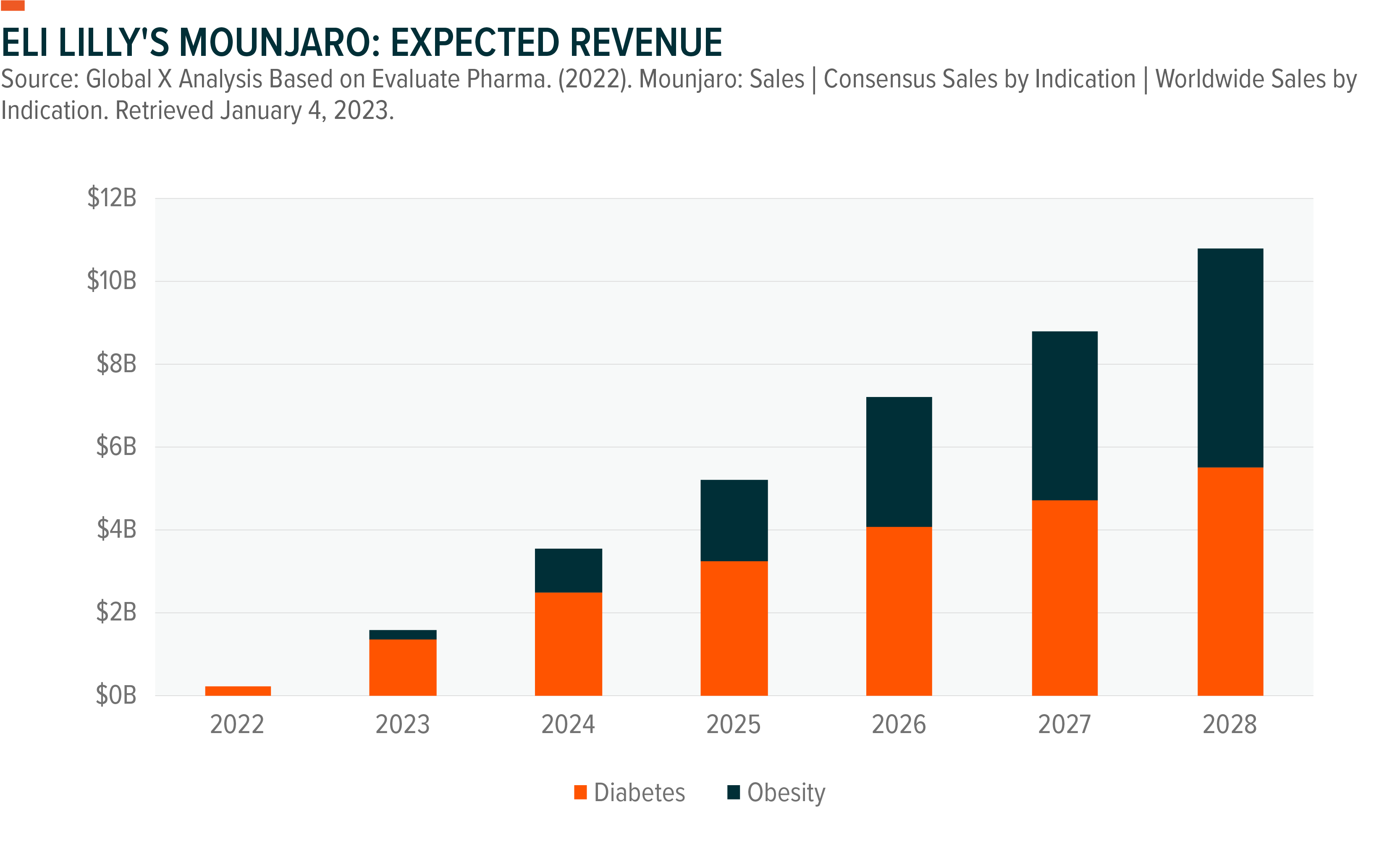

In 2022, the FDA and the European Medicines Agency (EMA) approved Eli Lilly’s Mounjaro (Trizepatide) for Type 2 diabetes. Eli Lilly’s endocrinology portfolio comprised an estimated 47% of its total revenue in 2022, led by blockbusters Trulicity and Jardiance.5 The two drugs brought in a combined $10 billion last year.6 With its next-generation approval, Eli Lilly has a road towards long-term success in the $64 billion diabetes market.7

In 2023, Eli Lilly seeks expanded approval of Mounjaro for obesity, a move that would nearly double the expected sales for the drug by 2028.8 Expanded approval would play a key role in estimated annual peak sales of $25 billion for Mounjaro, which would make it the most successful drug ever, topping AbbVie’s Humira, which achieved in an estimated $22 billion in 2022.9, 10

Diabetes & Obesity: Mounjaro Capitalizes on Converging Categories

Mounjaro is a dual-action drug that activates the GLP-1 [glucagon-like peptide-1] and GIP [glucose-dependent insulinotropic polypeptide] receptors, both of which stimulate the body to produce more insulin when a patient’s blood sugar levels start to rise. The treatment is injected once a week, with a dosage adjustable to the patient’s needs.

These drug categories also help curb hunger, opening its potential use to the obesity market, which is expected to be worth over $50 billion by the end of the decade.11 The obesity market is expected to grow at a compound annual growth rate (CAGR) of 33% from $2.7 billion, propelled by the broader shift in healthcare to focus more on causes of illnesses like diabetes and cardiovascular disease rather than treatment of their symptoms.12 Prediabetes patients, for example, could benefit from such treatments. Estimates show that for every type 2 diabetic, a population of 30 million patients in the United States, there are about twice as many prediabetics.13, 14

Clinical Trial Data Suggest Mounjaro Can Be an Obesity Market Leader

In its SURMOUNT-1 clinical trial, Lilly reported that Mounjaro helped patients achieve average weight reductions of 16%, 21.4%, and 22.5% at 5mg, 10mg, and 15mg doses, respectively.15 The results topped Novo Nordisk’s diabetes drug Ozempic, marketed as Wegovy to obesity patients, which in clinical trials helped patients lose an average 12.4% of their body weight versus placebo.16

The medical community is excited about Mounjaro and what it could mean for the obesity market, as its efficacy data compares favorably to traditional surgical methods. Average weight reduction for sleeve gastrectomy surgery and gastric bypass are 20% and 25-30% respectively, but surgery-related risks are high, as are their price tags at upwards of $35,000.17

CRISPR Therapeutics’ Exa-Cel Can Help Validate Gene Editing Market

Gene editing frontrunner CRISPR Therapeutics, in collaboration with Vertex Pharmaceuticals, is one step closer to bringing its investigational gene editing treatment, exa-cel, to the market. This treatment allows scientists to edit parts of the genome by removing, adding, or altering sections of a patient’s DNA sequence.

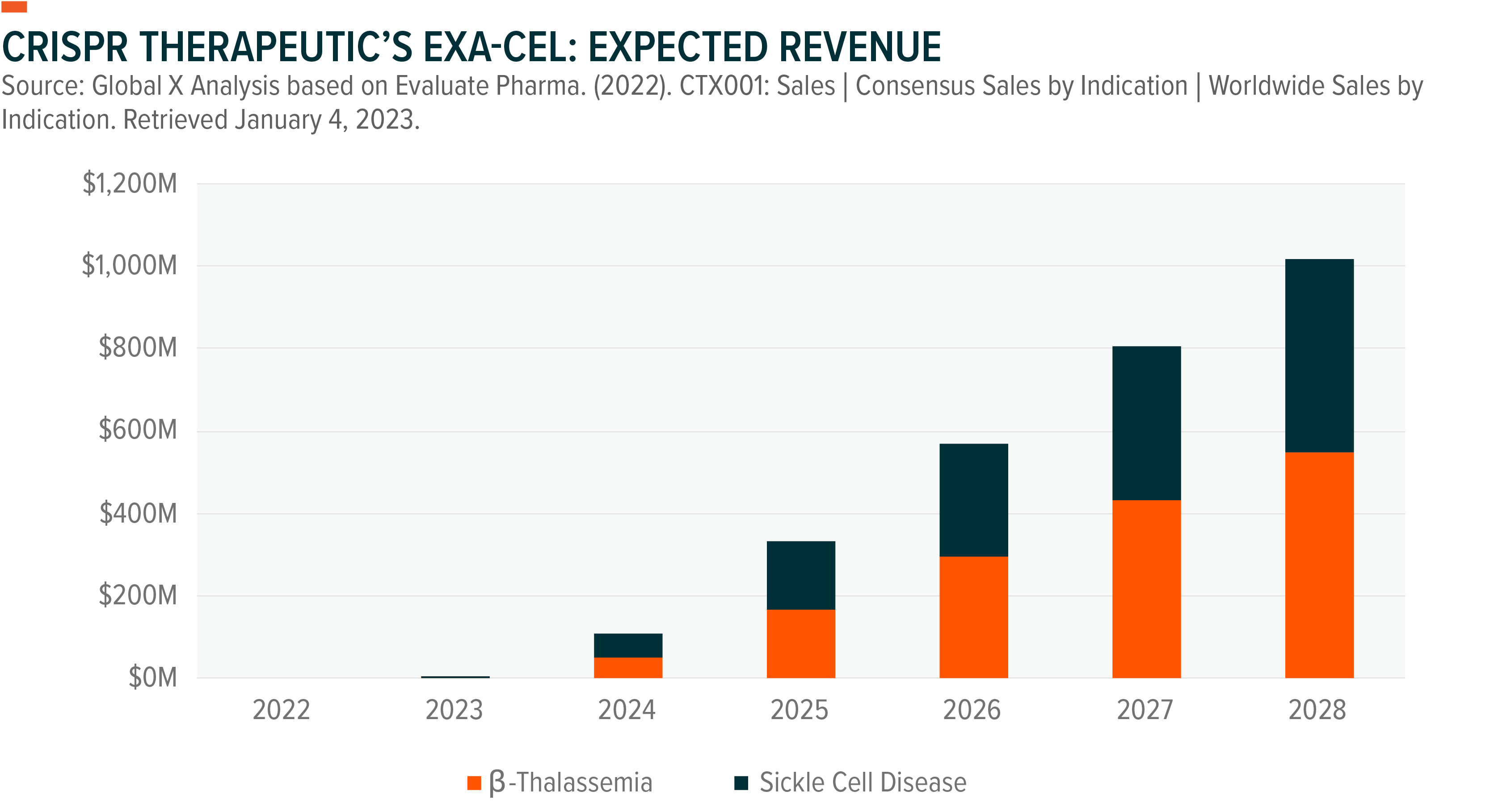

If approved, exa-cel’s sales are expected to top $1 billion in 2028, with expected market share of 20% in sickle cell and 36% in thalassemia.18, 19 An approval would validate the promise of gene editing techniques and open a market estimated to be worth $5.7 billion in 2028 with far-reaching potential across a host of genetic disorders.20 In addition, the FDA’s review of exa-cel will establish regulatory precedents and, if approved, pricing benchmarks for gene editing that will be key in the field’s long-term success.

Exa-cel: A Curative Option for Sickle Cell Disease and Beta-Thalassemia

Exa-cel is a potential one-time treatment for sickle cell disease and β-Thalassemia, two blood-based disorders that distort the production and structure of hemoglobin, the protein in red blood cells that carries oxygen. Without enough normal hemoglobin, red blood cells change shape, allowing them to clump together and block blood flow. Patients often require frequent transfusions to restore blood volume levels and oxygen flow. Exa-cel edits the patient’s stem cells to produce higher levels of hemoglobin, helping to alleviate or eliminate transfusion requirements for patients.

In its latest update, CRISPR and Vertex reported that 42 out of 44 participating patients with β-Thalassemia are transfusion free after treatment, with follow-up ranging from 1.2 to 37.2 months.21 This result represents 95% efficacy, higher than the 89% for bluebird bio’s Zynteglo, a one-time β-Thalassemia gene therapy approved by the FDA in August 2022.22

In sickle cell, all 31 patients treated with exa-cel were free of vaso-occlusive crises, with follow-up ranging from 2.0 to 32.3 months. On average, trial patients had hemoglobin levels of 43% 12 months after infusion with strong safety data.23

Hemoglobinopathies Is an Increasingly Competitive Market

Hematological disorders have served as a proof of concept for new therapeutic modalities, such as gene therapy, cell therapy, and gene editing. A result is an increasingly competitive market for cumbersome blood-based genetic disorders like sickle cell disease and β-Thalassemia. However, in our view exa-cel has a unique advantage in the market due to its reported clinical trial data and the expected timing of its market entry.

Bluebird bio, following FDA approval of its β-Thalassemia gene therapy, now seeks a green light for its sickle cell therapy in Q1 2023.24 Recent clinical trial data show that patients on the treatment had hemoglobin levels of 45% at 24 months after infusion.25 Notably, safety data might limit the appropriate pool of patients for the therapy if approved. Gene therapy competitors Intellia and Editas are working on their own CRISPR-based therapies for sickle cell, though they are much earlier in their clinical development processes, giving CRISPR and Vertex an early lead.

Sarepta Therapeutics’ SRP-9001 Could Be on the Approval Fast Track

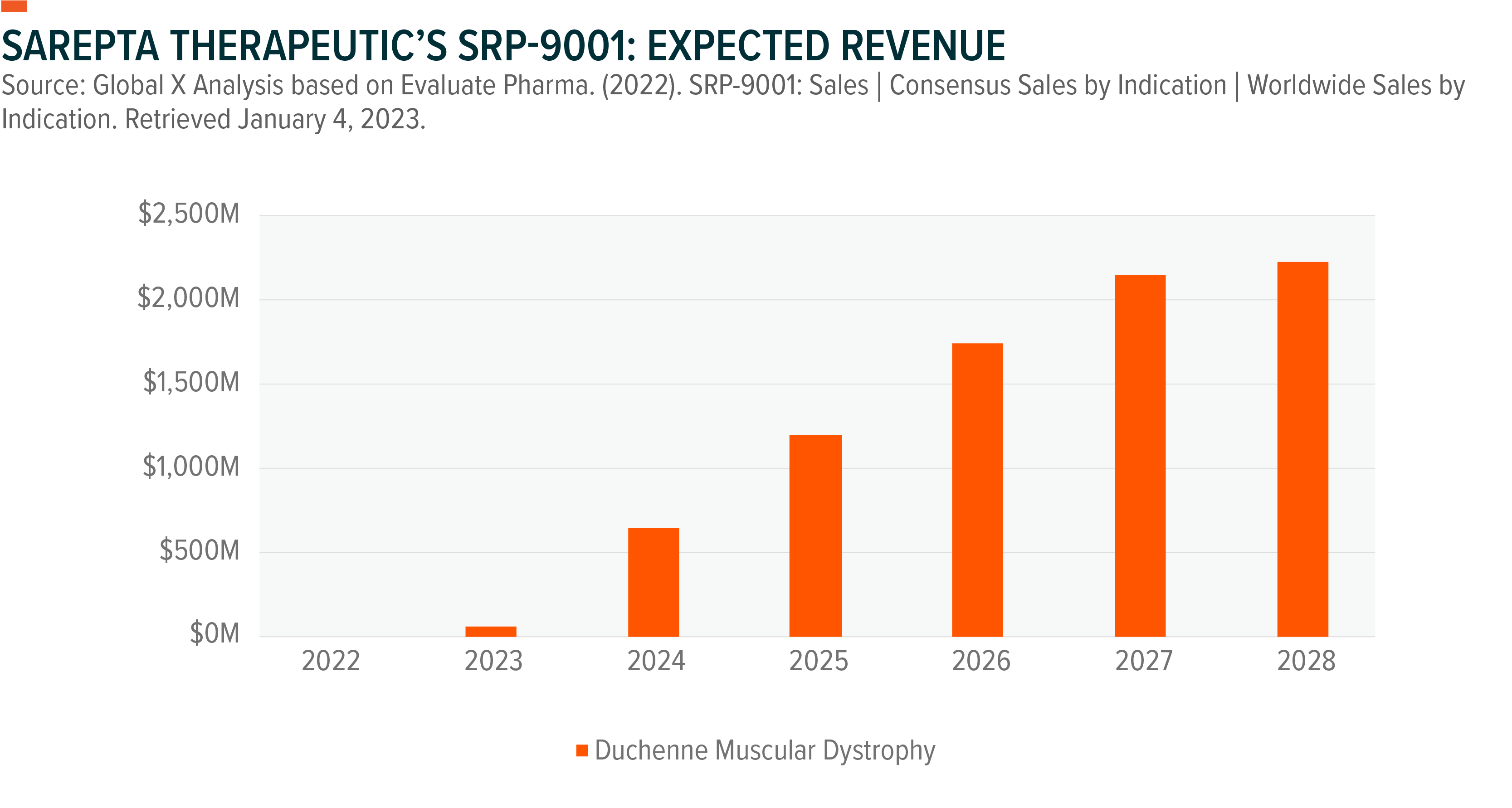

Sarepta Therapeutics, leader in the Duchenne musical dystrophy (DMD) treatment space, looks to expand its footprint by offering a functional cure for the illness via an investigational gene therapy. DMD is a rare disorder of progressive muscular weakness that occurs due to a mutation in the dystrophic gene. The disease usually affects boys in early childhood.

Sarepta has successfully commercialized three DMD therapies, each of which facilitates the creation of partially functional dystrophin via exon-skipping technology. In total, Sarepta’s exon-skipping therapies are a good match for an estimated 29% of DMD patients.26, 27, 28 Sarepta’s combined DMD sales were expected to total $811 million in 2022, representing the entire DMD treatment market. If Sarepta receives regulatory approval for its SRP-9001 therapy, its combined DMD-related sales could jump to $3.2 billion in DMD-related sales in 2028, led by SRP-9001’s $2 billion contribution.29 Sarepta expects total peak sales for SRP-9001 to reach $4 billion.30

SRP-9001 Changing Treatment Landscape for DMD

In Duchenne patients, a mutation in the DMD gene leads to a severe lack of dystrophin production. Dystrophin is a protein that works to ensure the integrity and structure of muscle fibers in skeletal and heart muscles. Without dystrophin, normal activity causes excessive damage to cells, and is replaced with fat and fibrotic tissue over time. Among symptoms, patients can experience frequent falls, trouble getting up, difficulty running, and learning disabilities. On average, patients require a wheelchair by 10–12 years old and assisted ventilation by 20.31 Approximately 1 in every 2,400 boys worldwide is born with DMD.32

Sarepta’s SRP-9001 is a gene therapy designed to deliver dystrophin-encoding gene into a patient’s muscle tissue to prompt production of dystrophin. The therapy shows strong improvement in clinical trial patients, with statistically significant improvement in motor ability at 48 weeks after infusion.33 In its phase II trial, the 20 patients treated with the gene therapy had a mean improvement of 1.3 points in the broadly used rating scale to measure functional motor abilities in children with DMD.34 In the same time frame, patients usually experience a 0.7-point decline in motor function.35

SRP-9001 Approval Can Give Sarepta a Head Start in DMD Gene Therapy Market

If approved on an accelerated timeline, SRP-9001 could be marketed right away, and Sarepta would submit data from its EMBARK clinical trial as a post-marketing study to confirm clinical benefit. The firm expects a decision by May 29, 2023.36 Approval by this date would give Sarepta significant time as the only such DMD therapy on the market. The next DMD therapy expected to come to the market is Pfizer’s in 2024, at the earliest.37

Sarepta is also expanding its research to offer an entire portfolio of solutions for DMD. In collaboration with Harvard University and Duke University, it is investigating curative gene editing technology to correct the DMD-causing mutation and produce fully functional dystrophin.

Conclusion: Pending Approvals Show Biotech’s Continued Promise

With potential approvals forthcoming, we believe Eli Lilly, CRISPR Therapeutics, and Sarepta Therapeutics can help pave the way towards a more effective patient treatment paradigm across key disease areas. For investors, Mounjaro, exa-cel, and SRP-9001 represent latest round of breakthroughs in patient care, where the focus continues to shift from treating symptoms to addressing the root causes of diseases at the biological level. With exposure to the Genomics & Biotech and Aging Population investment themes, investors can capture breakthroughs like these and potentially benefit from their growth as they disrupt traditional patient care for the better over time.

Related ETFs

GNOM – Global X Genomics & Biotechnology ETF

AGNG – Global X Aging Population ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Arelis Agosto

Arelis Agosto