The November MLP Monthly Report can be found here offering insights on MLP industry news, the asset class’s performance, yields, valuations, and fundamental drivers.

The latest quarterly MLP Insights piece providing analysis into the midstream space can be found here as well.

Summary

News:

1) Phillips 66 (PSX) announced plans to acquire the remaining units of Phillips 66 Partners (PSXP) it does not own for $3.4 billion. The all-stock deal is expected to close in the first quarter of 2022 in aim to simplify its governance and corporate structure.

2) Crestwood Equity Partners LP (CEQP) has entered into a definitive merger agreement to acquire Oasis Midstream Partners LP (OMP) in an equity and cash transaction for approximately $1.8 billion including the assumption of debt. The merger is expected to enhance its competitive position in the Williston and Delaware Basins and provide an opportunity to realize approximately $45 million in commercial and cost reduction synergies.

3) OPEC+ has decided to stick to 400,000 barrels per day (bpd) output each month. The decision has led to rising oil prices, with crude hitting the highest levels since 2014. With 2 million barrels of additional production added to the market since August 2021, the cartel has adopted a conservative approach, as it expects a seasonal drop in demand for oil in the first and fourth quarters of the year.

Sources: Phillips 66 Partners LP, Crestwood Equity Partners LP, CNBC.

Performance: Midstream MLPs, as measured by the Solactive MLP Infrastructure Index, increased 5.30% last month. The index has increased by 84.08% since last October. (Source: Bloomberg)

Yield: The current yield on MLPs stands at 7.87%. MLP yields remained higher than the broad market benchmarks for High Yield Bonds (4.79%), Fixed Rate Preferreds (4.11%), Emerging Market Bonds (4.33%), and Investment Grade Bonds (2.26%).1 MLP yield spreads versus 10-year Treasuries currently stand at 5.88%, higher than the long-term average of 5.75%.2 (Sources: Bloomberg and Fed Reserve)

Valuations: The Enterprise Value to EBITDA ratio (EV-to-EBITDA), which seeks to provide more color on the valuations of MLPs, increased by 1.32% last month. Since October 2020, the EV-to-EBITDA ratio is up by approximately 10.77%. (Source: Bloomberg)

Crude Production: The Baker Hughes Rig Count increased to 544 rigs, increasing by 23 rigs from last month’s count of 521 rigs. US production of crude oil increased to 11.500 mb/d in the last week of October compared to September levels of 11.100 mb/d. (Source: Baker Hughes & EIA)

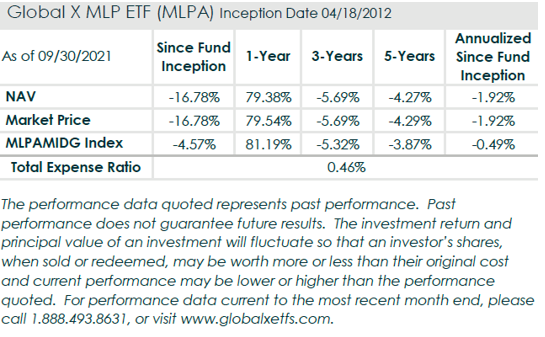

For performance data current to the most recent month- and quarter-end, please click here

As of 10/31/2021, Phillips 66 Partners, L.P. (PSXP) was a holding in the Global X MLPA ETF (MLPA) with a 4.46 % weighting and MLPX ETF with a 0.76% weighting. Crestwood Equity Partners, L.P. (CEQP) was a holding in the Global X MLPA ETF (MLPA) with a 4.73 % weighting. Oasis Midstream Partners, L.P. (OMP) was a holding in the Global X MLPA ETF (MLPA) with a 3.00% weighting.

MLPX ETF and MLPA ETF do not have any holding in Phillips 66 (PSX).

Rohan Reddy

Rohan Reddy