The public and private sectors are likely to inject hundreds of billions more dollars to modernize U.S. infrastructure over the next several years. But with the upcoming pivotal election cycle, questions about potential changes to the trajectory and composition of that spending loom large. Among them, how can the election’s outcome affect the nexus between public policy and infrastructure development? Also, what type of influence can political dynamics, competing priorities, and potential policy shifts have on the nation’s approach to addressing its significant infrastructure needs? From crumbling bridges and aging transportation networks to renewable energy and sustainable water systems, the country’s infrastructure challenges are abundant, but in our view, so are the investment opportunities.

Key Takeaways

- We believe that investment in U.S. infrastructure is likely to maintain bipartisan support, and as a result, government funding is likely to remain a powerful driver of infrastructure activity.

- The IIJA and CHIPS Act are likely safe from rollback should Republicans win back the White House, as these bills passed with bipartisan support. In our view, under Republican control, the climate-focused IRA is more likely to face a slowdown in implementation rather than a full repeal.

- Regardless of election outcomes, the clean energy transition and manufacturing reshoring are two well-established tailwinds that we expect to continue to provide opportunities in U.S. infrastructure.

Infrastructure Investment is a Source of Common Ground

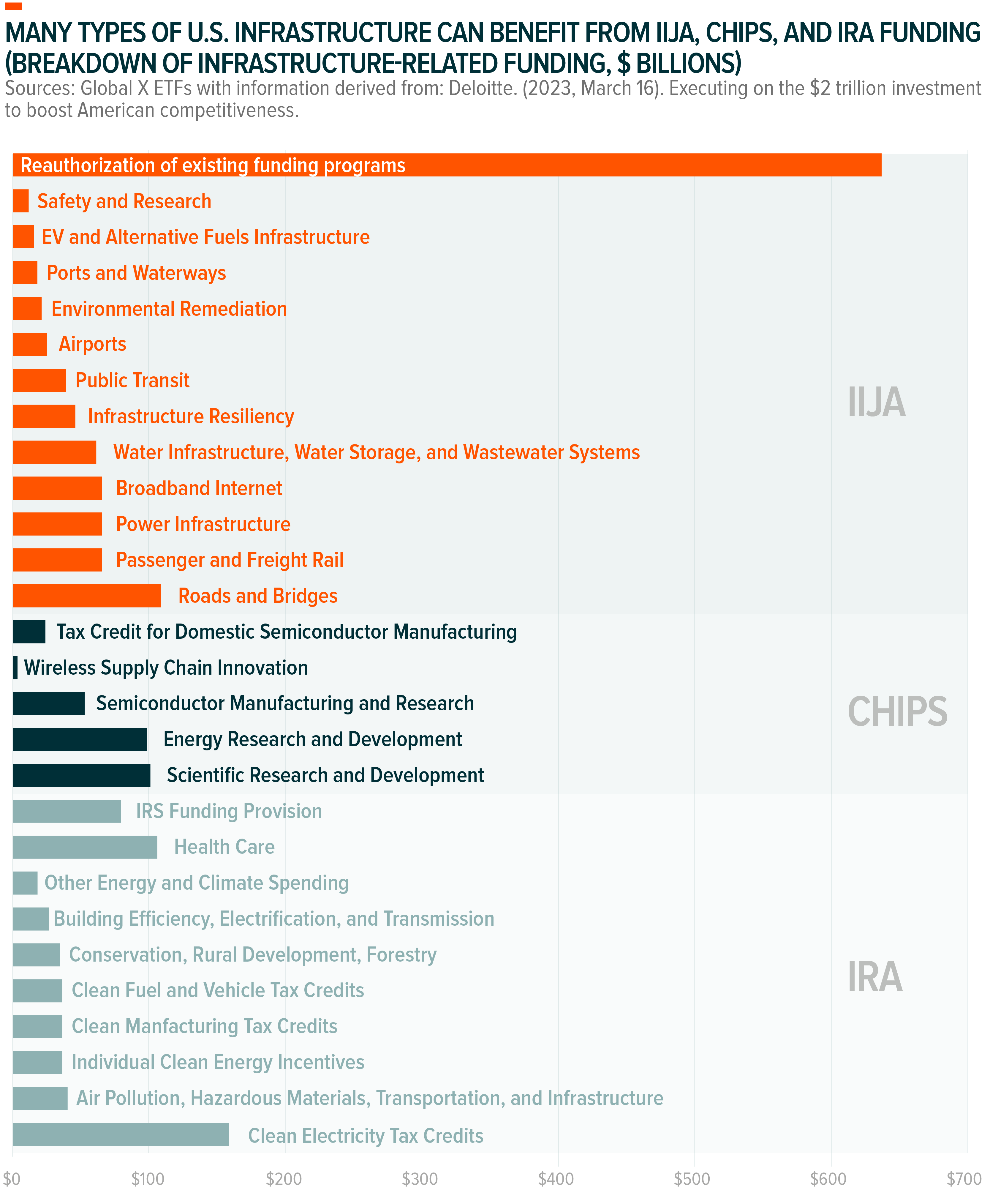

Funding from the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and the CHIPS and Science Act (CHIPS Act) is expected to add hundreds of billions of dollars into the U.S. infrastructure value chain over the next several years.1 The IIJA alone includes $1.2 trillion in funding for infrastructure projects between 2021 and 2026, of which around $492 billion remains to be allocated.2 Furthermore, private spending in relation to these landmark legislative efforts is magnifying potential opportunities for U.S. infrastructure companies. As of mid-March 2024, private companies had announced $676 billion in manufacturing investments during the Biden administration.3

As the United States heads towards the presidential and legislative elections in November, there is elevated uncertainty over the longevity of these tailwinds. However, infrastructure typically garners strong bipartisan support across all levels of government, and it has been a key pillar of focus from both recent Democratic and Republican administrations and lawmakers. At the federal level, the Biden Administration’s efforts have been cemented by the IIJA. Also known as the Bipartisan Infrastructure Law, the IIJA passed with relatively strong cross-party support in 2021.4 During the Trump administration, both parties also expressed interest in bolstering federal support for infrastructure, although no major infrastructure spending packages were ultimately passed.5

Given relatively strong bipartisan support and the widespread benefits of the IIJA, we expect that the act is likely safe from being rolled back no matter the outcome of the upcoming elections. Additionally, cross-party support at the state and local levels, along with the private spending, is also likely to continue creating opportunities. During Tetra Tech’s Q1 2024 earnings call, the consulting and engineering services firm’s management team noted that their clients across all end markets “are benefitting from multiple state, local, and commercial funding opportunities, sometimes augmented by federal government funding like the IIJA.”6 In Jacobs Solutions’ Q1 2024 earnings call, management noted design opportunities from both IIJA and state-level funding initiatives.7

CHIPS Act Recognized as Key for the U.S. to Assert Leadership in the Global AI Race

Against the backdrop of intensifying geopolitical tensions, the strategic importance of maintaining leadership in AI has never been more pronounced. Semiconductors are indispensable hardware for AI-enabled technologies, and government efforts to boost semiconductor research and development (R&D) and manufacturing are likely to maintain strong bipartisan support. The CHIPS Act represents the culmination of concerted bipartisan efforts to safeguard the United States’ technological edge and enhance national security interests.8 Since its enactment in August 2022, the CHIPS Act has not been targeted by any legislative repeal efforts, and in our view, it is unlikely to be targeted no matter the outcomes of the 2024 election cycle.

Looking forward, this means that infrastructure companies could continue to benefit from the expanding U.S. semiconductor manufacturing landscape. The Biden administration only just began distributing funds from the $39 billion in the CHIPS Act for semiconductor manufacturing incentives.9 An additional $24 billion is for tax credits for chip production, and billions more are for semiconductor R&D and workforce development.10 As of late February 2024, the Commerce Department had received over 600 statements of interest from companies about CHIPS Act funding opportunities.11

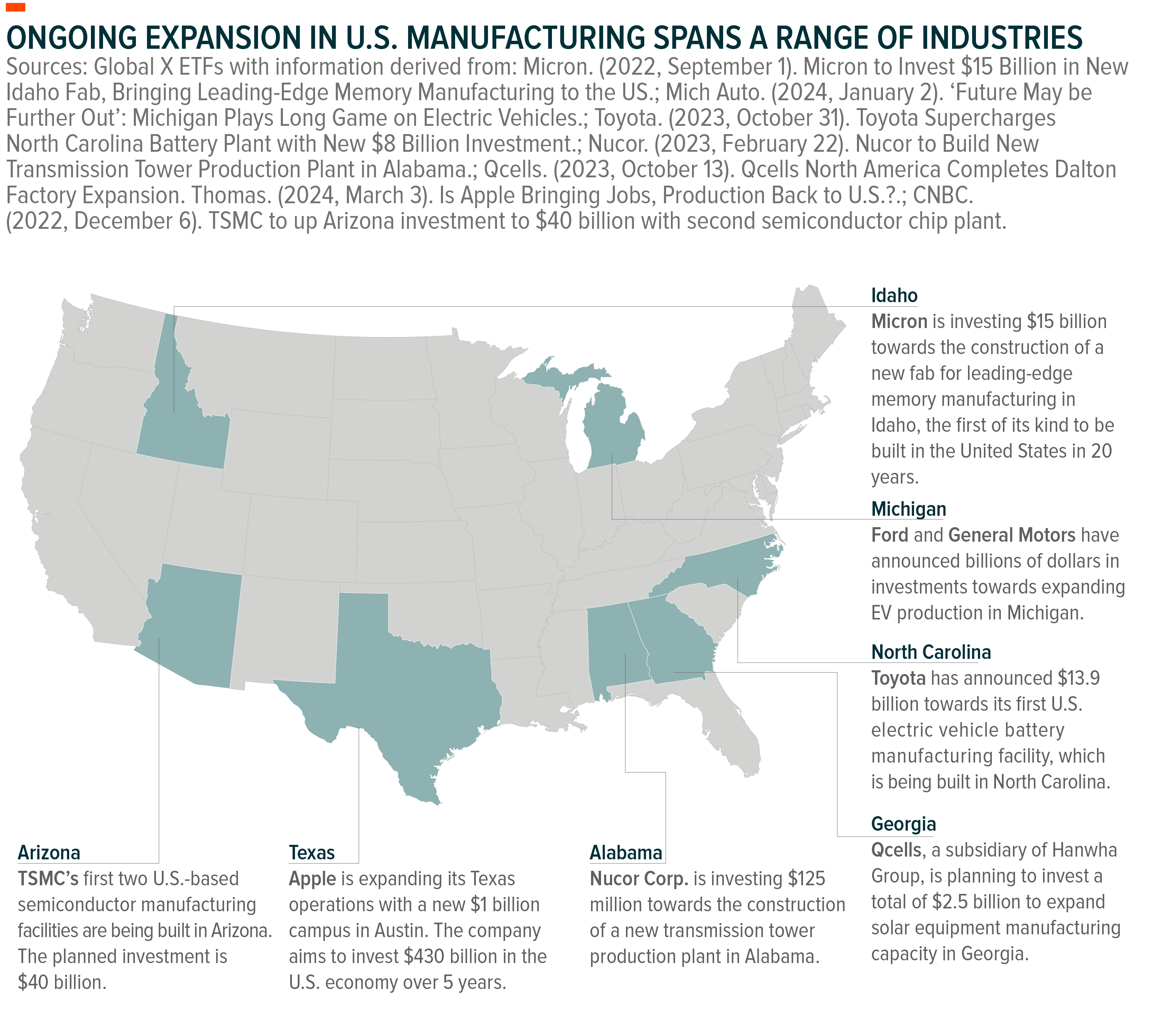

Additionally, pledges of private investment for semiconductors and electronics manufacturing total $244 billion, accounting for 36% of the $676 billion in private manufacturing investments announced since 2021.12 Even before the CHIPS Act, companies like Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest contract chipmaker, and Intel, the largest American chipmaker, were in talks with the Trump administration to expand their manufacturing footprints into the United States.13 In May 2020, TSMC announced plans to build its first U.S.-based manufacturing facility in Arizona.14 The facility is expected to begin initial production in 2025.15 Following the CHIPS Act’s passage, TSMC announced plans for a second manufacturing facility, which could begin production in 2027 or 2028.16 In total, the company is spending more than $40 billion across the two facilities.17

The IRA is likely to Remain a Republican Target, Including Provisions like EV Tax Credits

Unlike the IIJA and CHIPS Act, the IRA passed along party lines through the reconciliation process in 2022. Given that the IRA represents the U.S. government’s largest-ever investment towards addressing climate change, pushback from conservative legislators is likely to continue in some form. Republican lawmakers made 31 attempts to repeal the plan or specific IRA provisions in the law’s first year alone, although none were successful.18 Former President Donald Trump has said that undoing the IRA would be a top priority for him if elected.19

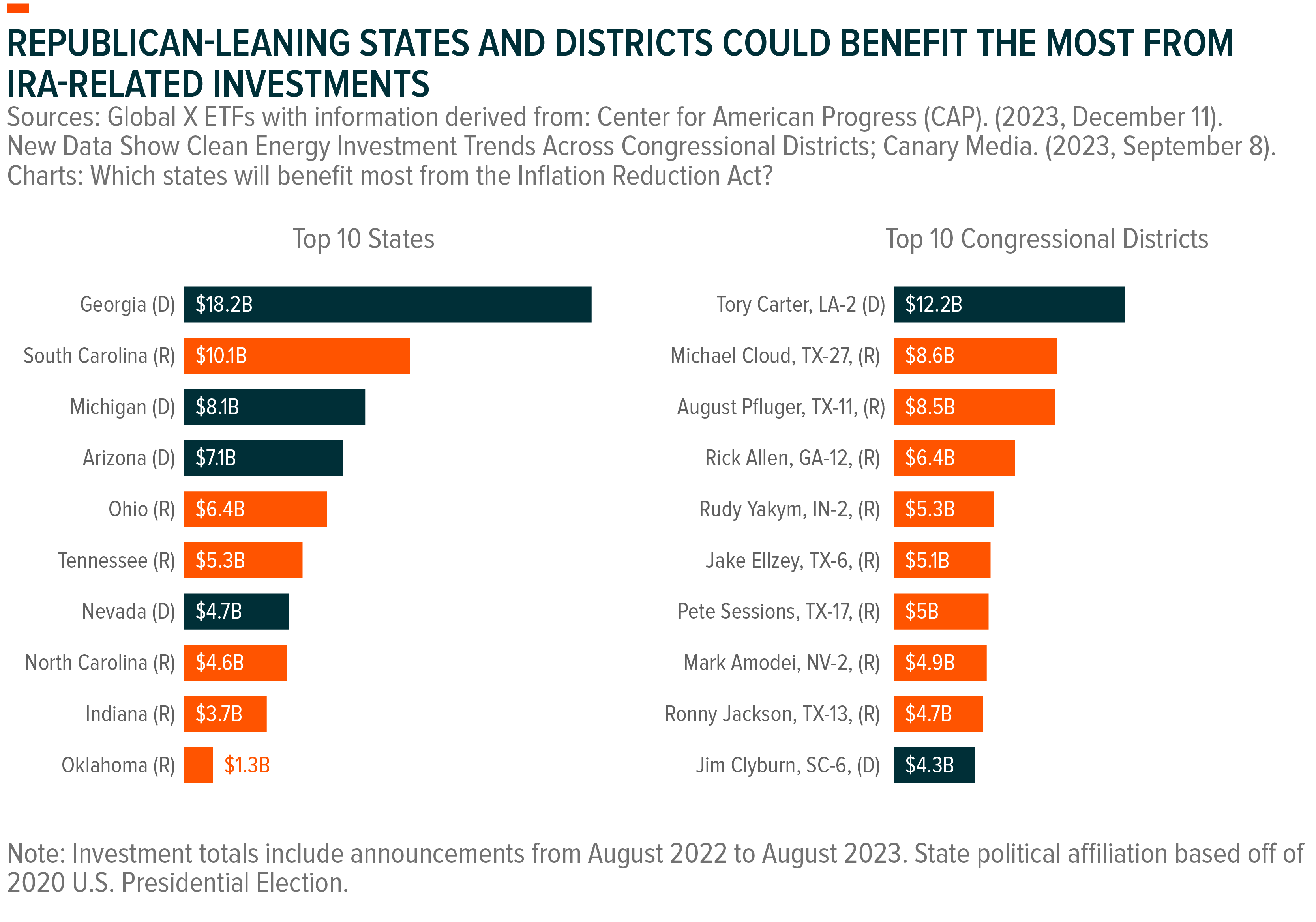

In our view, a full repeal would be extremely difficult even in the event of a Republican sweep of the White House, House, and Senate. So far, IRA incentives have benefitted Republican-led states significantly, resulting in job growth and private investment. We estimate that roughly 60% of private investment for electric vehicle (EV), battery, and clean tech manufacturing and renewable energy projects since the IRA’s passage have gone to states that Trump won in 2020.20 Others estimate the share of IRA-related funding going to Republican-leaning states to be as high as 66%.21 Also, Republicans represent eight of the top 10 congressional districts for announced IRA-related investments.22 As a result, we believe that enough lawmakers, corporations, and constituents would push back against a full repeal.

That said, specific provisions, particularly tax credits for qualifying new and used EVs and EV charging systems, could be Republican targets. EV tax credits have been at the center of Trump’s critiques about the IRA during campaign speeches.23 In the near term, efforts like these could keep EV sticker prices higher than comparable internal combustion engine vehicles; however, we expect further price reductions for EVs as battery technologies advance and economies of scale kick in. Also, removing tax credits could accelerate a natural market evolution towards EV adoption by pushing manufacturers to accelerate R&D efforts to lower costs and offer more competitive pricing. An increasingly competitive EV landscape and an ongoing price war are already putting pressure on automakers to find ways to make EVs more attractive to a wider consumer base. Furthermore, EV sales in China grew 29% year-over-year (YoY) in 2023, despite purchase subsidies ending in 2022, showing that it is possible for strong EV sales growth even in the absence of purchase incentives.24

As a result, we expect that infrastructure companies are likely to see continued opportunities from the ongoing largest shift that the transport sector has seen in over a century. For example, infrastructure consulting firm AECOM was selected by the Arizona Department of Transportation to develop a plan for the deployment of EV charging stations throughout the state.25 Equipment providers like Eaton and Hubble offer EV charging equipment.

Clean energy tax credits, one of the largest components of the IRA budget, could also face repeal attempts or executive actions that limit their impact. However, the solar investment tax credit (ITC) and other clean energy tax credits have previously been supported by Democrats and Republicans, and some have even been introduced by bipartisan groups of legislators.26 The ITC was renewed every year under the Trump administration, even in years where Congress had a Republican majority. The IRA extends the ITC from 2022 through 2032, eliminating annual uncertainty about its renewal.

Other provisions that focus on energy efficiency or hinder oil and gas (O&G) activities could be targeted under a Republican administration, while those that support critical mineral and battery production are likely safe due to their strategic importance for national security. Policy shifts that support broader O&G operations, as well as continued support for mining activity, could open up different opportunities for infrastructure companies.

Clean Energy and Reshoring Are Likely Infrastructure Tailwinds That Transcend Federal Policy

While incentives from the IIJA, CHIPS Act, and IRA have been integral in the recent uptick in U.S. manufacturing and cleantech investments, we expect these megatrends will continue to transcend beyond recent federal policies and can bolster U.S. infrastructure activity over the long-term.

Even without strong federal support, the U.S. clean energy transition gained pace during the Trump administration due to wind and solar’s improving cost competitiveness coupled with supportive city and state-level policies and corporate sustainability efforts. As a result, wind and solar were already becoming the technologies of choice for new power generation. In 2019, wind and solar projects accounted for a combined 61% of net electricity capacity additions in the United States.27 In 2020, their combined share rose to 77%.28 If the IRA had not passed, solar power capacity additions were still forecast to grow to more than 30,000 megawatts (MW) annually by 2028, a sizeable increase from the 8,500MW added in 2020.29,30

The IRA plus other supportive tailwinds means that solar power capacity additions are now forecast to surpass 50,000MW annually by 2028.31 It also means that the United States must build out more renewable energy equipment manufacturing capacity and expand grid infrastructure, such as transmission lines and power management solutions.

A multitude of factors beyond federal incentives for semiconductors and cleantech has interest in U.S. manufacturing renewed and momentum building. For example, more than 95% of executives surveyed by Kearney in 2023 consider reshoring as part of their corporate strategies.32 Many companies want to increase their U.S. manufacturing capacity to boost supply chain resilience, protect against geopolitical risks, and bolster sustainability efforts. AI and automation are also becoming more advanced and affordable, with the average cost of industrial robots expected to decline by 85% from 2005 to 2030.33,34 More efficient and less-labor intensive factory operations can help close the gap between labor costs in the U.S. and abroad, making U.S manufacturing increasingly viable for companies.

Conclusion: U.S. Infrastructure Should Remain a Significant Opportunity

This election cycle does create uncertainty, but at this point, many of the megatrends and tailwinds bolstering infrastructure appear likely to continue regardless of the composition of the U.S. government. Companies throughout the U.S. infrastructure value chain are just beginning to see benefits from the significant public and private investments flowing into the industry, and we expect that momentum to continue. From roads, airports, and bridges to manufacturing facilities, broadband internet, and renewable energy, we believe that modernizing U.S. infrastructure presents numerous and diverse opportunities for investors to consider for the long term.

Related ETFs

PAVE – Global X U.S. Infrastructure Development ETF

DRIV – Global X Autonomous & Electric Vehicles ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Madeline Ruid

Madeline Ruid