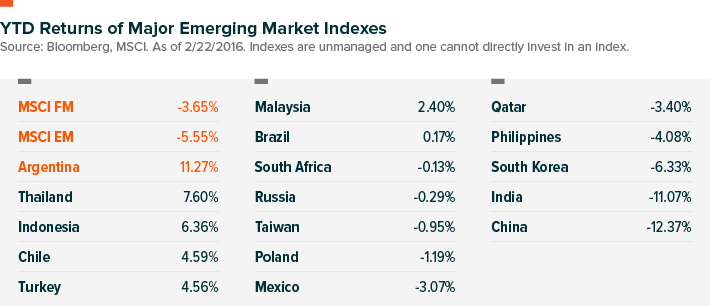

While 2016 has proven to be a rocky start for equities around the globe, Argentina has bucked the trend. The MSCI Argentina Index is up over 11%, while emerging markets are collectively down over -5% and frontier markets are down nearly -4%.

Argentina has not magically avoided the economic troubles that are plaguing most other emerging markets. It’s an economy that is highly dependent on commodity exports, suffering from slowing demand from key trade partners like China. So what’s the difference between Argentina and a similar country like Brazil, which has been flat this year? We believe, in a word, leadership. While Brazil’s president is currently fighting off impeachment charges for corruption, Argentina’s newly elected Mauricio Macri has swiftly begun addressing issues that have hampered growth in the past, such as removing currency controls and negotiating with the country’s creditors.

Timeline of Accomplishments:

November 22: Macri wins Argentina’s Presidential election, unseating the leftist Peronist government which had ruled for 12 years.

December 17: Macri removes capital controls on the Peso, allowing it to float freely; a move that devalued the currency nearly 30% in a single day.

January 13: Argentina meets with creditors to negotiate on defaulted sovereign debt, working to restore the international community’s confidence in making loans to Argentina.

Argentina’s performance this year should remind investors that effective leadership can be an important catalyst for returns. While the current status of emerging markets has failed to inspire many investors, one strategy to consider is betting on leaders that are enacting meaningful policies to open their economies and promote private business and foreign investment. In addition to Macri in Argentina, other leaders are standing out in the international community for enacting such reforms, such as India’s Narendra Modi and Indonesia’s Joko Widodo.

Global X offers the only Argentina-focused ETF in the US, the Global X MSCI Argentina ETF (ARGT). The ETF tracks a liquid and broader version of the MSCI Argentina Index, called the MSCI All Argentina 25/50 Index.

Global X Research Team

Global X Research Team