In Part I of this series, we explored the disparities between regional and the largest diversified banks, delved into concerns raised by rating agencies, examined proposed regulatory changes, and scrutinized differences in loan exposure between Global Systematically Important Banks (G-SIBs) and smaller depository institutions.

In this installment, we delve into the compelling opportunities presented by this macro landscape in preferreds issued by G-SIBs. As the primary issuers of preferred shares, we believe that the resilience of G-SIBs can make them an attractive addition to investors’ portfolios. We will also investigate how G-SIBs have emerged as major players in the preferred market, how market cap-weighted preferred funds can balance exposure to the largest issuers while mitigating idiosyncratic risk and explore how the Global X U.S. Preferred ETF (PFFD) may offer a solution for investors seeking alternative income with expanded exposure to the largest banking institutions and defensive companies and industries.

Key Takeaways

- Large banks increased preferred share issuance over a decade ago to meet capital requirements in the wake of the regulations set in motion by the global financial crisis and the declining interest rate regime. This trend has slowed materially in the current higher cost of capital environment, creating a positive backdrop for preferred shares.

- G-SIBs can offer attractive yields with low credit risk at the aggregate, but banks and preferred issuers still carry idiosyncratic risk. Market cap-weighted preferred funds provide diversified exposure to various securities while focusing on the largest issuers.

- The Global X U.S. Preferred ETF (PFFD) offers overweight exposure to G-SIBs compared to the more muted regional banking sector weight due to its market capitalization-weighted methodology. We believe that this feature, amongst others, makes PFFD an attractive investment option relative to other income-oriented asset classes.

Largest Banks Create a Favorable Technical Backdrop for Preferreds

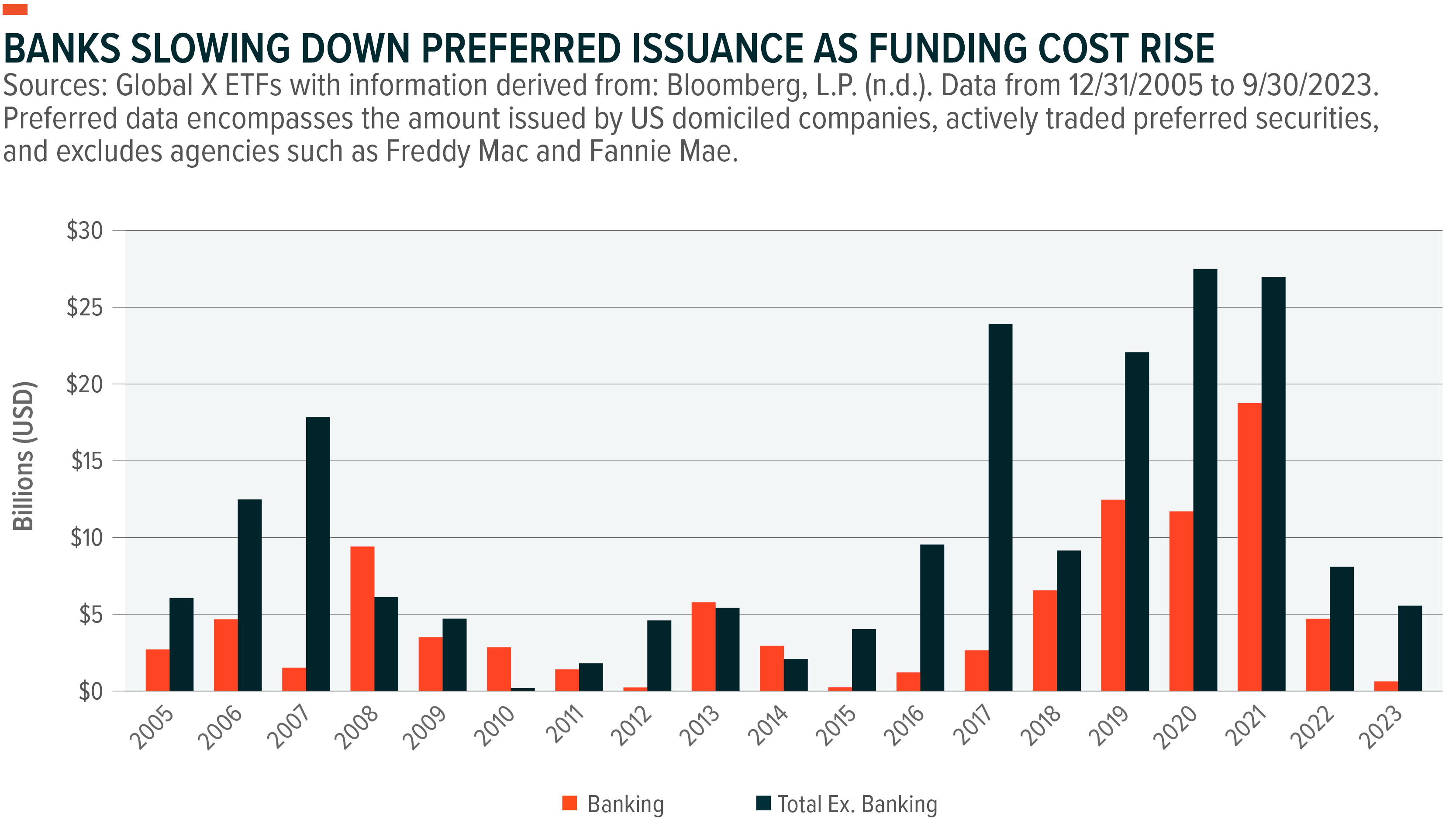

Banks have been the predominant issuers of preferred shares, a trend that began over a decade ago when the largest banks issued a substantial volume of preferred shares to meet heightened capital requirements. Although preferred share issuance has slowed down in the current higher cost of capital environment, as illustrated in the chart below, there was a notable surge in issuance by banks during the pandemic when interest rates were low. This slowdown in issuance since the start of current Fed hiking cycle has created a favorable technical backdrop for preferreds, helping to balance supply and demand dynamics.

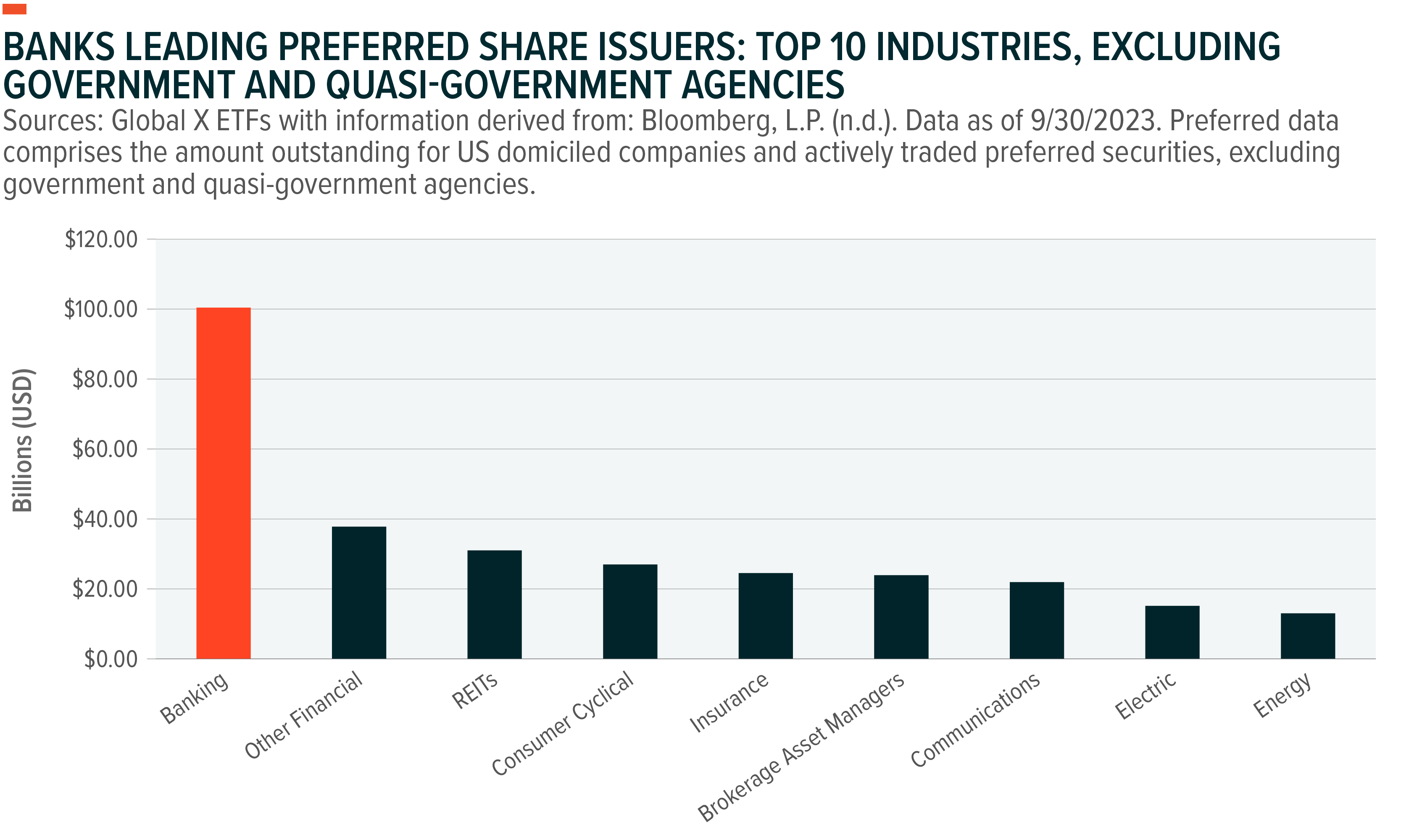

As depicted in the graph below, banks continue to comprise the largest segment of the preferred market when considering the total amount outstanding. This holds true even considering the recent slowdown in preferred issuance by banks, which has been a strategic move to manage net interest costs.

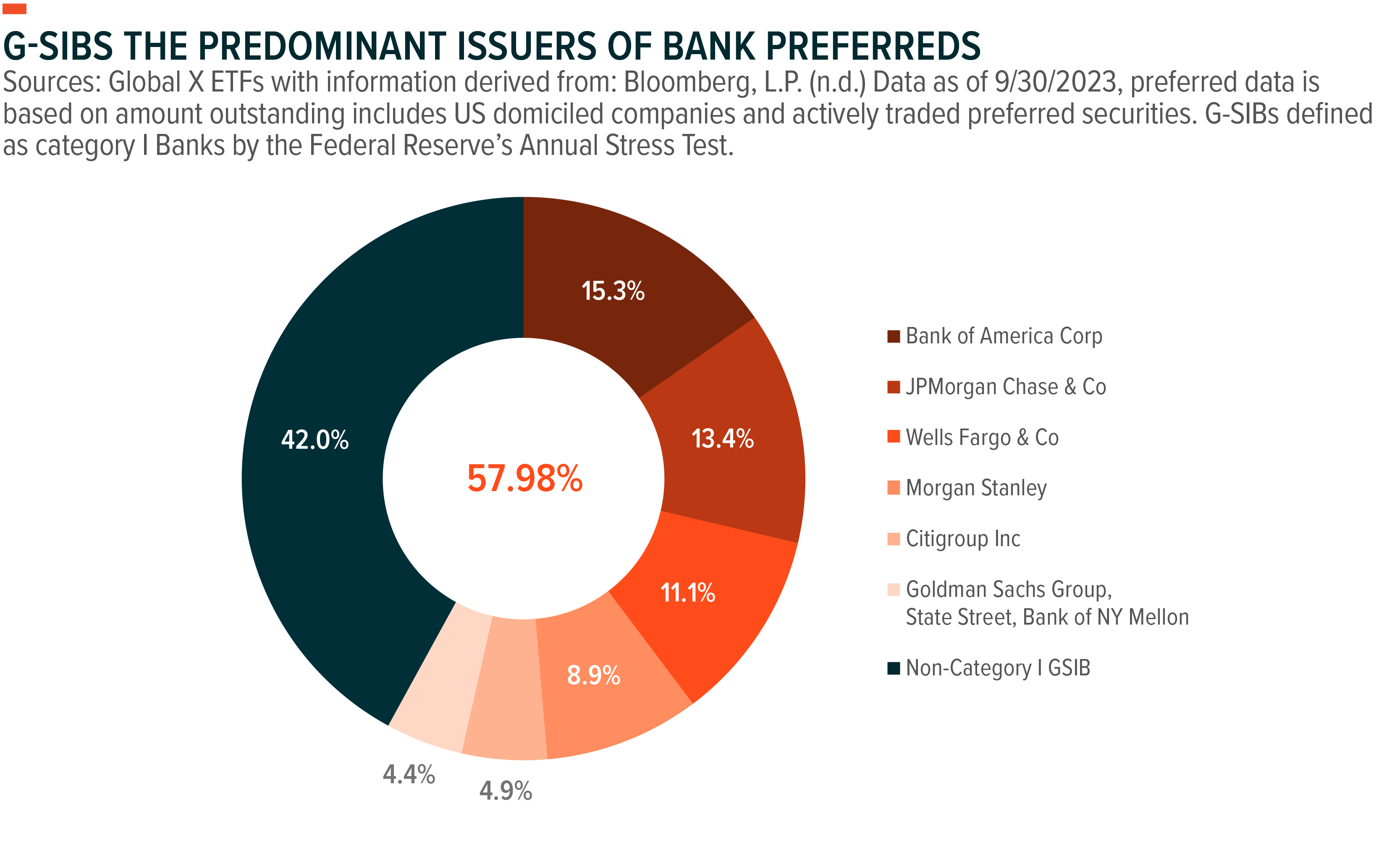

Diving a layer deeper, the eight Category I G-SIBs collectively account for nearly 58% of the amount outstanding of U.S.-denominated preferred shares by banks.

Diversifying Across Issuers to Help Lessen Idiosyncratic Risk

As highlighted in Part I of this series, G-SIBs stand out as an attractive option, offering high yields and seemingly low credit risk. However, it’s essential to acknowledge that banks and other preferred issuers carry a level of idiosyncratic risk stemming from various factors, including regulatory constraints, revenue streams, credit exposure, and duration risk. Moreover, the preferred market is somewhat opaque compared to more traditional asset classes like common equity or fixed income, with a significant portion of preferreds featuring built-in optionality, such as callable preferreds, embedded covenants, and different coupon types. Due to these considerations, market cap-weighted preferred funds emerge as an appealing vehicle to gain exposure towards a wide variety of different securities, while maintaining exposure towards the largest issuers.

PFFD Favors G-SIBs and Large Institutions Alleviating Regional Bank Uncertainty

The Global X U.S. Preferred ETF (PFFD) offers exposure to Global Systematic Banks (G-SIBs) and other high-quality preferred issuers in a market cap weighted structure. This strategy can also mitigate idiosyncratic risk by capping issuer exposure at 10% upon rebalance and by exclusively including issuers domiciled in the United States to alleviate international risk. In addition, each preferred must be exchange traded helping to add a layer of liquidity and must have a credit rating by at least one of the three major rating agencies. The only exception being convertible preferreds, which make up a small segment of PFFD.

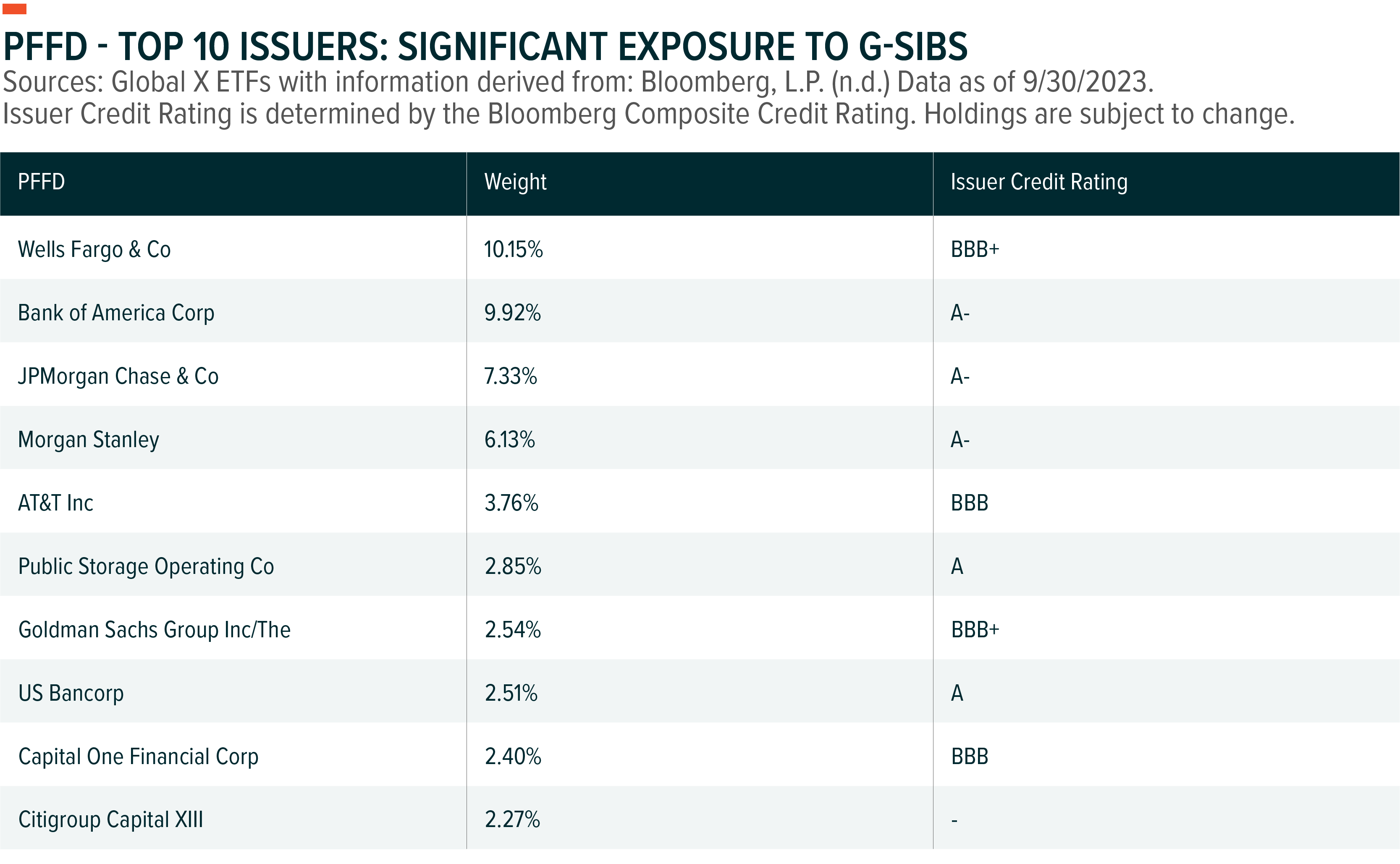

Diving into the credit quality of the individual preferreds within PFFD, over 60% of the 250+ preferred securities, on a weighted average, have an investment grade rating (BBB- or higher), highlighting the quality component as of 09/30/2023.1 Preferreds typically have a credit rating 1–2 notches below the issuers’ long-term credit rating, underlining the robust credit ratings of the issuers found in PFFD.2 As illustrated in the table below, the top 10 issuers in PFFD maintain high credit ratings, reinforcing the solvency of the underlying issuers and G-SIBs such as Wells Fargo, Bank of America, JP Morgan, Morgan Stanley, Goldman Sachs and more being the key issuers in PFFD. The ETF also includes exposure to entities like AT&T and Public Storage, both of which boast investment-grade long-term credit ratings as of 09/30/2023, adding a layer of diversification outside of financials.3

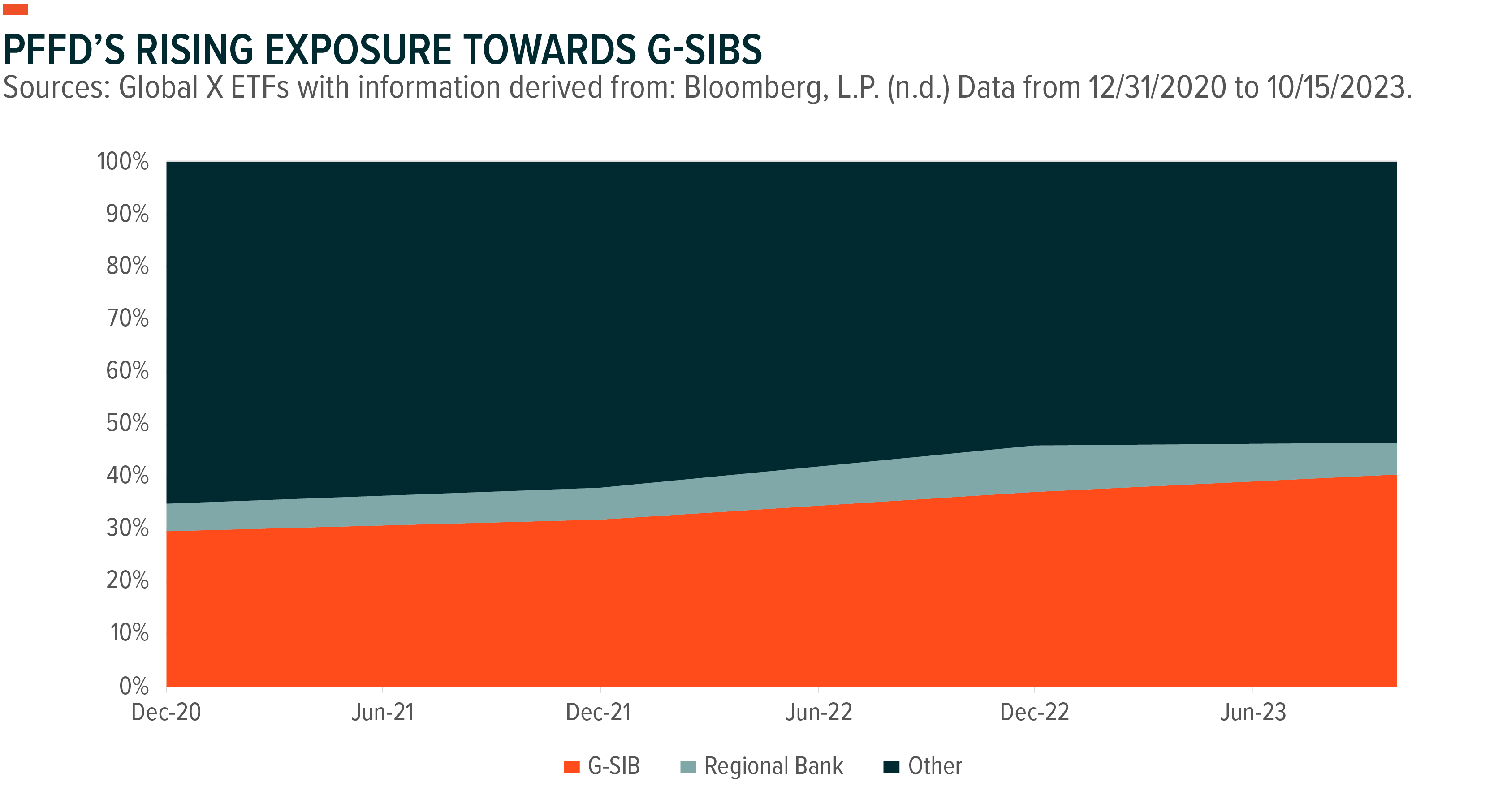

The market cap structure of PFFD plays a pivotal role in enhancing exposure to G-SIBs, especially given the diminishing popularity of regional bank preferreds over the past year. The current allocation to regional banks is just below 5.9%, down from approximately 8.8% in December 2022. G-SIBs now constitute a substantial 40.5% of the portfolio, compared to 37.1% at the end of 2022, providing investors with opportunities to enhance their yield potential while maintaining their exposure to the largest banks in the United States.

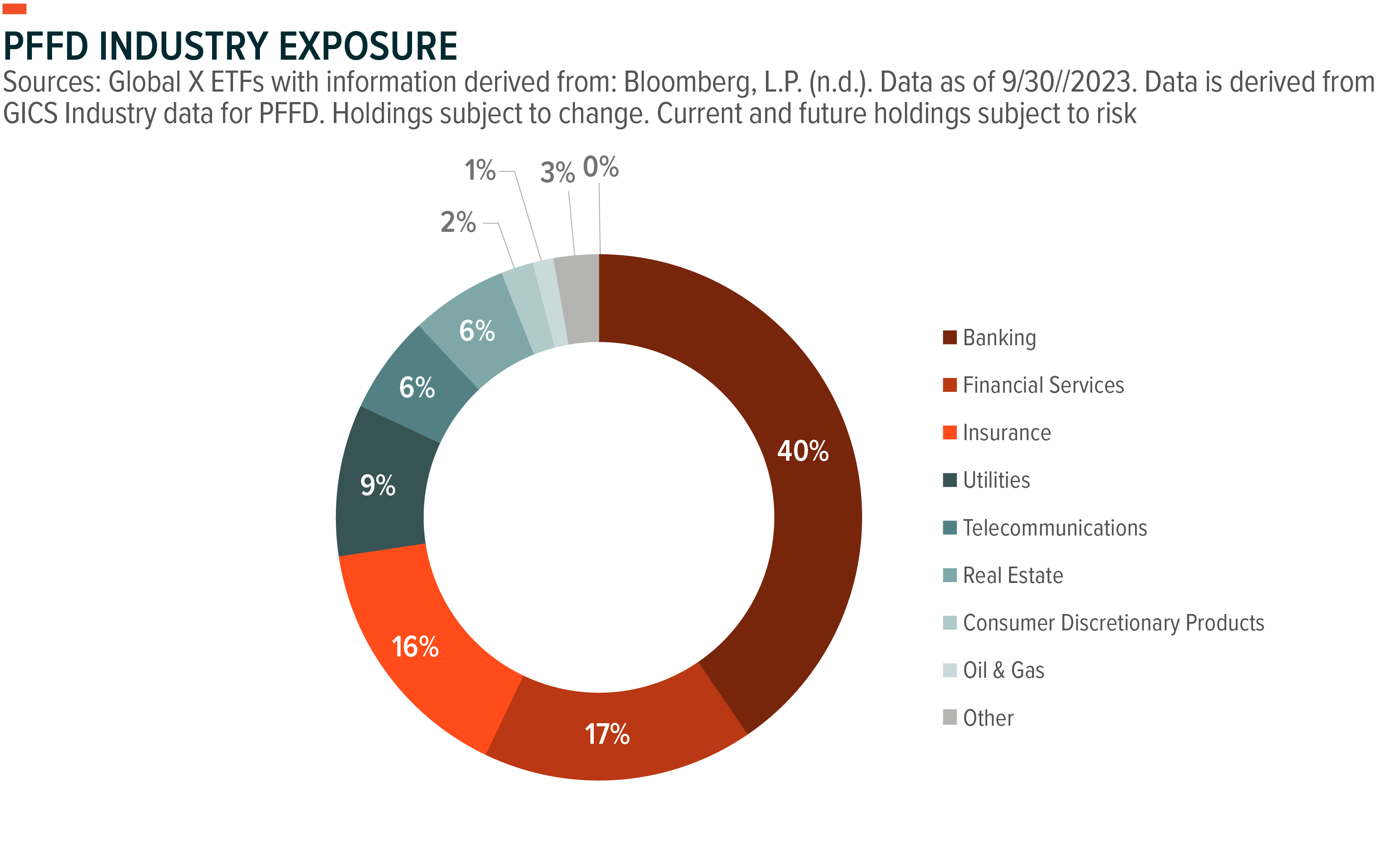

In addition to G-SIB exposure, PFFD offers diversified exposure to defensive sectors such as Utilities and Telecommunications. This diversification can be particularly relevant in late-cycle markets. Non-financial exposure comprises nearly 27% of the fund’s weighting in aggregate.

PFFD’s Appealing Valuations on the Backdrop of Higher Rates

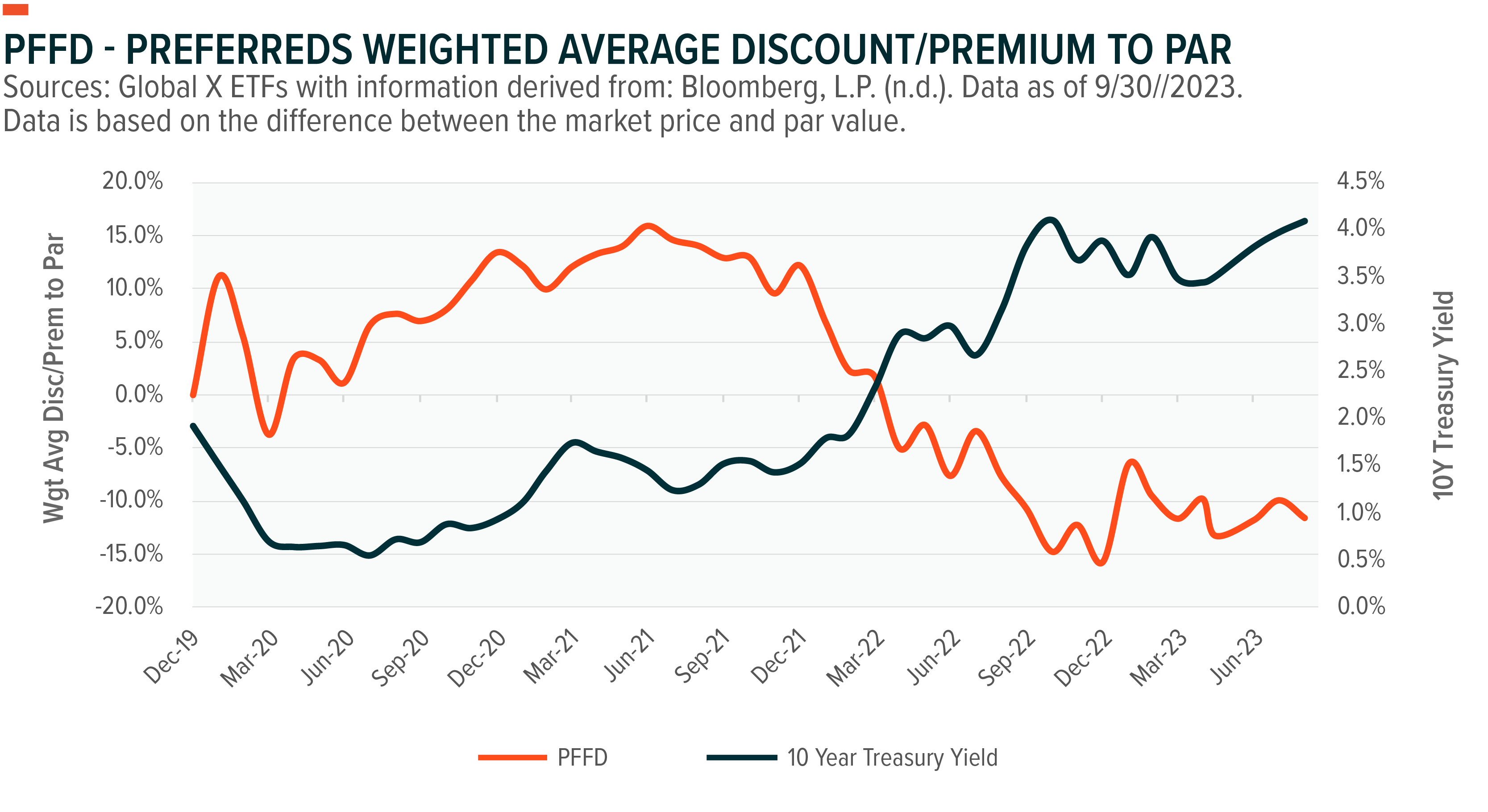

The high allocation towards investment grade securities and issuers dampened the performance of PFFD during the current rising interest rate environment that began in 2022. This phenomenon was triggered by the Federal Reserve’s decision to tighten the federal funds rate, which reached a 22-year high at 5.5%, aimed at curbing inflation. As a result, the 10-year Treasury yield surpassed 4.8%, a level not seen since the Global Financial Crisis (GFC).4 The consequences of this rising rate environment have continued to impact PFFD since the first-rate hike occurred in March 2022. PFFD’s option adjusted duration (OAD) profile was measured at 5.34, as of 9/30/2023.5

PFFD is currently trading at a 16% weighted average discount, meaning investors have the potential to secure higher dividends while also leaving room for potential upside participation.

Furthermore, historical data provides valuable insights, suggesting that U.S. policy rates tend to remain at their peak for approximately 7 months on average.6 Considering the possibility of rates declining sooner than anticipated, preferred securities may present a promising opportunity to capitalize on falling rates compared to other income investment strategies.

Data presented represents past performance. Past performance is no guarantee future results.

Navigating Shifting Market Dynamics: PFFD’s Duration Advantage

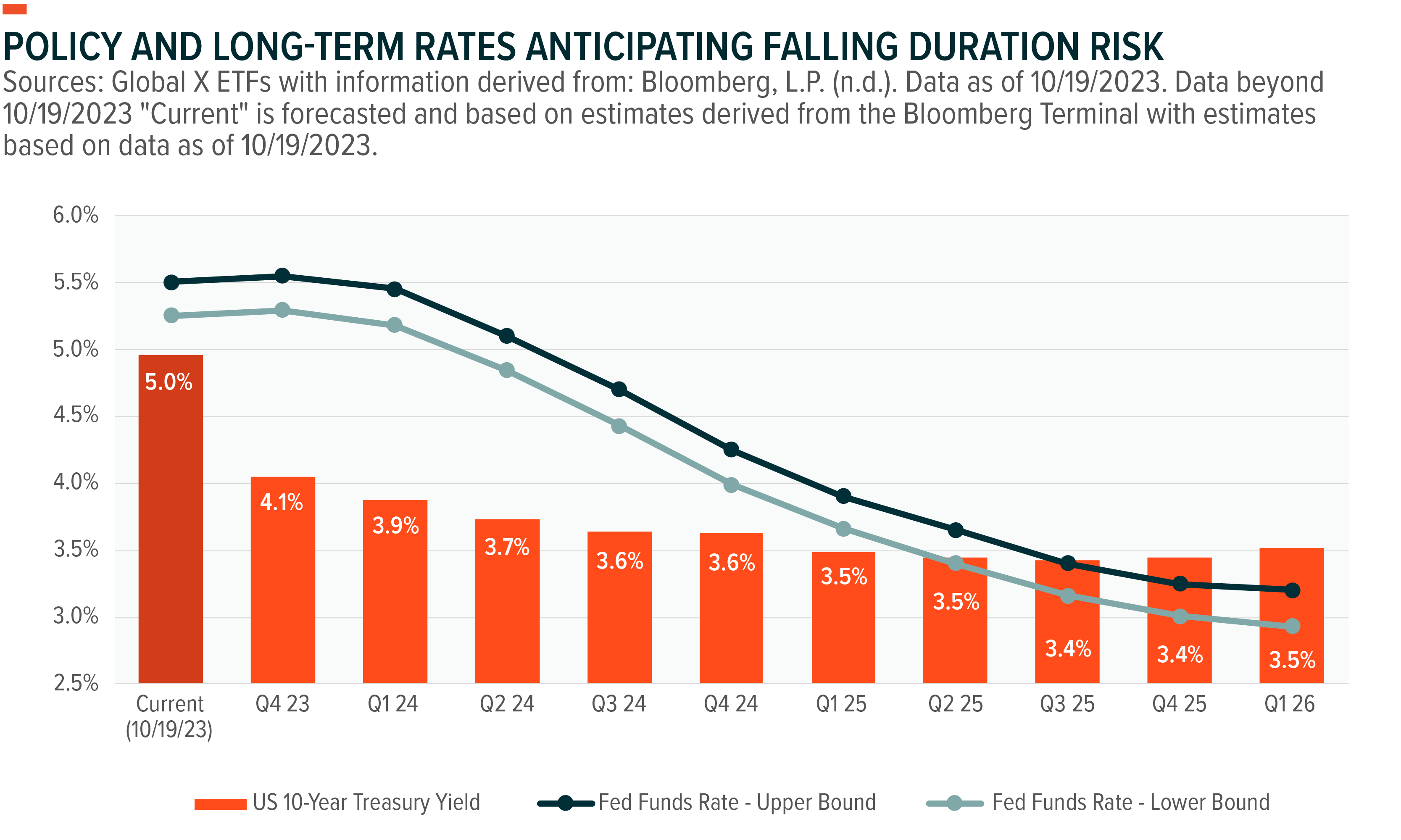

The transformation of PFFD’s duration profile, potentially transitioning from a headwind to a tailwind, is further corroborated by the expectations within the Federal Funds Futures market and the outlook for bond yields across the yield curve. A closer examination of the Federal Funds Futures Market in the near term reveals that markets presently assign a mere 18.6% probability to an additional 25 basis point rate hike in November, with a 39% chance for December, based on data as of September 30th.7 Notably, market sentiment already incorporates expectations of rate cuts for the years 2024 and 2025. Furthermore, this sentiment is underscored by the anticipation of declining bond yields across the entire yield curve, encompassed from the policy rate to the long end, as typified by the 10-year Treasury.

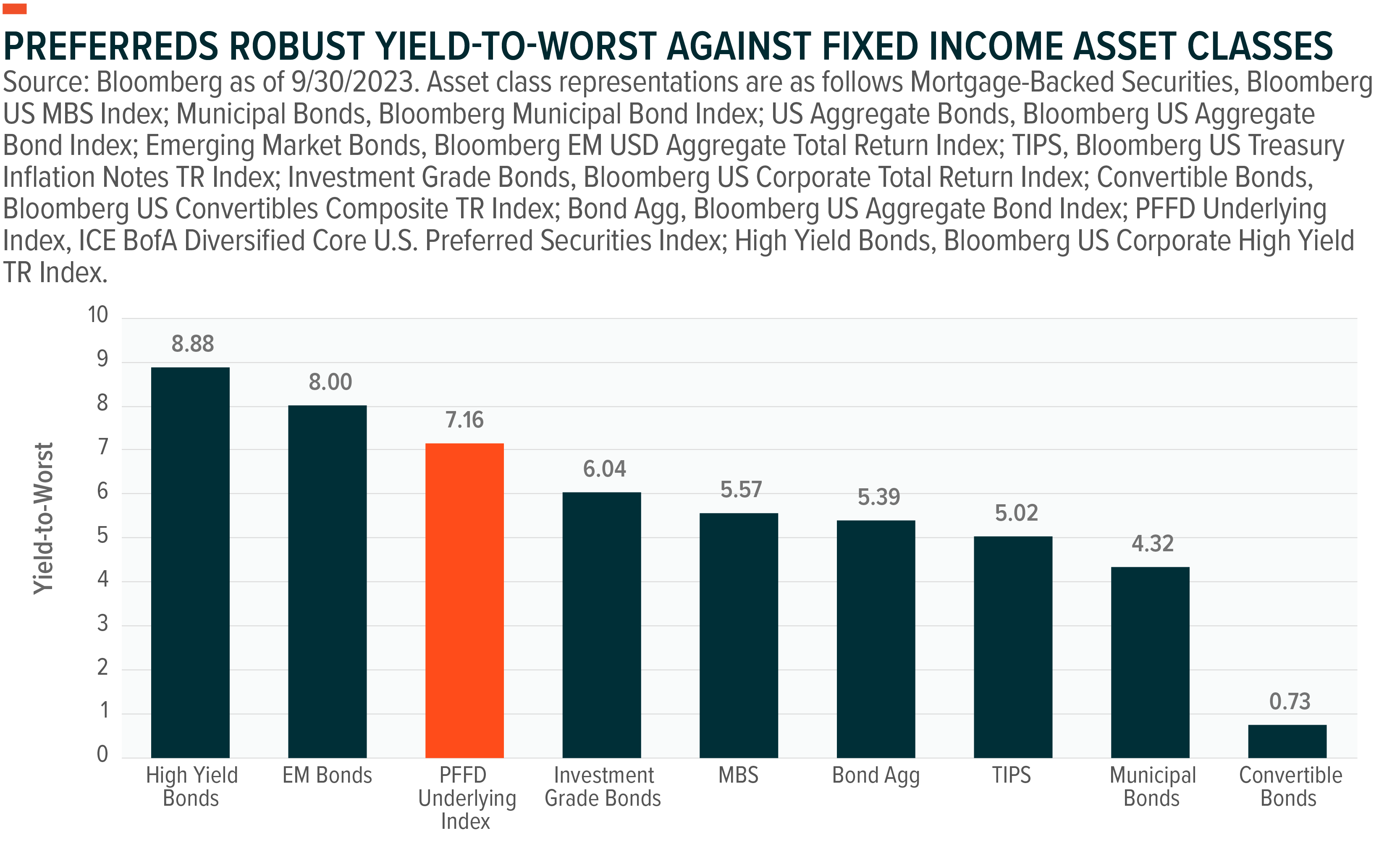

Enhancing Yields with PFFD: Exploring Yield-to-Worst and Strategic Diversification

Beyond the potential advantages linked to this anticipated shift in market conditions, PFFD underlying index also boasts a robust Yield-to-Worst (YTW). This metric represents the lowest yield that a bond or preferred holder may receive, assuming all early retirement provisions are exercised by the issuer. The graph below illustrates that PFFD’s YTW closely trails high-yield bonds, signifying a competitive yield profile. Additionally, PFFD positions itself favorably by concentrating on high-quality constituents, as indicated by the proportion of holdings with investment-grade status measured by the Bloomberg composite Rating scale as of 09/30/2023 and the augmented exposure to G-SIBs (Global Systemically Important Banks).

Conclusion: Preferreds Can Be a Resilient Income Source

Conclusion: Preferreds Can Be a Resilient Income Source

PFFD’s strategic approach not only provides opportunities for diversification but also serves to mitigate uncertainties associated with regional banks. The enduring appeal of G-SIB preferreds stems from the robust balance sheets of these institutions, bolstered by stringent regulations implemented post the Great Financial Crisis (GFC). Moreover, with rates across the treasury curve reaching decade-high levels, the valuations present an enticing entry point. Given PFFD’s exposure to G-SIBs and defensive sectors, it stands as an appealing alternative income source. Whether in a stable or falling rate environment, PFFD’s potential for yield and strategic diversification can empower investors to navigate evolving market dynamics while seeking resilient income streams.

Related ETFs

PFFD – Global X U.S. Preferred ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Rohan Reddy

Rohan Reddy