On March 21, 2024, Global X listed the Bitcoin Trend Strategy ETF (BTRN) on the New York Stock Exchange. BTRN leverages a trend signal developed by CoinDesk Indices called the Bitcoin Trend Indicator (BTI), which aims to detect the presence, direction, and strength of the price trend of bitcoin to capture the upside potential of bitcoin (BTC) while limiting exposure to downside volatility. Based on the BTI signal, BTRN dynamically shifts between BTC futures contracts and U.S. Treasury Bills using the Global X 1-3 Month T-Bill ETF (CLIP). In this blog post, we discuss the methodology behind the strategy and the opportunity it provides.

Key Takeaways

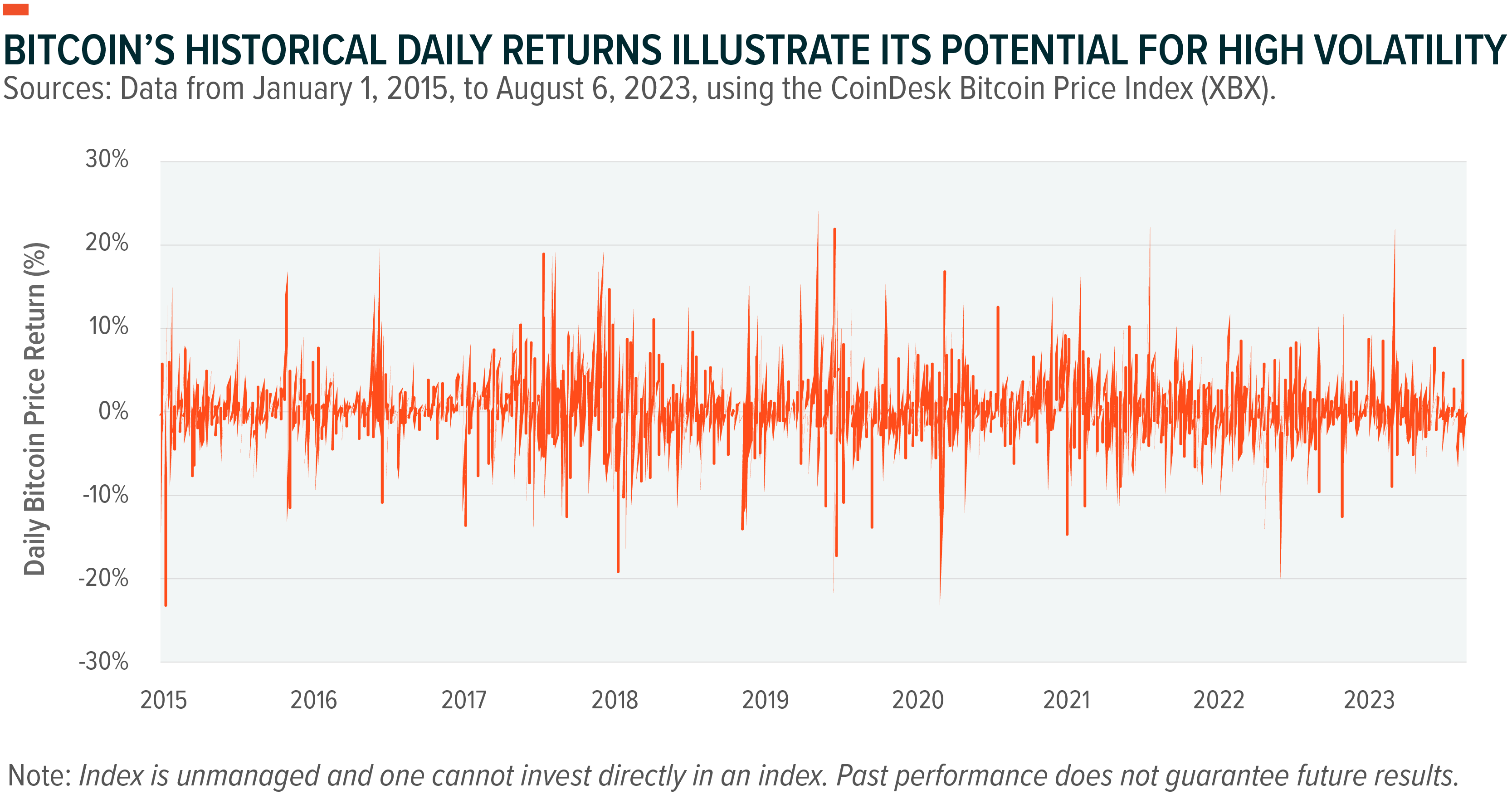

- While the market for bitcoin has slowly matured since its inception in 2009, bitcoin remains subject to significant bouts of volatility and large drawdowns. Despite its generational performance, bitcoin’s volatility has made investing in the nascent asset a challenge from a risk management perspective.

- The Bitcoin Trend Indicator (BTI) measures a series of exponential moving average (EMA) crossovers to quantify bitcoin’s price momentum. The BTI returns a daily value on a spectrum from -1, indicating a significant downtrend, to 1, indicating a significant uptrend.

- The Global X Bitcoin Trend Strategy ETF (BTRN) references the BTI and dynamically balances exposure between CME Bitcoin Futures contracts and short-term U.S. Treasury Bills using the Global X 1-3 Month T-Bill ETF (CLIP) accordingly. This robust risk management strategy is designed to provide opportunity to capture bitcoin future’s secular growth trends while mitigating downside risks by increasing the allocation to the Global X 1-3 Month T-Bill ETF when BTI indicates a downtrend.

Understanding the Bitcoin Trend Indicator (BTI)

A Risk Management Strategy That Tracks Bitcoin’s Price Trends

CoinDesk Indices (CDI) developed the Bitcoin Trend Indicator (BTI), a daily signal that communicates the direction and strength of bitcoin’s price. The BTI generates one of five possible signals every day at 4:00 PM EST, indicating the price momentum of bitcoin on a spectrum ranging from a significant downtrend (-1) to a significant uptrend (1).

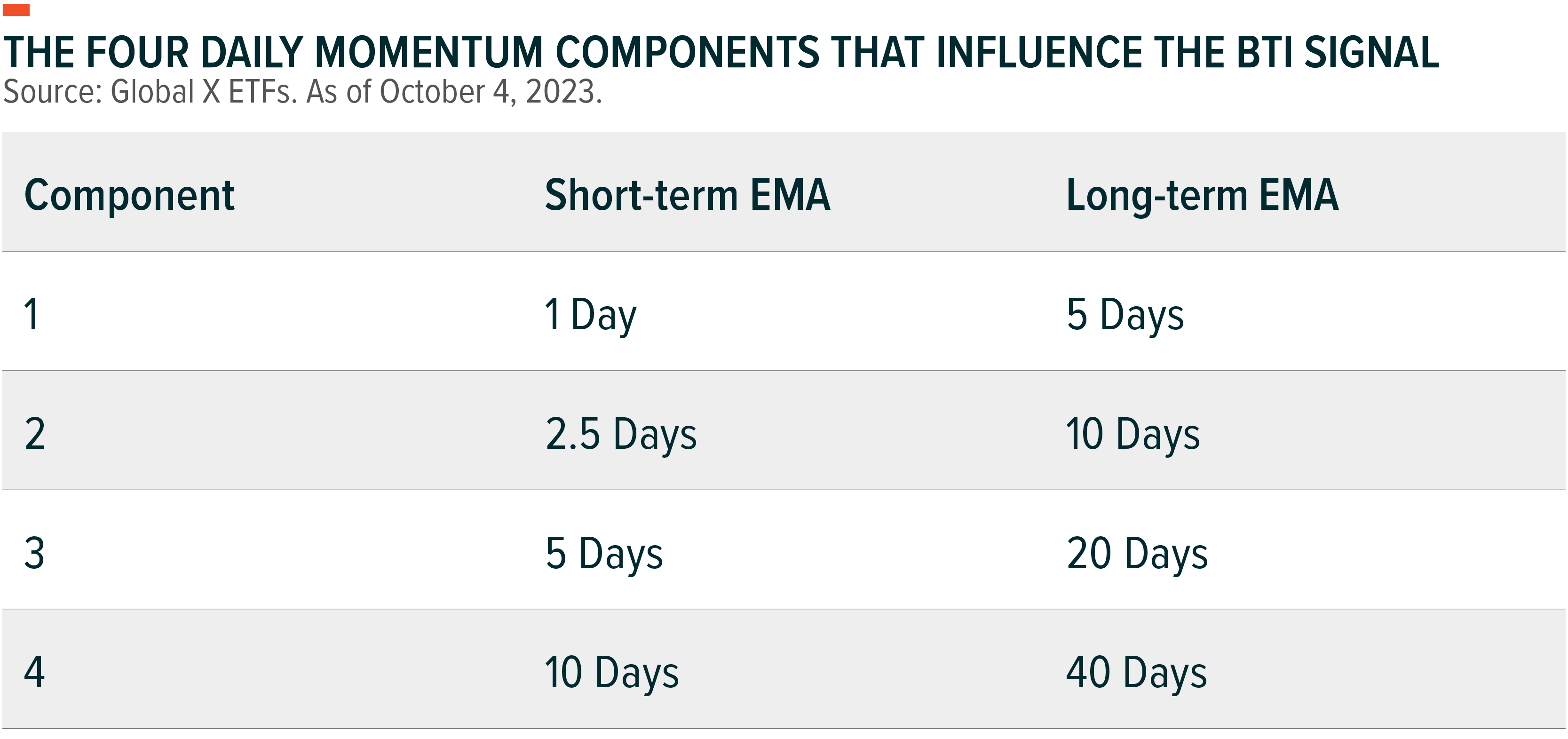

The BTI’s signal is the average of four components, each of which consists of a pair of exponential moving average (EMA) pairs of bitcoin’s price: one short-term and one long-term moving average. Every day, the EMA pairs of each BTI component are compared, yielding a result of either 1 or -1. When the component’s short-term EMA is greater than or equal to its long-term EMA, the component’s value is equal to 1, indicating an uptrend. Conversely, when the short-term EMA is less than the corresponding long-term EMA, the component’s value is equal to -1, indicating a downtrend. Upon deriving the values for each of the four components, the BTI calculates the average of these four values to produce the daily signal, which ranges from -1 to 1 in half point increments.

When short-term moving averages exceed long-term moving averages, it suggests that the recent upward price trend is gaining momentum as it is strong enough to boost the short-term average above the long-term trend. By the same logic, when short-term moving averages are lower than long-term moving averages, it suggests that the recent downward price trend is gaining momentum as it is strong enough to pull the short-term average below the long-term trend.

Moving averages as a whole, and EMAs in particular are useful for smoothing data over various time periods. This makes them ideal quantitative tools for identifying trend changes as they are able to reduce the impact of excess noise in a dataset. EMAs are a type of moving average that place greater weight on more recent data points. Because of this, EMAs tend to be more responsive to changes in trend than simple moving averages (SMAs) which assign an equal weight to every data point. As a result, data lags tend to be less pronounced in EMAs than SMAs. When applied to the BTI, more recent values of bitcoin’s price influence the EMA calculation to a greater extent than older data points.

Assume, as an example, that the short-term EMA is higher than the long-term EMA for three of the four components on a given day. These three components would each return a value of 1, while the fourth component would return a value of -1. Averaging these four inputs, the BTI would yield a signal of 0.5, indicating an uptrend but falling short of a significant uptrend.

Global X Bitcoin Trend Strategy ETF Leverages the BTI Signals to Shift Between BTC Futures and Short-Term U.S. Treasury Bills

The Global X Bitcoin Trend Strategy ETF (BTRN), a long-only strategy, references the BTI signal to dynamically adjust the fund’s asset allocation between CME BTC futures contracts and U.S. Treasury Bills using the Global X 1-3 Month T-Bill ETF (CLIP). This strategy allows investors to maintain exposure to bitcoin futures’ secular growth trends while providing a means to reduce the impact of negative momentum in bitcoin’s price on a portfolio.

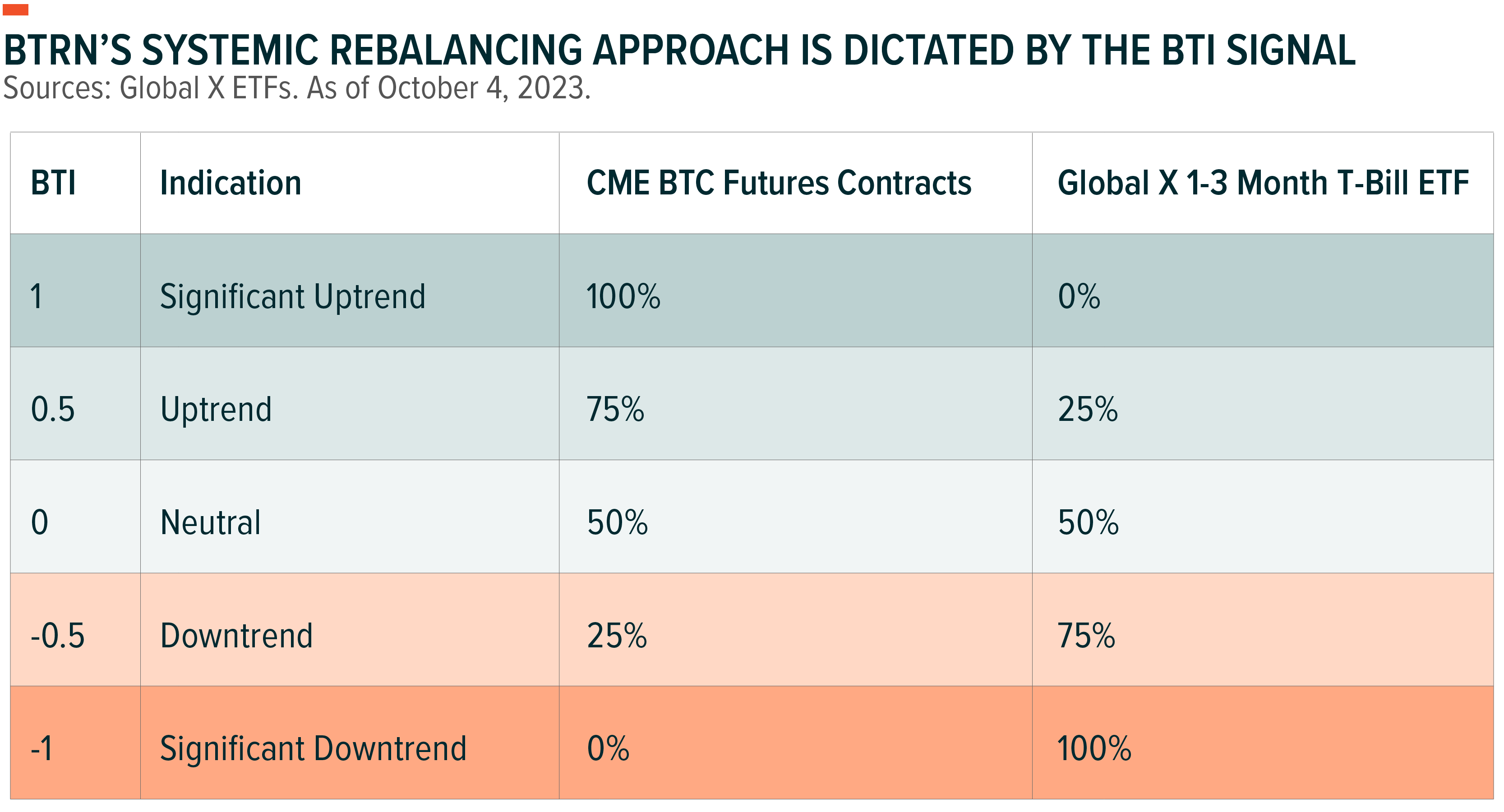

The relative weightings of bitcoin futures contracts and CLIP within the fund are determined by the value of the BTI. When the BTI returns a value of 1 (-1) indicating a significant uptrend (downtrend), the portfolio is rebalanced to 100% (0%) bitcoin futures contracts and 0% (100%) CLIP. Between these two extremes, portfolio weightings for each of these holdings increase or decrease by 25 percentage points for a change of 0.5 in the BTI. A BTI signal of 0.5, for example, would yield a portfolio with a 75% weighting in bitcoin futures contracts, and 25% weighting in CLIP. To balance the impact of very short-term volatility on portfolio turnover and the realization of taxable events, BTRN is rebalanced on a weekly basis. Additionally, portfolio rebalances are subject to a 50% turnover limit per weekly rebalance period, meaning that the strategy may not fully adjust to a significant market dislocation that takes place over a period of a few days. For such a significant change in price trend, more than one rebalance may be needed to fully adjust for the change in trend, though such events would likely only manifest under extreme circumstances.

CLIP Provides a Low-Cost Alternative to Gain Exposure to T-Bills

When the BTI indicates a risk-off environment, BTRN rotates out of bitcoin futures and reallocates capital to CLIP, benefitting from its stability and potential yield.

CLIP invests primarily in U.S. government Treasury Bills with a maturity of 1 to 3 months and a minimum outstanding value of $250 million, ensuring that the fund maintains a high level of liquidity for ease of entry and exit.

While money market funds and other cash equivalent instruments offer the flexibility to invest in a wide range of assets, including treasuries, they often charge higher expense ratios and may include added credit risk. CLIP has an expense ratio of half of the average passive ultrashort bond ETF at 0.07%, offering an attractive vehicle for a strategy such as BTRN.1, 2

Exposure to Bitcoin Adoption with Downside Risk Mitigation

BTRN’s Strategy Seeks to Dampen Bitcoin’s Historical Volatility

Though markets for BTC have matured significantly since bitcoin’s inception in 2009, bitcoin is still subject to significant fluctuations in price. Historically, investors who have taken a long investment horizon have been able to capture bitcoin’s historic upside potential by maintaining their exposure through periods of significant volatility. For this subset of investors, multiple 70%+ peak-to-trough drawdowns and prolonged bear markets have undoubtedly made this strategy difficult and inadvisable from a risk management perspective.3 For most investors, however, bitcoin’s volatility has been a deterrent to investing in the first place.

BTRN seeks to address this barrier to investment by building a risk management strategy directly into the product. Using a data-driven approach, BTRN seeks to shield investors against a portion of bitcoin’s downside risk all while being ready to increase exposure to bitcoin futures as price trends begin to reverse to the upside.

What Are the Conditions Under Which the Strategy Is Most and Least Likely to Be Successful?

The strategy works best when there is clear and steady momentum to either the upside or the downside. This type of market environment allows the BTI to return consistent signals, meaning the strategy need only make smaller adjustments to market positioning, thereby reducing portfolio turnover while managing risk levels as indicated by the overarching market trend.

Conversely, periods of high volatility, especially those characterized by rapid, violent changes in the price of bitcoin could result in less optimal performance. This is because rapid changes in price in either direction may affect how quickly the portfolio can be rebalanced. In part, this is due to the portfolio only being rebalanced once per week. As such, a rapid change in price may not be reflected in new portfolio weightings for several days.

Related ETFs

BTRN – Global X Bitcoin Trend Strategy ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Global X Research Team

Global X Research Team