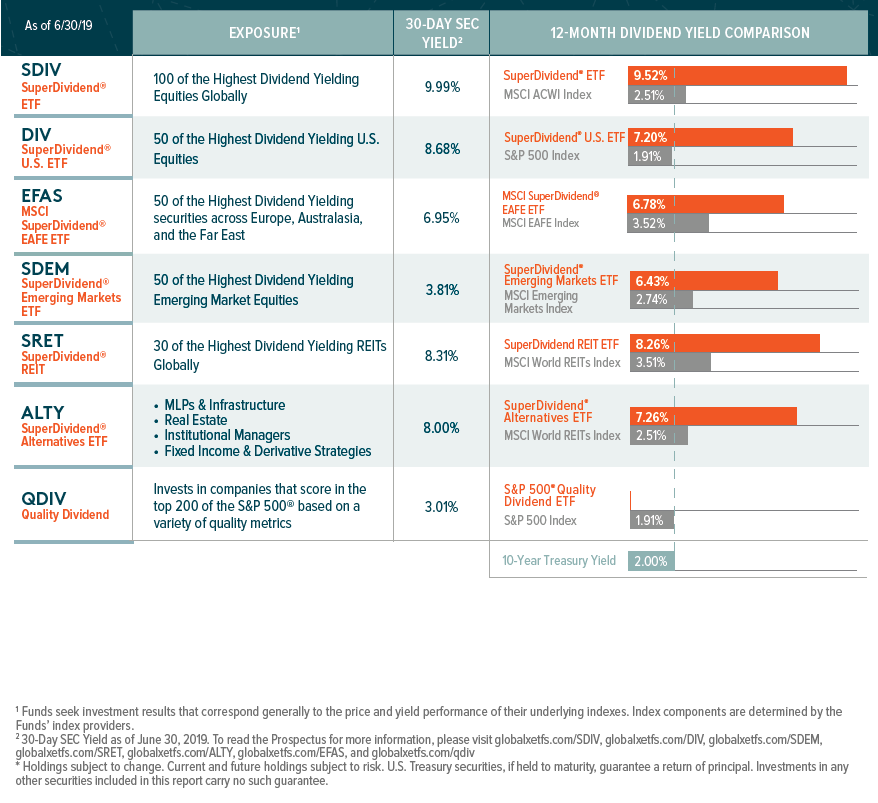

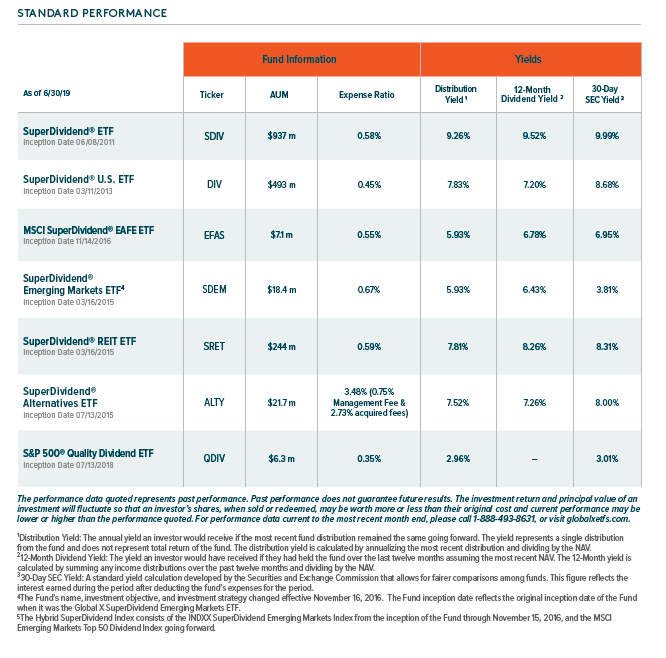

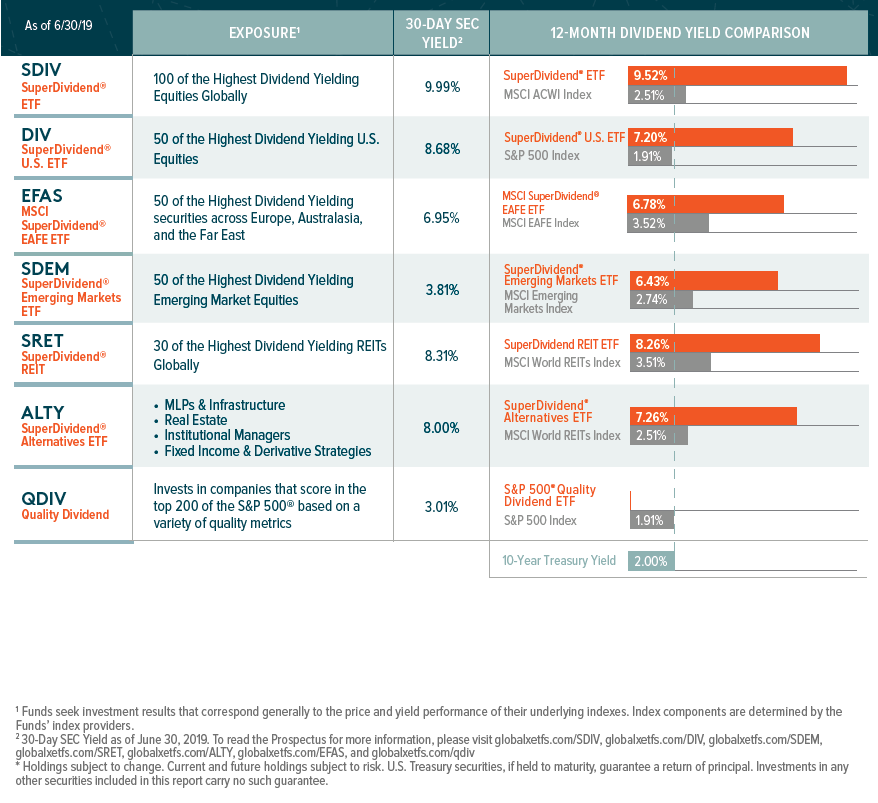

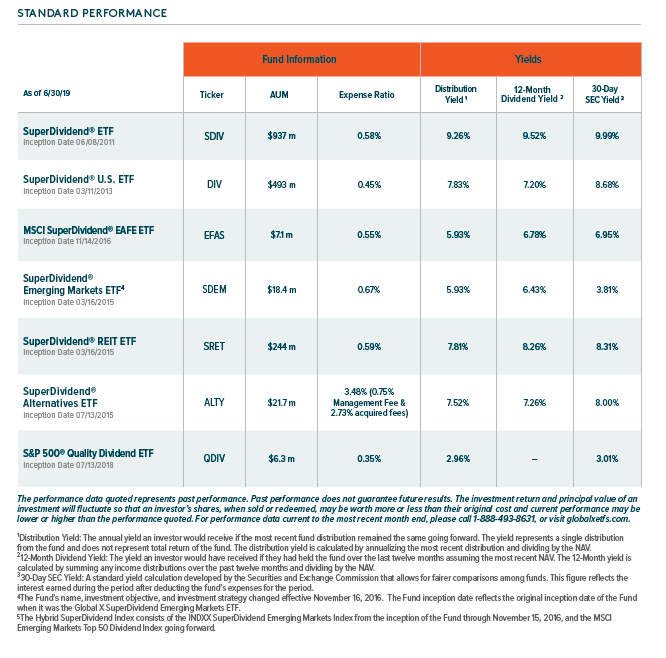

The Global X research team has posted the SuperDividend® Report for Q2, highlighting yield comparisons, performance, historical distributions, and underlying credit ratings for the Global X SuperDividend suite. Click here to read the report.

The Global X research team has posted the SuperDividend® Report for Q2, highlighting yield comparisons, performance, historical distributions, and underlying credit ratings for the Global X SuperDividend suite. Click here to read the report.

For performance data current to the most recent month- or quarter-end, please visit SDIV, DIV, EFAS, SDEM, SRET, ALTY, QDIV.

Investing involves risk, including the possible loss of principal. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Narrowly focused investments typically exhibit higher volatility.

Diversification may not protect against market loss.

High yielding stocks are often speculative, high risk investments. These companies can be paying out more than they can support and may reduce their dividends or stop paying dividends at any time, which could have a material adverse effect on the stock price of these companies and the Fund’s performance. There is no guarantee that dividends will be paid.

The potential benefits of investing in MLPs depend on them being treated as partnerships for federal income tax purposes. Further, if the MLP is deemed to be a corporation then its income would be subject to federal taxation at the entity level, reducing the amount of cash available for distributions to the fund which could result in a reduction of the fund’s value. The risks associated with real estate investment trusts including interest rate risk which may cause certain REIT holdings to decline in value if interest rates increase. REITs are subject to general risks related to real estate including default risk and the possibility of decreasing property values. Real estate is highly sensitive to general and local economic conditions and developments, and characterized by intense competition and periodic overbuilding. Many real estate companies, including REITs, utilize leverage (and some may be highly leveraged), which increases risk and could adversely affect a real estate company’s operations and market value in periods of rising interest rates.

ALTY may invest in MLPs, infrastructure investments, REITs, mortgage REITs, convertibles, preferred stocks, senior loans, currency trading, long/short credit, business development companies (“BDCs”), private equity, alternative strategy managed portfolios- and option-writing and therefore may be subject to all underlying risks. ALTY may invest in derivatives, which are often more volatile than other investments and may magnify the Fund’s gains or losses.

EFAS may invest in small- and mid-capitalization companies, which pose greater risks than large companies.

EFAS, SDEM, SRET, ALTY, & QDIV are non-diversified.

This information is not intended to be individual or personalized investment or tax advice. Please consult a financial advisor or tax professional for more information regarding your tax situation. The fund is required to distribute income and capital gains which may be taxable. Buying and selling shares will result in brokerage commissions and tax consequences. Shares are only available through brokerage accounts which may have minimum requirements. Only whole shares may be purchased.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Market price returns are based upon the midpoint of the bid/ask spread at the close of the exchange and does not represent the returns an investor would receive if the shares were to trade at other times. Brokerage commissions will reduce returns. NAVs are calculated using prices as of 4:00 PM EST.

This material must be preceded or accompanied by a current summary or full prospectus, full prospectus. Investors should read it carefully before investing or sending money.

Global X Management Company, LLC serves as an advisor to the Global X Funds. The Global X Funds are distributed by SEI Investments Distribution Co., which is not affiliated with Global X Management Company or any of its affiliates.