The Global X research team is pleased to release the Q4 2021 edition of the Thematic ETF Report. The report recaps Global X’s classification system for disruptive themes and the thematic ETFs that track them. It also provides industry-level analysis of thematic investing ETFs, looking at new launches and closures, changes in assets under management (AUM), and fund flows.

Click here to download the Thematic ETF Report Q4 2021

Thematic ETF Landscape – Q4 Recap

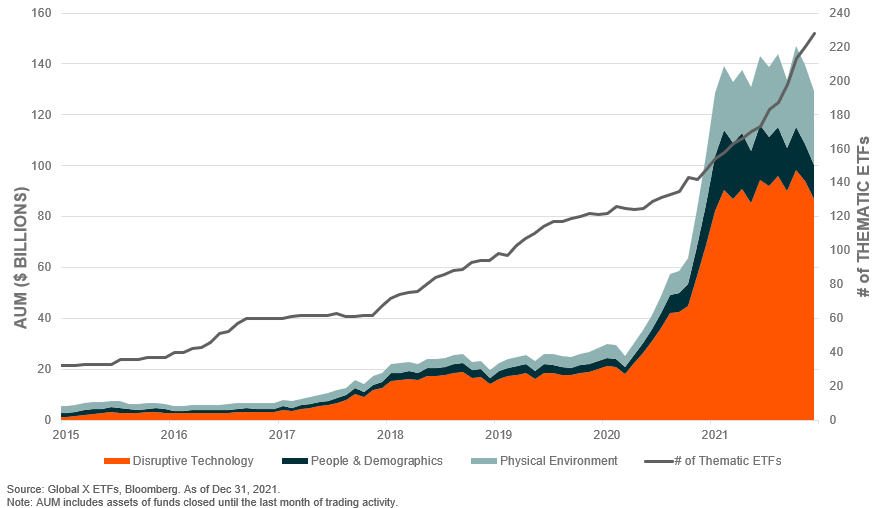

At the end of Q4 2021, thematic ETFs represented 1.8% of the US ETF industry’s $7.2T total AUM. This is slightly lower than the 2.0% level reached at the end of Q3 2021.

Digging in, Thematic ETF AUM fell to $129.4B this quarter, down 3% from Q3’s AUM of $133.7B. The fall in thematic assets compares negatively to the broader US ETF industry’s 9% quarter-over-quarter (QoQ) gain.

Despite the decline in assets, Thematic ETFs saw positive net inflows during the quarter amounting to $3.2B, with market activity of -$7.5B responsible for Q4’s overall AUM decrease.

On a year-over-year basis, Thematic ETF AUM increased 24% from $104.1B at the end of Q4 2020.

There are now 228 thematic ETFs, up from 198 at the end of last quarter, with 32 launches and 2 closures.

Physical Environment-related themes saw an increase in AUM of $2.2B. On the other hand, People & Demographics-related themes saw the largest AUM decline of -$3.6B, followed by those related to Disruptive Technology of -$2.9B.

At a theme-level, Cybersecurity became the largest theme by AUM, followed by CleanTech and Cloud Computing.

Thematic ETFs AUM & Number

T = Trillions, B = Billions.

Global X’s Thematic Classification System

Global X’s research team established a thematic classification system that provides a consistent framework for identifying disruptive themes and categorizing the thematic ETF space. Often, we have seen conflicting definitions of thematic investing in the media and financial world, which leads to confusion about which ETFs are thematic and what themes they are tracking. With the introduction of this classification system, we hope to provide more clarity around disruptive themes and their related ETFs.

Defining Thematic Investing

Global X defines thematic investing as the process of identifying powerful disruptive macro-level trends and the underlying investments that stand to benefit from the materialization of those trends.

By nature, thematic investing is a long term, growth-oriented strategy, that is typically unconstrained geographically or by traditional sector/industry classifications, has low correlation to other growth strategies, and invests in relatable concepts.

Notably, thematic investing does not consist of ESG, values-based, or policy-driven strategies, unless they otherwise represent a disruptive structural trend (e.g. climate change). Further, funds that adhere to traditional sector or industry classifications, or that are used primarily to gain exposure to cyclical trends (e.g. currencies, valuations, inflation) are not considered thematic. Finally, alternative asset classes, such as listed infrastructure, MLPs, and ubiquitous commodities are not considered thematic.

Classifying Themes

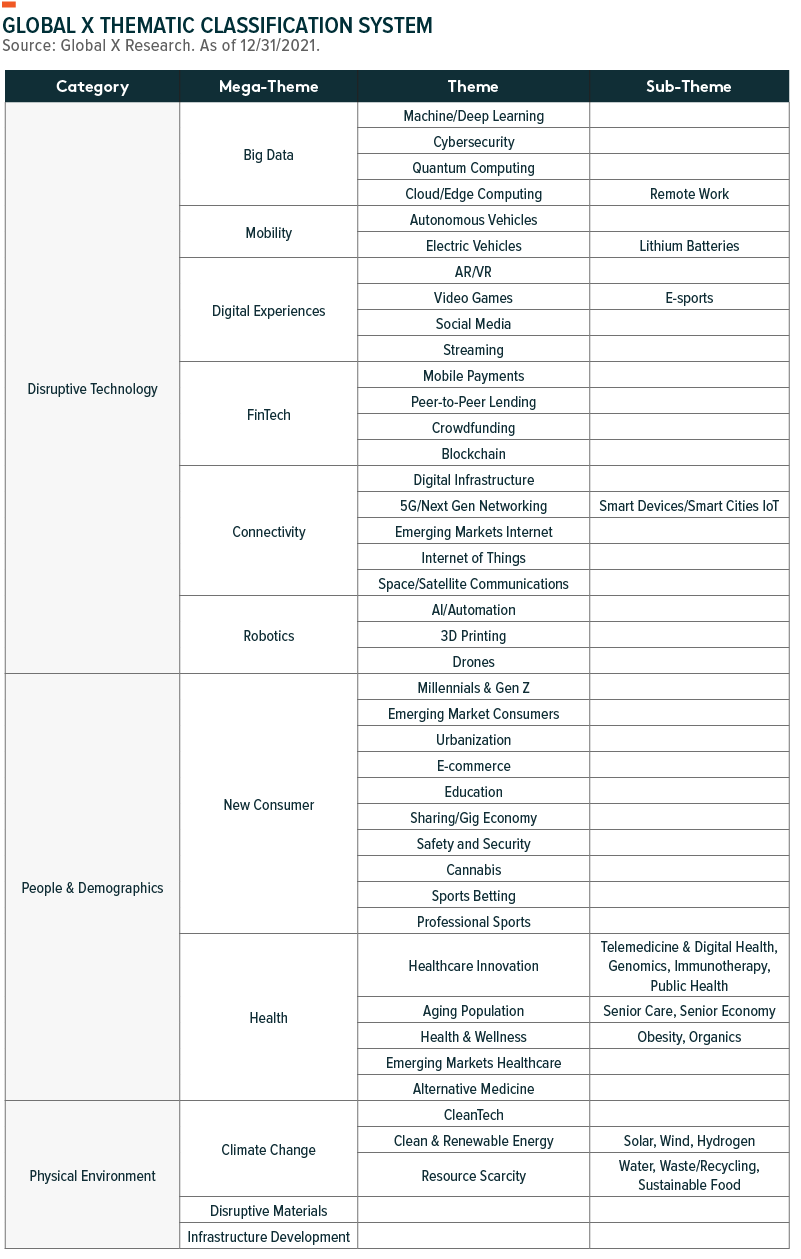

Global X’s thematic classification system consists of four layers of classifications: 1) Categories; 2) Mega-Themes; 3) Themes; and 4) Sub-Themes, with each layer becoming sequentially narrower in its focus.

‘Categories’ is the broadest layer and represents three fundamental drivers of disruption: exponential advancements in technology (Disruptive Technology), changing consumer habits and demographics (People & Demographics), and the evolving physical landscape (Physical Environment).

One layer down are ‘Mega-Themes,’ which serve as a foundation to multiple transformative forces that are causing substantial changes in a common area. Conceptually, Mega-Themes are a collection of more narrowly targeted Themes. For example, Big Data is a Mega-Theme that consists of Machine/Deep Learning, Cybersecurity, Quantum Computing, and Cloud/Edge Computing.

Further down, we identify ‘Themes’ as the specific areas of transformational disruption that are driving technology forward, changing consumer demands, or impacting the environment. There are currently 40 themes in the classification system.

‘Sub-Themes’ are more niche areas, such as specific applications of themes or upstream forces that are driving themes forward.

Thematic ETFs can target a specific category, mega-theme, theme, or sub-theme. Our categorization process seeks to find the best fit for a specific ETF, analyzing its methodology, holdings, and stated objectives. The thematic classification system is reviewed quarterly to consider new potential categories, mega-themes, themes, or sub-themes. As a new ETF launches or changes its strategy, its classification is evaluated immediately.

Conclusion

In an uncharted era of new technologies disrupting existing paradigms, demographics reshaping the needs of the world’s population, shifting consumer behaviors forcing changes to existing business models, and dramatic changes in our physical environment, we find that there is a growing need for a consistent framework to track these themes and the investment vehicles providing access to them.

Pedro Palandrani

Pedro Palandrani