Covered call strategies can play an important role in the modern investor’s portfolio, offering a diversified potential source of income while mitigating downside risks. Historically, covered call strategies required investors to trade options themselves, a task requiring expertise and frequent hands-on trading. But the availability of exchange-traded funds that incorporate covered call strategies, such as the Global X Nasdaq 100 Covered Call ETF (QYLD), can help investors efficiently add these strategies to their portfolios.

Covered Call Strategies Can Generate Meaningful Income Amid Periods of High Volatility

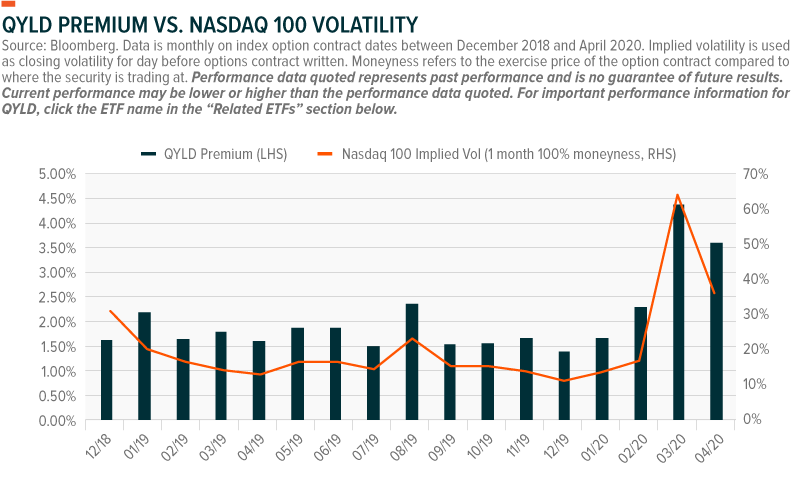

Equity markets typically loathe volatility. In periods of stress, volatility rises and stocks sell off as investors move towards lower-risk investments. Yet covered call strategies can turn volatility into an asset. This is due to a basic tenant of options investing: option premiums are positively correlated to volatility.

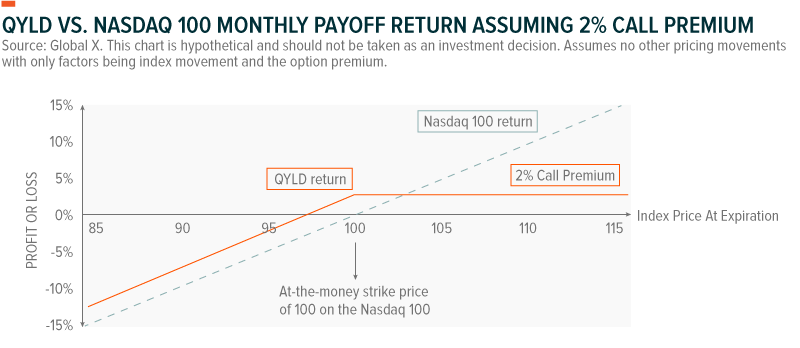

Investors can take advantage of this principle by writing or selling options contracts. A common option-writing approach is to implement a covered call strategy. QYLD for example buys the underlying stocks in the Nasdaq 100 and writes a corresponding at-the-money (ATM) monthly call option on the Nasdaq 100 Index, continuously rolling over the contracts monthly at expiration. This covered call strategy allows the fund to collect the monthly premium from selling Nasdaq 100 Index options, while hedging against a rally in the index.

The chart below shows the historic relationship between the premiums received by the fund and the Nasdaq 100’s implied volatility.

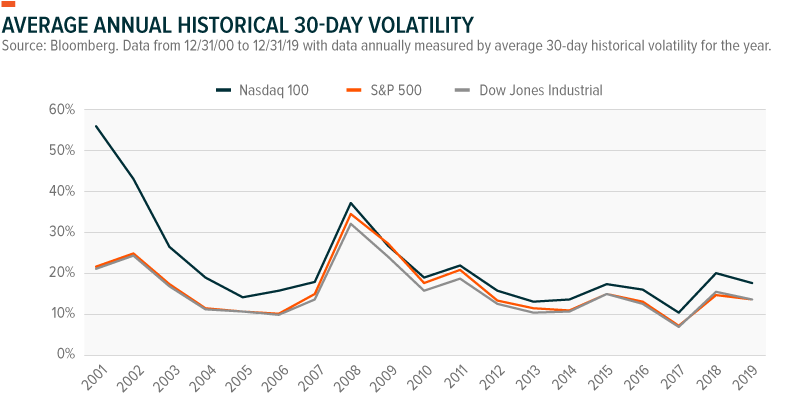

The Nasdaq 100 Index is not only a widely traded index, but also one that tends to be more volatile than its peers. The chart below shows the historical volatility of the Nasdaq 100 consistently exceeding its US broad market index peers – the S&P 500 and Dow Jones Industrial. As discussed above, higher volatility can result in higher option premiums, making the Nasdaq 100 a potentially attractive solution for a covered call strategy.

Covered Call Strategies Offer Defensive Characteristics

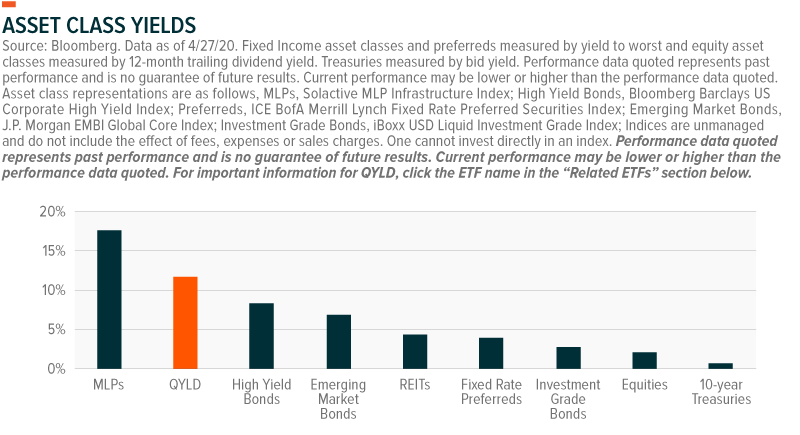

The current investment landscape features a host of concerns for income-oriented investors: heightened market turbulence, low bond yields, and widespread dividend cuts. Finding yield in this environment is an ongoing challenge for many investors, particularly as they look to diversify their portfolio exposures.

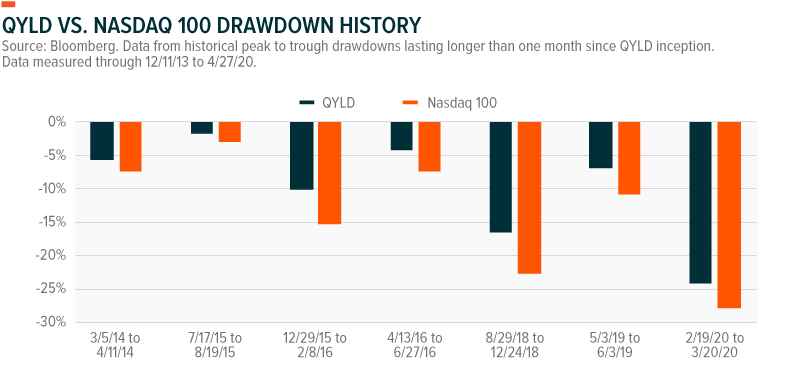

Covered call strategies can play a useful role in a portfolio not just as a yield-generator, but also as a way to potentially outperform in downturns and certain sideways markets. For QYLD, its drawdowns tend to be lower in most downturns compared to the underlying Nasdaq 100 Index because the option premiums help buffer against drawdowns.

A Diversifier for An Income Portfolio

Unlike equities and bonds, it’s not always easy to know where to fit a covered call strategy into an income portfolio. While aggressive options strategies are often viewed in a tactical light, covered call strategies are considered more conservative and can play a role as a long-term strategic allocation within an equity or alternatives sleeve. The chart below shows that very few asset classes offered the income that QYLD generated over the last 12 months.

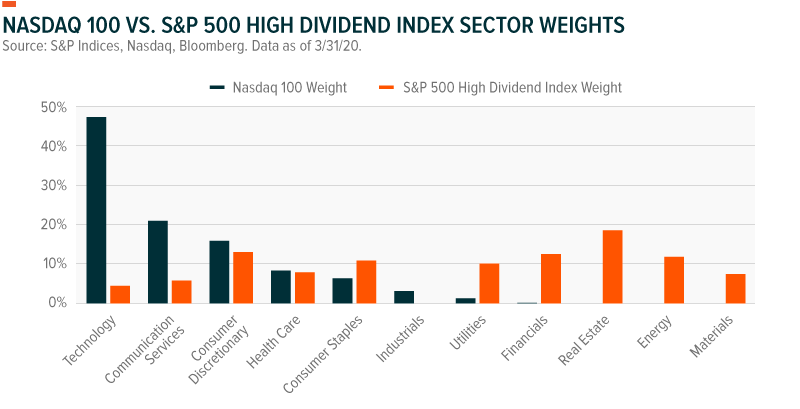

But beyond yield, QYLD can also provide diversification. The Nasdaq 100 is weighted heavily towards the Information Technology and Communications Services sectors, whereas most dividend strategies tend to favor sectors like Energy, Real Estate, and Utilities. In addition, monthly options premiums are not greatly impacted by interest rates, whereas traditional fixed income instruments typical possess meaningful duration risk. Finding potential income from sources with low duration and unique exposures can be an overlooked challenge for investors, but a covered call approach with the Nasdaq 100 may be an important diversifier.

Conclusion: Covered Call Strategies Can Play Multiple Roles In an Income Portfolio

Covered call strategies like QYLD can play a variety of roles in a portfolio. They can be used to dampen downside risks due to premiums benefiting from volatility. Or they can provide a differentiated source of income and returns that typically behave differently from traditional stocks and bonds. In the current environment, where income is scarce, and portfolios often suffer from over-concentration, we believe it is important to consider covered call strategies alongside other income-producing assets.

Related ETFs

QYLD: The Global X Nasdaq 100 Covered Call ETF follows a “buy-write” (also called a covered call) investment strategy in which the Fund buys a stock or a basket of stocks, and also writes (or sells) call options that correspond to the stock or basket of stocks. The Fund uses this strategy in an attempt to enhance its portfolio’s risk-adjusted returns, reduce its volatility, and generate monthly income from the premiums received from writing the call options.

Rohan Reddy

Rohan Reddy