On February 11, 2026 we listed the Global X Commodity Strategy ETF (COMD) on the Cboe BZX. COMD is an actively managed ETF that seeks to provide exposure to commodity assets. The fund primarily gains exposure to commodities through long positions in commodity futures contracts and exchange-traded products that invest in physical commodities (“Physical Commodity ETPs”). COMD is benchmarked against the Bloomberg Commodity Total Return Index.

Key Takeaways

- Many advisors recognize the potential role commodities can play within a diversified portfolio but may find it challenging to closely monitor the broad and complex universe of individual commodity markets.

- COMD is designed to provide a long-term, actively managed approach to commodity exposure.

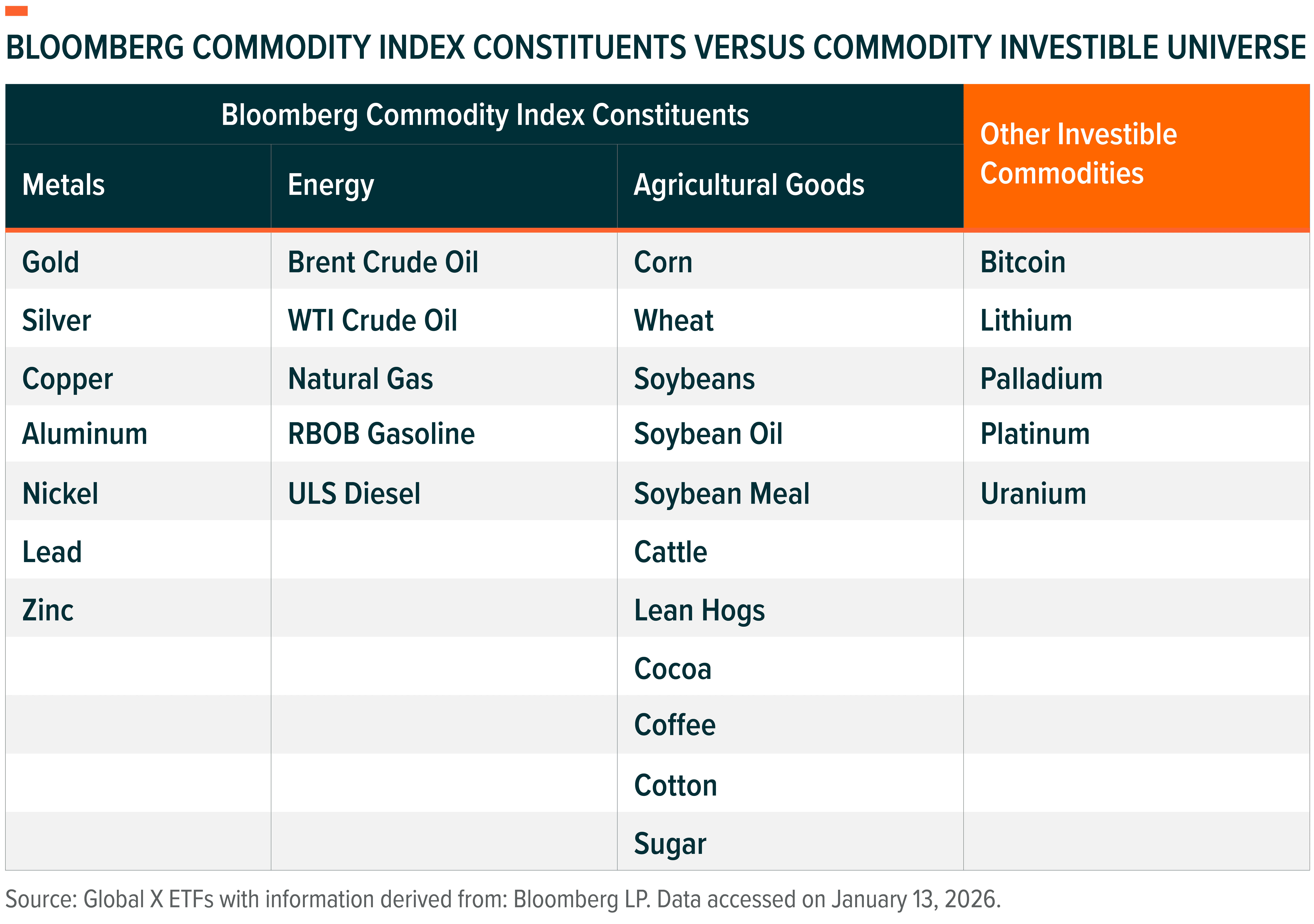

- In addition to traditional commodity markets, COMD may consider exposure to select off-benchmark commodity futures as part of its broader opportunity set, including assets associated with technological innovation, artificial intelligence, and electrification, such as bitcoin, platinum, and uranium.

Introducing the Global X Commodity Strategy ETF (COMD)

Many allocators understand the potential benefits commodities could bring to portfolio construction but may not have the expertise or time required for selection. We believe that investing in this asset class can benefit from active management that includes specialized expertise, continuous monitoring of market conditions, and an understanding of both macroeconomic and idiosyncratic drivers across a diverse set of commodities. The Global X Commodity Strategy ETF (COMD) is designed to actively manage commodity exposure with the objective of seeking capital appreciation. COMD seeks to leverage a combination of fundamental research and quantitative analysis to inform commodity selection and positioning, while also layering human risk management and portfolio construction.

The fund is managed by a three-person portfolio management team with deep experience in commodity analysis and futures trading. The fund managers will also be supported by Global X Management Company’s fundamental research and trading teams. The team will also leverage quantitative models from research provider Wealthspot LLC. COMD combines the liquidity, transparency, and accessibility of an ETF with the flexibility of an actively managed strategy for a total expense ratio of 0.55% while not having to issue K-1 tax forms to investors.

Portfolio Managers

- Trevor Yates: Trevor joined Global X Management Company in 2023 and serves as a Senior Investment Analyst on the Emerging Markets team with a focus on the materials sector. Prior to joining Global X, Trevor worked on the same team at Mirae Asset Global Investments based out of New York. Before breaking into finance, Trevor was a professional hockey player. He graduated from Cornell with a degree in Applied Economics and Management with a concentration in Finance.

- Sandy Lu: Sandy joined Global X Management Company in 2021 and oversees the management of the firm’s Quantitative and Fixed Income Investment team. Prior to joining Global X, Sandy worked for PGIM Fixed Income as a portfolio analyst and junior portfolio manager on the Emerging Markets Debt team. He began his career at Lincoln Financial Group. Sandy earned his B.S. in Economics from the Wharton School of the University of Pennsylvania and is a CFA charter holder.

- Paul Dmitriev: Paul joined Global X Management Company in 2023 and serves as Co-Portfolio manager and a Senior Investment Analyst on Global X active Emerging Market strategies, with a focus on the energy sector. Before joining Global X, Paul worked as an investment analyst at Mirae Asset Global Investments. Paul began his career at HSBC as a research analyst covering credit and equity across energy, industrials, and utilities. Paul holds a B.S. from NYU Stern School of Business, where he focused on Economics, Finance, and Political Science.

Why Invest in Commodities?

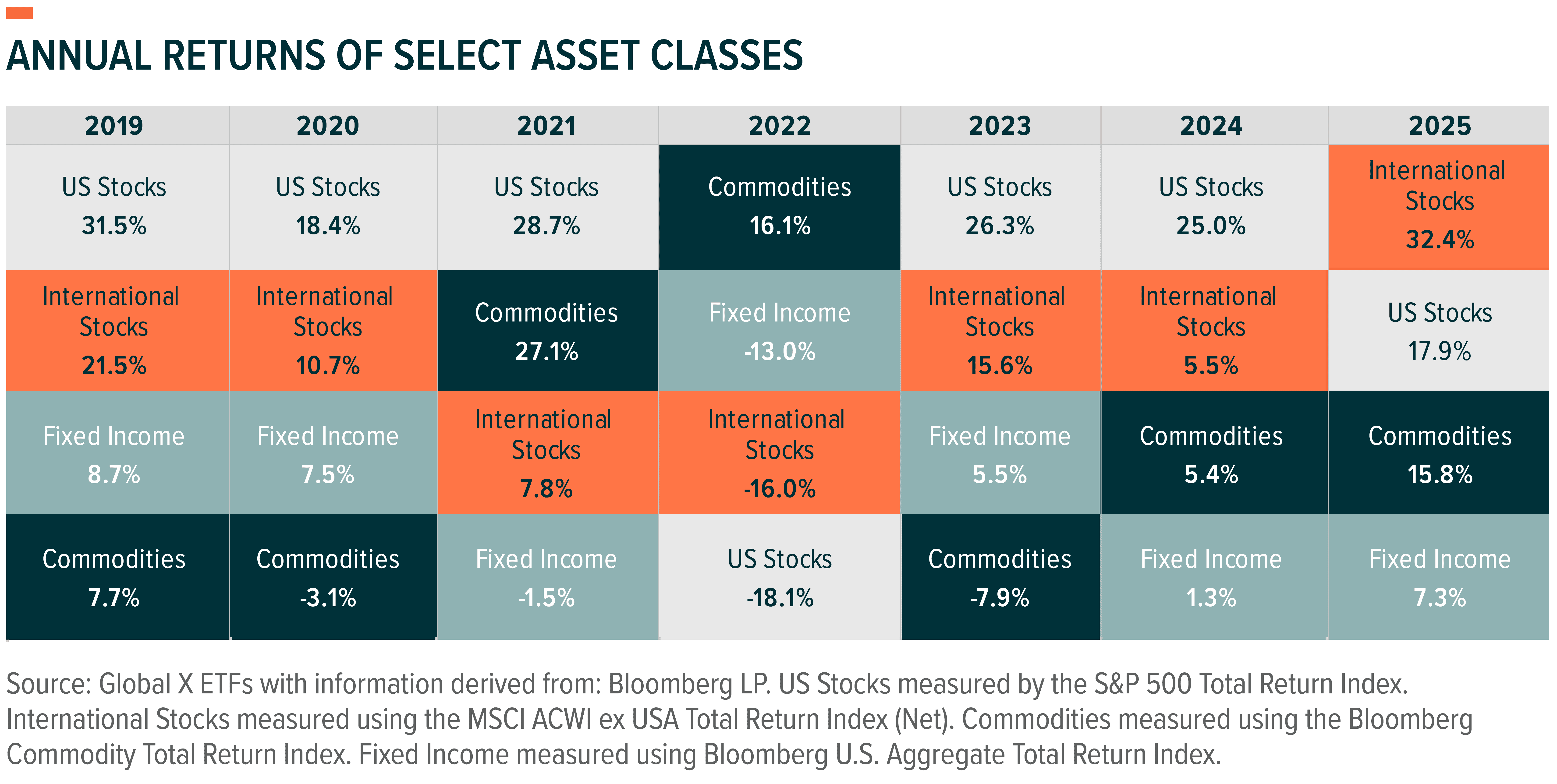

Commodities have long played a foundational role in the global economy and may serve an important function in investment portfolios. Commodities can potentially provide diversification to a traditional 60/40 asset allocation because commodities have historically exhibited low or, at times, negative correlation to traditional asset classes such as equities and fixed income.1 As a result, they may help reduce overall portfolio volatility through diversification.2 (Diversification does not ensure a profit or guarantee against a loss). Commodities have also been viewed as a potential hedge against inflation, as prices for physical goods and raw materials often rise alongside increases in the general price level and therefore may help protect against currency debasement.3 Additionally, because commodity demand is closely linked to global industrial activity and consumption, commodities may offer exposure to real economic cycles and global growth. Across market environments, these characteristics have positioned commodities as a potential tool for enhancing risk-adjusted returns and, as a result, we believe commodities can play a crucial role within investors’ portfolios.

Index returns are for illustrative purposes only and do not represent Fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

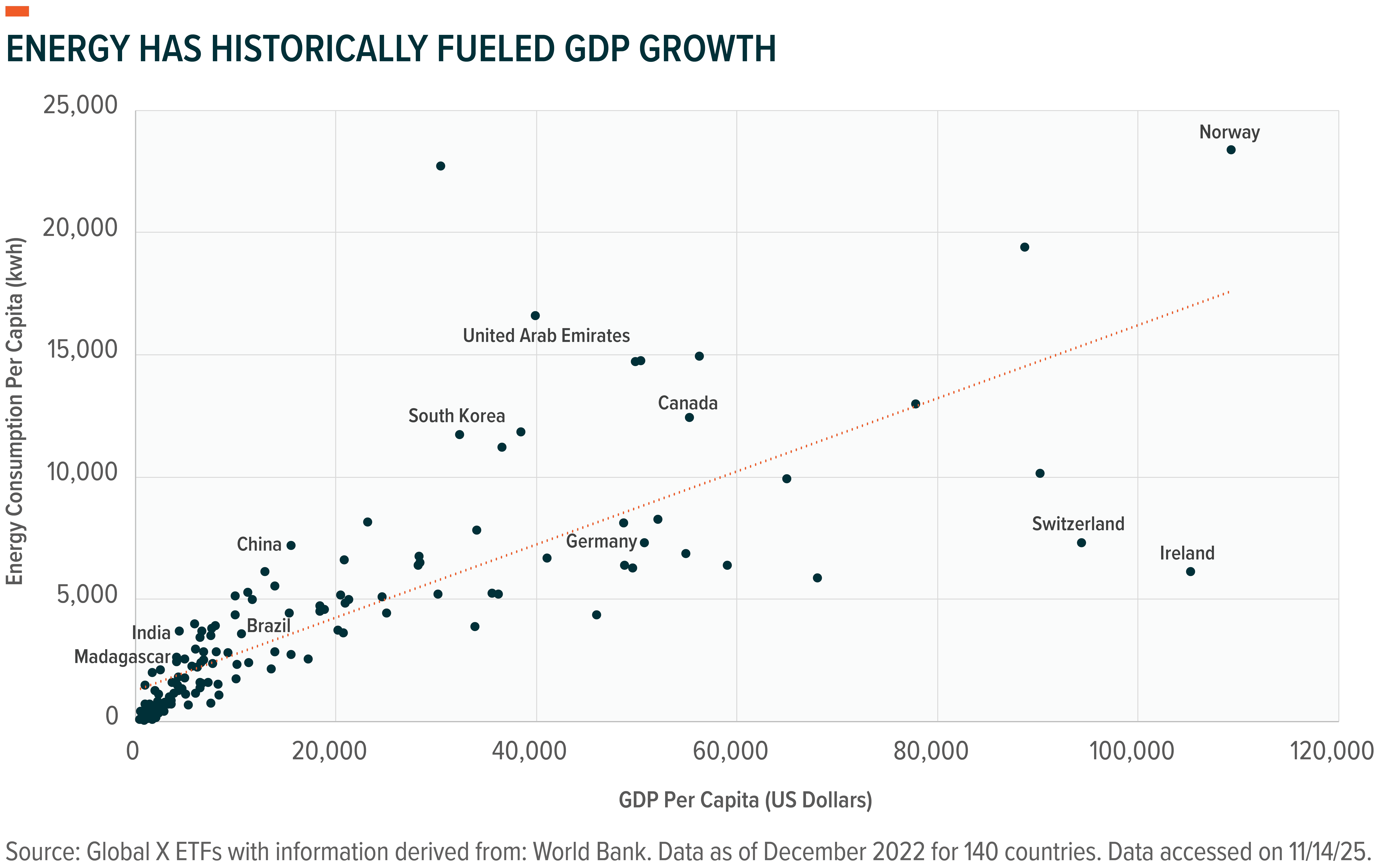

Commodities have long been the building blocks of the global economy, and there is a direct relationship between energy consumption and economic growth: Energy commodities power global transportation networks, heat homes, and fuel industrial production; Metals form the backbone of infrastructure development and are critical inputs for electrification and clean-technology initiatives; Agricultural commodities support food security by supplying essential inputs to the global food system. These characteristics make commodities essential to everyday life, underscoring their importance to economic development and growth. Beyond their physical utility, commodities may also offer exposure to innovation, with new technologies not only bringing new use cases for existing technologies but also creating new commodities themselves, such as bitcoin. Technological innovation alongside structural megatrends, such as electrification, urbanization, and artificial intelligence, can alter long-term supply-and-demand balances and create differentiated drivers of growth for the asset class beyond traditional cyclical demand. As a result, we view commodities as not only essential to fuel global growth, but vital to unlocking innovation in the real economy.

Why Consider an Active Approach to Commodity Markets?

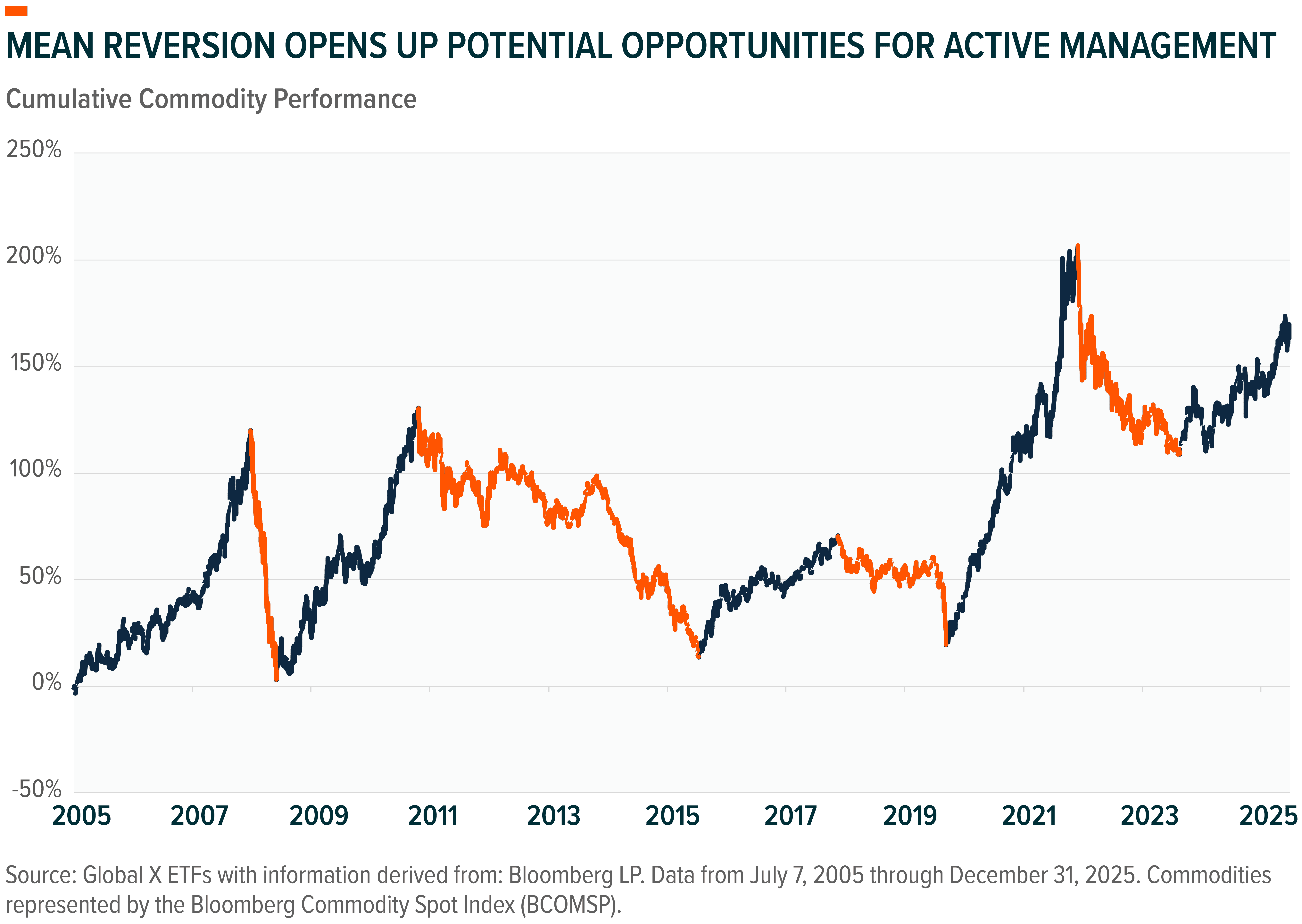

Commodity markets are shaped by ever changing real-world forces such as supply constraints, fluctuations in demand, substitution, weather, geopolitics, and policy, factors that can change quickly and unevenly across markets. These factors have led to the prevalence of boom-and-bust cycles over time, with commodities historically exhibiting heightened cyclicality and mean reversion tendencies. Adding to this, each individual commodity also maintains its own unique supply-demand dynamics, with each market possessing many unique and idiosyncratic factors. As a result, different commodities often perform differently across economic environments, which can potentially create opportunities for active management. A static, index-based approach may not account for these changing dynamics, while an active strategy can seek to adjust exposures as conditions evolve, emphasizing areas with more favorable fundamentals while also seeking to manage concentrations of risk.

Index returns are for illustrative purposes only and do not represent Fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Active strategies may also add value through a more deliberate and flexible approach to implementing commodity exposure. Choices related to contract selection, futures rolling, and portfolio construction can meaningfully influence outcomes, particularly during periods of heightened volatility or unusual market conditions. Rather than relying on fixed, rules-based methodologies, an active approach allows for greater discretion in seeking to manage risks and inefficiencies that can arise in futures markets. Active strategies such as COMD may also have the option to invest in commodities that are currently not included in the benchmark, such as bitcoin, uranium, platinum, and palladium, potentially providing exposure to commodities with evolving or favorable long-term supply-demand fundamentals.

Conclusion: COMD Offers Active Exposure to an Often Underappreciated Asset Class

Commodities are essential inputs to the global economy, offering exposure to real economic activity and innovation, as well as potentially to structural themes such as electrification. The asset class can play an important role in portfolio construction, given the potential diversification benefits, as well as historically acting as an inflation hedge. However, commodity markets are complex, shaped by shifting supply-and-demand drivers, market structure, and futures market dynamics, factors that can create meaningful differences in outcomes over time and highlight the potential value of active management. COMD offers actively managed exposure to commodity markets, leveraging fundamental research, quantitative insights, and human portfolio construction at a total expense ratio of 0.55% while avoiding K-1s.

Related ETF

COMD – Global X Commodity Strategy ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.