At its core, Chainlink bridges a gap. In September 2017, the Chainlink whitepaper introduced a solution that expands smart contracts’ use cases while addressing their limitations and providing tamper-resistant infrastructure. Native smart contracts lack the ability to communicate with resources external to their host blockchain (off-chain computation), limiting the functionality and programmability of decentralized applications (dapps) to internal data (on-chain data). Chainlink, a network of oracles, acts as a bridge between smart contracts and off-chain computation.

A central provider of off-chain data would stand in opposition to a blockchain’s main principles. This is because blockchains seek to avoid trust in a single entity. Chainlink addresses this fault by using a large network of decentralized and independent nodes to connect off-chain services and data requests with smart contracts.

The protocol launched on the Ethereum network on May 30th, 2019. Since then, Chainlink has grown to become the largest decentralized oracle network powering the leading smart contract blockchain ecosystems. Aside from Ethereum, the Chainlink network services most EVM-compatible chains, which are blockchains that adopted Ethereum’s virtual machine as their operating system, as well as the Solana network.

We believe that demand for the services that Chainlink provides, the manner in which it provides them, and its economic model create a compelling value proposition for its native asset, LINK. Chainlink enables tens of billions of dollars to move across DeFi, on-chain gaming, and other major industries. As the dominant oracle, Chainlink is foundational to the success of blockchain-based applications and the growth of Web3.

Key Takeaways

- Chainlink is the largest decentralized oracle network powering the leading smart contract blockchain ecosystems. Its product offerings include tamper-resistant off-chain services that expand the use cases of smart contract technology.

- The network of decentralized oracles supports sectors such as decentralized finance (DeFi), and on-chain gaming, among others. Powering the entire ecosystem, the LINK token fuels network activity and sits at the core of Chainlink’s economic model.

- Chainlink is positioned to be a key project in the infrastructure that scales the growth and adoption of smart contract use cases.

Chainlink’s Decentralized Services Trigger a Wave of Smart Contract Deployment

To power the bridge between on-chain applications and off-chain computation, Chainlink introduced a network of hundreds of decentralized oracles (DONs) that enable smart contracts to expand their possible use cases. These DONs can be classified as input oracles, output oracles, cross-chain oracles, and compute-enabled oracles.

Input oracles connect off-chain data with smart contracts. Chainlink Data Feeds, the first input service to launch, is Chainlink’s leading product, supplying blockchains with external data resources such as financial markets information, outcome of sporting events, and identity verification among others.

In practice, smart contracts request off-chain computation through a requesting contract. The requested computation can be in the form of a data request or a service request. The contract specifies the needs and can include predefined instructions such as query parameters and the number of deliverables required. These requests generate an event under the Chainlink network, triggering a service level agreement contract (SLA). The SLA creates three sub-contracts: a reputation contract, an order-matching contract, and an aggregating contract. Each contract has a unique purpose and plays a key role in the decentralization of data aggregation.

The reputation contract evaluates a node’s track record and performance metrics, which allows the network to select honest providers and maintain a healthy servicing mechanism. The order-matching contract delivers the requesting contract to the qualified providers interested in servicing the contract and takes request bids. Importantly, these bids have a capital commitment, known as a stake, that can be taxed in the case of improper behavior. The size of a node’s stake is another variable considered when Chainlink matches operators with a data request. Once parameters are met and sufficient qualified bids have been received, the order-matching contract selects those bids that match the parameters specified by the requestor, or if unspecified, that meet certain standards.

All contract communication occurs through proprietary software called Chainlink Core. Through Chainlink Core, providers can convert on-chain data formatting into a programming language that external application programming interfaces (APIs) can interpret. Through API integration, external computation such as real-world data is collected and the Chainlink Core software re-processes the data into an on-chain compatible language. For instance, providers source price data from multiple independent and qualified aggregators and feed the median value generated back to the Chainlink Core system. The median value is then posted to the aggregating contract.

The aggregating contract consolidates all the computation provided by the service providers, verifies the accuracy of the data, and provides a single output based on the median and/or the parameters requested; for example, a DeFi dapp might request an ETH/USD real-time price with a minimum of 15 submissions to be consolidated. This approach to data aggregation provides strong resistance to data manipulation. Once the data has been supplied to the requesting contract, oracle reputations are updated, staked collateral is returned to honest nodes, and service fees are distributed.

Input oracles are Chainlink’s dominant service today, but other services, such as output, cross-chain, and compute-enabled oracles, continue to gain traction. Output oracles perform the opposite function of input oracles and are used to send instructions to off-chain systems based on on-chain activity. Cross-chain oracles enable data to be shared across siloed blockchains. Lastly, compute-enabled oracles are an increasing area of focus for Chainlink developers. These services enable off-chain computation such as a verifiable source of randomness and the automation of on-chain processes. The recent rollout of Chainlink Verifiable Randomness (VRF) can enable smart contracts to integrate fair, tamper-proof, and low-cost randomness.

Chainlink’s Most Popular Solutions Today

Data Feeds for Money Market DeFi Dapps

Lending and borrowing DeFi dapps such as Aave and Compound use Chainlink Data Feeds to fetch market prices. By using external and real-time data, these platforms can provide accurate asset prices, which is an essential foundational element to all financial processes. Off-chain connectivity ensures accurate pricing that protects user deposits from potential liquidations due to a fault in price data infrastructure and enhances the optimization of these money market platforms.

Verifiable Randomness (VRF) for On-Chain Gaming

Games built on top of blockchains require a source of randomness to generate gaming scenarios, which prevents developers and/or gamers from tampering with results and provides an even playing field. As on-chain gaming continues to gain traction, particularly due to its ability to revolutionize in-game economics through the tokenization of digital assets, we expect the Chainlink VRF offering to thrive.

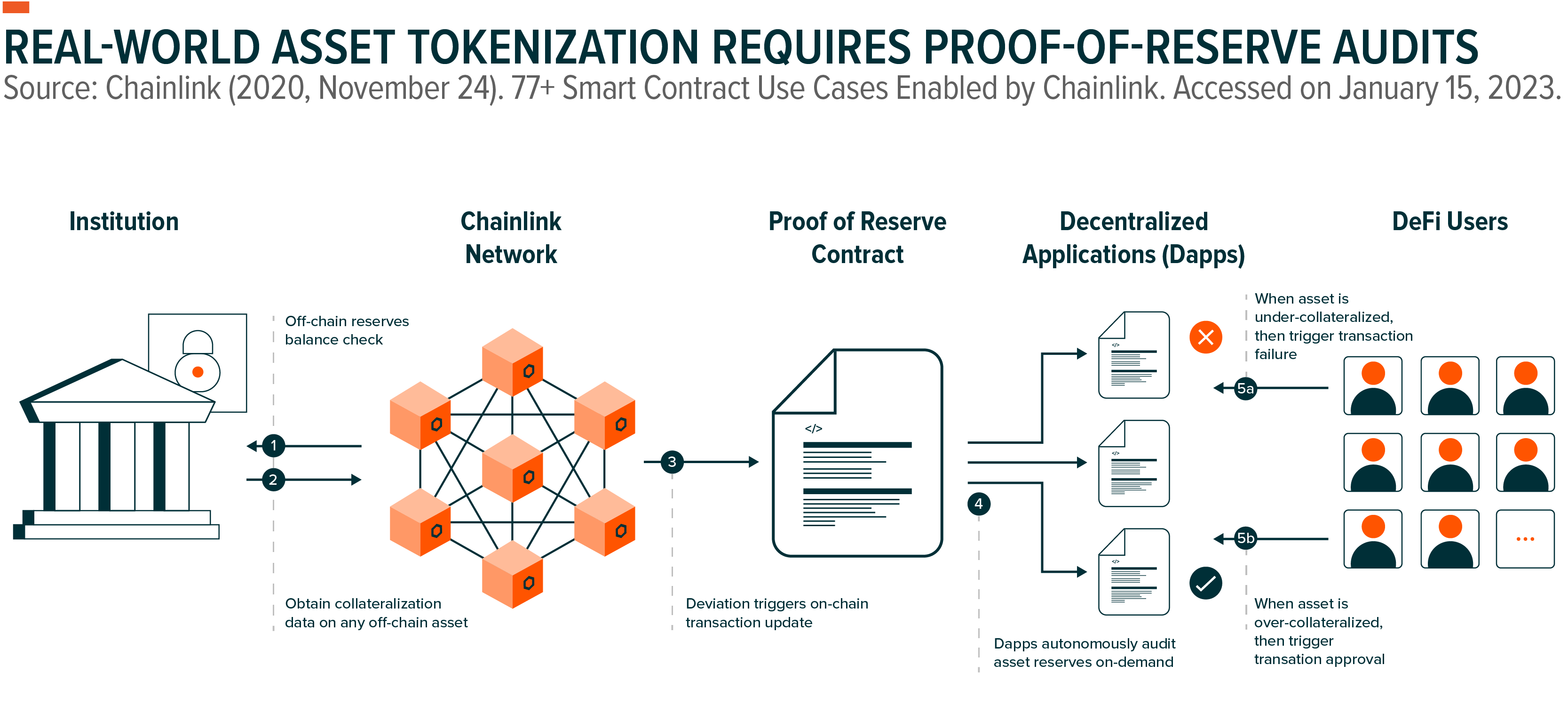

Proof of Off-Chain Reserves to Protect and Provide Asset Visibility

We believe that the on-chain tokenization of real-world assets will be another major area of disruption. Bringing external real-world assets onto the blockchain has the potential to bring liquidity to otherwise illiquid assets, providing greater flexibility and access. For this concept to work, network participants require full transparency over the custody of any tokenizable asset. Through Chainlink Proof-of-Reserves, external entities can provide an immutable and definite source of truth.

Chainlink’s Native Token Powers the Network’s Economy

The LINK token is built out of Ethereum-compatible standards, which makes it a composable asset within the entire ecosystem. Maximum total supply is set at 1,000,000,000 LINK, with roughly 35% distributed to investors through an initial funding round, 30% distributed to project members and founders, and 35% reserved for gradual distributions that support network incentives, service promotions, and node operator staking rewards.1

Every service request requires a fee to be paid in the form of LINK tokens. The prices paid by smart contracts depend on market demand for the requested service. To incentivize network security, node operators must stake LINK as collateral in a smart contract. Should a node provide inaccurate services or fraudulent data, the collateral can be taxed. Honest participants are rewarded with the LINK fees received from requesting smart contracts as well as potential LINK distributions from the 35% node operator reward allotment initially allocated to the protocol. Importantly, as network demand grows and the protocol’s reserve is reduced due to initial incentive distributions, the expectation is that request LINK fees alone can support the operating costs and sustainability of network security.

Participants who are unable to run oracle nodes but want to contribute to network security and increase assurance of certain services can also stake LINK. Through staking, LINK token holders can benefit from the rewards of securing the network while further enhancing the validity of high-quality oracle nodes. This is because LINK stakers can alert the system if certain performance guarantees have not been met.

Chainlink Ushering in a New Era of Growth and Economic Security

The Chainlink ecosystem is a key building block in expanding blockchain utility. On April 15th, 2021, the Chainlink 2.0 whitepaper introduced a roadmap for driving greater value to the LINK token. Additionally, the team announced Chainlink Economics 2.0, an enhanced strategy that deepens the value capture of the network, fueling greater dapp adoption by creating new onboarding initiatives, increasing the economic security of the network, and continuing to expand product offerings. As part of the updated economic model, the Chainlink BUILD and Chainlink SCALE programs are set to create initiatives that offset the costs of onboarding off-chain computation, allowing dapps to accelerate their growth while providing dedicated support in exchange for a commitment of project fees and/or other incentives.

The recently launched LINK staking sits at the center of all Chainlink economic activity. The network adds a new layer of security while driving greater value for the asset because node operators and token stakers accrue value through request fees, oracle rewards, and new projects onboarding commitments.

Chainlink continues to scale its offerings and adoption continues to grow. With a new economic model, a proven and secure infrastructure, and an expansion in services, Chainlink is at the forefront of the Web3 infrastructure layer.