This post is the second post of a multi-part series of pieces designed to provide education around ETFs. For the full publication, click here.

How do ETFs compare to Actively-Managed Mutual Funds?

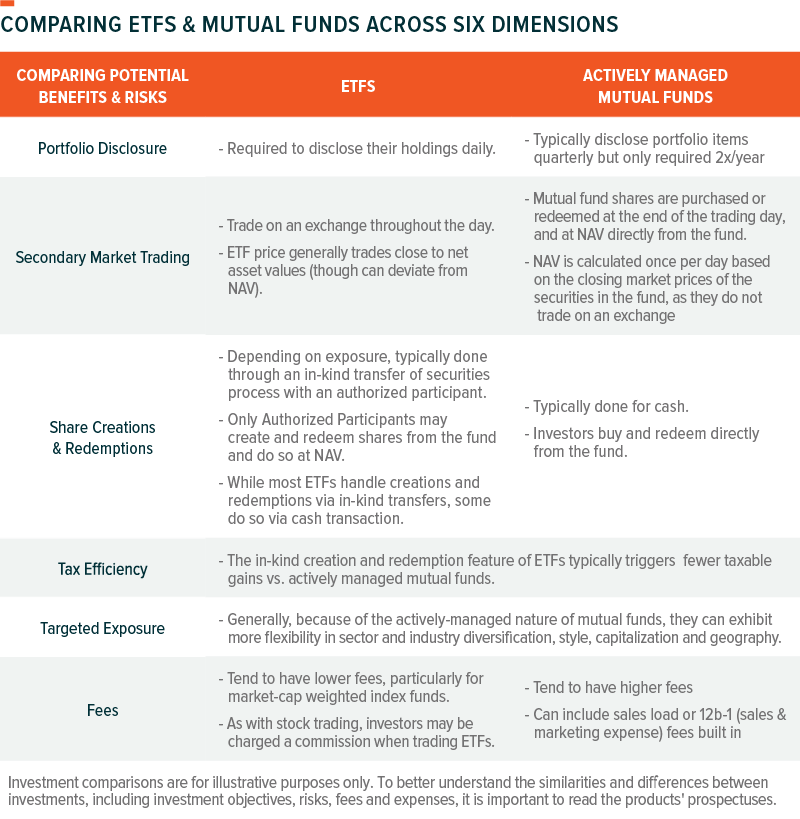

There are six key dimensions on which to compare Passively Managed ETFs and Actively Managed Mutual Funds:

- Portfolio Disclosure

- Secondary Market Trading

- Share Creations & Redemptions

- Tax Efficiency

- Targeted Exposure

- Fees

Across these six dimensions (see chart below for discussion on potential benefits and risks for ETFs and Actively Managed Mutual Funds) some of the benefits, namely transparency of holdings, ease of trading and generally lower fees, of ETFs may shine through. Some areas where actively managed mutual funds may shine over ETFs include, but are not limited to, the flexibility to achieve a targeted exposure (see #5 below). (Also, for a more thorough discussion of ETFs’ in-kind share redemption and creation, download the full “Exploring ETFs” document from the link below.)

Often when looking at ETFs, it is important to think about the value of index investing and on the transparent precision of ETFs (i.e., systematic, published methods), which can eliminate manager drift and are available to every investor in the ETF in question.

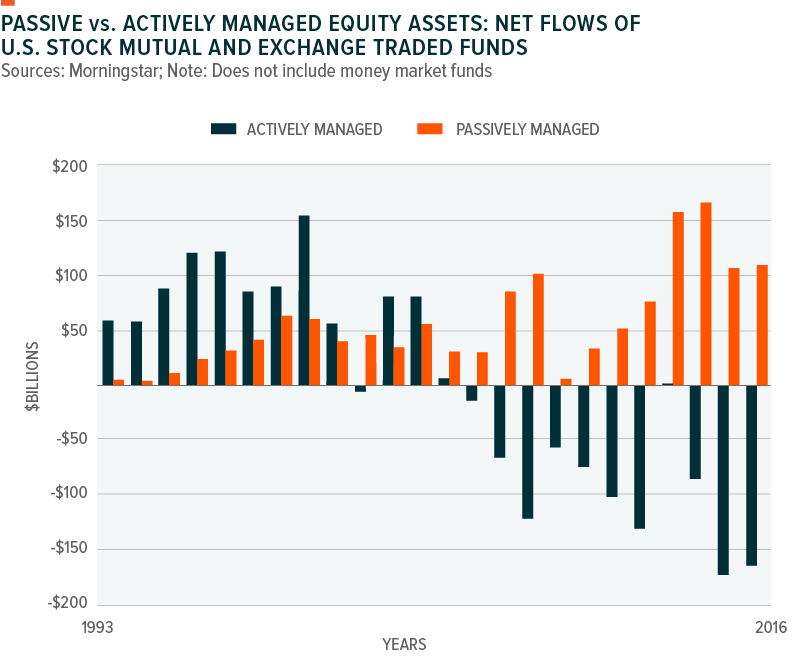

While Active Mutual Funds remain a larger business at this point, in terms of AUM, the rapid growth of ETFs does show the potential for ETFs to continue to take market share from Actively Mutual Funds, especially as investors become increasingly aware of ETFs and weigh their potential benefits and risks.

Index Investing & Its Popularity

Index investing has gained popularity due to many potential factors, which include greater investor demand for beta vs. alpha1, especially in periods of volatility, underperformance by active managers, asset management industry’s emphasis on asset allocation vs. individual stock picking.

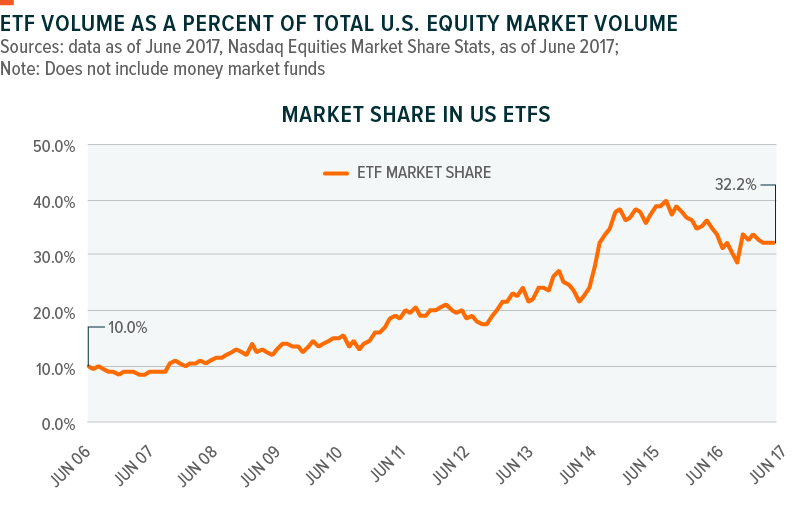

Passively-managed ETFs track indexes and the gaining popularity of index investing has, in turn, triggered a proliferation of ETFs in the market, which is reflected in increased trading volumes (see line graph below).

Global X ETF Model Portfolio Team

Global X ETF Model Portfolio Team