Recapping 2019: Positive, But Costly Returns

Purely from a returns perspective, 2019 appeared to be a banner year. The S&P 500 and other major equity indexes posted double-digit gains and hit new all-time highs in 2019. Investors feasted on easy money from accommodative central banks. U.S. equities set the pace, despite some high-profile wobbles. Developed markets were close behind. Sentiment towards emerging market (EM) equities remained firmly linked to a US-China trade deal, as any trace of progress led to surges in investor optimism, including the start of Q4 when EM jumped to the head of the pack. Fixed income also performed well, boosted in the first 9 months of the year by both duration and credit assets.

But it wasn’t all rosy in 2019. Returns don’t tell the whole story. Much of the returns this year were recapturing losses from Q4 2018. Low (and lower) interest rates helped stimulate asset prices across the board, but they generally failed to boost growth in the real economy. US corporate earnings for the year are likely to turn in flat. And yet, in the face of heightened uncertainty, the consumer kept the economy stable.

Long-dated US treasury yields may have finally found a floor after the much-publicized—and potentially recession-signaling—inversion of the yield curve. While the Q4 yield curve steepening was a positive for equities, duration-sensitive fixed income assets paid the price. The probability of an interest rate reduction at the December Federal Open Market Committee (FOMC) meeting dropped from a high of 60% in early October to single digits by mid-November.

Uncertainty about the trade war remains one of the biggest issues globally and continues to take its toll. Manufacturing is arguably in a recession already, hurt by the lack of a trade resolution and snail-like global growth. Its plight reflects the questions many investors should be asking as 2019 draws to a close: It’s been a good year, but at what cost? And what does it mean for 2020?

2020 Expectations: Uncertainty Is The Only Certainty

To get a read on 2020, a worthy exercise is to follow what market participants expect from central banks. The market expected liquidity in 2019 and central banks obliged. Robust equity and fixed income returns followed. But what happens if central banks turn off the free money spigot?

As the saying goes, there’s no such thing as a free lunch. But markets continue to act as if central bankers will continue to pick up the tab. At some point, somewhere, investors will get a bill. And the price may be steep. The focus should be on sustainable organic growth, not handouts from central banks. More specifically, sustained earnings growth that doesn’t come from tax cuts or share buybacks is what the market really needs. Our best bet is for this growth to come from long term structural trends such as advancements in technology or changing consumer behaviors. The market also needs businesses to invest more, though that requires more policy certainty than we have in the current environment.

Unfortunately, uncertainty is likely to remain front and center in 2020. The major themes to watch in 2020 are nothing new, but as important as ever.

US-China trade war: Prognosticating on a trade resolution is largely a fool’s errand at this point, even though a partial trade deal may occur in 2020 We do know that the damage caused by the trade war is real. The International Monetary Fund (IMF) estimates trade conflicts could lower global GDP by roughly $700 billion by 2020, which is about 0.8% of global GDP.1 Already, capital expenditure growth for US companies is tepid and overall earnings are declining. And it appears as though global manufacturing recession may already be underway. The economies that depend the most on trade are suffering.

Recession: We do not expect a recession in the next 12 months. However, a risk in this 24-hour news cycle is that a recession becomes a self-fulfilling prophecy. To this point, consumers have done their part to help the economy and they seem to be continuing to help through the 2019 holiday season. But if people become consumed by the chatter about a slowdown and curb their spending, then the math is simple: firms make less, invest less in their business, hire less or downsize. And, before you know it, we have a recession. In particular, small business sentiment and small business sales expectations, which measures small business confidence and hiring, are two areas likely to shed light on any forthcoming recession.

The election: If anyone has forgotten, there’s a presidential election in 2020. Many Wall Street pundits have touted that the stock market will decline if a Democrat is elected, with the magnitude of decline dependent on the candidate and their policies towards health care reform, tech regulation, or corporate taxes. But with a divided government likely (there is only a small chance Democrats will take the Senate and the Presidency) either way, expect the same gridlock and policy uncertainty.

The bottom line: All indications are that the global economy will remain in a slow growth environment in 2020. Upside from here is possible even as a recession inches closer. On average, a recession typically doesn’t kick in until around 20 months after the 10-year/2-year spread inverts. So, equity and credit markets have time to benefit from potentially better economic data and corporate profits. However, after the spree in 2019, artificial stimulus from central banks and government spending is likely unsustainable.

In the analysis below, we take a deeper look at three key areas that will play an important role in investors’ portfolios in 2020: interest rates and income, global macroeconomics and geopolitics, and key thematic growth drivers.

Interest Rates Expected to Stabilize, but Investors’ Hunt for Yield Persists

2019 featured a dramatic policy shift by the Fed. Heading into Q4 2018, market participants largely expected a hawkish Fed to continue its rising rate cycle. However, in a dramatic policy shift, prompted by sluggish growth and urging by the Trump Administration, the Fed cut rates three times. The consequences were felt throughout the course of the year and across financial markets. Short rates fell in tandem with Fed policy, but many strategists who had reduced duration risk during the rising rate period missed out on a major winning trade in 2019, as the long end of the curve fell sharply as well. Other interest rate sensitive investments were impacted by the course change, benefiting areas like Utilities and Real Estate sectors and preferred stocks.

Outside of the US, low growth and inflation prompted more easing from central banks. The European Central Bank (ECB) began injecting €20 billion a month into the economy after halting asset purchases at the end of 2018, while the Bank of Japan (BOJ) signaled they were open to further interest rate cuts in the future, and China’s slowing economic growth prompted the PBOC’s first loan rate cut in three years. These actions suppressed yields on fixed income assets globally, helping bond returns, but making the search for yield even more challenging for income-oriented investors. Some investors question the efficacy of these policies to stimulate growth, concerned that central banks are running out of ammunition to support growth, particularly if the global economy were to fall into a recession.

The Fed communicated it has less desire to cut rates further should the economy stay on its current path. As of late November, the markets believed the most likely scenario is just one rate cut in 2020.2 Resilient consumer demand, the growth slowdown finding at least a temporary floor, and the declining efficacy of rate cuts is driving this outlook. However, a catalyst for further rate cuts could potentially stem from lack of progress in finding a resolution for the US-China trade war as well as other geopolitical risks. Another factor to consider is the 2020 presidential election cycle. A victory for Democrats could cause a rotation out of stocks and into fixed income assets. For investors believing that 2020 will mostly maintain the status quo – low growth, back-and-forth trade negotiations, and temporary geopolitical flare-ups – short term rates are likely to remain flat and long-term rates could trend upwards as the yield curve normalizes. Without much upside left in the fixed income market, such a scenario could drive a steady shift from bonds to stocks, supporting positive equity markets in 2020, but a bear market for duration-sensitive assets.

Such a dynamic could pose challenges for income-oriented investors, potentially forcing investors towards riskier parts of the credit spectrum that sport higher yields. Yet tight spreads and recent weakness in lower quality junk bonds may be signaling cracks in the high yield bond market. Given structural demands for income from a large retiring baby boomer population, we believe investors should consider other income-oriented asset classes. Preferred stocks, for example, offer comparable income to high yield bonds, but from higher credit quality issuers (due to their subordinated nature).

Investors looking to couple income with growth potential may look to equity-based yield strategies as well. But with high valuations in broad market indexes, dividend yields have been driven lower. The S&P 500’s current 12-month yield stands at just 1.87%, while the long-term average stands at 2.0%.3 Further, a growing preference for stock buybacks over dividend increases is transforming yield potential into price appreciation for many stocks, further hindering income (although not impacting total returns). Therefore, investors seeking equity income may need to look at more narrow strategies for yield. One solution could be Master Limited Partnerships (MLPs), which have attractive valuations and high distribution rates. In addition, covered call strategies offer a method to generate income while remaining invested in the market.

Our major takeaways for investors in 2020: continue to expect low rates, but less support from the Fed going forward. Lower credit quality bonds, which appear both expensive and risky, are likely to fall out of favor, creating potential opportunities for equity income strategies as investors continue their search for yield.

Global Growth to Remain Slow as Geopolitics Muddy Picture

Trade tensions were of course the major geopolitical and global macroeconomic story in 2019, as policy uncertainty limited business investment, caused economic growth to stall and central banks to yet again take dovish actions. Economists lowered global growth forecasts throughout the year, with the World Bank reducing global growth expectations from 2.9% in January to 2.6% by June.4 Ironically, the unexpected slowdown had a greater impact outside the US and China, as GDP growth expectations remained unchanged between the two trade war heavyweights, but were reduced by -0.4% in the Euro Area, and -0.3% in emerging markets.5 As a result, US stocks outperformed international developed markets (DMs) through the end of November by nearly 10%, and EMs by more than 15%.

Global GDP Growth Expectations

Yet such broad analysis of economic growth and equity returns misses the more idiosyncratic events and trends that impacted regions and asset classes differently throughout the year. For example, notwithstanding Europe’s headwinds, Germany’s DAX stock index nearly matched US returns as ‘not as bad as expected’ sentiment coupled with supportive ECB policies and a bottoming in a manufacturing slowdown helped valuations recover. And despite lagging for most of the year, EM equities turned a corner in early Q4 as news of a potential trade détente and a weakening USD helped propel returns.

Looking even more narrowly, certain individual countries and sub-regions have demonstrated a resilience to, or insulation from, the impact of trade tensions and slowing global growth. Greek and Colombian equity markets, for example, outperformed broad EM indexes this year and are expected to achieve GDP growth rates faster than their peers. Similarly, Southeast Asia is projected to grow its GDP by 4.6% in 2020, which is well above the 3.4% global growth projection, helped by greater domestic consumption and regional trade integration. Greece and Portugal are expected to grow 0.4-0.5% faster than Europe as their economies continue to recover from the impacts of the European debt crisis. Colombia is expected to grow 3.4% versus a modest 0.2% for Latin America. Broadly, the countries that are managing above-average growth feature strong political institutions, growing domestic demand, and diversifying economies. On the other hand, the countries that are struggling in this environment tend to be more singularly focused on exporting commodities or manufacturing. This includes many EM countries like Argentina and South Africa, as well as DMs like Japan.

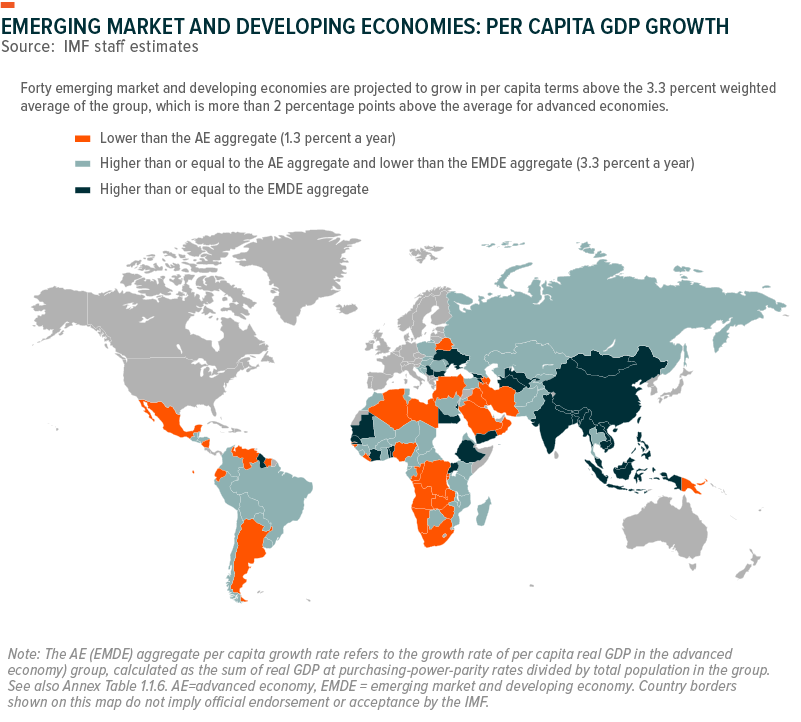

For 2020, our main takeaway is that divergence is likely to continue as geopolitical tensions drive a wedge between certain countries, regions, and levels of development. Global growth in advanced economies is projected at a modest 1.7%, while expectations for manufacturing and capex in places like the US and Europe remain muted.6 Contrast this with emerging markets, which are cheaper yet expected to grow broadly at 4.6%-4.7%, driven by long term structural tailwinds, like rising consumerism and technological adoption.7 If markets turn to a more risk-off environment in a re-escalation scenario, the embedded riskiness of EMs could outweigh these attractive features, favoring the more stable footing of DMs.

Consumer Spending to Drive Key Themes

Consumer spending proved resilient, bolstered by strong employment figures, low interest rates, and falling oil prices. But business investment remained muted by trade uncertainties. We expect consumer spending to continue to drive the US’s GDP growth in 2020, as it has in recent quarters. The prime working-age cohort’s labor participation rate is up 1.4% since July’s 2-year lows; unemployment remains stable at 3.6%; and disposable income is up 4.6% year-over-year (YoY).8 These positive factors should position growth-oriented and consumer-driven themes for success in the new year. Among these are Millennials, E-commerce, FinTech (particularly digital payments), Health & Wellness, and Social Media. And as the oldest millennials enter their most productive years and the youngest millennials enter the workforce, consumer-led growth in millennial-focused industries should remain a driver, next year and beyond. E-commerce penetration, digital advertising and digital payment platforms, for example, drove an 18% YoY increase in online sales.9

Homing in on business investment, low interest rates and increasing margin pressures would typically drive investment into areas that can reduce long-run costs and/or increase productivity. Yet companies were tepid to deploy sidelined investment dollars. A trade agreement would likely change this dynamic, as geopolitical clarity should cause capex to flow more freely. This could position more enterprise-focused themes like Robotics and AI, Internet of Things (IoT), Big Data and Analytics, Cybersecurity, and US Infrastructure Development to thrive over the next 12 months. A clearer trade picture and increased business investment could boost the 5G rollout, along with demand for connected devices and IoT value-chain components like semiconductors, for example. Robotics & AI, which suffered from weakness in historically important end-markets like auto and consumer electronics, could rebound from a steadying or uptick in global manufacturing. As such, the International Federation of Robotics expects industrial robot sales to grow 10% YoY next year.10

Greater uncertainty exists for themes more exposed to regulatory and political risks. Investors face the inexact task of sifting through noise and distilling policies’ potential impact on the financial markets, given the heightened polarization and rhetoric seen in advance of 2020’s presidential elections. Sweeping changes to the US healthcare system, rules around insurance coverage and new drug pricing mechanisms could affect healthcare-related themes like Genomics, Health and Wellness and Longevity. Similarly, the cannabis industry’s future depends heavily on regulatory progress at the local, state, and federal levels in the US, as well as abroad as countries like Mexico contemplate less stringent cannabis laws. Even traditionally less-regulated areas like social media are under increased scrutiny and could face government intervention as a headwind for return expectations. On the other side of this coin, regulatory pressure for data privacy should accelerate the cybersecurity industry’s continued growth. Cybercrime’s economic cost is set to reach $6tn by 2021 and just this year several companies were imposed with record-breaking fines for violating new data protection regulations like GDPR. As a matter of necessity, cybersecurity spending is estimated to see 12-15% YoY growth through 2021.11

We believe thematic investing should focus on the long-term drivers of disruption, though the business cycle’s typical ups and downs, and changes in consumption, investment, and regulations can still have an impact on near-term returns. Among these drivers, consumption appears to be on the most stable footing for 2020, but business spending and regulations appear to be at important inflection points. Developments in trade, interest rates, and economic growth could affect these factors and propel returns in either direction.

What Does It All Mean?

2019’s strong returns across asset classes defies the broad trends of slowing growth and heightened geopolitical risks. While the Fed and other major central banks played a major role in driving returns forward in 2019, such support cannot continue indefinitely and will likely taper in 2020. Therefore, positive returns will require a new catalyst, or set of catalysts – a trade resolution, a rebound in manufacturing, or fearless consumers could be the keys. Yet even if some of these catalysts materialize, their impact on various asset classes, regions, sectors, and themes are likely to be felt unequally, resulting in wider return dispersion than witnessed in 2019.

Global X Research Team

Global X Research Team