As we continue through the second quarter of the year, significant macroeconomic challenges persist. Concerns remain about a possible global recession and the probability of a soft or hard landing, largely due to tight financial conditions and the potential delayed effects of the Federal Reserve’s rapid increase in the federal funds rate from 0% to 5.25% over 14 months.1 Furthermore, with the US debt ceiling deal now agreed, investors are worried about the potential liquidity drain resulting from the expected issuance of $1 trillion or more of short-term treasury debt to replenish the treasury general account.2

On the more positive side, optimistic investors argue that there is still caution in the market, with significant amounts of cash held in money market funds according to a recent survey by Bank of America.3 They believe the consumer and the US economy have displayed greater resilience than anticipated. These bullish market participants contend that the markets have already factored in much pessimism and that any positive surprises could trigger a further surge. Recent market movements have been influenced by various factors that support this narrative. The gathering of semiconductor manufacturers in Tokyo before the G7 meeting has infused positivity, given the US’ efforts to foster closer alignment among its allies against China’s perceived technological and military advancements.4

Despite limited widespread participation in the current market, with only a few leading stocks driving the market advance in 2023, there are positive signs within specific sectors. Communication services, consumer discretionary, and technology sectors show strength.5 Currently, there is speculation that a sustained bull market could be initiated by an emerging trend such as artificial intelligence, as innovative technologies often mark the beginning of such market phases. In the coming weeks, economic data including the next CPI print and Fed meeting will provide crucial insights into market direction, determining whether the expected Fed pause and market narrative are justified.

Investment strategies highlighted this month:

- Balancing Risk and Reward – Using defined outcome strategies for upside potential and downside buffering.

- Revolutionizing Industries – Harnessing the power of automation, robotics and artificial intelligence for growth and transformation amid soaring adoption worldwide.

- An Era of Emerging Threats – Investing in resilient cybersecurity to hedge against geopolitical risks.

Balancing Risk and Reward – Using Defined Outcome Strategies for Upside Potential and Downside Buffering

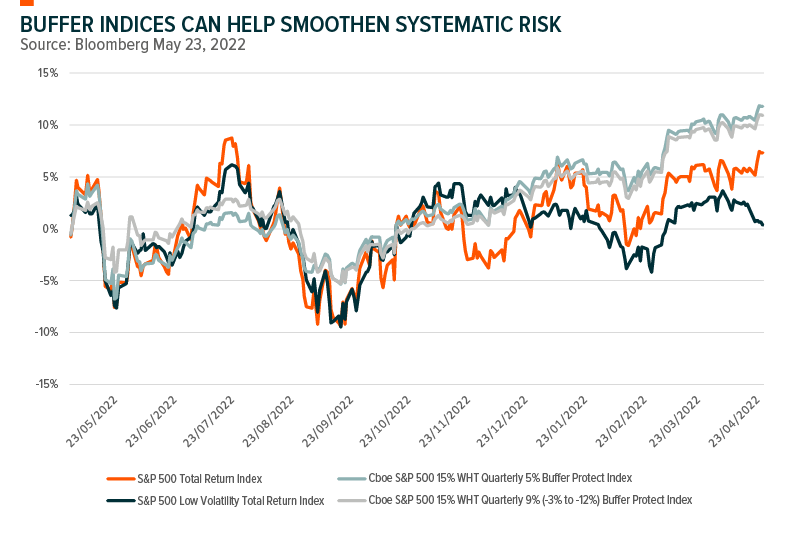

Investors who believe that equity markets are currently overextended, driven by a strong rally in mega-cap stocks, may consider adding defined outcome strategies to their portfolio. These strategies aim to provide capital appreciation up to a capped level while offering the added benefit of buffering downside moves. By utilizing defined outcome strategies, investors can remain invested in the market while seeking protection against potential market corrections.

For investors who anticipate near-term volatility, defined outcome strategies, can serve as a tactical implementation tool. These strategies can help buffer declines in equity markets. Even if the investor’s view proves to be incorrect, they may still benefit from the appreciation in the reference indices up to a capped level. The cost for an investor however is that they take the risk of downside losses occurring from steeper equity selloffs that are beyond the buffer and risk capping their upside in a strong market environment.

Defined outcome strategies may perform well in sideways, slightly appreciating, and slightly depreciating markets. In addition to risk mitigation, these strategies could offer the benefits of portfolio diversification and reducing overall equity betas. This may distinguish them from low volatility strategies, which have shown limitations in successfully mitigating downside risk due to sector concentration. Defined outcome strategies may provide a way for investors to differentiate their risk/return profiles and possibly serve as an alternative to traditional 60/40 portfolios. This may allow for a more tailored and balanced approach to risk management, offering investors potential greater flexibility in navigating changing market conditions and how they might achieve their investment objectives.

Revolutionizing Industries – Harnessing the Power of Automation, Robotics and Artificial Intelligence for Growth and Transformation

Thematic investing provides access to the key disruptive, technological trends shaping our world. Automation plays a key role in driving efficiency, growth and transforming production processes. Recent disruptions in supply chains and geopolitical security concerns are prompting nations to consider reshoring activities which are expected to further fuel the growing demand for these technologies with adoption increasing across industries such as manufacturing, transportation, logistics and healthcare. Automation enables companies to achieve higher productivity levels through increased efficiency, cost reduction, and improved product quality. According to BBC Research, the global robotics market is projected to grow from $55.8 billion in 2021 to $91.8 billion by 2026, with a compound annual growth rate (CAGR) of 10.5% during the forecast period.6

In the field of artificial intelligence, companies have experienced positive momentum in the past six months, driven by generative AI product launches from companies such as Google and Microsoft.7 The semiconductor industry has experienced significant momentum with NVIDIA more than doubling this year, which benefits from the initial wave of investments required to establish the infrastructure supporting widespread adoption of AI models at a large scale.8 The addressable market for AI investments may expand further into enterprise capabilities with recent announcements such as ServiceNow unveiling a partnership with NVIDIA, building upon its ecosystem for enterprise-grade generative AI capabilities. ServiceNow will leverage NVIDIA’s custom large language models trained on data specifically for its Now platform.9 On the robotics front, the long-term trend of adopting automation technologies remains strong. Recent data show that North American robot sales reached a record high in 2022, increasing 11% year on year, to 44,196 robots valued at $2.38 billion.10 This demonstrates the resilience of the industrial robotics market, even amid ongoing macroeconomic uncertainties.

India is a favored destination for reshoring in the manufacturing sector out of China. The Indian government is now aiming to explore new diversification options, such as friend-shoring, by partnering with countries that share similar values and interests. Industrial robot sales in India reached a record high of 4,945 units installed in 2021, marking a 54% increase compared to the previous year. India’s potential in the robotics industry becomes more evident when compared to China, as India’s robot density in the automotive industry reached 148 robots per 10,000 employees in 2021, surpassing China’s density of 131 units in 2010 and 772 units in 2021.11

An allocation to a diversified basket of robotics and artificial intelligence companies could offer pure play exposure to companies that strongly utilize artificial intelligence and robotics within their business models and operations. The risk of such an approach however is that the theme is innovative in nature and may bring with it amplified volatility. A basket could also serve as a broader large-cap play due to multi-themed exposure which could replace traditional large-cap growth strategies that are either inefficient at capturing structural themes or have other concentrated exposures.

An Era of Emerging Threats – Investing in Resilient Cybersecurity

Continued geopolitical risks remain paramount and investors may want to consider defensive themes that offer hedges to risks originating from Russia and China. Since the invasion of Ukraine, the global cyber threat landscape has transformed, involving more aggressive state actors employing hybrid warfare tactics across various domains, including social media platforms, information networks, and critical infrastructure. Notably, pro-Russia hacking groups like Killnet have launched cyber-attacks on Western companies, media outlets, government services, and NATO, often resulting in direct physical consequences, such as disruptions to critical services and resources like Viasat’s satellite network.12 A recent research report by Google highlighted that global cyberattacks increased by 38% in 2022 compared to 2021 with recent data showing that cyberattacks on NATO member countries have increased by 300%.13 In March 2023, the US updated its National Cybersecurity Strategy which offered a more proactive framework for the private and public sectors to disrupt and protect against cyberattacks compared to previous strategies.

Further the global nature of technology supply chains can introduce vulnerabilities into critical systems without being aware of them or having the legitimacy to address them. Each of these challenges requires coordination and pooling of government and private sector resources, as well as the development of adaptive offensive and defensive cyber strategies.14 Cybersecurity may also benefit from macro upside, as it is a complement to holding cloud stocks in that one could argue they are the modern health care industry of the global digitization trend.

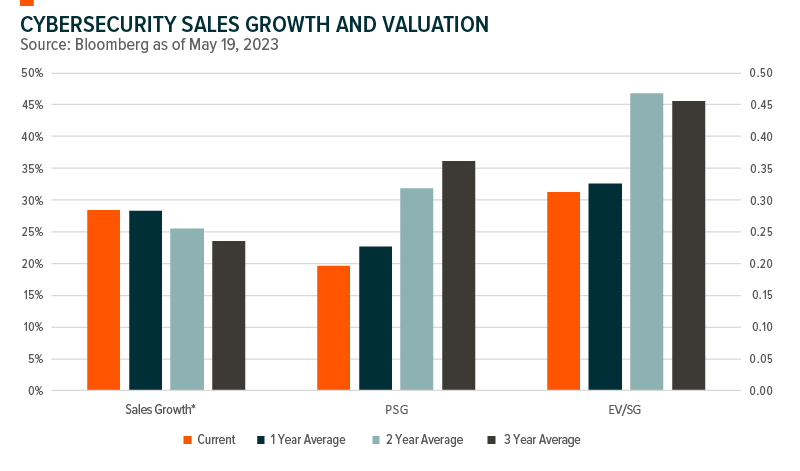

Cybersecurity as a basket has shown strong sales growth which remains above the average growth rate experienced over the past several years. From a valuation perspective, the PSG ratio which measures the price to sales per unit of 12-month forward consensus sales growth, recently stood at 0.20x versus the two-year average of 0.32x. Further the EV/sales growth ratio, which considers leverage, is currently valued at 0.31x versus its two-year average of 0.47x.15

As businesses and governments are increasingly reliant on newer technologies, they are more vulnerable to cyberattacks, creating a growing demand for cybersecurity products and services. For investors, a basket of cybersecurity companies could provide a well-diversified mix of service providers including security architecture, endpoint protections, and Zero-Trust infrastructure. The risk to a diversified basket approach is that certain companies may not be profitable yet as they are still in their growth phase.

Alex Roll

Alex Roll