Preview

The rapid expansion of the generative AI landscape is a dominant theme in 2023. Despite their scale and abundant resources, even Big Tech and cloud hyperscalers cannot control the entire generative AI ecosystem. These companies do have their in-house language models, but those are generally horizontally structured, unsuited to deliver performance on more vertical, niche, and specialized tasks. This gap creates exciting opportunities for startups like Anthropic, Cohere, and Hugging Face to offer alternative platforms, and their emergence has Big Tech’s attention.

We believe Big Tech’s prolific deal-making with and selective proximity to trailblazing generative AI startups indicates the depth of their ambition. With AI wars likely to intensify, in this piece we explore how these relationships are vital to ensuring long-term product advantages and boosting Big-Tech’s top-line growth.

Key Takeaways

- We expect Big Tech’s capacity to disseminate their foundational models at minimal cost to bolster their market dominance, as startups building on these models will generate substantial revenue for their underlying cloud services.

- Startups have ample opportunity to build specialized apps. Recent moves suggest that Big Tech recognizes the immense value potential of distributing top models for their cloud franchises, and early partnerships with bellwether startups could be performance differentiators in the long term.

- For investors looking for exposure to promising generative AI startups, we believe Big Tech provides a viable channel, as they continue to invest in and form cloud & distribution partnerships with them.

Microsoft Bets Big on OpenAI

In January 2023, OpenAI raised fresh capital at a $29 billion valuation. That valuation made it not only the largest and most notable startup in the AI category, but also the sixth most valuable private company in the United States.1 This growth should come as no surprise, as the recent release of its flagship product, ChatGPT, effectively commenced the generative AI arms race among Big Tech giants. Just eight years after its founding, OpenAI expects to generate $200 million in revenue for 2023.2 For 2024, the company projects revenue of $1 billion.3

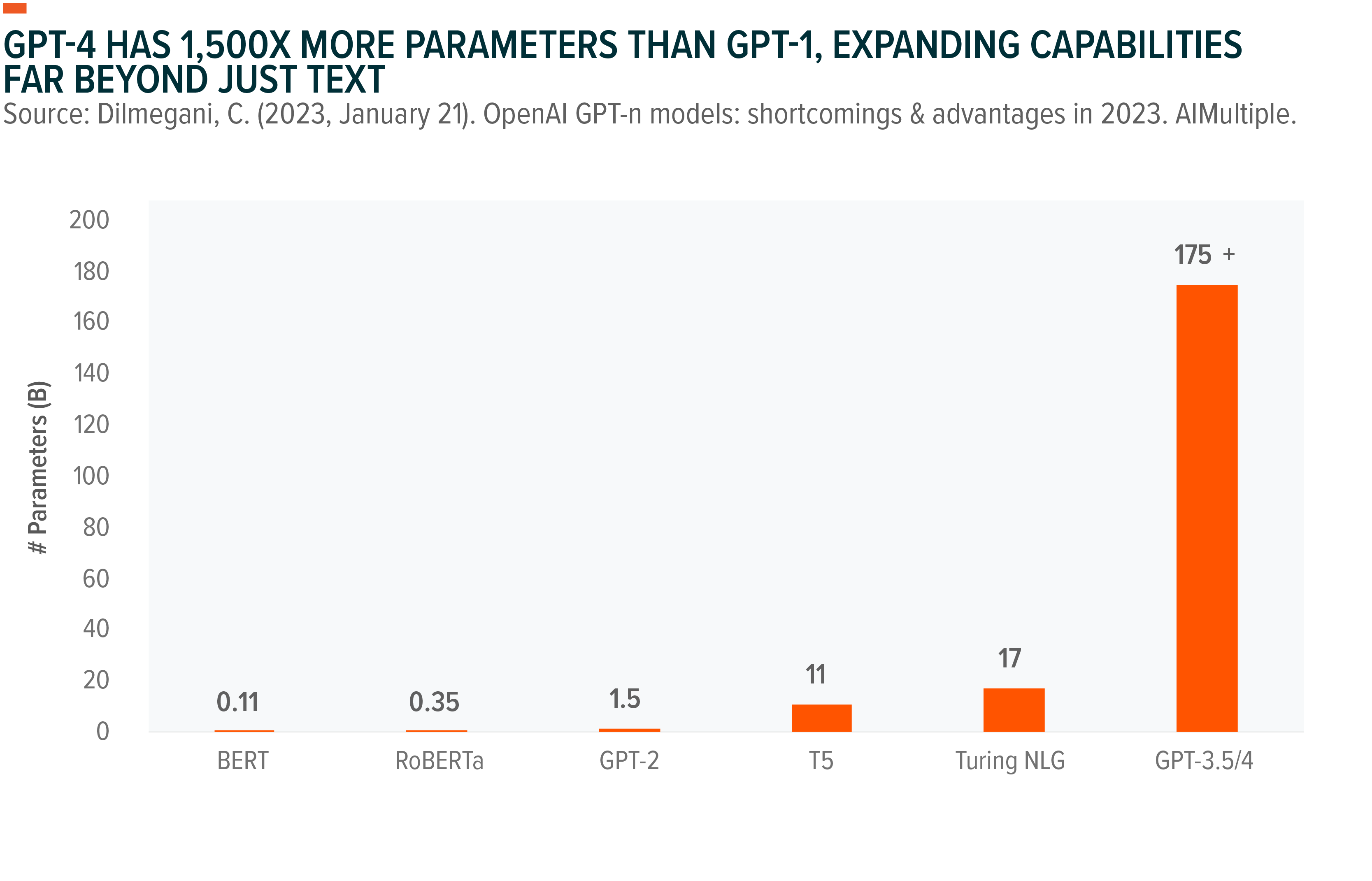

In addition to ChatGPT, OpenAI’s product suite includes GPT-4, DALL-E, Whisper, and InstructGPT. These products enable a variety of use cases, such as language modeling, content and image generation, audio transcription, and embedded model development.4 User adoption has been rapid. Since its launch for public use in November 2022, ChatGPT has scaled to over 500 million global users. DALL-E has amassed more than 3 million active developers since its release in early 2021.5,6

Included in OpenAI’s sizeable capital raise this January was an investment from Microsoft, catapulting the tech giant to the forefront of the latest wave of large language models (LLMs) and generative AI. Microsoft, which first invested close to $1 billion in OpenAI in 2019, strengthened the relationship in January via a $10 billion investment and partnership to be OpenAI’s exclusive cloud provider.7,8 The partnership affords both companies a wide range of commercial and financial benefits.

As OpenAI’s exclusive cloud provider, Microsoft Azure powers all OpenAI workloads across research, products, and API services, and it integrates OpenAI’s products into its own consumer and enterprise platforms.9 This could allow OpenAI to scale rapidly by leveraging Microsoft’s distribution arm to reach more developers and companies seeking to integrate generative AI into their own services.

Microsoft will receive 75% of OpenAI’s profits until its investment is recouped, followed by 49% of subsequent profits, up to a certain cap. Microsoft also gets to augment its own products, such as Bing, GitHub Copilot, and Office, while differentiating Azure from its cloud competitors as a leading global provider of AI cloud infrastructure.10,11 Revenue for Microsoft’s Azure and other cloud services grew 27% year-over-year (YoY) as of Q3 2023, and we expect the deal with OpenAI to boost that growth rate significantly in the near term, despite recent cloud related headwinds.12

Alphabet Supplements In-House Efforts with Anthropic Partnership

Microsoft beat Alphabet to the punch with OpenAI, however Alphabet’s proven expertise and leadership in AI should likely limit any negative implications. Alphabet’s in-house efforts include successes like Bard, Google’s Language Model for Dialogue Applications (LaMDA)-based chatbot. In April 2023, the company also introduced Magi, a project designed to improve Google Search’s math, coding, and logic capabilities via its in-house Pathways Language Model (PaLM) technology.13

In terms of partnerships, Alphabet chose to bet on Anthropic, which was founded in 2021 by former OpenAI researchers. Last valued at $4.4 billion. Anthropic is the company behind Claude, the ChatGPT-like text generator released in January.14

Anthropic differentiates from competition by focusing on AI safety, with the goal of creating more reliable, predictable, and controllable AI systems. Anthropic achieves reduced bias by utilizing the Constitutional AI learning model, which combines reinforcement learning and supervised learning to align AI with human intentions.15 The company plans to raise an additional $5 billion over the next two years to compete with rivals, expand into new industries, and most significantly, develop a frontier model. Tentatively called Claude-Next, Anthropic intends for the new frontier model to be 10 times more capable than today’s most powerful AI.16

In February, as part of its foray into generative AI, Google revealed a $300 million investment in Anthropic, giving it a 10% stake in the company. Like the agreement between OpenAI and Microsoft, Anthropic will purchase-cloud computing resources in a preferred provider partnership with Google Cloud.17 Additionally, Google Cloud intends to build large-scale, next-generation tensor processing unit (TPU) and graphics processing unit (GPU) clusters, which Anthropic intends to use for training and deploying its own AI models.18

Amazon Takes the One Platform, Third-Party Partnership Route

In April 2023, Amazon Web Services (AWS), the world’s largest cloud computing provider, unveiled Bedrock. This platform enables businesses to build generative AI-powered apps via pretrained models from third-party startups, including Stability AI, AI21 Labs, and Anthropic, as well as Titan foundation models (FM), AWS’ in-house trained models.19,20 Bedrock provides AWS with a more distinct offering because focuses exclusively on corporate clients rather than consumers.

AWS’ collaborations in recent months with generative AI startups, including Hugging Face, may have hinted at the Bedrock release. For example, Stability AI, the creator of Stable Diffusion, an open-source image generator that rivals OpenAI’s Dall-E, made AWS its preferred cloud provider to enhance its AI models for image, language, audio, video, and 3D content generation. In turn, now via Bedrock, Stability AI leverages AWS’ expansive reach to make its open-source models available to a wider range of end users.21

In anticipation of future growth, likely linked to its partnership with AWS, Stability AI is reportedly pursuing a fresh round of funding at a valuation of $4 billion, a fourfold increase from the company’s valuation in October 2022.22 This potential development not only underscores the synergistical advantages of partnering with tech juggernauts, but also the eagerness of venture capital firms to invest in this burgeoning technology.

Meta and Apple Choose to Ride Solo

Apple is no stranger to AI. The company made its first decisive AI bet in 2010 when the company acquired the team that designed the smart assistant Siri for roughly $200 million.23 Smartphone assistants have struggled to deliver on their promise, and some of Apple’s competitors in the space have fared better. However, we do not consider Apple a laggard in the Generative AI race. We expect Apple’s AI efforts will be in-house, tested and refined on its own mobile apps like Photos, Fitness, and more, where the company’s localized neural networks provide an advantage.

Meta Platforms also recently reaffirmed its commitment to generative AI in a companywide memo, and it appears the company will focus on building the tools internally. The firm recently formed an in-house generative AI team and rolled out several open-sourced frameworks like LLaMA, its own AI language model, and the Segment Anything Model (SAM), which could identify objects in images and videos even in cases where it had not encountered those items in its training.24, 25 Similarly, they expect to build generative AI tools that enable companies to produce personalized advertisements for different target audiences by the end of 2023. 26

The Emergence of “Copilot” Apps Benefits Big Tech’s Pockets

As venture capital dollars continue to pour into promising startups capable of streamlining specific tasks, the emergence of Copilots and enterprise apps is likely to accelerate. And as the underlying cloud service providers on which these applications are built, we expect hyperscalers to generate substantial revenues indirectly. For example, Jasper.ai built a product designed specifically for sales and marketing content generation. The company, last valued at $1.5 billion, has over 105,000 active customers and is powered by OpenAI’s GPT-3. 27,28 There are countless such examples across industries and functions.

We also expect established tech titans to continue acquiring leading startups to bring new features to their billions of users, or to integrate them into their existing enterprise and consumer applications. Some recent examples include Spotify’s 2022 acquisition of synthetic voice startup Sonantic, which helped enable the company’s release of its generative AI DJ.29 Future examples could feature incumbent graphic designers acquiring top image and video editing startups or social media companies acquiring leading avatar related businesses.

Conclusion: Hyperscalers Are Positioning for the Future of Software

We expect the jockeying for leadership in generative AI to continue with its adoption rising by the day. To maintain their cloud computing dominance and avoid disruption from top startups, Big Tech players are making their foundational models easily accessible, and they’re investing in and partnering with the startups building specialized apps on top of their models. For investors seeking exposure to leading private generative AI companies, Big Tech provides adequate exposure through their partnerships and acquisitions. And given Big Tech’s proven long-term track record of success implementing and dispersing newer technologies, exposure to generative AI through them may also come with less risk.

Related ETFs

BOTZ – Global X Robotics & Artificial Intelligence ETF

AIQ – Global X Artificial Intelligence & Technology ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.