Yes, X marks the spot. But only when you have a good map. The era of easy money fueled by central bank intervention has investors searching for clues about where the market is in this protracted cycle and whether the water we are seeing—the Dow Jones Industrial Average Index is up 1200 points since its 2018 intraday low on May 3—is this an oasis or a mirage. The natural question everyone is asking is, Where are we now? It’s a good question.

A Host of Factors have Contributed to Market Uncertainty

First, it’s important to remind investors that investing hasn’t changed. The numbers behind this cycle are reminiscent of others. The same factors still drive and flummox the market, from the economic, to the geopolitical, to the random tweet. Different are the details about the storyline.

Looming over everything is that the last decade has been extraordinary, marked by (very) easy monetary policy designed to stimulate consumption. Factor in an equities market that rocketed higher (and higher) in 2017 and it was only a matter of time before volatility crept back up, knocked the market down from its perch, and left investors trying to figure out what’s next. Taken together, the following haven’t exactly helped in mapping out the market’s path:

- The Federal Reserve (Fed) continues to put one foot in front of the other. To no one’ surprise, the Federal Open Market Committee held the fed funds rate at 1.50-1.75% in April after its latest 25 basis point hike in March. Most notably, the Fed’s preferred measure of inflation (which excludes food and energy) increased to the Fed’s target level of 2% in April. The Fed is likely to continue their plan for gradual rate hikes. Officials gave little indication that a rapid rise in prices or an abrupt economic slowdown could alter its pace.

- The economy continues to show broad strength. Wage growth remains disappointing, though. Hiring slowed with the economy adding 164,000 jobs in April, less than its monthly average of 191,000 additions over the past year. Unemployment fell to 3.9%, its first move from 4.1% in six months. However, wages were up just 2.6% year over year.

- Rising Treasury yields and a flatter yield curve are a potentially worrisome wrinkles. The 10-year Treasury yield unnerved investors recently after it hit 3% a few weeks ago, an important psychological level. And with the 10-year now above 3%, the possibility of an inverted yield curve—when short-dated yields are higher than longer-dated yields—and its recessionary implications have been bandied about.

- Escalating trade tensions with China added to the muddled geopolitical scenario. When Berkshire Hathaway’s Warren Buffett, The Sage of Omaha, said recently that a trade war is “counter to the interests of every country in the world” because the world “thrives on trade,” it provides some perspective. It also shows that investors are correct to consider the implications of souring trade relations with China.

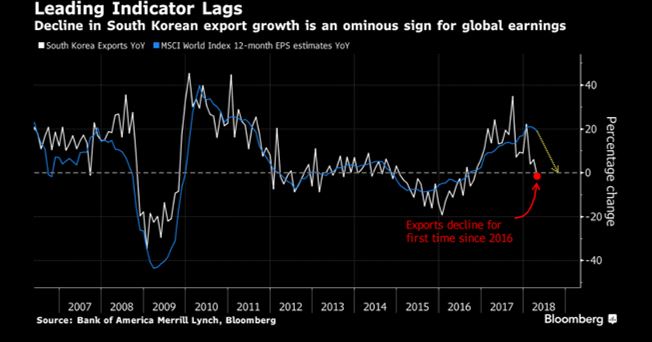

EPS estimates YoY is the estimated annual change in earnings per share

- And the latest addition to the smorgasbord is the US backing out of the Iran nuclear deal. Continuing their recent trend higher, US crude oil futures jumped to more than $70 per barrel after the announcement, their highest level since late 2014. Word that the US would reinstate sanctions on Iran is likely to stoke talk of what a newly volatile oil market could mean as well. The complexities of pulling out of a multi-national agreement with our closest allies are yet unknown.

Something to Note about Economic Cycles and Capex

This economic cycle will end at some point. History tells us that much. But this one appears to be marching to the beat of its own drummer. And maybe that’s a byproduct of the still-to-be-defined post-financial crisis normal.

Status Check: Recent Market Moves

US and international markets have lacked direction on year-to-date and quarter-to-date bases. The S&P 500 Index has returned +2.7% qtd and +1.9% ytd. The MSCI World ex USA Index and MSCI Emerging Markets Index has returned +4.0% and 0.0% qtd, respectively, and +1.9% and +1.4% ytd. Performance in Europe has improved, led by the United Kingdom and core Eurozone countries. Conversely, risk-off sentiment, trade uncertainty and the strengthening US dollar has hurt Emerging Markets, though Emerging Asia has held up relatively well.

YTD disruptive technologies have experienced strong returns beyond the broad strength in Information Technology. Particularly strong disruption has occurred in Industrials, where robotics and artificial intelligence made further headway in automating manufacturing processes. FinTech had a similar impact on the Financial sector, as people leverage new technologies to manage their financial affairs.

S&P 500 Information Technology at +11.3% ytd led all sectors, followed by the S&P 500 Energy’s +7.8% and S&P 500 Consumer Discretionary’s +6.9%. In Q2, Energy has dominated with a +14.5% return amid the roughly 13% rise in WTI prices to more than $70 per barrel. It is still to be seen how energy prices will react following the Trump administration’s announcement that the U.S. is exiting the Iran nuclear deal.

Historically, when there has been trade conflict and rising geopolitical tensions, domestic-facing U.S. stocks have tended to outperform. The small cap Russell 2000 Index has returned +4.7% qtd and ytd, while the Russell 1000 Index returned +3.6% and +2.8% qtd and ytd, respectively. From a size and style perspective, qtd the Russell 2000 Value Index was the top performing area with a +5.1% return, followed by the Russell 1000 Growth Index at +4.6%.

The Final Word: Market, Meet Life

We got a puppy. Like most puppies, Teddie has brought a lot of energy and life to her new home. And as a proud dog dad, I have to say that Teddie’s a pretty bright little pooch. Is she housebroken yet? Not quite. But I’m encouraged that she gets the concept, even if the execution isn’t all the way there.

Teddie’s hits and misses are similar to trying to track this market. The forces of nature call, yet there are some plot twists that have yet to be fully understood, like when Teddie met our new rug for the first time. While looking at one-offs can be informative, the market is a never-ending story to be judged in larger blocks of time. And it’s possible that events of the last decade have skewed the typical timeline.

What we care about is our thought process and making sure that we’re looking at the right triggers to determine how to proceed. And it’s not much different than that old investing adage—adding layers of diversification (and maybe one of those doggie pads on the rug) can help mitigate some of the uncertainty that is all part of investing.

Global X ETF Model Portfolio Team

Global X ETF Model Portfolio Team