A shakeup in the Global Industry Classification Standard (GICS) after market close on September 28, 2018 is set to have far-reaching implications for portfolio management. First announced at their annual review in November 2017, index providers MSCI and S&P Dow Jones will rename the Telecommunications sector ‘Communications Services.’ The refreshed sector will consist of stocks from the sectors formerly known as Telecoms, Information Technology and Consumer Discretionary. The indexing firms said the changes are intended to improve the categorization of stocks to reflect the changing nature of the global economy.

With these GICS changes right around the corner, Chief Investment Officer, Jon Maier, and Head of Research & Strategy, Jay Jacobs, preview what it could mean for the markets and how investors may need to adjust their investment approach.

What is the rationale for the new GICS classification?

Jon Maier: In 2016, REITs were lifted out from the Financials sector to establish their own Real Estate sector. Before that, the last change was in 1999. People still had VCRs in 1999. So I think it’s fair to say that we’re probably overdue for a more adequate representation of how today’s companies relate to one another and the broader economy.

Jay Jacobs: The other major driving force is that the Informational Technology sector has simply become too big. It’s currently 26.4% of the S&P 500 and in all likelihood would continue to expand given the scale effects of many Tech companies and the sector’s flourishing startup culture.i Once any one sector becomes that large, it shows the sector’s definition has been painted with too broad of a brush and is due for refining.

What is at the core of the changes?

Maier: Evolution and disruption. The VHS days are long gone (DVDs are going fast as well), replaced by technologies that allow us to stream our favorite movies and TV shows. And these technologies have created a whole new set of investable assets to account for. As MSCI and S&P Dow Jones put it in their announcement, “This evolution is a result of integration between telecommunications, media, and Internet companies. Companies have further moved in this direction by consolidating through mergers and acquisitions and many now offer bundled services such as cable, Internet services, and telephone services.”ii

Broadly, what will the new sectors look like?

Jacobs: Telecommunications will be revamped and reengineered as Communication Services. The goal is to group companies that promote communication and distribute related content across various platforms. The sector will include the existing Telecoms as well as select traditional and Internet media companies currently grouped in Information Technology (Tech). Also moving over from Consumer Discretionary will be the Media Industry Group and select companies from the Internet & Direct Marketing sub-industry.

A further change is happening with online marketplace companies for consumer products and services moving out of the Tech sector and into Consumer Discretionary. Within Tech, there are some reorganizations happening as well. Companies in the Internet Software & Services Sub-Industry, including those providing data centers, cloud networking, storage infrastructure, and web hosting, will comprise Internet Services & Infrastructure. Also, cloud-based software companies currently classified as Internet Software & Services will form an Application Software group.

How will the changes affect Global X’s ETFs?

Jacobs: For the most part, we expect these changes to have a minimal impact on our ETFs, but it ultimately depends on the underlying methodology. For example, our Thematic suite of ETFs is intentionally sector agnostic, meaning there are few if any constraints on sector exposures. In some of our ETFs, the index methodology may include a ‘sector cap’. These funds typically land in the income-oriented space, which tend to have less technology exposure to begin with, so rarely have these funds ever seen their technology exposure reach those caps. If you consider the new Comms sector to be a new form of technology (which I do) then hypothetically overall tech exposure (Information Technology + Communications) could reach a higher aggregate weighting in these funds.

How much will the new GICS affect asset allocation and risk analysis?

Maier: Big time. From a portfolio manager’s perspective, this will be a whole new ballgame. Think of it like this—For years, many investors could look to Telecom as a defensive sector that offered higher yield potential. That strategy is now obsolete following the reclassification. The new additions to the Communications Services are much growthier (maybe even more so than the IT sector) than the traditional Telecoms, which essentially functioned like Utilities. The new sector will include a diverse mix of the original telecom companies and a basket of growth stocks that will likely offer smaller, or no, dividends.

What should investors know about sector investing amid the GICS changes?

Maier: It’s very likely their exposures, and therefore risks, will change. We would encourage investors who allocate assets to specific sectors or industry ETFs to review their portfolios, particularly at their funds’ underlying holdings level to see what they currently own and what they will expect to own post-sector change. Investors will want to verify that they have the type of exposure they want. For example, what it means to “invest in tech” will take on some added nuance. Investors should also understand that they may own ETFs following transitional indexes (one that are rebalancing to the new conventions over time) and that their current holdings may overlap or potentially lack certain exposures as a result of the sector reclassification process.

How will the Tech sector change?

Jacobs: Structurally, the reclassification will be quite significant for Tech, the market’s darling in recent years. Consider that most of the Internet Services & Software sub-industry will move to Communication Services, headlined by several growth portfolio heavyweights in internet search and social media. What remains in the Tech sector will mostly be hardware and software companies, which in my opinion, are much less interesting from a growth perspective than those moving to the Communications sector.

What about Tech’s fundamentals?

Jacobs: From a market cap and forward Price-to-Earnings (PE) ratio perspective, Tech is the one sector that did not get a significant bump in the weighted average of these metrics. Conversely, the inclusion of large companies with higher forward PE ratios in the new Communications Services means the existing Telecoms have some new weightier partners. Consider that just five names—and several former Tech stalwarts—will comprise roughly 70% of the new sector based on market cap.

What should happen to sector valuations?

Jacobs: As it stands, Communication Services should have higher valuations than Tech. Notable, too, is that Consumer Discretionary has become quite highly valued. The increase in size and valuation can be traced to a certain online marketplace that will account for more than a third of the sector, carrying some rather significant concentration risk.

What should investors note about sector weights in the S&P 500?

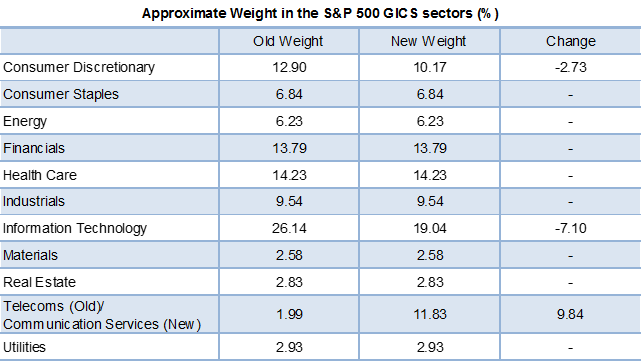

Maier: Communications Services will have some added heft, much more so than Telecom did previously. In fact, it will become the fourth largest sector at almost 12% of the S&P 500®. The table below outlines the approximate weighting in the GICS sectors before and after the new sector.

Source: Bloomberg data, MSCI data and Global X internal research as of 17 July 2018

Overall, how should ETF investors view the run-up to the reclassification?

Maier: Investors have known this was coming for a while. But now it is close to becoming a reality. Like anything, education and preparation are key. Investors with exposure to Technology, Consumer Discretionary and Telecom sector ETFs (which is likely most investors) should pay attention to the changes given the potential repercussions for risk, their growth potential, and income generation potential. Yet it’s important to remember that this changes next to nothing for the underlying companies themselves, which will continue to execute on their business plans and attempt to maximize shareholder value as they did prior the sector reclassifications.

How relevant is GICS anymore?

Jacobs: GICS can still be useful, but its relevance is fading. Energy companies still behave quite differently than Consumer Discretionary companies, and portfolio managers can use these groupings to help evaluate the broader risks and performance drivers for each sector. Yet at the same time, the economy is rapidly undergoing significant changes that is calling into question the distinctions between sectors. What is Tech anymore? Industrial manufacturing has made some Industrials firms the most advanced tech companies on the planet. Online marketplaces have blended consumer staples, discretionary, and IT into one website. The FinTech industry has been born out of the convergence of Tech with Financials, and it isn’t crazy to think Ind-Tech, Mat-Tech, Ener-Tech, or Ut-Tech could gain popularity. Increasingly, and particularly in the thematic investing space, we think investors need to think outside of the artificial constraints established by sector-based investing to get exposure to the powerful trends that are driving growth in the economy.

Global X ETF Model Portfolio Team

Global X ETF Model Portfolio Team