For years, sustainable investing struggled to get off the ground. By nature, it’s aspirational, which wasn’t always the best fit for corporate bottom-liners. But investors’ interest in sustainable investing is exploding, helped by what we believe to be an inflection point for its acceptance and growth: COVID-19 and the events of 2020. As the world had more time to opine on the future, global assets under management (AUM) for sustainably oriented exchange traded products (ETPs) grew exponentially. AUM in these products reached a record $269 billion in April 2021 after increasing 192% in 2020, followed by a further 39% increase during the first four months of 2021.1 And as interest begets investment, investment may beget performance, and performance may beget more innovation and interest. With an ample supply of innovation and investment options to consider, we highlight why we expect sustainability’s momentum to continue and how to implement it in a portfolio.

The Conscious Investor: Why We Believe Sustainability is a Growing Trend

Sustainable investing broadly describes investment approaches that incorporate environmental, social, and/or governance (ESG) considerations with the intent to affect positive change while seeking competitive returns. Interest in this space has increased significantly in recent years. Nearly $3 of every $10 of global equity inflows has been in ESG funds in 2021. Assets in ESG funds hit a high of $1.4tn in April, more than double the AUM in April 2020. Overall, ESG assets have grown at nearly 3x the pace of non-ESG assets this year.2

We expect pandemic effects, increased awareness of social issues, and the Biden Administration’s focus on reducing carbon emissions and implementing clean technologies to make sustainability an even bigger part of the public discourse. We saw clear evidence of sustainability’s growth in May. Last month, three of the world’s biggest publicly traded oil and gas companies—Exxon Mobil, Royal Dutch Shell, and Chevron—were told either by courts or shareholders that they must act to reduce greenhouse gas emissions. Over time, we believe real change in energy use will be the result of pressures like these, with consumers wielding the most power to force oil producers to change.

Top-down government policies will help drive sustainable investing trends, but we expect innovation’s bottom-up approach to be equally, if not more, important. Momentum for innovative segments like CleanTech, renewable energy production, electric vehicles, lithium & battery technology, health & wellness, longevity, and education should continue to grow as people recognize the effects of corporate behavior on society and the environment.

We also expect changing demographics to sustain the momentum for corporate sustainability. In a 2018 survey, 85% of Millennials felt that companies should implement environmental programs, versus just 72% of Baby Boomers and 65% of the Silent Generation.3 Those preferences make sense: Millennials grew up learning and hearing about the importance of sustainability. And when they came of age, they had sustainable investment options at their disposal. Conversely, older generations typically had a larger portion of their wealth invested prior to the availability of accessible investment options that could align with their beliefs on sustainable or social issues.4 As such, just 20% of Baby Boomers evaluated their portfolios for sustainability considerations, compared to 78% of Millennials.5

Millennials had a head start on valuing corporate sustainability more than older generations. However, sustainability awareness and portfolio considerations are rising among older generations, especially Gen X.6 Over time, we expect evaluations like these will be the norm across generations.

Adding Sustainability to a Portfolio

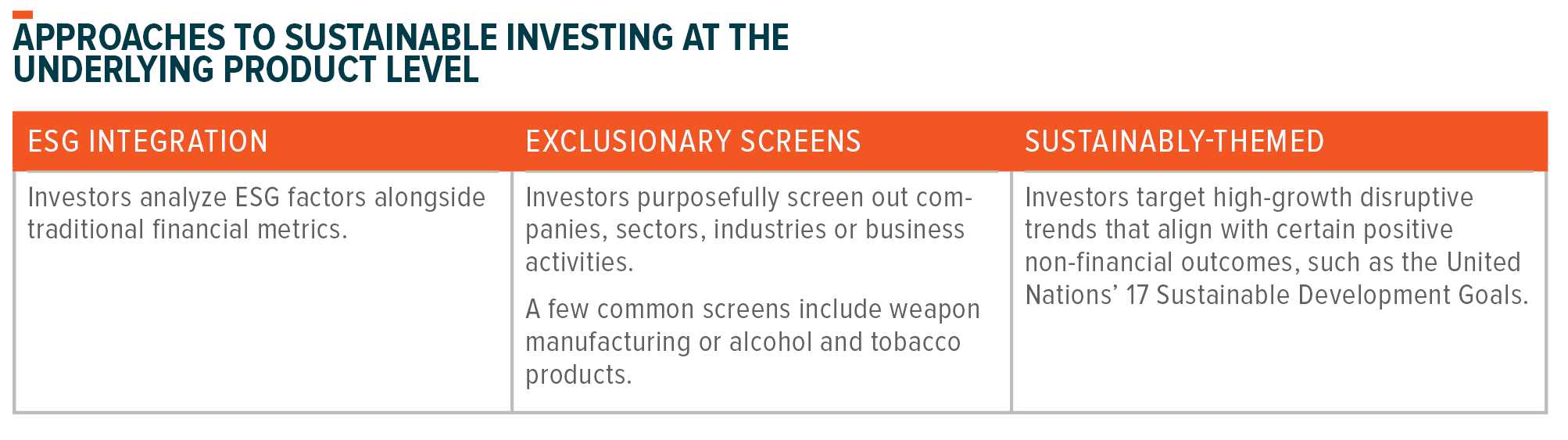

Within the ETF universe, there are several different approaches to sustainable investing. These include: ESG integration, exclusionary screens, and sustainably-themed. These approaches can be used as the building blocks to create a cost-effective sustainable portfolio.

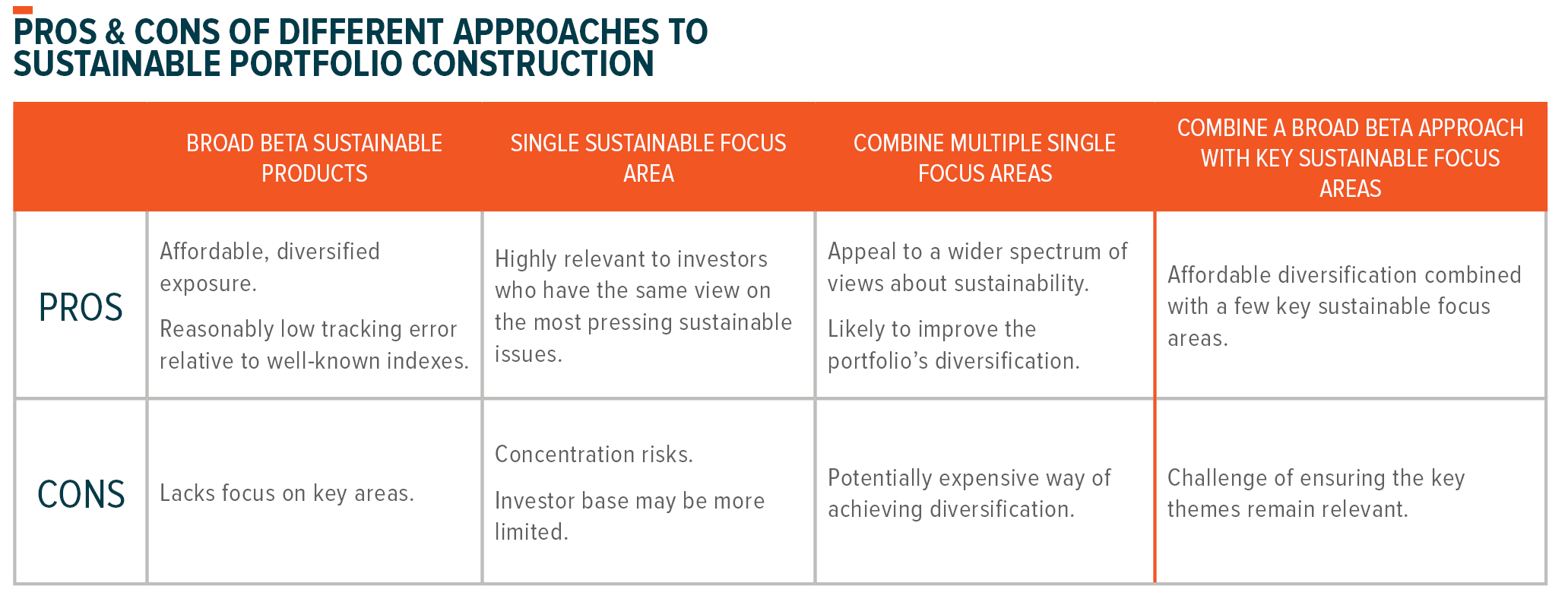

When constructing a portfolio, cost and diversification are often among the most important considerations. For example, it’s possible to build a sustainable portfolio focused on just a few key areas, such as companies that are helping to address climate change. However, a portfolio that is too narrowly focused will likely face concentration issues and fail to appeal to a wide investor base. Conversely, including a wide range of sustainable focus areas in a portfolio can address concentration issues, but that could also mean less efficient access to diversification. The table below outlines a few different approaches and some of their pros and cons.

At Global X, our approach to constructing and managing sustainable portfolios combines elements from broad beta and focused sustainable exposures. We combine products with ESG integration and products with exclusionary screens to build a robust core exposure. Key sustainably themed exposures are included to complement the core exposures. Our approach provides exposure to investments that help address key issues in society while ensuring diversification and being mindful of costs.

Broad Beta Sustainable Exposure

These exposures can be used to establish an affordable foundation for a portfolio. Most sustainable products in this section fall under ESG integration or exclusionary screens. ESG integration is an investment approach that explicitly considers ESG factors alongside traditional financial metrics in the pursuit of competitive returns and positive change for people and the planet. Some ESG integration products have an inclusionary process, meaning companies must earn their way into the product. As a result, these products can be more targeted to specific sustainable issues while potentially having a higher level of tracking error relative to typical non-sustainable products.

Conversely, products with an exclusionary process screen out specific companies, sectors, industries, or business activities. These screens are frequently based on the level of revenue exposure that a company has to a specific product or activity that goes against a pre-specified view on sustainability. Depending on the specific methodology, these products can provide a sustainable tilt while maintaining a reasonably low level of tracking error relative to typical non-sustainable products.

Defined Exposure: Sustainable and Disruptive Themes

One way to provide defined sustainable exposure is ESG integration with a focus on ESG factors that target specific issues, such as climate change or social issues. Another way to target defined sustainable exposures is through sustainably themed products. Sustainable themes focus on innovative and disruptive industries that could lead to tangible improvements in certain environmental and social matters. These industries should be well-positioned to grow as beneficiaries of paradigm shifts and as possible solutions to some of the world’s most pressing issues.

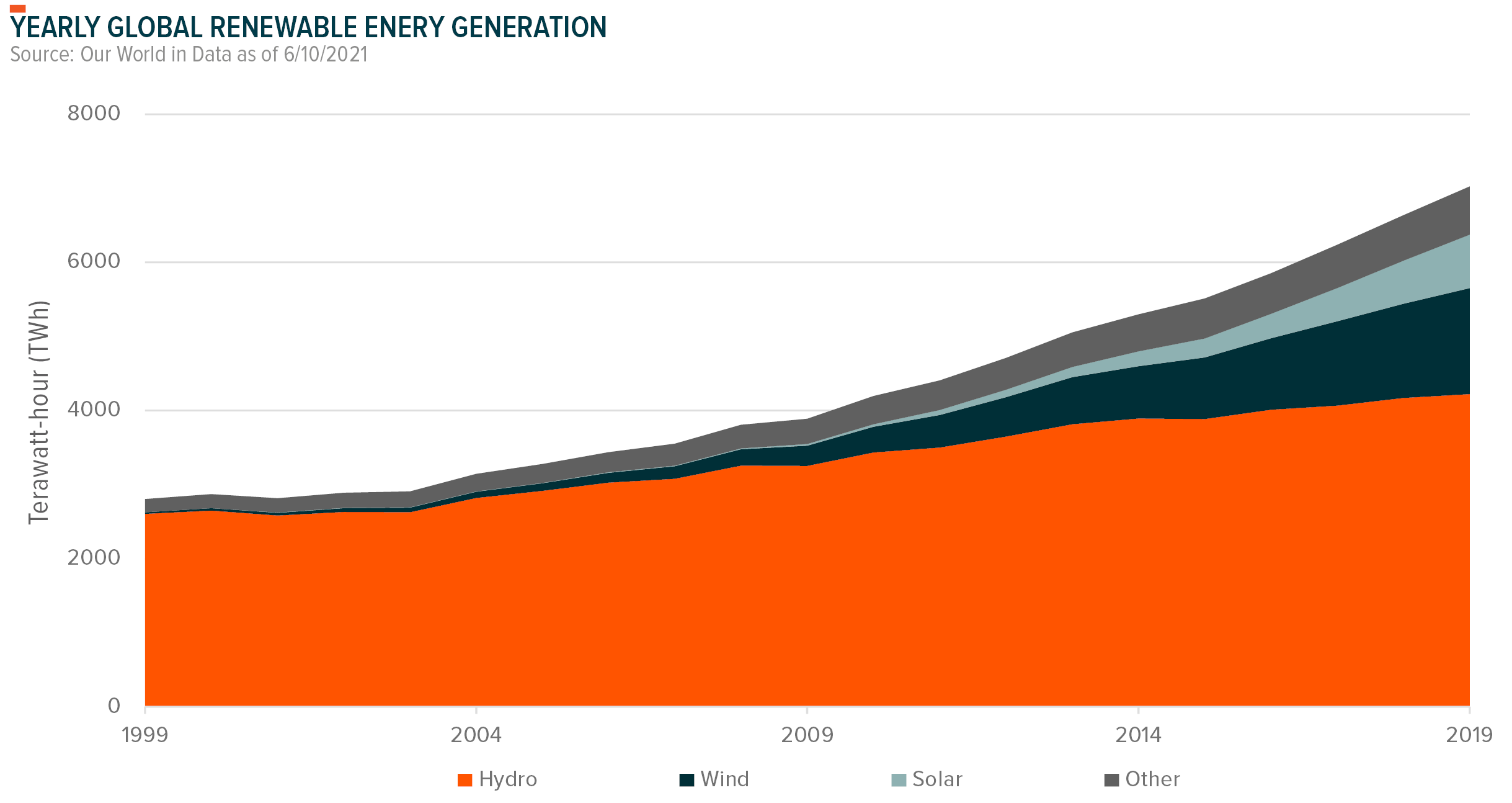

In 2015, the UN categorized some of these issues via 17 Sustainable Development Goals (SDGs), with an objective of achieving them by 2030. These goals frame the main sustainability trends that have the potential to create long-term growth opportunities. For example, the UN’s Affordable and Clean Energy goal looks to ensure access to affordable, reliable, sustainable and modern energy for all people, in part by increasing renewables’ share of the overall energy mix. Clean technologies typically target companies in renewable energy production, energy storage, smart grid implementation, building energy efficiency, and carbon-reducing products and solutions. Clean energy generation still only makes up 11% of the global energy mix.7 However, we believe we’re at the beginning of a major push towards clean technologies that power devices, cars, homes, and more, fueled by a top-down push from the federal government.

Some trends are so disruptive that they map to several SDGs. For example, Fintech, which delivers financial services through innovative technology, can map to Decent Work and Economic Growth as well as Industry, Innovation, and Infrastructure. Fintech is more than digital wallets and mobile payments. It also offers powerful solutions that can create opportunities, particularly for previously underserved populations. It’s a theme that promotes development-oriented policies that can spur job creation, entrepreneurship, and the growth of micro and small businesses.

Right for the Times

For a long time, the general perception was that for companies to align with ESG criteria, it came at a cost. We believe that cost now creates investment opportunities as companies increasingly pivot their business models toward sustainability. Motivations for the pivots aren’t uniform, but they’re informed by more socially conscious investors and consumers. Today, sustainable investing is capable of changing corporate behavior for the better, potentially leading to better financial outcomes for companies and clients. In our view, investors don’t have to sacrifice performance for sustainability.

Michelle Cluver

Michelle Cluver