Preview

This piece is part of a larger whitepaper, Investing in Thematics From a PM Perspective.

Consumer trends are shifting as demographic changes alter who consumes, how they consume, and what they want to consume. New pools of consumers with growing discretionary spending power include younger generations and the middle class in emerging markets (EMs). Also, a changing regulatory backdrop may facilitate new demand and opportunities for goods and services that were previously illegal or highly restricted. We believe these demographic and regulatory shifts form the backbone of a new consumer that will shape longer-term consumption patterns and create compelling portfolio positioning opportunities.

Key Takeaways

- An estimated $84.4 trillion is expected to be transferred from Baby Boomers to younger generations, who have very different preferences than their older counterparts, including a values-driven approach to purchasing.1

- China and India represent a compelling opportunity to tap into consumers coming into wealth. China and India accounted for roughly 35% of the world’s population in 2020 and are expected to account for more than one billion first-time consumers over the next decade.2

- New areas of consumer growth include markets that capture changing consumer attitudes and preferences, including the cannabis and legalized sports gambling markets.

Why New Consumer is Such a Powerful Force

A younger, more diverse consumer is emerging amid a massive generational wealth transfer.

Growing consumer diversity creates a complex mosaic of new wants and needs, and opportunities and risks, across the global economy. In the U.S., for example, the racial makeup of Baby Boomers is roughly 75% white, while Generation Z is only 52% white and 25% identify as Hispanic.3 Also, people are living longer while birth rates have declined. In 2020, the average age in the United States was 38, up from 27 in 1970.4 An aging population coupled with a more diverse younger population presents different spending priorities and patterns, particularly as older generations transfer their wealth.

Baby Boomers are no longer the largest U.S. generation, yet they continue to hold more wealth than any other. Baby Boomers’ share of wealth peaked at 55.9% in Q3 2016 before declining to 52.1% in Q3 2022.5 In 2022, research and consulting firm Cerulli Associates forecast wealth transfers through 2045 to total roughly $84.4 trillion, with about $72.6 trillion of that total going to heirs. Cerulli expects the majority of this wealth transfer to come from Baby Boomers.6 Cerulli estimates that Generation X, ages 40 to 55, will inherit nearly $30 trillion over the next 25 years, while Millennials, ages 24 to 39, will inherit over $27 trillion.7

Connectivity establishes new methods for consumption.

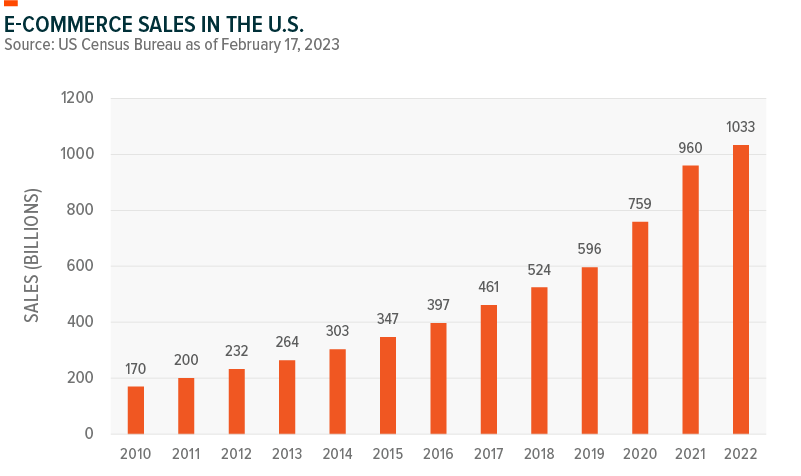

New technology-driven consumer anchors are emerging, especially among younger generations that reflect who they are and their priorities through how they spend their time and money. This connectivity means that geography is no longer a limit. The ease of connection through devices like the smartphone increases the demand for convenience, contributing to the continued rise in online shopping. In 2022, U.S. e-commerce sales increased 7.6% year-over-year (YoY) to top $1 trillion for the first time.8

Younger generations prioritize societal good.

Growing visibility of climate change, including droughts, wildfires, hurricanes, and rising sea levels, largely settled the debate that human actions negatively affect the environment. A result of this understanding and growth in climate-related concerns is that consumers are more compelled to act through their purchasing decisions, especially younger generations. Millennials and Gen Z are far more likely to purchase from companies that make sustainability and social justice a focus. More than 60% of Millennials are willing to pay a premium for sustainable products, while 73% of Gen Z survey respondents say the same.9,10 At the same time, 78% of Millennials evaluated their portfolios for sustainability considerations in 2018, compared to just 20% of Baby Boomers.11

Growing opportunities as emerging market disposable income rises.

Consumption in fast growing markets such as China and India can reshape consumer trends. These consumers are experiencing increasing purchasing power and driving demand for a wide range of products. While the bulk of Chinese consumers have moved from lower-income into the middle class, this large consumer group remains an important area of growth as they continue their trajectory from middle income to upper-middle income. On the other hand, India is a market of new consumers who are experiencing an increase in discretionary disposable income.

Chinese consumers are becoming more affluent.

Over the past two decades, Chinese economic growth brought billions of its consumers out of poverty and into the middle class. China’s middle-income population rose from 391 million people in 2000 to roughly 707 million in 2018.12 Per capita disposable income also rose, reaching CNY 35,100 in 2021, an increase of more than 8x compared to CNY 3,700 in 2000. The upward mobility is set to continue. By 2030, consumer economic conditions are expected to strengthen and result in a larger upper-middle income tier. As the chart to the right shows, this tier is estimated to account for 56% of households and 60% of urban consumption. Lower-middle income households are expected to shrink to 29% of households and 18% of consumption. Also encouraging is that another 20% of consumption could come from affluent populations, more than double the current 10% share.13

Higher middle-class income has enabled Chinese consumers to be better connected. China’s internet penetration rate skyrocketed from just 1.8% of the population in 2000 to over 54% of the population in 2017. The penetration rate among urban residents is a robust 76%.14 Consumers are no longer limited to traditional shopping channels and are willing to explore different ways of shopping, a behavioral change that has led to the expansion of live streaming and instant retail shopping.15 China’s e-commerce market is now the largest in the world, with e-commerce sales estimated at $2,879 billion in 2022, more than double U.S. e-commerce sales. By 2026, e-commerce sales are expected to approach $4 trillion in China.16

India’s consumers are a growing economic power.

Tremendous growth over the last decade now makes India the world’s fifth largest economy.17 Domestic consumption, which comprises 60% of the country’s GDP, is expected to grow 4x from $1.5 trillion in 2018 to $6 trillion by 2030, supported by a population of 1.4 billion that is younger than that of any other major economy.18 Historically, household savings are high in India, with families putting away more than a fifth of their income. This buffer provides support to domestic consumption expenditure even through challenging cycles in economic activity.

Like China, the growth of middle-income and high-income households in India provides an economic anchor. The chart below shows that nearly 80% of households are expected to be middle-income by 2030, climbing from 50% in 2018. This class of consumers is expected to comprise 75% of consumer spending, with the high-income segment responsible for another 14%.19 Concurrently, there is a government push to reduce the percentage of households below the poverty line from 15% to 5%.20

A big factor in the Indian consumer’s growing influence is that the information divide between rural and urban consumers continues to shrink with the expansion of the internet and devices like smartphones. Metro areas and emerging boom towns are expected to continue to drive economic growth, but there is opportunity for rural per capita consumption to grow faster than in urban areas. Infrastructure improvements should help the gap narrow further.21

The relative youth of India’s population is another factor. The median age in India is about 29 years old, significantly younger than the U.S. population and China’s.22 The 370 million people who comprise India’s Gen Z population will grow up in a significantly different India than older generations. Gen Z’s India features ubiquitous access to the internet, smartphones, digital media, and digital consumption platforms. This connectivity is expected to reshape consumer preferences. At the same income levels, the more connected consumer is more likely to spend freely, own durables, and have more brand awareness. Their less connected counterparts are more likely to spend frugally, own few durables, and continue buying more of the same.23

Deregulation makes cannabis and sports betting new consumption segments.

The global legal cannabis market size was valued at $22.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 25.5% from 2023 to 2030.24 Forecasts suggest that the market could surpass $100 billion by 2030 with over 70 countries having legalized some form of cannabis for medical use in recent years.25 Previously, as a restricted substance, medical use cases of cannabis were challenging to study. With restrictions eased, medical studies are likely to increase, potentially creating new opportunities for market expansion. In the U.S., 37 states currently allow cannabis for medical use and 22 states permit its sale for recreational use.26

Like many segments of the new consumer economy, the cannabis market’s integration with technology, including online ordering and delivery services, can help meet consumer demand. Cannabis delivery among Gen Z consumers increased by 125% YoY in 2022 and overall cannabis delivery increased by 97%.27

Legalized sports betting is another booming new consumer segment. The pivotal moment came in 2018 when the Professional Athlete and Amateur Sports Protection Act (PASPA), which restricted sports betting, was overturned in the U.S..28 Over the next four years, 36 states moved to legalize gambling on sports. In 2022, nearly $80 billion was wagered within the U.S. and the global sports gambling market was valued at $83.6 billion. By 2030, this market is expected to grow to $180 billion, a compound annual growth rate (CAGR) of 10.3%.29 Tailwinds for this market include the penetration of connected devices and the development of digital infrastructure. Connectivity is particularly consequential to this market, as over 70% of online betting revenue in 2020 came from mobile devices.30

Visualizing the Market Opportunity

[carousel id="2"]

Risks to the New Consumer Theme

China’s aging population could dampen consumption.

Although China softened its one-child policy in 2016, the country’s fertility rate remains well below the replacement rate.31 An aging population adds pressure on younger generations, given that they are usually the ones to take care of the elderly. When generations expand sequentially, this issue is not as acute. However, China’s one-child policy created an inverted pyramid known as “4-2-1,” or four grandparents and two parents dependent on one child.

In the next 10 years, 123.9 million more people will age into the 55 and above segment in China, the largest demographic increase among all ages.32 More people will be needed to care for the elderly, and demand for retirement communities and other infrastructure tailored to an older population will increase. Care for the elderly may require more savings from a nation that historically saves more than other countries, potentially dampening future consumption.

Increased focus on sustainability could change consumption patterns.

A growing majority of consumers have an interest in sustainable products, and they increasingly ask companies how they incorporate sustainable practices in their business models. In a recent survey, 85% of respondents indicated that they have shifted their purchase behavior towards being more sustainable in the past five years.37 About 40% of millennials will choose a sustainable alternative when available, whereas older generations are slightly less likely (26-31%). Overall, European consumers report major shifts in their purchasing decisions towards sustainability, notably in Austria (42%) and Italy (41%), more so than U.S. consumers (22%).

The increased desire for sustainable products may shift consumption to longer-lasting items that don’t need to be replaced as frequently, which is already the case with goods such as paper towels and recycled clothing.38 Growing interest in sustainability could stifle demand for many “dirtier” legacy industries while increasing the demand for those perceived as “cleaner.”

Thematic Intersection with the New Consumer

Mobility

Younger generations’ desire for sustainability cuts across many facets of their life, including how they get around. As these generations come into wealth over the coming years, this desire will likely accelerate the adoption of electric vehicles (EVs).

A recent survey revealed that seven out of 10 U.S. drivers would be interested in buying an EV when charging infrastructure expands and EV costs drop.39 To meet this demand, one estimate says automakers and suppliers need to invest at least $526 billion in EVs and batteries between 2022 and 2026, more than double the five-year EV investment forecast of $234 billion for 2020–2024.40 To achieve the International Energy Agency’s (IEA) net zero emissions by 2050 goal, global EV sales would likely need to increase to 60% of total car sales by 2030.41

Fintech

The intersection of financial services and technology, or fintech, is where many people now go to spend, lend, borrow, invest, and trade. Fintech makes financial services more personal and inclusive. Over the last two years, fintech adoption has increased dramatically around the world, with smartphone access and usage a primary driver.

Demographic divergence across different fintech applications is vast, but adoption among younger generations is much more prevalent. They are highly comfortable using technology for financial transactions, including using mobile payment apps for peer-to-peer (P2P) payments. Seventy-two percent of mobile payments users are Millennials or Gen X.42 For older generations, concern about loss of funds is the biggest obstacle to adoption. As trust grows across generations, we expect digital payments markets to accelerate.

New Consumer in a Portfolio Context

Consumers are the engine for economic growth across the globe. Understanding generational preferences and dynamics will be essential to drive corporate growth. We expect the Millennial Consumer theme to become increasingly prominent in investment portfolios. On the adoption curve, both the Millennial Consumer and E-commerce themes land squarely in the early majority phase, indicating that adoption levels are high and rising.

The pie chart breaks down the geographic exposure of the largest Millennial and E-commerce thematic ETF products. We believe that there is ample innovation occurring outside the U.S., and that limiting exposure to the States will exclude key players to the detriment of investors over the long term.

In our view, thematic equity should be targeted using screens to ensure that the underlying companies provide the desired exposure. This pure play focus minimizes overlap between themes while also differentiating the exposure provided by the theme relative to broad beta products. We conducted an overlap analysis between Millennial and E-commerce ETFs, the S&P 500, MSCI All Country World Index (ACWI), and the most applicable S&P 500 sector ETFs: the Consumer Discretionary Select Sector SPDR Fund (XLY) and the Technology Select Sector SPDR Fund (XLK). We found that the average overlap by weight for the Millennial and E-commerce themes was 7.5% when compared to the S&P 500, 5.7% vs. the MSCI ACWI, 15.14% vs. XLY, and 3.5% vs. XLK.43 The low overlap with broad indexes reflects the benefits of thematic exposure, as sector indexes have yet to include substantial exposures towards these targeted consumer themes.

New Consumer reflects the rapidly changing consumption landscape in the U.S. and around the world. As the Baby Boomer generation continues to retire and transfer wealth to younger generations, we expect shifts in consumer behavior and preferences. In EMs, the growing middle classes in China and India create access to a new consumer that is gaining purchasing power and becoming more interested in quality goods and services. In our view, it is essential for companies to anticipate and adapt to these shifts to be better positioned to build long-term relationships with consumers and shareholders.

How to Access New Consumer

The graphic below identifies the largest U.S. listed ETFs that provide direct exposure to the New Consumer theme.

Read the next section of the Thematic Investing Whitepaper on the Healthcare Innovation theme.