The 20th National Congress of the Communist Party of China (CPC) opened in Beijing on October 16, 2022, and the week-long event closed with President Xi Jinping embarking on his third term. Overall, President Xi’s report was consistent with the policy directions we have seen from China over the last few years, emphasizing development as a top priority for the Party. In this note, we explore the key messages of Xi’s political report and its potential implications on China’s Covid-19 policy and the outlook for various sectors.

Key Takeaways

- President Xi’s political report to the 20th National Congress laid out the long-term vision and ideologies for the Chinese Communist Party, where development remains a top priority over the long term. We see the willingness to set long-term growth targets as a positive sign that this generation of leaders is continuing to focus on growth.

- While there were no signs of deviations from China’s zero-Covid policy at the 20th Party Congress, much has changed with the 20 measures to optimize pandemic prevention and control policy and protests that called for reopening. Total reopening will take time, but new signs are pointing towards it happening faster than initially expected.

- Finally, from a sector perspective, we await more concrete policies over the coming quarters but expect most sectors to benefit from China’s increased focus on development, security, and self-sufficiency.

Economic Development Remains Top Priority for the Party

With numerous global and domestic uncertainties this year, President Xi’s speech delivered at the opening of the Party Congress was met with much anticipation. However, observers looking for clues on China’s future policy direction may have been disappointed. The key thing to note is that Xi’s address at the Party Congress was a ‘political report,’ delivered once every five years, which focuses on the ideologies and long-term targets of the Chinese Communist Party. In contrast, many had expected a ‘work report’ that addressed China’s near-term challenges and provided solutions for the way forward.

The distinction is an important one. While work reports do also include political signaling, they are more directed in their response to specific policies and objectives and are more oriented to current challenges. With this context in mind, it makes sense why current events like the property crisis and future COVID policies may not have been directly addressed. Still, the rhetoric points to a broad direction of thinking from which we can infer potential outcomes.

Overall, Xi’s report was consistent with the policy direction we have seen from China over the last few years. Development remains a top priority for the Party, promoted under the theme of ‘Chinese-style modernization’. Xi called on the Party to overcome the “unbalanced and inadequate development” across the country to better meet the “people’s needs for a better life”. We see this closely related to China’s focus on ‘Common Prosperity’ and expect the Party to elaborate more on this idea in future policy meetings.

Closely aligned to development are implicit long-term growth targets, which appear to remain intact. Xi highlighted the importance of more inclusive and high-quality growth, rather than focusing on GDP growth targets. However, he also recognized that a reasonable growth rate is needed, maintaining the long-term target that by 2035, China’s GDP per capita would reach that of a “medium-level developed country”. Initial analysis suggests that to achieve this target, China will need to deliver an average annual growth rate of around 4.7% in 2021-2035.1 However, given the structural headwinds underway, such as the declining property sector, aging population, and geopolitical tensions, policymakers may need to adopt a more pro-growth policy stance in the coming years. Still, we see the willingness to set long-term growth targets as a positive sign that this generation of leaders will continue to have growth among their top priorities.

Elsewhere, security and self-sufficiency have become increasingly important but do not override development goals. The main focus areas include food, energy, and supply chain security, while other areas, like data, infrastructure, finance, and culture, were also recognized.

Finally, in terms of ideology, investors may express concerns about the concentration of decision-making. With Xi embarking on his third term and promoting four new members to the seven-seat Politburo Standing Committee (PSC), the PSC now has a higher share of Xi’s proteges. This setup raises questions about the checks and balances in place and the potential risks of policy mistakes. Alternatively, it could bring about solidarity at the highest level and allow for more effective policy execution and bolder reforms. We will closely monitor upcoming political sessions with the PSC to determine the committee’s ability to set future policies.

As Gradual Easing Takes Place, Shifts in Messaging Start to Appear

Important political events, a cold winter that is conducive to infections and the mass movements of the Chinese New Year lead us to believe that reopening will be a gradual process unlikely to culminate before H2 2023. Key events include the Central Economic Work Conference in December 2022 and the National People’s Congress in March 2023. Shortly after the Party Congress, it seemed unlikely that the Party would dramatically change its zero-COVID messaging. This is beginning to change after a series of protests in late November, as the government begins to use terms like “dynamic zero-COVID (dongtai qingling)” less and less. Discussion about how more recent variants of COVID are much less lethal are also being increasingly tolerated.

Immediately after the 20th Party Congress, there were early signs of a gradual reopening:

- A quicker-than-expected reopening of Hong Kong;

- The Chinese government resuming e-visas and group tours for mainland tourists to Macau for the first time in almost three years;

- Resumption of the Beijing Marathon on November 6 after being cancelled for the last two years; and

- Chinese airlines announced in mid-October that they will increase international flights over the next two months.

In the time since the Party Congress, even more signs are emerging:

- The 20 measures to optimize zero-COVID policy reduced quarantine times, testing requirements and eliminated the circuit breaker mechanism for inbound flights;

- State media and government documents seem to be avoiding the term “dynamic zero-COVID”

- In early December, a series of announcements by local governments made testing and quarantine requirements much less stringent.

- The announcements by local governments were soon followed by the central government’s announcement of 10 new COVID rules, which call for more easing of restrictions.

As these signs continue to roll in, we expect to see more progress towards a gradual relaxation over the next two quarters rather than a sudden overnight change, especially as the focus remains on building COVID-related healthcare infrastructure and increasing vaccinations. While this relaxation occurs, the gradual shift in messaging could continue, with more emphasis on how newer variants are less dangerous.

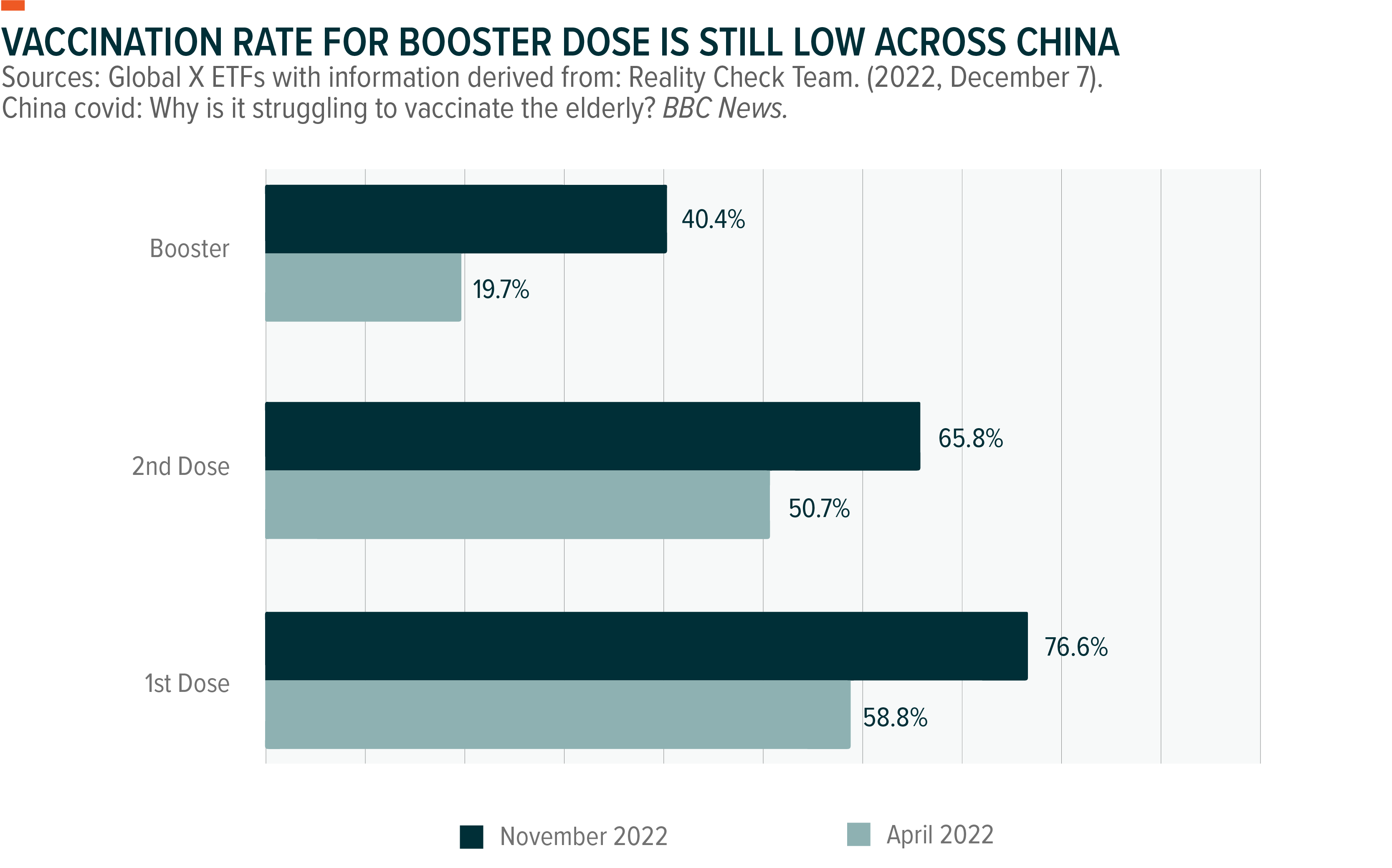

A prerequisite to China’s reopening is a more effective booster vaccination to reach critical mass against the prevailing variant. However, vaccination rates, especially booster doses, remain low across the population, particularly for the elderly. Waning immunity after several months means a booster shot is necessary for the population to maintain its defense against the pandemic.

However, the pipeline of new vaccinations and Covid-19 treatments does show some promise. To date, four Covid-19 vaccines have been granted market approvals in China as a primary vaccination regimen, while three others have been granted emergency use approvals. Seven mRNA vaccine candidates are under clinical trial in China, with CSPC Pharmaceutical Group’s mRNA vaccine appearing to be the most promising candidate. In terms of treatment drugs, China’s National Medical Products Administration (NMPA) issued conditional approval for Pfizer’s ‘Paxlovid’ and Henan Genuine Biotech’s ‘Azvudine’ pill for certain adult patients. Brii Biosciences’ Covid-19 neutralizing antibody cocktail was also approved as an antibody therapy.

Outlook and Latest Sector Updates Following the Party Congress

Information Technology Moves Towards Innovation and Self-Reliance

President Xi’s political report mentions China’s continuous pursuit of technological self-reliance. We’ve already seen several policy support rounds calling for greater localization across the whole hardware supply chain and software industry. More specifically for software, there’s still a gap in technological capabilities and software performance stability between domestic and foreign vendors in subsectors like basic software (operating systems, middleware, and databases), industrial software, high-end enterprise resource planning (ERP), etc. However, domestic software companies have invested heavily in talent over the past decade to enhance their research and development (R&D) capabilities.

Technology and products are iterating at an unprecedented speed. With a greater emphasis on self-reliance, we expect accelerated substitution to domestic software products, starting from government institutions, then to state-owned enterprises, and finally to other enterprises. Looking past the near-term macroeconomic challenges that hamper government and enterprises’ IT budgets, we expect a rising proportion of spending on software by the whole nation to continuously digitalize and improve operational efficiency.

Throughout Xi’s speech, national security was emphasized in dedicated and separate parts. With China’s economy undergoing accelerated digital transformation, cyber security will likely remain one of the most strategically critical software sectors to help safeguard digital assets from attacks. More granular regulatory guidelines have already been released, such as the MLPS 2.0 (Multi-Level Protection Scheme). The scheme classifies information security risks into five levels ranging from threats to individual interests to threats to national safety, and requires enterprises and local governments to invest in relevant technology/products. As cybersecurity technology evolves rapidly, leading industry players are likely to continue investing in cutting-edge technology development.

There was little mention of internet companies in Xi’s Party Congress report and we expect most of the heavy sector regulations to be largely behind us. The emphasis on “high-quality growth” for China’s economy should mean fair competition for all internet platforms and potentially increasing focus on profitability instead of growing at all costs.

Batteries and Clean Energy Likely to Continue Benefitting From Favorable Policies

Following the Party Congress, we do not expect any industry-wide policy risks to the battery and clean energy sector. Development goals over the next five years mentioned high-quality growth, progress in tech self-sufficiency, and further opening up to secure supply chains in the global market. China has emphasized many times the importance of hi-tech manufacturing, including the electric vehicle (EV) value chain and energy transition via wind and solar on the back of carbon neutrality. Thus, we believe that battery and clean energy will remain beneficiaries of favorable policies in the medium and longer term.

As a matter of fact, China has become the largest market of battery and solar in terms of demand and production, dominating many segments along the supply chain, such as anodes, separators, polysilicon, wafers, cells, etc. China has built up competitive advantages in battery and clean energy technologies, cost, and production scale. China-made battery shipments will likely increase thanks to the acceleration of EV penetration with more popular car models and policy tailwinds. Leading battery makers consolidate their competitiveness by breaking into global carmakers’ supply chains and expanding local production overseas. The energy storage business has witnessed rapid growth this year amid clean energy acceleration in Europe following the recent energy crisis. Demand from power and energy storage batteries remains solid looking into 2023.

Solar and wind demand are also growing fast despite raw material cost hikes. Domestic solar installations are likely to exceed at least 75GW by the end of the year, while residential and commercial D/G projects are the main sources of demand for better profitability.2 We expect demand from large-scale solar farm projects to pick up next year when the polysilicon shortage eases.

Manufacturing Goals Shift From Scale to Sophistication

Manufacturing continues to be one of the core bread-and-butter segments in China, with the country ranking top globally in terms of manufacturing scale and based on the value of traded goods. In the latest Party Congress report, the key relevant direction of growth was centered around innovation and supply chain safety. Consistent with the desire for higher-quality national development, China wants to upgrade its manufacturing standards, gradually shifting from scale manufacturing to advanced manufacturing.

Continuous innovation is the key to advanced manufacturing, which must be carried out on the corporate level. The term “Little Giants” was first introduced in 2018 and then further categorized in 2021 into small- and medium-sized enterprises (SMEs) that are specialized, refined, differentiated, and innovative. As of September 2022, there are 8,997 companies in the complete “Little Giants” universe.3 Many of these companies were selected by Chinese authorities and appear strategically important to China in terms of its growth sustainability and national security. These corporate entities are offered various policy incentives, including tax incentives, fiscal stimulus, financing availability, resource allocation, and talent recruitment. We believe these forms of support are essential for innovation and will continue over the next few years.

Supply chain security and national security are also key elements mentioned in the report. With the pandemic-induced lockdowns and heightened geopolitical tensions, supply chain management has become both more important and challenging. It is critical for China to achieve a certain degree of supply chain independence and make sure core parts and components can be localized. Hence, we see a strong appetite for Chinese products to gradually gain market share from foreign players, even in advanced applications such as robotics, vehicle parts, and industrial software.

Resource Allocation and Commercialization Become Priorities for Biotech

China’s Healthcare sector, especially the CRO (Clinical Research Organization) and CDMO (Clinical Development and Manufacturing Organization) subsectors, saw a sharp correction following the US Government’s Executive Order (EO) on Biotech and Biomanufacturing. On September 12, the US Government passed an EO with the aim of 1) growing its domestic biomanufacturing capacity and securing supply chains, 2) encouraging R&D to drive medical breakthroughs, and 3) building and protecting the US biotechnology ecosystem, including data collection, data security, and data sharing with partners.

Days later, the White House released more details on a specific funding budget with over $2bn to advance the biotech/biomanufacturing initiative to lower prices, create jobs, and strengthen supply chains. The largest funding was assigned to domestic biomanufacturing expansion with the US Department of Defense and the Department of Agriculture.

In our view, the EO is nowhere near as powerful as the $52bn investment in the ‘CHIPS and Science Act’. We believe the EO has limited impact on China’s biomanufacturing industry at this stage since there are not any specific restrictions on China, nor does it mention any specific restrictions on biological products, biotechnologies, supply chains, or key raw materials.

With a high base in 2022 for CRO/CDMO companies with COVID revenues, the market is likely to be more optimistic until there is more visibility of 2023 revenue delivery. Most companies see limited impact from inflation, which they can pass down to downstream clients, and backlog visibility remains very high. Moreover, capacity expansion remains in progress, driven by robust client demand.

For biotech companies, we believe re-prioritizing pipelines to optimize resource allocation and commercialization will become the next area of focus. We have seen early signs of companies re-prioritizing and being agile in the evolving competitive landscape for their assets. For more established companies, the sales recovery post-COVID lockdowns will likely be the main focus after opening up.

Consumer Discretionary Performance Hinges on Possible Reopening

China’s consumption has been heavily impacted by the zero-Covid policy in 2022, especially when major cities such as Shanghai experienced citywide lockdowns in April and May. Since then, we have seen a gradual recovery, but consumer confidence remains low under the zero-COVID policy, which became stricter in October before the CPC meeting.

While the zero-COVID policy may be here to stay, we expect to see gradual relaxation towards reopening in the coming quarters. We have already seen some progress with the government reducing restrictions in Hong Kong and Macau earlier than expected, while the Beijing Marathon will resume for the first time since the pandemic. These small changes should gradually improve consumer confidence and lead to a recovery in consumption. Discretionary and service industries should benefit the most, especially where the zero-COVID policy impacted demand and, as a result, pent-up demand is high.

With the new Politburo members confirmed, we expect the government to refocus on growth, as economic development is key to resolving many social issues. We expect to see more easing policies to boost domestic consumption over the coming quarters.

With a gradual reopening process, overall consumption may stay weak for the next 3-6 months, but a lot of this is already priced in. Overall, we think this presents a good buying opportunity to invest in high-quality consumer companies in the coming quarters as we get more visibility on the path towards reopening and government support to boost domestic demand and drive economic growth.

Support for Semiconductors and AI Might Help Offset Export Control Headwinds

Semiconductors and artificial intelligence (AI) remain key strategic focus areas in China’s tech development. The broader policy direction we gather from the Party Congress remains consistent with previous policies: 1) focus resources on leading-edge technology and develop independence in the core supply chain, and 2) create a competitive ecosystem to encourage innovation and attract talent.

The US Department of Commerce published a new set of export controls on advanced computing equipment and semiconductors to China. In short, the new rules mainly aim to limit China’s manufacturing capabilities in advanced logic (16nm or below) and memory chips (128 layers NAND, 18nm DRAM or more advanced), as well as access to high-performance computing semiconductors from US companies.

We expect the Chinese government to introduce favorable policies to support semiconductors and AI, and more details will emerge as we head into the two sessions in March 2023. For example, the Shenzhen government recently drafted a new set of policies to provide subsidies in key sanctioned semiconductor subsectors. The subsidies range from RMB 5 million for individuals to RMB 15 million for corporate/projects.4

Global X Research Team

Global X Research Team