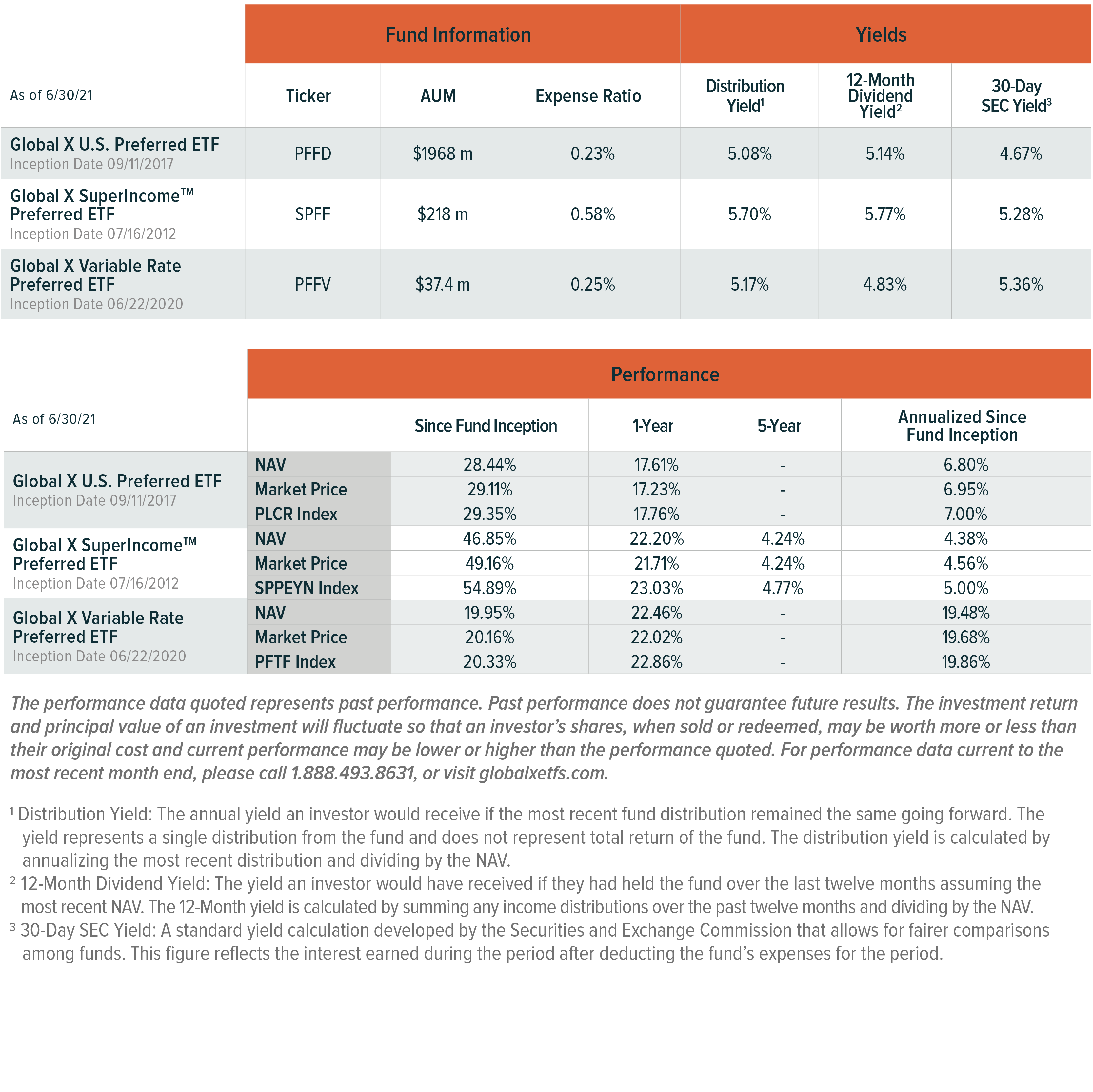

Investing involves risk, including the possible loss of principal. Preferred stock is subject to many of the risks associated with debt securities, including interest rate risk. In addition, preferred stock may not pay a dividend, an issuer may suspend payment of dividends on preferred stock at any time, and in certain situations, an issuer may call or redeem its preferred stock or convert it to common stock. High yielding stocks are often speculative, high-risk investments. These companies can be paying out more than they can support and may reduce their dividends or stop paying dividends at any time, which could have a material adverse effect on the stock price of these companies and the fund’s performance. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Variable and Floating Rate Securities may have limits on the maximum increases in coupon rates and may lag behind changes in market rates. PFFD, PFFV and SPFF are non-diversified.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Beginning October 15, 2020, market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. Prior to October 15, 2020, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. The returns shown do not represent the returns you would receive if you traded shares at other times.

Since PFFD and PFFV’s shares did not trade in the secondary market until several days after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares, the NAV of the Fund is used to calculate market returns. Indices are unmanaged and do not include the effect of fees, expenses or sales charges. One cannot invest directly in an index.

This material must be preceded or accompanied by the funds’ current prospectus. Please read it carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC. Global X Funds are not sponsored, endorsed, issued, sold or promoted by BofA Merrill Lynch nor does BofA Merrill Lynch make any representations regarding the advisability of investing in or the suitability of the Global X Funds. Neither SIDCO nor Global X is affiliated with BofA Merrill Lynch. BofA Merrill Lynch indexes are “as is”. BofA Merrill Lynch makes no representations or warranties and disclaims all liability arising from the ICE BofA Merrill Lynch. BofA Merrill Lynch makes no representations or warranties and disclaims all liability arising from the BofA Merrill Lynch indexes or their use.

Rohan Reddy

Rohan Reddy