Global X launched its first ETF, the Global X MSCI Colombia ETF (GXG), 10 years ago this month. The fund was born out of a need for targeted exposure to a growing economy that was often overlooked by investors or represented a miniscule portion of broad emerging market indexes. With a decade of history behind the fund, we thought it would be an opportune time to revisit Colombia – to see what’s changed, and what’s stayed the same, since 2009.

Colombia, 2009

After decades of controlling the political climate and narcotrafficking business, the guerrilla paramilitary group, the FARC, was losing territory and assets to aerial fumigation, military intervention, and international sanctions. Colombia’s President Álvaro Uribe, who was two years into his second term, restarted Colombia’s peace talks with the FARC, in an effort to set the country on a peaceful path of growth.

Despite working towards peace, foreigners rarely traveled to Colombia during this time, given the lack of Open Skies agreements, residual violence related to narcotrafficking, and skeptical views on Colombia’s overall national stability.

Economic growth was stymied by limited trade, with few free trade agreements in place and regional integration efforts unrealized. Foreign capital was limited, Colombia’s capital markets were comparatively small versus other Latam emerging markets like Mexico and Brazil, and efficient tools for direct access were sparse (hence the launch of GXG).

Progress was slow, steady, and uneven.

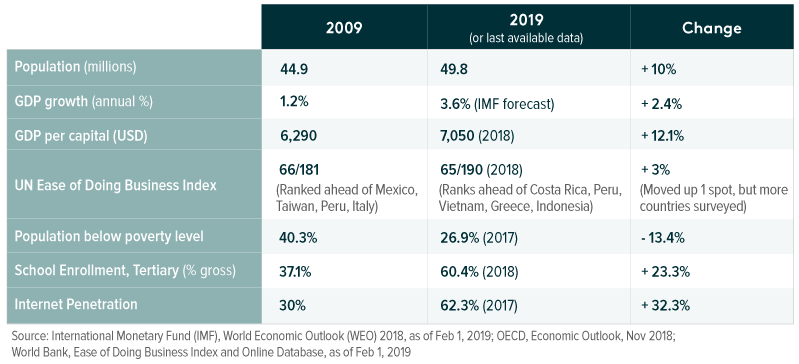

Yet today, Colombia is a bright spot in the developing world, endowed with rich natural resources, a stable political environment, and prudent market-friendly policies. Investors are increasingly attracted to Colombia’s growth potential, liberal market values, and favorable business conditions. Below are some key stats illustrating Colombia’s transformation from 2009 to today:

Macroeconomic Backdrop

Colombia’s history is marked by its strong democratic institutions and prudent macroeconomic policies. It is one of a few Latam countries that never experienced dictatorship or defaulted on its sovereign debt, largely escaping the swell of a populist “Pink Tide” in the 2000s and the waves of populism and protracted Import Substitution Industrialization (ISI) policies that defined regional politics for decades.

As such, Colombia’s economic development over the past decade was steadily built upon the solid foundation of an independent central bank, a healthy current account, increasingly strong trade relations, and a modernizing economy.

- Independent Central Bank: Colombia’s Central Bank is among the most well-respected across EMs and is seen by some as Colombia’s strongest institution. Utilizing an inflation-targeting regime, a flexible exchange rate, and supervisory tools, the central bank has maintained autonomy and credibility and buttressed investor confidence. In 2011, policymakers introduced a structural fiscal rule seeking to anchor government finances and debt sustainability. Colombia also benefits from the support of the IMF, which extends a Flexible Credit Line (FCL) of over $11 billion to the country

- Healthy Current Account: Despite strong commodity exports, Colombia is a net importer, causing its current account deficit to grow in nominal terms since 2009. As a percentage of GDP, however, the deficit has remained stable. The deficit is narrowing faster than expected,1 and could accelerate with the growth of domestic and international demand as Colombia continues diversifying its exports and attracting FDI

- Strong Trade Relations: Colombia joined Chile and Mexico in the OECD (the only other Latin American members), and signed several bilateral and multilateral trade agreements, including with the US, Canada, EU, South Korea, and the Pacific Alliance (a trade bloc formed in 2012 by Colombia, Chile, Mexico, Peru). It continues negotiating with Turkey and Japan and has an agreement pending with Panama.2 These agreements cover trade in goods and services and expand capital markets access by granting legal protections and better terms to foreigners

- Modernizing Economy: As Colombia grows its service sector, it reduces the size of its informal economy, which expands the tax base, improves access to education, and encourages female labor participation. Further, the country has made significant efforts to diversify away its dependence on oil and has committed to modernizing its infrastructure to create a better business environment

Safety and Security

Colombia officially ended a decades-long civil conflict two years ago, signing a Peace Accord with the FARC, an insurgent guerilla group that truncated Colombia’s growth since the 1940s. Colombian President Juan Manuel Santos received the Nobel Peace Prize shortly after, an international symbol of recognition for Colombia’s momentous progress which has also led it to becoming the fourth-largest economy in Latam.3

Colombia’s economy was stymied by violence and narcotrafficking but began to develop before the conflict was officially ended. During the 1990s, security began to improve incrementally. Tourism in Colombia is one of the industries that has benefitted most from an improved security situation and has helped reduce unemployment and improve GDP. As one of the fastest growing industries, Colombia last year estimated that it would welcome nearly double the 1.4 million tourist visits from 2009. Looking forward, Colombian officials anticipate tourism will continue on its growth trajectory through 2028.

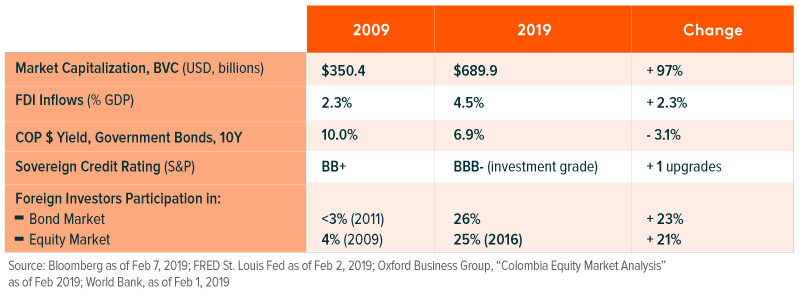

From Conflict to Capital Markets

Colombia’s capital markets have fluctuated, but overall improved markedly from 2009. The local Bolsa de Valores stock exchange (BVC) has nearly doubled its total market capitalization as the economy continues formalizing and integrating with global markets.

- Liquid Local Bond Market: Colombia’s debt composition favoring peso-denominated debt, protects it from currency depreciation and external risk while attracting bond investors looking for relatively lower risk EM exposure. Colombia aims to increase its domestic to foreign debt ratio from 62:38 to 70:30 and expects its bond markets to raise ~$2.6 billion this year (only 16% in foreign currency)4

- International Integration: In 2011, Colombia joined the Latin American Integrated Market (MILA), an integrated stock exchange between the Pacific Alliance countries (Colombia, Chile, Mexico, and Peru), established to increase depth, liquidity, and market access across the region. The Inter-American Development Bank (IDB) and Development Bank for Latin America (CAF) played critical roles in capital markets by supporting MILA and advising on general regulatory framework

- Past Headwinds: One year after joining, the BVC took off, peaking in market cap and trading activity. More challenges arose in 2015 when falling oil prices dragged down the peso and the overall economy, which was then compounded in 2016 with a national drought and a trucker’s strike, and then again in 2017 with tax reform. These events dampened market potential and complicated the central bank’s inflation-targeting efforts, but fixed and foreign investments and the expansion of Colombia’s liquid bond market by corporate issuers, helped buoy capital markets and stimulate reform appetite

- Reforms: Reforms aimed at formalization and capital mobility have been critical to Colombia’s capital markets development over the last 10 years. Fiscal reform in 2012 incentivized Colombians to make formal social security contributions, fomenting demand in both the equity and money markets. The reforms were fairly successful, leading to “an unprecedented growth” in private pension plan contributions.5 Last year, Colombia also announced it would more closely align with Basel III standards, which could improve Colombia’s credit profile and attract more inflows; in October 2018, Finance Minister, Alberto Carrasquilla, launched a “Capital Markets Experts Commission” that seeks to analyze and recommend policies to further develop and deepen Capital Markets

While greater retirement contributions are overall positive, Colombia’s four private pension funds’ investments are concentrated on foreign investment vehicles such as ETFs, as well as large domestic public companies, and private equity investments. This has somewhat disincentivized smaller companies from going public, resulting in a stock exchange dominated by large-caps. More reforms are needed to balance formalization with capital market development. Reducing the shadow banking sector by capping interest rates, for example, could boost competition and increase banking penetration or public offers, rebalancing issuers’ dependence on debt markets with capital raising opportunities in equity markets.

Investments help Colombia Boost Production but Reduce Reliance on Oil

As an export-driven economy reliant on oil revenues, many would classify Colombia as a commodity economy. But its services sector, which comprises a majority of its GDP and labor market, are evidence of an economy that is well into a transition phase. Oil revenues should continue to fuel growth, but consumption and non-traditional exports, which include services, renewable energy, and agriculture, are expected to become a greater source of growth as the country expands its infrastructure and increases productivity. Some important considerations pertaining to investment and the service sector are highlighted here:

- Domestic and International Investment: High yields have attracted international investors to Colombia, but the depth of its local markets have kept interest rates competitive – encouraging domestic investment into key infrastructure initiatives, including the 4G toll road initiative, estimated to entail $25 billion investments. Gross fixed capital formation is expected to increase 4.5%6 this year whereas an estimated $17.5 billion is expected in Foreign Direct Investments (FDI)

- Services: Services make up 62% of its GDP and labor force composition.7 This includes areas like Finance, Construction, Tourism, and Infrastructure, which occupy a smaller portion of equity markets, compared to oil and gas names, even though their contribution to GDP is collectively greater. As reforms encourage expansion of capital markets, the dominance of large-cap energy firms could level the playing field to diversify the universe of equities represented

Outlook

Colombia’s progress over the last 10 years has been thoughtful and steady, but this gradualist approach has allowed the country to overcome challenges associated with its legacy of civil conflict and oil market volatility.

Following Presidential elections in 2018, Colombia’s outlook is marked by higher expected GDP levels and lower expected inflation levels compared to Latam on average. Forecasts according to the IMF project solid performance8 in the near term as growth is projected to accelerate because of resilient FDI inflows and non-traditional exports. Its stable political climate, reform appetite, and infrastructure projects continue to stimulate investor interest. Year-to-date, Colombia has outperformed EMs broadly – a trend that could continue given the rebound in consumer spending following the release of broader positive economic data.

In the near term, municipal elections this Fall could ease political and reform stagnation to allow the government to pass needed pension and labor market reform, which could improve market efficiency by formalizing more jobs and prompting wage increases. Over the long term, Colombia should benefit from higher consumption aided by low inflation, currency stability, and investor confidence. The economy is likely to remain sensitive to commodity prices but could benefit if higher oil and coal revenues increase fixed investments and infrastructure spending.

Lastly, if there is a positive reversal of the political and economic turmoil in neighboring Venezuela, Colombia’s manufacturing exports could accelerate given that Venezuela was Colombia’s 2nd largest trade partner in 2008 and accounted for 17% of total exports.

Related ETFs:

GXG: The Global X MSCI Colombia ETF invests in among the largest and most liquid securities with exposure to Colombia.