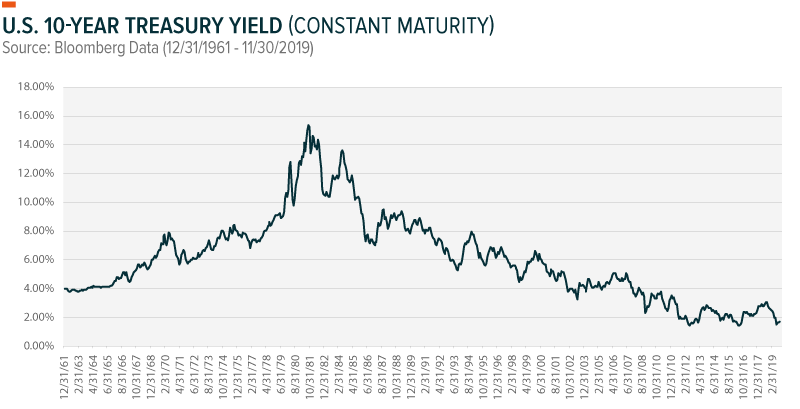

As evidenced by the chart below, yields are historically low, and show a downward trajectory going back 30 years. Why is this the case? Since the financial crisis, we have had tons of liquidity in the form of low interest rates and bond purchases. Protectionism and tariffs (which tend to be inflationary) have not yet caused a meaningful amount of inflation in the US for the following reasons: 1) companies took the bulk of the pain and did not meaningfully increase prices; 2) overall technological scaling and business efficiencies. It appears that our modern economy requires fewer physical inputs (here come the robots), one of the benefits of the internet and continued technological innovation. Over the last few decades, globalization (despite more recent protectionary policies) along with increasingly efficient business models and production lines have driven prices lower, further boosted by cheap energy provided by the US energy renaissance. Treasury rates while low historically, are elevated on a global scale. As the prevalence of near and sub-zero rates sweep the world, inflows into US debt continues, pushing debt prices higher and yields lower still. The wild card here is huge deficits which could lead to inflation and thus higher rates. Stay tuned.

Michelle Cluver

Michelle Cluver