The current government shutdown is the longest in U.S. history and a source of pain for many on an individual level. From a market perspective, stocks haven’t really noticed yet. Typically, shutdowns don’t last long and equities shrug them off. The S&P 500 Index has delivered positive returns in two-thirds of the 14 shutdowns since 1980.1

As for the broader economy, most shutdowns have a limited effect. According to economists from JP Morgan and Bank of America, they usually result in a temporary reduction of 0.1–0.2 percentage points in quarterly GDP per week.1

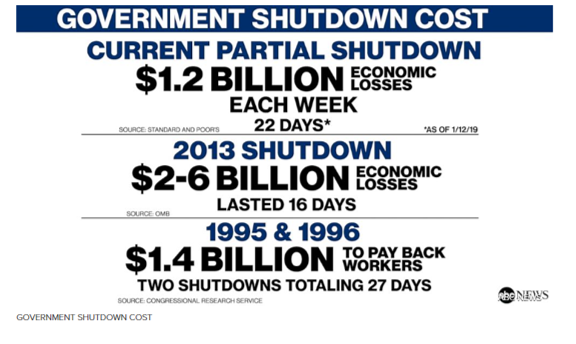

But we may be in uncharted territory here, with no precedent for a shutdown measured in months and no party willing to negotiate. The irony is that the cost of this shutdown could exceed the cost of the wall ask as it increasingly brings normal economic processes to a standstill.

Shutdown creates near-term uncertainty about economic data

Aside from workers’ paychecks, also gone missing amid rolling closures are nine of the 15 cabinet-level departments and dozens of agencies. For context, the nine cabinet-level departments currently closed account for around $325 billion of federal spending (7% of total federal spending), meaning government consumption is likely to take a hit.1

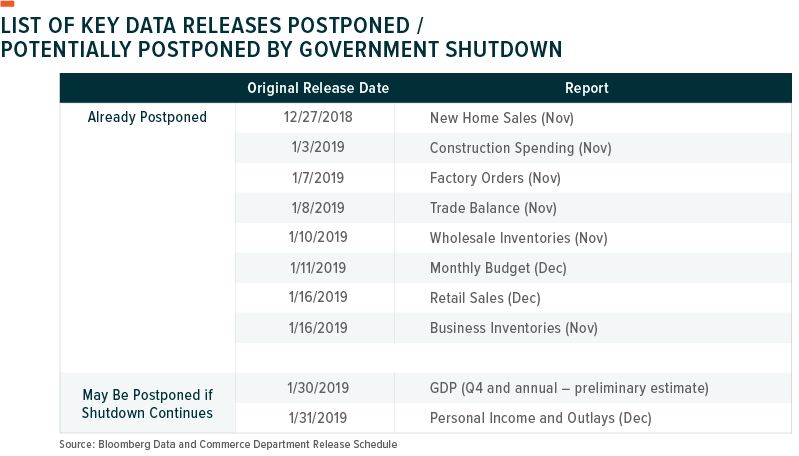

The Commerce Department’s closure is particularly significant in the near term. Should the shutdown continue until the Federal Reserve meeting on 29-30 January, Federal Open Market Committee members will make their interest rate decision without full clarity on Q4 GDP growth. Fortunately, the Labor Department continues to operate, making Jobless Claims and Non-Farm Payrolls even more important indicators of the current state of the economy.

Once the government shutdown ends, it will likely be a couple of months before the Commerce Department’s release calendar returns to normal. Also problematic is that the shutdown could put the accuracy of these data releases in question for months following the shutdown.2

Shutdown could dent sentiment if it extends to February, March

Should the shutdown extend into February, its effects could begin to weigh materially throughout the economy, particularly among consumer data. If the shutdown extends into March, the repercussions become even more serious.

For one, a lapse in funding for food stamps may affect personal consumption and dent Q1 GDP growth. Some of this will be made up once back pay is released.1 Still, roughly 800,000 federal employees not receiving wages until the shutdown is resolved will likely hit retail sales and potentially consumer sentiment. In addition, the Small Business Administration stopped approving new loans, the effects of which will increase the longer the shutdown continues.3

Elsewhere, the agricultural industry does not have the data and services that it requires, including the World Agricultural Supply and Demand Estimates. This makes pricing and risk management more challenging within the agricultural industry.3

March debt ceiling looms, U.S.’ AAA debt rating could be at risk

With Congress split, debt-ceiling negotiations figured to be difficult anyway and require a bipartisan agreement. They could be even more challenging now, especially if the shutdown looks like it will run up to the 1 March debt-ceiling trigger. According to ratings agency Fitch, the U.S.’ AAA credit rating could be at risk if the shutdown affects negotiations.1 The risk is a potential technical default. However, that would not happen until several months after the 1 March debt-ceiling trigger, when the U.S. Treasury runs out of extraordinary measures.

Source: ABC News, “White House Now Expects Greater Impact on Economy from Shutdown as of Day 26,” Jan 16, 2019.

Michelle Cluver

Michelle Cluver