German equities have rallied strongly in 2025, with the DAX up 37% year to date (YTD) through August 14th (in U.S. dollar terms) and outperforming most global peers.1 Yet we believe this is only the early innings of a broader re-rating cycle, underpinned by a decisive fiscal shift, improving corporate fundamentals, and underappreciated positioning tailwinds.

Key Takeaways

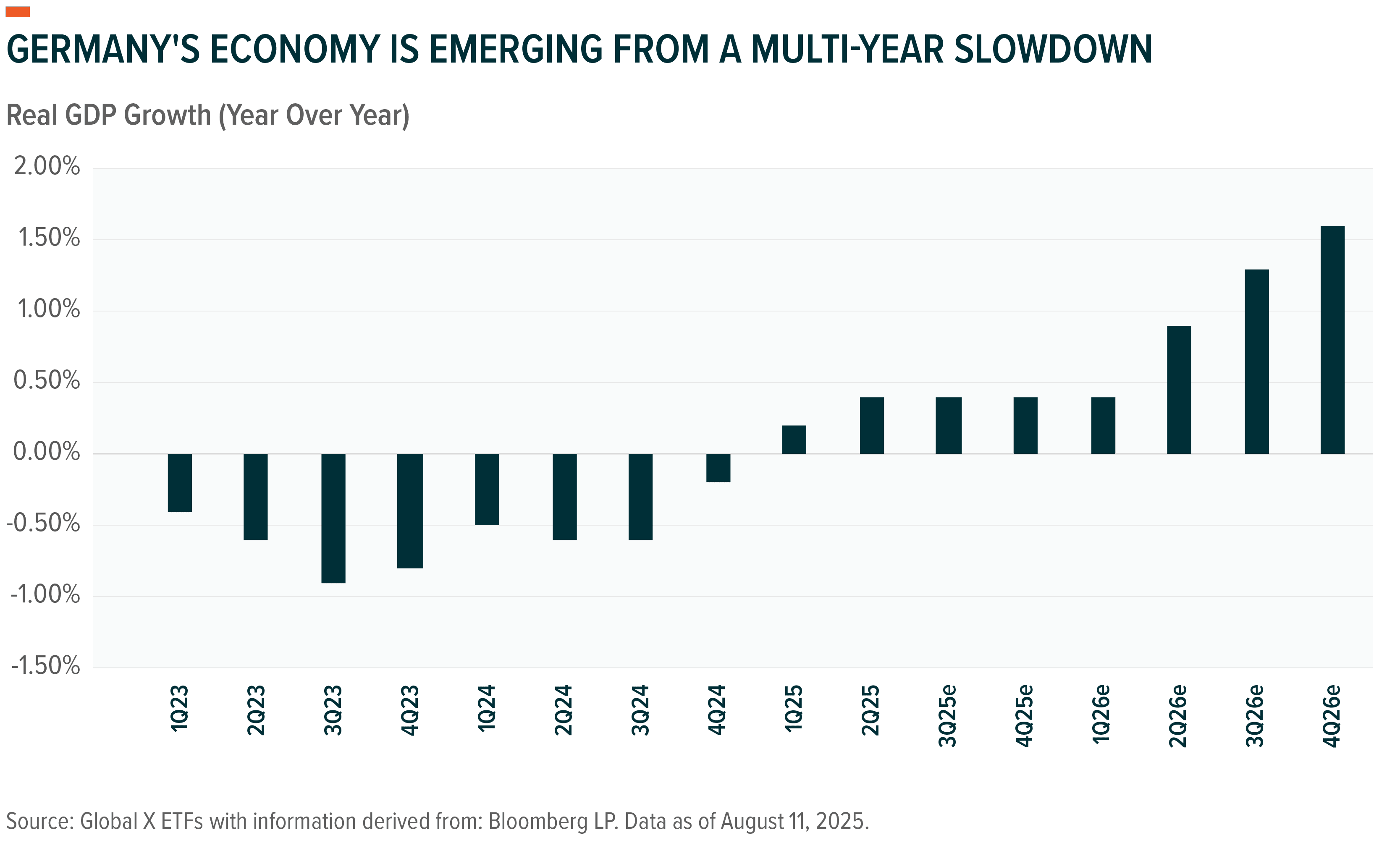

- Growth: After two years of GDP contraction, Germany’s economy is finally emerging from a multi-year slowdown. With GDP climbing on a year-over-year basis in the first two quarters of 2025, the fiscal impulse from infrastructure and defense spending is expected to lift growth closer to 2% in 2026.2

- Governance & Reforms: The new CDU/SPD (Christian Democratic Union/Social Democratic Party) coalition has enacted constitutional reforms to relax debt constraints, enabling increased public investment.3 A €46bn tax relief package has been introduced to stimulate private sector growth.4

- Valuations: German equities as measured by the DAX trade at a forward P/E of 15.09x, 29% below the over 21x level of the S&P 500 Index.5 Germany’s book value multiple is less than one half of the S&P multiple, and its dividend yield is more than double.6 We see the recent fiscal announcement as driving growth higher, which has historically led to multiple expansion.

- Catalysts: The €500bn infrastructure fund (2025–2036) authorized earlier this year is front-loaded, with €37bn allocated for H2 2025, targeting rail, education, and digitalization. Defense spending is set to reach €75bn in 2025 (2.4% of GDP), surpassing NATO targets.7 A €4bn subsidy plan for heavy industry is under consideration to support energy-intensive sectors.8

- Positioning: Despite the rally, investor positioning in German equities remains light. We see the possibility for global asset managers to continue increasing their allocations to international equities after being overweight U.S. assets, albeit for good reason, for over a decade, with this shift potentially in the early innings.

- Geopolitcs: Germany maintains a balanced geopolitical stance, enhancing its appeal to global investors seeking stability amid global uncertainties.

Conclusion

We believe Germany’s equity market is at the cusp of a structural re-rating. The combination of substantial fiscal stimulus, improving economic indicators, and favorable valuations could present a compelling investment opportunity.