The next few months will likely shed critical light on tariffs, their impact, and the potential trajectory of both inflation and interest rates. While those policy decisions continue to dominate the headlines, secular shifts transforming the economy speed ahead.

Last fall, we proposed that the Information Age had ended and that the Automation Age had begun (link here). The implications are far-reaching, with one of the most important being that traditionally asset-heavy, inefficient industries now have opportunities to streamline operations.1 So, just as Florida unleashes 40 robot bunnies to study and address the Burmese python threat to the everglades, we jump back down the automation rabbit hole.2

Pun aside, automation is spreading well beyond mega cap tech and driving new efficiencies for sectors that once seemed left behind. The S&P 500 Industrial sector is a prime example, as its profit margin averaged 6.4% from 1990 to 2021, but since then has averaged 9.1%.3 In our view, automation of physical activities through robotics and cognitive functions through AI is already reshaping the economy and creating opportunities for businesses large and small.

Key Takeaways

- Robots and AI are making their way into industries like construction, infrastructure, and utilities, helping to drive efficiency and margin growth.

- Consumers are about to get a first-hand view as automation enters industries ranging from restaurants to taxis.

- Robots-as-a-service could reshape the physical automation industry much like software-as-a-service made enterprise technology accessible to more businesses while creating a more stable cash flow for robot producers.

Robots in Unexpected Places

The New York Power Authority (NYPA), the largest state public power organization in the United States, oversees 1,550 circuit-miles of transmission lines, or roughly the distance from New York City to Denver.4 Manual inspection of lines is inherently inefficient, costly, and hazardous, often requiring multiple teams and taking months or even years to complete.

To improve efficiency, NYPA and other utility and infrastructure companies have started using Skydio drones to inspect power lines more efficiently.5 Utility companies’ profit margins were reasonably stable prior to 2022, averaging 7.5%, but since then, they have been running at 11.5%, hitting a record 13.8% in Q1 2025.6

Robots are turning up in infrastructure as well. Advanced Construction Robotics’ TyBOT ties horizontal rebar, which is commonly used in bridge construction. Typically, manual fusing is done at a rate of 150 to 200 ties per hour, but TyBOT can tie a staggering 1,100 per hour.7 The company also has IronBOT, which lifts, carries, and self-places horizontal and longitudinal rebar. Together, these two robots helped cut rebar construction time in half on a project in Port St. Lucie, Florida.8

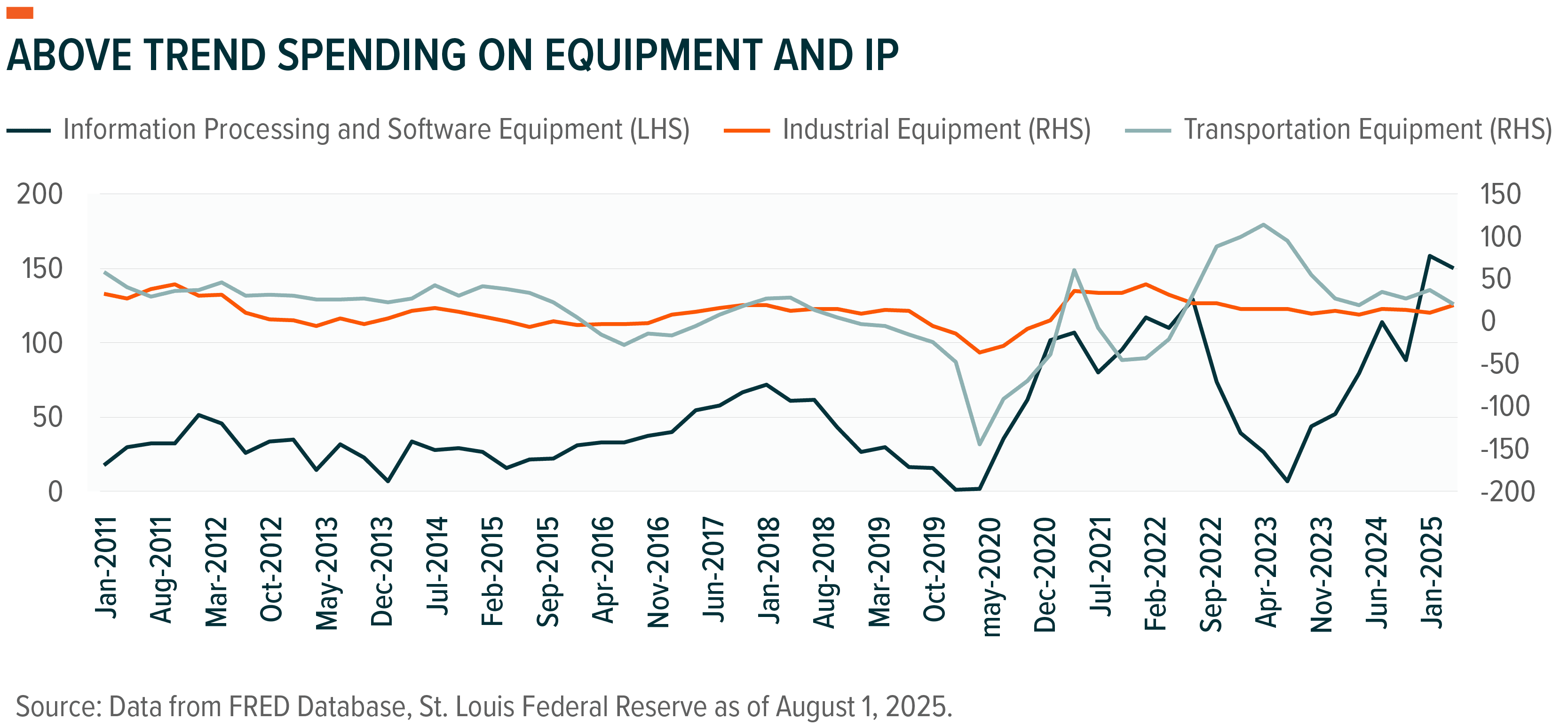

Also, while construction firms have leveraged computer-assisted tools for years, new AI use cases show promise. Energy equipment and manufacturing company GE Vernova announced plans to acquire Alteia SAS, which developed an AI system that uses photos of power lines and transmission structures to assess storm-related damage.9 With this information, companies responsible for the electric grid can react more quickly to make repairs and be more proactive in reducing risks in their most vulnerable areas. While headlines around U.S. investment were lack luster for Q2 2025, investment in both information technology (including software) and industrial equipment are growing at near record levels.10

Everyday Automation for Consumers

The days of waiting a week or more for many mail order and online items have mostly passed, and that near-instant delivery gratification is largely due to advances in automation. Amazon, for example, now has over 750,000 robots helping the company move packages throughout its fulfillment facilities.11 The Hercules robot can move pods of items weighing up to 1,250 pounds and travel across 1 million square feet. Meanwhile, the Sequia bin systems help employees find orders quickly and the Sparrow robotic arm helps them identify and sort specific items.12

Robots are also serving the restaurant industry, with companies like RobotLAB offering solutions that automate hosting duties, food delivery, and conducting specific kitchen and bar tasks.13 Elsewhere, robots equipped with coolers and heaters accessible via code are now delivering takeout food. A $2.3 billion market in 2024, the food service robot market is projected to grow more than 20% annually through 2034.14

Self-driving taxis are making inroads. With a fleet of 1,500, Alphabet’s Waymo already operates in Phoenix, San Francisco, Los Angeles, Austin, and Atlanta (through Uber). This year, the company plans to expand to Miami, Washington, DC, Las Vegas, and San Diego.15 Waymo is in discussions to pilot in New York City, one of the largest car-hire markets in the world, though current laws requires that a person must be in the driver’s seat.16 Several other companies are interested in bringing automated vehicle services to market as well, perhaps sooner than many consumers expect.

Robot-as-a-Service for Small and Mid-Sized Firms

Historically, automation technologies have been capital purchases that flow through company capital expenditures. Large firms with access to investment capital through public markets and financial institutions have been able to afford these large-ticket purchases. Conversely, such capital outlays can be challenging for small and mid-sized firms. However, a new trend may help them address that issue.

Increasingly, robots are available for rent. Among the main benefits is that resource-constrained businesses gain access to tools that improve their efficiency and profitability. Second, robot manufactures may be able to convert cyclical investment-driven revenue streams into more persistent and stable cash flows, much as software-as-a-service did in cloud computing and cybersecurity.

The market for robot-as-a-service is projected to grow from $16.2 billion in 2025 to $125.2 billion in 2034, helped by companies like Knightscope.17 The firm offers autonomous security robots through a subscription model called Machine-as-a Service, where clients pay a monthly fee for the hardware, software, and support. Knightscope recently announced 14 contract renewals with clients in the self-storage, hospitality, healthcare, residential, and logistics industries.18

One of the largest robotics companies in the world, ABB, is also embracing the robots-as-a-service model. Listed under the Robotics & Discrete Automation segment, ABB’s offering grew 6% year-over-year in Q2 2025, while cash flow from that segment rose nearly 25%.19 The company’s GoFa robot, a collaborative system designed to work alongside humans, has applications across multiple industries and, notably, for smaller businesses.20