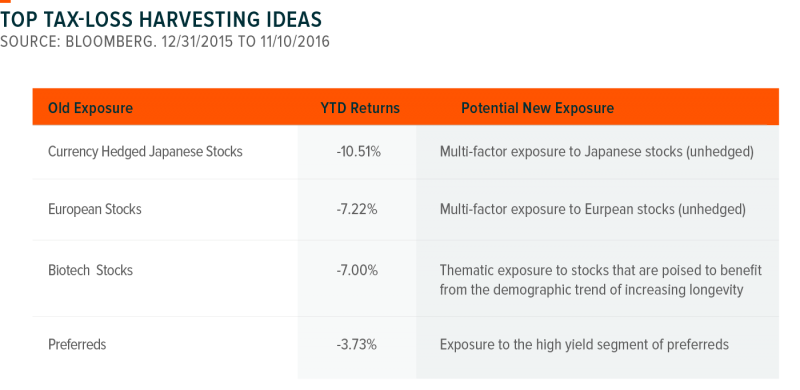

In the discussion below, we highlight four tax-loss harvesting strategies to consider before 2016 draws to a close:

- If considering harvesting Currency Hedged Japanese exposure – Consider Multi-factor exposure to Japanese stocks (unhedged)

- If considering harvesting European exposure – Consider Multi-factor exposure to European stocks (unhedged)

- If considering harvesting Biotech exposure – Consider Thematic exposure to stocks that are poised to benefit from the demographic trend of increasing longevity

- If considering harvesting Preferreds – Consider Exposure to the high yield segment of preferreds

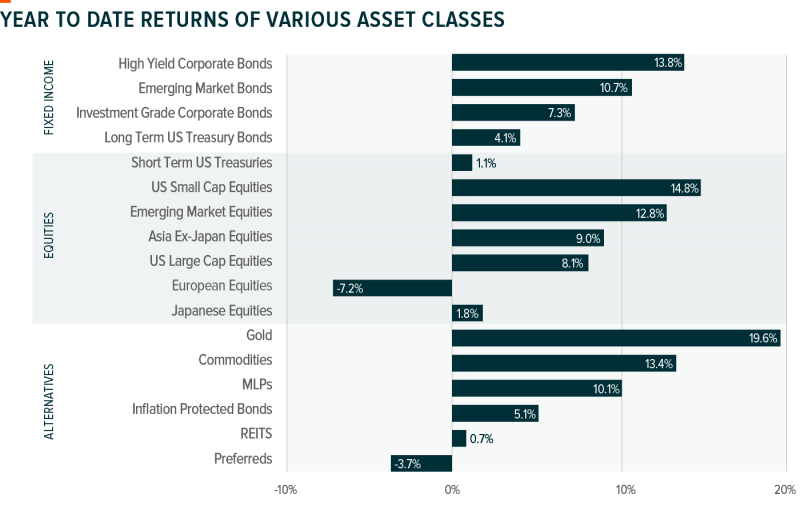

Revisiting Year-to-Date Returns of Various Asset Classes

In our mid-year review, we expressed surprise at how, despite multiple scares in 2016, most asset classes delivered positive returns. Another 4 months have passed, and this still holds true. Notwithstanding uncertainty around oil production, Brexit, elections, and interest rates, 15 of the 17 asset classes listed below delivered positive performance thus far in 2016.

Source: Bloomberg. 12/31/2016 to 11/10/2016

Index returns are for illustrative purposes only. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

A major factor in the near-universal positive returns was the dovish actions taken by central bank actions around the world, which kept interest rates at low or even negative values. At the end of 2015, the US Federal Reserve indicated there would be four interest rate hikes in 2016. As of November 14, 2016, the market is pricing in approximately an 86% chance of just one rate hike before the end of the year.1 Elsewhere, Japan lowered its central bank policy rates from 0.10% to -0.10% in January. The European Central Bank (ECB) cut its deposit facility rates from -0.30% to -0.40% in March. The Bank of England (BoE) cut its Bank Rate from 0.50% to 0.25% in August. Such actions drove global bond yields down ever further than their already suppressed levels, resulting in positive price returns across many bond indexes. The nearly non-existent bond yields impacted equity prices as well, lowering the required return for equities and supporting higher valuations as investors sought returns outside of the fixed income arena.2

The impact of positive returns across many asset classes has numerous implications. For one, investors who kept cash on the sidelines were vindicated during each bout of volatility, but the strategy has left returns lagging most broad benchmarks. For investors who put their money to work this year, many are faced with the unusual situation of lamenting the lack of tax-loss harvesting opportunities. Tax-loss harvesting involves selling assets at a loss to help offset capital gains taxes due for selling securities at a gain. Typically, money managers look for opportunities to sell certain securities which are trading below their cost basis towards the end of the year in preparation for portfolio rebalances, which often requires selling winners that have appreciated in value.

Given that opportunities to harvest losses from broad asset class exposures are sparse, below is a list of our top tax-loss harvesting ideas.

Source: Bloomberg. 12/31/2015 to 11/10/2016.

Index returns do not represent the returns one may achieve from actual investment.

If considering harvesting Currency Hedged Japanese stock funds – Consider Multi-factor Japanese stock funds (unhedged)

Earlier this year, we compared currency hedged exposure to Japanese stocks versus an unhedged multi-factor approach. We found that the Japanese yen has exhibited a negative correlation with Japanese stocks; as the yen appreciates, cap-weighted Japanese benchmarks tend to sell off as export-heavy large caps become less competitive. As a result, we found that having a more diversified weighting scheme with less exposure to exporters and an unhedged approach helped reduce volatility. An unhedged multi-factor approach, like the Global X Scientific Beta Japan ETF (SCIJ), can help provide more diversified exposure to Japanese stocks and tilt towards factors that have historically been well-rewarded over the long run, like value, size, momentum, and low volatility.

If considering harvesting European Stocks – Consider multi-factor exposure to European stocks (unhedged)

Similarly, we believe cap-weighted exposure to European stocks introduces investors to additional undue idiosyncratic risks. Instead, we prefer a more diversified weighting scheme and tilts towards the value, size, momentum, and low volatility factors for potential outperformance versus broader market cap weighted benchmarks. This approach underlies the Global X Scientific Beta Europe ETF (SCID).

If considering harvesting Biotech Stocks – Consider thematic exposure to stocks that are poised to benefit from the demographic trend of increasing longevity

Investors often look to biotech stocks for high growth potential, particularly in times like the current environment where many economists and investors are concerned about future growth. This year, biotechs have sold off over increased potential for price regulations on drugs and medical devices. We believe that rather than betting on one segment of the healthcare industry, which can be heavily influenced by new regulations or policies, investors should consider investing in the broader spectrum of companies that are poised to benefit from the demographic trend of people around the world living longer lives, as we explored in our infographic on longevity. This theme can be accessed through the Global X Longevity Thematic ETF (LNGR).

If considering harvesting broad-based Preferreds – Consider exposure to the high yield segment of preferreds

The selloff in preferreds presents an additional opportunity for tax loss harvesting. Even as the Fed prepares for another potential rate hike in December, interest rates continue to remain well below long term averages and income oriented investors will continue to need exposure to high income producing asset classes, such as preferreds. The Global X SuperIncome Preferred ETF (SPFF) provides access to 50 of the highest yielding preferred stocks in North America.

And, one last reminder…

As a final note, in November many mutual funds announce their expected capital gains distributions for the end of the year. One of the appealing features of ETFs is that they tend to be more tax efficient than mutual funds.3 In an additional effort to potentially minimize end of year taxes, we believe investors should consider ETFs with similar exposures.

Global X Research Team

Global X Research Team