In this piece, we explain why investors may want to consider collar strategies and how the Global X Nasdaq 100 Collar 95-110 ETF (QCLR) and the Global X S&P 500 Collar 95-110 ETF (XCLR) can be efficient ways of gaining this exposure.

Key Takeaways

- Collar strategies typically combine owning equity securities with buying an out-of-the-money (OTM) put option and selling an OTM call option on those same securities.

- A collar bounds performance between a specific range through the options’ expiration date. Downside is limited to the extent of the put option’s strike price, while gains are limited to the call option’s strike price. Depending on the collar design, the options contracts can be a net debit (meaning they cost money to implement), net credit (meaning they generate positive income), or zero cost.

- Investors seeking less extreme moves in their equity holdings may find collar strategies useful tools as core portfolio allocations. QCLR and XCLR offer investors efficient access to collar strategies, utilizing professional portfolio managers to purchase three month 5% OTM puts and sell 10% OTM calls. The strategies are ‘net debit’, as the cost of the put option is expected to exceed the premiums received from selling the call option.

What Are Collar Strategies?

Collar strategies typically own an underlying asset, such as equities, and overlay the purchase of an out-of-the-money (OTM) put option and the sale of an OTM call option on the same asset. They are designed to confine returns within a fixed range over the length of the options contracts. For example, the Global X Nasdaq 100 Collar 95-110 ETF (QCLR) is designed to invest in the securities of the Nasdaq 100 Index, while capping upside at 10% and limiting downside to 5% over the duration of a three-month option period. Collar strategies can come in several variations based on the potential upside, downside, cost to implement, underlying asset, and time frame, among other variables.

Collar strategies effectively combine the payoff structure of a protective put with a covered call.

Protective put strategies are widely associated with mitigating downside risk because they seek to put a floor on potential losses. A protective put consists of buying a security and coupling that with the purchase of a put option on the same security. A put option gives the buyer the right, but not the obligation to sell a security at a pre-determined strike price within a given time frame. In exchange for paying a premium to buy a put option, an investor owns a contract that can rise in value if the underlying security declines.

The cost of buying a put option varies based on several factors, but a major input is the strike price. Generally, the higher the strike price, the more expensive the option, but the greater protection that option affords the investor. For example, buying stock XYZ and an at-the-money (ATM) put option at XYZ’s current share price effectively hedges against downside moves. But it is also usually a very expensive option and could expire worthless if XYZ rises. Buying an OTM put option that is 5% below XYZ’s strike price will likely cost less, but only begin to protect against losses in excess of 5%.

Covered call strategies involve purchasing equities and selling a corresponding call option on those assets. A call option gives the buyer the right, but not the obligation to buy a security at a pre-determined strike price within a given time frame. The call option strike price can be customized to the investor’s liking. It can be ATM if an investor is willing to give up all of the security’s upside potential, or OTM if the investor would like to retain more of that upside potential. The tradeoff is that an ATM call option will generate higher premiums compared to an OTM call option.

Combining the economics of the protective put and covered call results in a collar strategy that bounds returns between a lower floor and upper ceiling over the length of the options contracts. Exactly where those floors and ceilings are set can impact whether the collar strategy costs money to implement, is zero cost, or generates income. If a collar is designed to generate income, it often features greater downside exposure than upside. This is the case with our risk managed income strategies (QRMI and XRMI), which seek to generate income from a “net credit” collar strategy. But collars can also be net debit, i.e. cost money to implement, particularly if they seek to maintain greater upside than downside potential. This is the case with our 95-110 collar strategies (XCLR and QCLR).

Why Should Investors Consider Collar Strategies

Investment returns can of course be volatile and unpredictable. In a given year, an investor may experience a euphoric rally, a crushing selloff, or simply see their investments meander in the middle. Not all investors want to experience such great volatility, particularly on the downside. Instead, they’d prefer to set expectations ahead of time for the range of possible outcomes. Collar strategies can help achieve this goal. Perhaps most importantly, they can mitigate downside risks through the purchase of a protective put. But by selling a covered call, the strategy can also help partially offset the cost of the put in exchange for limiting upside potential.

Global X Collar 95-110 Strategies, Explained

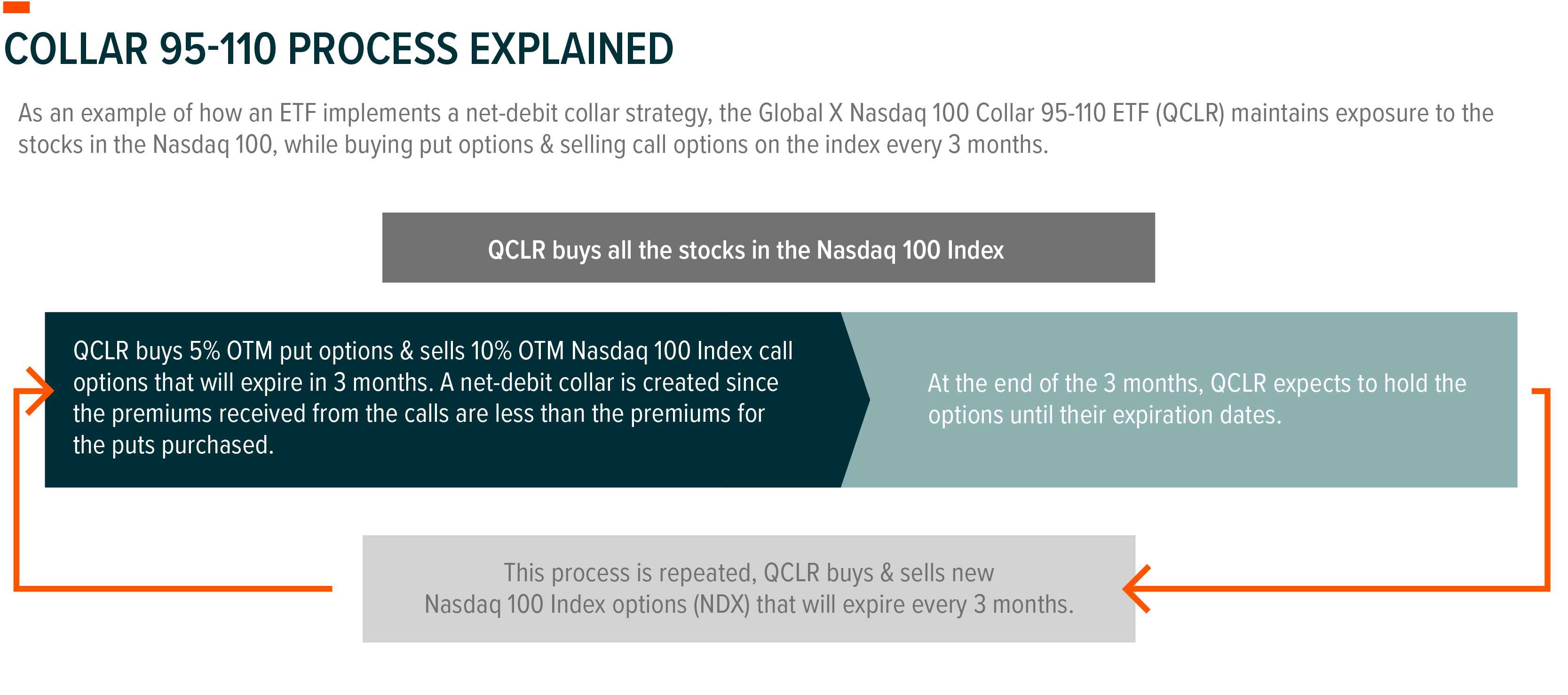

Global X’s Collar 95-110 ETFs, QCLR and XCLR, are both passive ETFs that implement systematic strategies designed to set a range of upper and lower bound returns for investors. They follow similar processes, but track different underlying indexes: the Nasdaq 100 and S&P 500, respectively.1 Using QCLR as an example, it starts by owning all the stocks in the Nasdaq 100. The fund then purchases a 5% OTM put option on the Nasdaq 100 with an expiration date in three months. Then, it sells a three-month call option on the Nasdaq 100 that is 10% OTM. On the options contracts’ expiration date, the portfolio managers settle the previous options and enter into new three-month contracts. The goal is that over each three-month option period, losses are limited to approximately 5% and gains are capped at 10%, before fees and expenses.

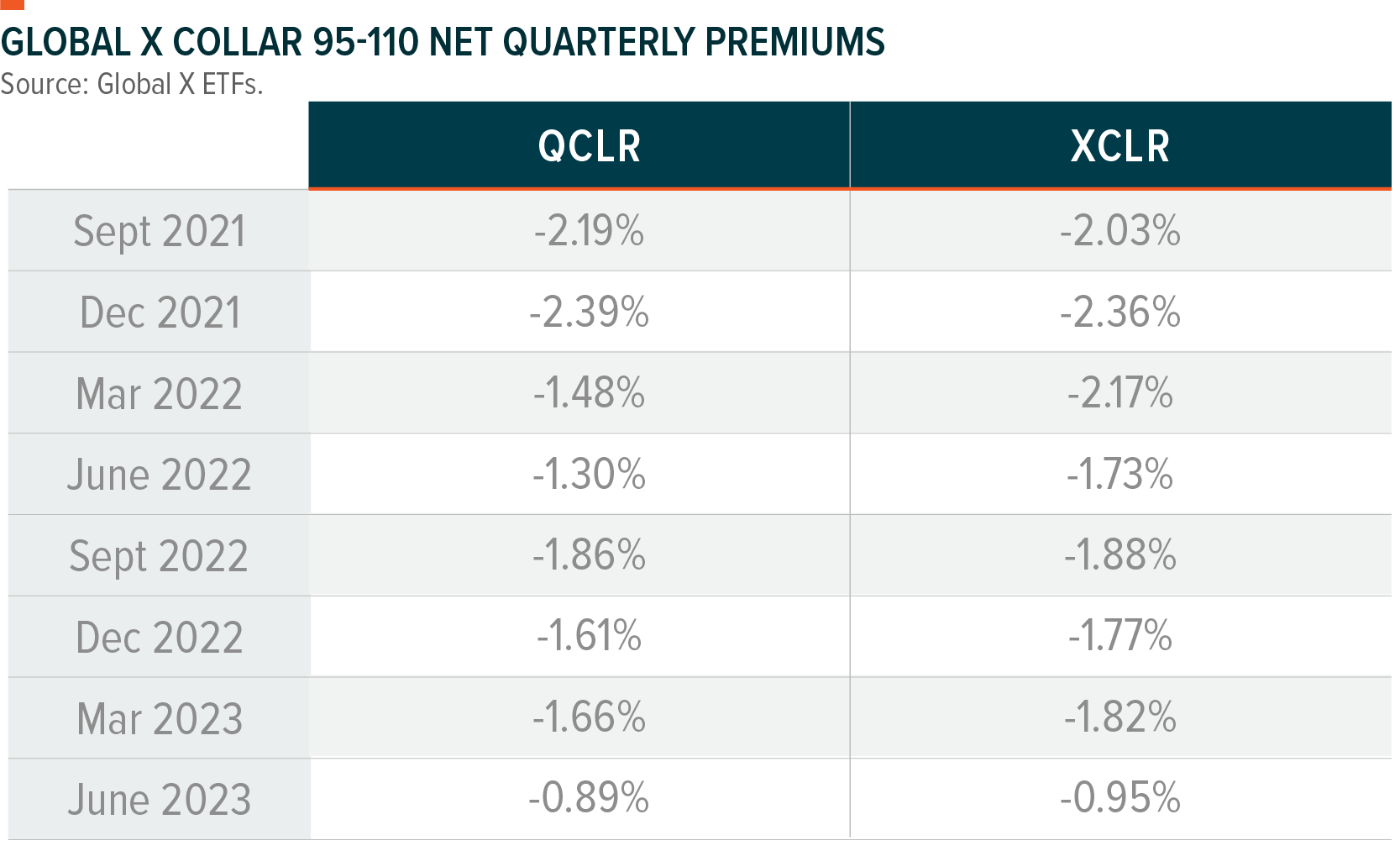

As discussed earlier, there are costs associated with utilizing a net debit collar strategy. QCLR and XCLR seek to strike a balance between limiting downside and retaining upside potential, while not making the strategy too costly to implement. Below we have highlighted the net quarterly premiums that have been paid by the funds since their inception, employing strategies on both the Nasdaq 100 and S&P 500 that buy a three month 5% OTM put option and sell a 10% OTM call option.

Incorporating the QCLR and XCLR Collar Strategies as a Portfolio Core

Investors who are not tactically looking to play the markets, but simply do not want the experience of major selloffs over the longer term may consider using QCLR and XCLR as portions of their core portfolio. They can assist accounts that have significant exposure to fixed income asset classes by supplying equity diversification without adding substantial risk. Indeed, these strategies carried equity betas of .41 and .51, respectively, from their inception dates on August 25th, 2021 through the conclusion of the second quarter, which suggests they can help mitigate volatility associated with the broader equity market on which they are based.2 With values below 100% signifying their ability to potentially outperform their equity indexes during periods of downside moves, the funds likewise exhibited downside capture ratios of 45% and 57%.3 These metrics underscore the defensive positioning that is supported by harnessing collar strategies as a core element in a portfolio. Funds like QCLR and XCLR, operating within the ETF structure, can also offer a means of convenience for investors already implementing these strategies, who might like to outsource the management to other portfolio managers.

Past performance is not a guarantee of future results. For performance current to the most recent month- and quarter-end, please click the fund names below.

Related ETFs

QCLR- Global X Nasdaq 100 Collar 95-110 ETF

XCLR- S&P 500 Collar 95-110 ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.