Electric Vehicles

EVs and Battery Markets Speed Up in First Half

Despite traditional automakers making progress, Tesla widened its lead as the top U.S. electric vehicle (EV) seller. In the first half of the year, Tesla sold roughly 300,000 more units than each of its closest competitors, Hyundai Motor and General Motors. For the same period in 2022, the unit gap was 225,000.1 Tesla’s sales increased an estimated 30% to 336,892 in the first half of the year (H1).2 General Motors quadrupled its electric car and truck sales to 36,322 units through June, while Volkswagen more than doubled its EV sales to 26,538 units.3 Advancements by key players like Stellantis, which introduced its STLA Medium platform, contributed to EV market growth. This platform supports multiple propulsion configurations and offers a standard range of over 500 kilometers, extendable up to 700 kilometers with a performance pack.4

The global battery demand for EVs is expected to increase from 509 gigawatt hours (GWh) in 2022 to 3,295GWh in 2030.5 Government mandates such as China’s extension of tax exemptions for new energy vehicles (NEVs) until 2027 is helping adoption.6 Currently, Chinese consumers can benefit from EV tax breaks starting at over $4,000 per vehicle, before the incentives gradually decline over the next four years.7

Social Media & Millennial Consumers

Threads Ties Younger Generations Together

Instagram’s new conversation-based Threads app garnered 2 million users within its first two hours and over 100 million users in a matter of days after its launch.8 Not only are users signing up for Threads, but they are also actively engaging with the app. Within the first day, there were more than 95 million posts and 190 million likes shared on the platform.9 Parent company Meta is excited about the successful launch, but management emphasized the need to assess user retention. Threads debuts at an opportune time with younger consumers increasingly relying on social media for guidance. A recent study found that 46% of Millennials seek restaurant information from eateries’ social media pages, followed closely by 42% of Gen Z consumers.10 For Gen Z, influencer recommendations and brand-sponsored content heavily influence their clothing purchases. One in three participants in a recent study cited recommendations from influencers as motivators to purchase from a new brand, while one in five said brand-sponsored content works.11

Cloud Computing & Artificial Intelligence

Generative AI and Hybrid Cloud Models

The rising popularity of hybrid cloud infrastructure, which integrates components of public cloud, private cloud, and on-premises infrastructure into a cohesive architecture, has companies expanding their business models. IBM announced a definitive agreement with Vista Equity Partners to acquire Apptio Inc. for $4.6 billion. Apptio, which provides financial and operational IT management and optimization (FinOps) software, can help accelerate IBM’s IT automation capabilities, allowing enterprise leaders to maximize the value derived from their technology investments.12 Apptio’s product lineup, including ApptioOne and Apptio Cloudability, includes features for managing and optimizing hybrid and public cloud expenditures.

In 2022, global revenue from public cloud services surpassed $500 billion, a significant milestone, and generative AI sets up to be a key catalyst for future growth in public cloud spending.13 In response, Amazon Web Services (AWS) committed a substantial $100 million investment towards a new generative AI program. Named the AWS Generative AI Innovation Center, the program aims to help customers develop and deploy generative AI solutions.14 As of now, Oracle’s Gen2 Cloud has emerged as the leading choice for running generative AI workloads, attesting to its mounting success as a provider.

Internet of Things & Data Centers

Asia Shows Its Semiconductor Dominance

Taiwan Semiconductor Manufacturing Corp.’s (TSMC) sales surged during the second quarter amid surging demand for AI applications and the company’s chipmaking prowess.15 TSMC is the primary contract manufacturer for Nvidia’s AI accelerator chips used to train large data models such as OpenAI’s ChatGPT. Japan’s government-backed fund, Japanese Investment Corp., proposed an acquisition of semiconductor materials giant JSR worth 903.9 billion yen ($6.3 billion).16 Japan is focusing on its traditional strengths, particularly companies like JSR, which specializes in chemicals and materials. Similarly, South Korea leads the memory chip market, which combined with its robust AI ecosystem, gives it an edge in the global AI chip race. Samsung Electronics and SK Hynix, two of the world’s largest dynamic random-access memory chipmakers, are investing in AI research and development. Samsung plans to invest 300 trillion Korean won ($228 billion) in a new semiconductor facility in South Korea.17 With its digital strategy, South Korea aims to be one of the world’s top three AI markets by 2027, closely trailing the U.S. and China.18

U.S. Infrastructure

Bipartisan Infrastructure Law in Full Effect

The Biden administration’s “Investing in America” tour continued to highlight the importance of the billions of dollars set to be allocated for infrastructure, green technology, and chips to support job growth. To date, private companies have announced over $500 billion of investments aligned with President Biden’s federal spending agenda.19 In late June, the Environmental Protection Agency (EPA) launched the $7 billion Solar for All grant competition, aiming to expand affordable and clean solar energy access for low-income households.20 Up to 60 grants will be awarded to various entities.21The administration granted over $2.2 billion through the Rebuilding American Infrastructure with Sustainability and Equity (RAISE) program, supporting 162 infrastructure projects across the country.22

The Biden administration advanced the Gateway Hudson River Tunnel project within the Federal Transit Administration’s (FTA) Capital Investment Grants (CIG) program, bringing the project closer to securing up to $6.88 billion in funding.23 The project involves constructing a new Hudson River Tunnel between New York and New Jersey and rehabilitating the existing rail tunnel, at a total cost of $17.18 billion.24 The Bipartisan Infrastructure Law allocates $66 billion to passenger rails, the largest investment since Amtrak’s establishment, and over $90 billion to public transit, the largest funding for the sector in history.25

Genomics

Pharmaceutical Deals and Approvals

Moderna secured a $1 billion deal to advance messenger RNA (mRNA) medicine research, development, and manufacturing in China.26 The deal represents another step towards Moderna’s goal of ramping up investments in Shanghai and forming partnerships with Chinese counterparts. In May, the company established the Moderna Biotech China unit in Shanghai. In the United States, two major pharmaceuticals achieved major milestones. Sarepta Therapeutics obtained accelerated Food and Drug Administration (FDA) approval for ELEVIDYS, an adeno-associated virus-based gene therapy for Duchenne muscular dystrophy (DMD). The therapy is for ambulatory pediatric patients, 4–5 years old, with a confirmed DMD gene mutation.27 Also, the FDA cleared BioMarin’s Roctavian as a one-time therapy for severe hemophilia A. The FDA-approved label for Roctavian highlights the phase 3 GENEr8-1 trial results. For 112 patients who received the gene therapy, bleeding cases per year declined by an average of 52% over a median three years of follow-up.28

THE NUMBERS

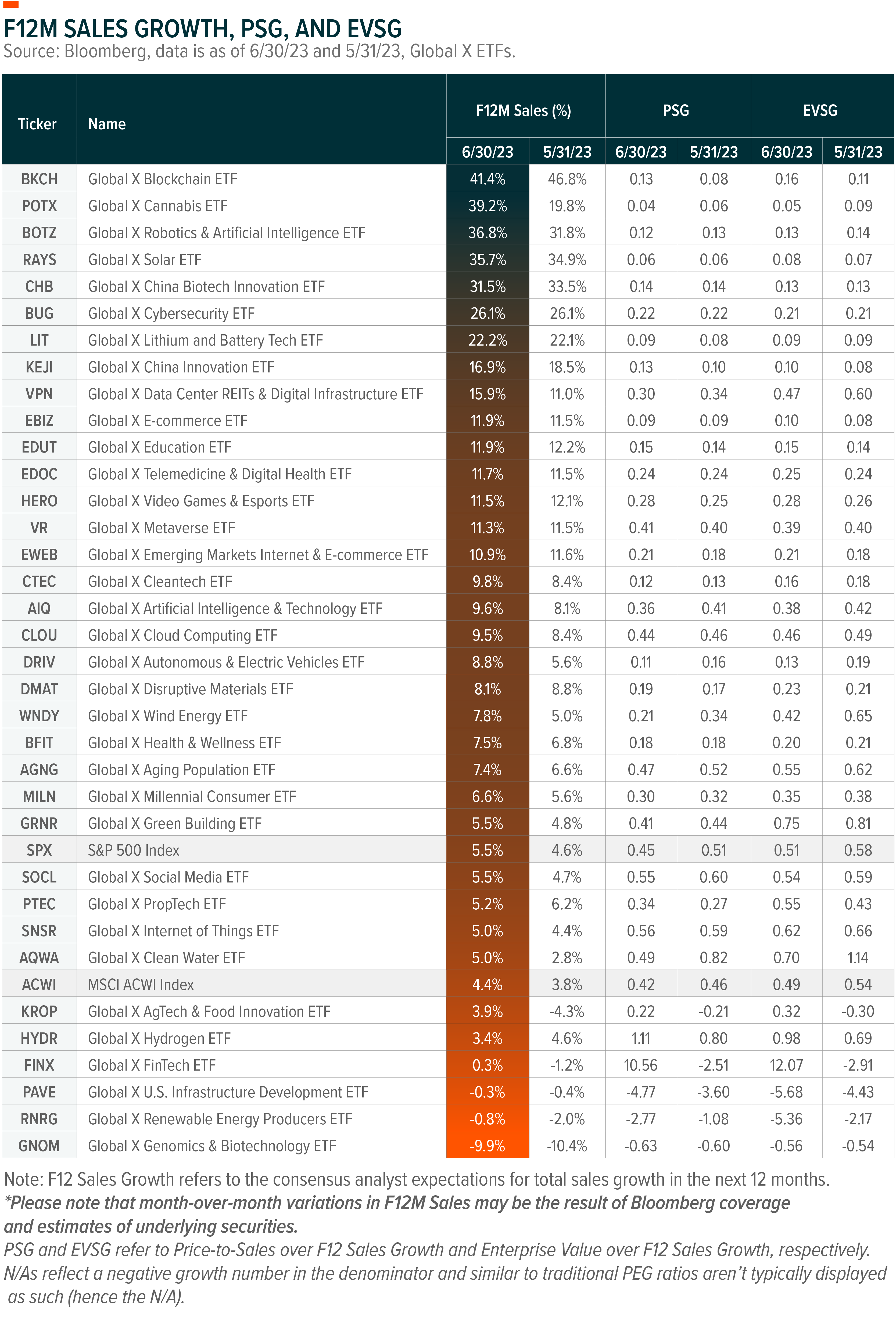

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs.

INTRO TO THEMATIC INVESTING COURSE – ELIGIBLE FOR CE CREDIT

Global X has developed an interactive, self-guided Intro to Thematic Investing course, that is designed to share the latest ideas and best practices for incorporating thematic investing into a portfolio.

This program has been accepted for 1.0 hour of CE credit towards the CFP®, CIMA®, CIMC®, CPWA®, or RMA certifications. To receive credit, course takers must submit accurate and complete information on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

For Canadian course takers: This program has been reviewed by FP Canada and qualifies for 1 FP Canada-Approved CE Credit, in the category of Product Knowledge, towards the CFP® certification or QAFP™ certification. To receive credit, course takers must submit accurate and complete information (including Job Title) on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

Questions on receiving CE credit may be sent to: Education@globalxetfs.com

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- ASCO Annual Meeting 2023: Precision Oncology Achieving Widespread Adoption

- Artificial Intelligence Opens a Generational Opportunity for Chipmakers

- Four Digital Health Companies Transforming the Healthcare Industry

- The Consumer Pulse: U.S. Student Loan Payment Resumption

- The Metaverse and Immersive Technologies Show Promise in Industrial Applications

ETF HOLDINGS AND PERFORMANCE:

To see individual ETF holdings and current performance across the Global X Thematic Growth Suite, including information on the indexes shown, click these links:

- Disruptive Technology: Artificial Intelligence & Technology ETF (AIQ), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Internet of Things ETF (SNSR), Social Media ETF (SOCL), China Biotech Innovation ETF (CHB), Data Center REITs & Digital Infrastructure ETF (VPN), Emerging Markets Internet & E-Commerce ETF (EWEB), AgTech & Food Innovation ETF (KROP), Blockchain ETF (BKCH), Blockchain & Bitcoin Strategy ETF (BITS), Metaverse ETF (VR), PropTech ETF (PTEC)

- People and Demographics: Cannabis ETF (POTX), Millennial Consumer ETF (MILN), Health & Wellness ETF (BFIT), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), Telemedicine & Digital Health ETF (EDOC), Education ETF (EDUT)

- Physical Environment: U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), Disruptive Materials ETF (DMAT), Green Building ETF (GRNR), Carbon Credits Strategy ETF (NTRL)

- Multi-Theme: Thematic Growth ETF (GXTG), China Innovation ETF (KEJI)

Tejas Dessai

Tejas Dessai