Data Centers & Digital Infrastructure

Data Center Demand Persists

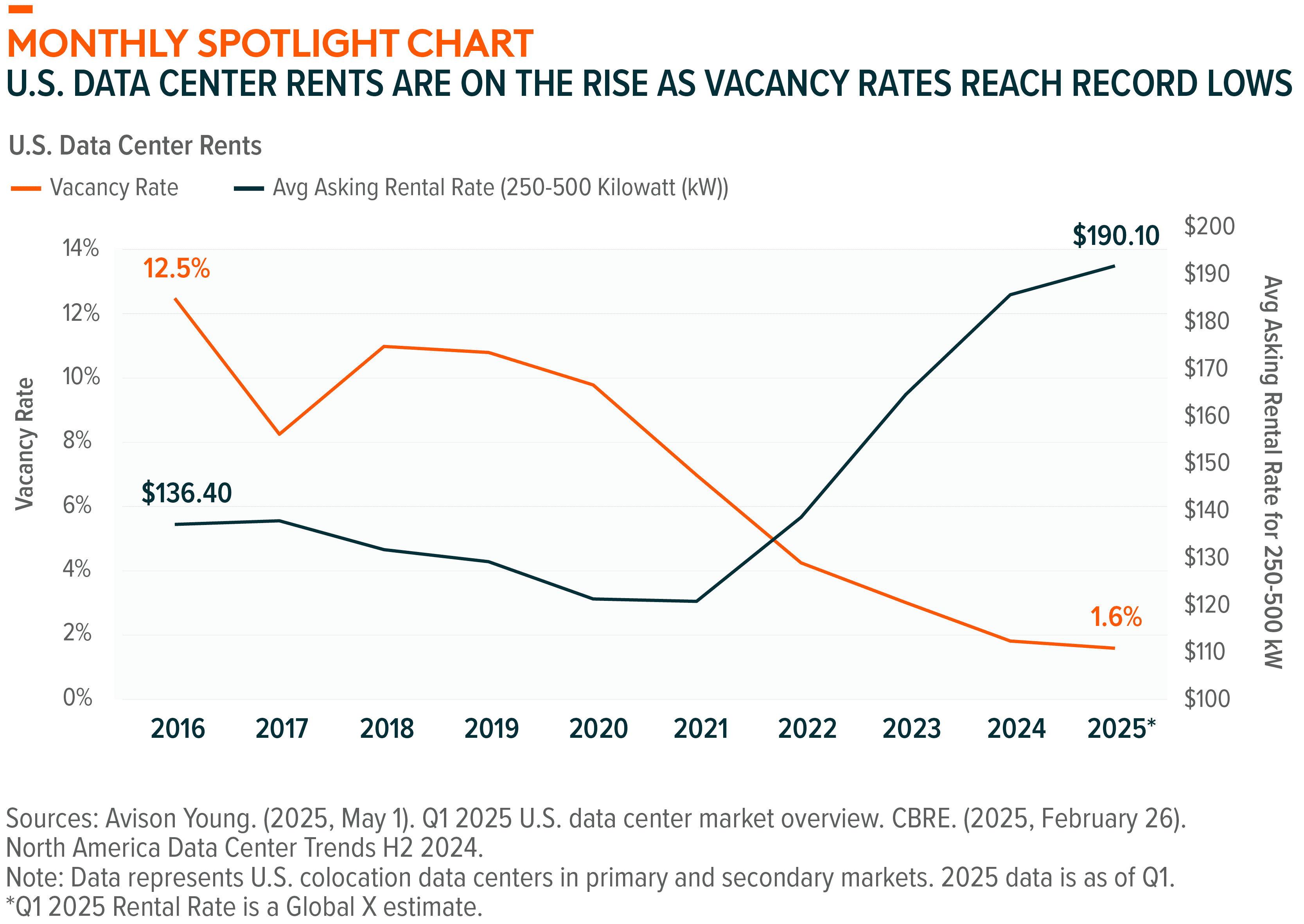

The U.S. data center market entered 2025 with strong momentum. In Q1 2025, U.S. vacancy rates reached a record low of 1.6% in primary markets, driven by AI adoption, the digital transformation, and the accelerating shift to cloud and edge computing. Major markets like Northern Virginia, Dallas/Fort Worth, and Las Vegas had strong leasing activity and colocation vacancy rates below 1%. Overall, colocation inventory in primary and secondary U.S. markets set a record high of 18.5 gigawatts (GW) during Q1, and construction pipelines continued to grow, signaling sustained long-term momentum. Demand for data center capacity across Europe is also rising at a record pace. In 2023, colocation data centers alone contributed €30 billion ($32 billion) to European GDP, a contribution that is projected to rise to a robust €83.8 billion ($90.7 billion) by 2030.1

![]()

Defense Tech

Global Defense Budgets Propose Spending Increases

After initially proposing an 8% budget cut for the armed services, the Trump administration is reversing course due to mounting geopolitical tensions and bipartisan pushback. Both the president and the secretary of defense are pushing for a $1 trillion national defense budget for fiscal year (FY) 2026, which would mark a 10–12% year-over-year (YoY) increase. While the rollout of the federal budget isn’t expected until May, renewed commitments to modernize and expand key areas of the defense industrial base are likely.2 Germany has officially backed President Trump’s push for NATO members to raise defense spending to 5% of GDP, up from the current 2% target. German leaders are proposing a phased approach, with 3.5% dedicated to core military spending and 1.5% toward broader security, including cyber and infrastructure. Chancellor Merz is pushing constitutional changes to unlock €500 billion for military modernization, aiming to make Germany Europe’s leading conventional force.3

![]()

Artificial Intelligence

Big Tech’s AI Spending and Growth Show No Signs of Slowing

Big Tech players will collectively spend over $300 billion on AI-focused infrastructure this year to support the growing demands of AI development. During Q1 2025 earnings calls, Meta Platforms raised its FY capex guidance to $64–72 billion from $60–65 billion, while Microsoft, Alphabet, and Amazon reaffirmed their FY capex forecasts of $80 billion, $75 billion, and $100 billion, respectively.4 Such spending amid broader macroeconomic uncertainties, tariffs included, underscores the strategic importance of AI to the future of each company. Meta also announced that it will launch a new standalone AI app, powered by its latest Llama 4 model, to compete with the likes of ChatGPT and Anthropic’s Claude. Microsoft reported that GitHub’s user base quadrupled to 15 million over the past year with demand for AI-assisted coding and AI agents growing. Amazon’s generative AI assistant, Alexa+, reached over 100,000 users within three months of launch.5

![]()

Healthcare Innovation

New Therapies Offer Encouraging Data in Diabetes, Obesity, and Heart Health

Eli Lilly announced positive late-stage clinical trial results for orforglipron, a daily GLP-1 pill for type 2 diabetes. The oral medication demonstrated significant improvements in blood sugar control and weight reduction, with efficacy approaching that of injectable GLP-1 treatments. This development is an important advance in the competitive race to create more convenient diabetes and obesity therapies. The pill, which could be approved as soon as 2026, is projected to hit $10 billion in sales in 2030.6 Lilly’s injectable GLP-1s are expected to reach $60 billion in sales by 2030.7 Verve Therapeutics announced encouraging early data from its Phase I clinical trial of Verve-102, a gene editing therapy targeting high cholesterol. Participants receiving the highest dose (0.6 mg/kg) experienced an average 53% reduction in LDL (“bad”) cholesterol. If clinical development continues to progress from here, the therapy could receive regulatory approval by 2029.8

![]()

Cybersecurity

Cyber Giants Are Bolstering Their AI Offerings to Combat More Sophisticated Threats

Palo Alto Networks announced its acquisition of Protect AI, a startup focused on securing machine learning (ML) systems, for an amount reportedly in the range of $650–700 million.9 Protect AI specializes in tools that secure the ML supply chain, helping companies detect vulnerabilities and manage risks associated with AI models. Its flagship product, NB Defense, identifies security gaps in notebooks used to build AI systems, while its Radar tool offers a software bill of materials for ML environments.10 The acquisition builds on Palo Alto’s recent AI momentum, including the launch of its Precision AI platform, and reflects broader industry trends towards acquisitions, consolidations, and partnerships, particularly to bolster AI-driven cybersecurity capabilities. As generative AI expands across industries, so too does the attack surface, with bad actors increasingly targeting the underlying AI pipelines and data sources.

![]()

Autonomous & Electric Vehicles

Global EV Sales Jump

In Q1 2025, 4.11 million EVs were sold globally, a 29% YoY increase. March sales were particularly strong, with 1.67 million units sold, up from 1.2 million in February. China maintained its position as the largest global EV market with 2.42 million units sold in Q1, a 36% YoY increase. China sold almost 1 million units in March alone. The country’s strong growth was aided by the extension of vehicle trade-in incentives into 2025. The United Kingdom, Germany, Norway, Sweden, and the United States also recorded double-digit YoY EV sales growth in Q1, even amid growing policy uncertainty and rising trade tensions. Notably, the United Kingdom had a record month in March, with EV sales growing 41% YoY with over 100,000 units sold for the first time.11

![]()

THE NUMBERS

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs or indices.

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- America’s Infrastructure Report Card in 2025: Still Behind, Still Underfunded

- Inflection Points: Roll with the Changes

- Three Themes Driving America’s Manufacturing Revival

- Why Multi-Theme Investing? Why GXDW?

- Why HealthTech? Why Heal?

ETF HOLDINGS AND PERFORMANCE

To see individual ETF holdings and current performance across the Global X Thematic Suite, including information on the indexes shown, click these links:

- Disruptive Technology: Artificial Intelligence & Technology ETF (AIQ), Blockchain ETF (BKCH), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), Data Center & Digital Infrastructure ETF (DTCR), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), PropTech ETF (PTEC), Defense Tech ETF (SHLD), Internet of Things ETF (SNSR), Social Media ETF (SOCL), U.S. Electrification ETF (ZAP)

- Consumer Economy: Millennial Consumer ETF (MILN), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), HealthTech ETF (HEAL)

- Infrastructure & Environment: U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), AgTech & Food Innovation ETF (KROP), Infrastructure Development ex-U.S. ETF (IPAV)

- Digital Assets: Blockchain & Bitcoin Strategy ETF (BITS), Bitcoin Trend Strategy ETF (BTRN)

- Multi-Theme: Dorsey Wright Thematic ETF (GXDW)

Appendix: Thematic Expected Sales Growth Graph Indices

AgTech & Food Innovation: Solactive AgTech & Food Innovation Index

Aging Population: Indxx Aging Population Thematic Index

Artificial Intelligence & Technology: Indxx Artificial Intelligence & Big Data Index

Autonomous & Electric Vehicles: Solactive Autonomous & Electric Vehicles Index

Blockchain: Solactive Blockchain Index

Clean Water: Solactive Global Clean Water Industry Index

CleanTech: Indxx Global CleanTech Index

Cloud Computing: Indxx Global Cloud Computing Index

Cybersecurity: Indxx Cybersecurity Index

Data Center & Digital Infrastructure: Solactive Data Center REITs & Digital Infrastructure Index

Defense Tech: Global X Defense Tech Index

E-Commerce: Solactive E-commerce Index

FinTech: Indxx Global FinTech Thematic Index

Genomics: Solactive Genomics Index

HealthTech: Global X HealthTech Index

Hydrogen: Solactive Global Hydrogen Index

Infrastructure Development ex-U.S.: Global X Infrastructure Development Ex-U.S. Index

Internet Of Things: Indxx Global Internet of Things Thematic Index

Lithium & Battery Technology: Solactive Global Lithium Index

Millennial Consumer: Indxx Millennials Thematic Index

PropTech: Global X PropTech Index

Renewable Energy Producers: Indxx Renewable Energy Producers Index

Robotics & Artificial Intelligence: Indxx Global Robotics & Artificial Intelligence Thematic Index

Social Media: Solactive Social Media Total Return Index

Solar: Solactive Solar Index

U.S. Electrification: Global X U.S. Electrification Index

U.S. Infrastructure: Indxx U.S. Infrastructure Development Index

Video Games & Esports: Solactive Video Games & Esports Index

Wind Energy: Solactive Wind Energy Index