Defense Tech

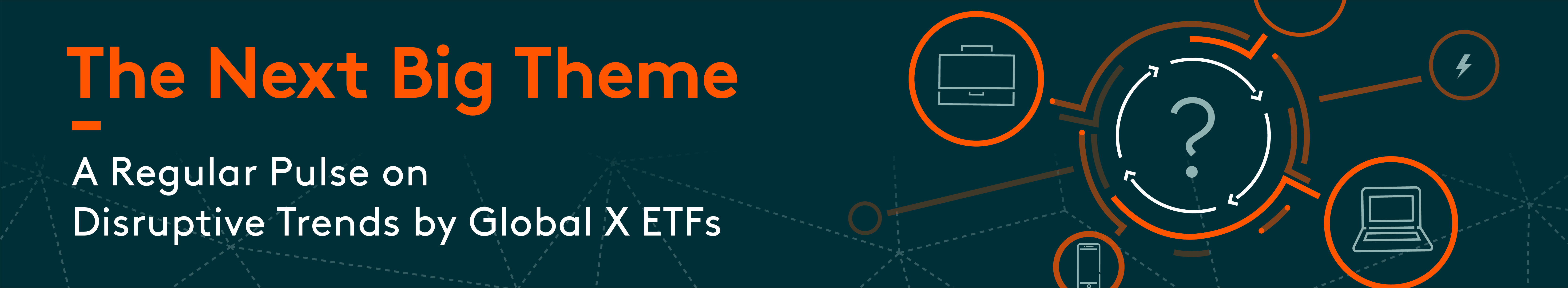

NATO Allies Agree to Major Defense Spending Increase

NATO members raised their annual defense spending target to 5% of GDP by 2035, up from the current 2% set in 2014. For perspective, the United States allocated 3.4% of its GDP to defense in 2024. The new 5% target includes at least 3.5% for core military capabilities such as troops, weapons, and defense technologies. The remaining 1.5% is earmarked for critical security infrastructure like cybersecurity.1 The move comes amid increasing hostilities with Russia, escalating tensions in the Middle East, and the current U.S. administration’s “America First” policy, which has pushed European allies to pursue greater military self-reliance. We expect much of the incremental spending to go towards modernizing military capabilities with technology-first solutions, particularly AI and drones.

![]()

Video Games & Esports

Nintendo’s Switch 2 Set Record Release

Nintendo’s Switch 2 sold over 3.5 million units in the first four days after its June launch, putting it on track to exceed the company’s goal of 15 million units sold for fiscal year (FY) 2026 and Switch 1’s first-year sales record. The Switch 2 launch, which marks the end of the longest gap between major console launches in Nintendo’s history, bodes well for the gaming industry’s value chain.2 Historically, hardware sales are a leading indicator of software and platform success. A substantial install base attracts developers and boosts software sales, which are typically more profitable than hardware, and overall platform growth. For instance, Nintendo has sold over 152 million Switch 1 units to date, resulting in $1.39 billion total software units sold.3,4 Similarly, Sony has sold over 160 million PlayStation 2 units, with software sales exceeding 1.5 billion units.5

![]()

Artificial Intelligence

Monetization Continues to Take Shape

Anthropic, a leading AI startup known for its Claude family of AI models, has quadrupled its annualized revenue run rate since the start of the year to a staggering $4 billion. The jump underscores the rapid commercialization of AI models as enterprises increasingly pay for access to powerful foundation models. Anthropic’s growth is driven primarily by its Claude chatbot and partnerships with major cloud providers. Amazon, which has committed up to $4 billion in funding, is now Anthropic’s largest customer through Amazon Web Services. Google has also invested in Anthropic and integrated Claude into its cloud marketplace.6 This milestone brings Anthropic closer to the scale of OpenAI and highlights how monetization across the AI stack is gaining speed. It also highlights the dynamism of the AI industry, where innovation and significant investments align to drive growth at rapid pace.

![]()

FinTech

Buy Now Pay Later (BNPL) Solutions Set to Factor into Credit Scores; FinTech Funding Gained Momentum

Fair Isaac Corporation (FICO) is launching two new credit scoring models this fall—FICO Score 10 BNPL and FICO Score 10 T BNPL – that will incorporate BNPL loan data for the first time. The move brings greater visibility and accountability to short-term installment loans, encouraging responsible BNPL usage to help build credit histories while penalizing missed payments.7 For the FinTech theme, the move marks a significant step toward integrating alternative lending into the traditional credit ecosystem, boosting transparency and regulatory alignment. June also included two highly successful FinTech initial public offerings (IPOs), suggesting robust investor interest across the theme. Circle Internet Group, which operates a blockchain-based financial infrastructure platform best known for issuing the USDC stablecoin, achieved the largest FinTech-related IPO since 2021. Chime Financial, which offers mobile-first banking services focused on fee-free checking, savings, and early direct deposit, also made a positive public market debut.8

![]()

U.S. Infrastructure Development

U.S. Reshoring Investments Continued to Accelerate

Micron Technology unveiled a $200 billion U.S. investment plan for manufacturing and research & development (R&D) through 2040 – doubling its previous $100 billion commitment. The spending includes $150 billion dedicated to domestic memory-chip manufacturing construction and $50 billion earmarked for R&D. New and expanded semiconductor fabrication facilities are slated for Idaho, Virginia, along with continued development of a megafab in New York. These upgrades aim to bring advanced packaging and High-Bandwidth Memory (HBM), critical for AI and data-center markets, into U.S. production. Aligned with a broader U.S. reshoring and CHIPS Act initiative, the investment supports Micron’s goal of producing 40% of its dynamic random-access memory (DRAM) domestically, enhancing national supply chain security. It also promises roughly 90,000 direct and indirect jobs, reinforcing U.S. leadership in semiconductor manufacturing and AI infrastructure.9

![]()

Lithium & Battery Technology

Battery Storage Is Rapidly Scaling and Becoming a Core Pillar of U.S. Grid Resilience

Between April 2024 and April 2025, nearly 180 large-scale battery energy storage systems came online in the United States. Total battery energy storage capacity grew 41%, from 18 gigawatts (GW) to 25 GW. Battery storage can help mitigate risks of supply disruptions on power grids caused by extreme heat and shifting supply-demand dynamics. For example, the odds of an energy emergency in Texas this summer have dropped from 15% a few months ago to under 4%, largely due to new battery capacity. Utilities nationwide are deploying massive lithium-ion battery systems to store excess energy—often from renewables like solar and wind—and discharge it during peak hours when air conditioning use spikes. National grid-scale battery capacity is expected to reach 30 GW by year-end, enough to power millions of homes for several hours.10

![]()

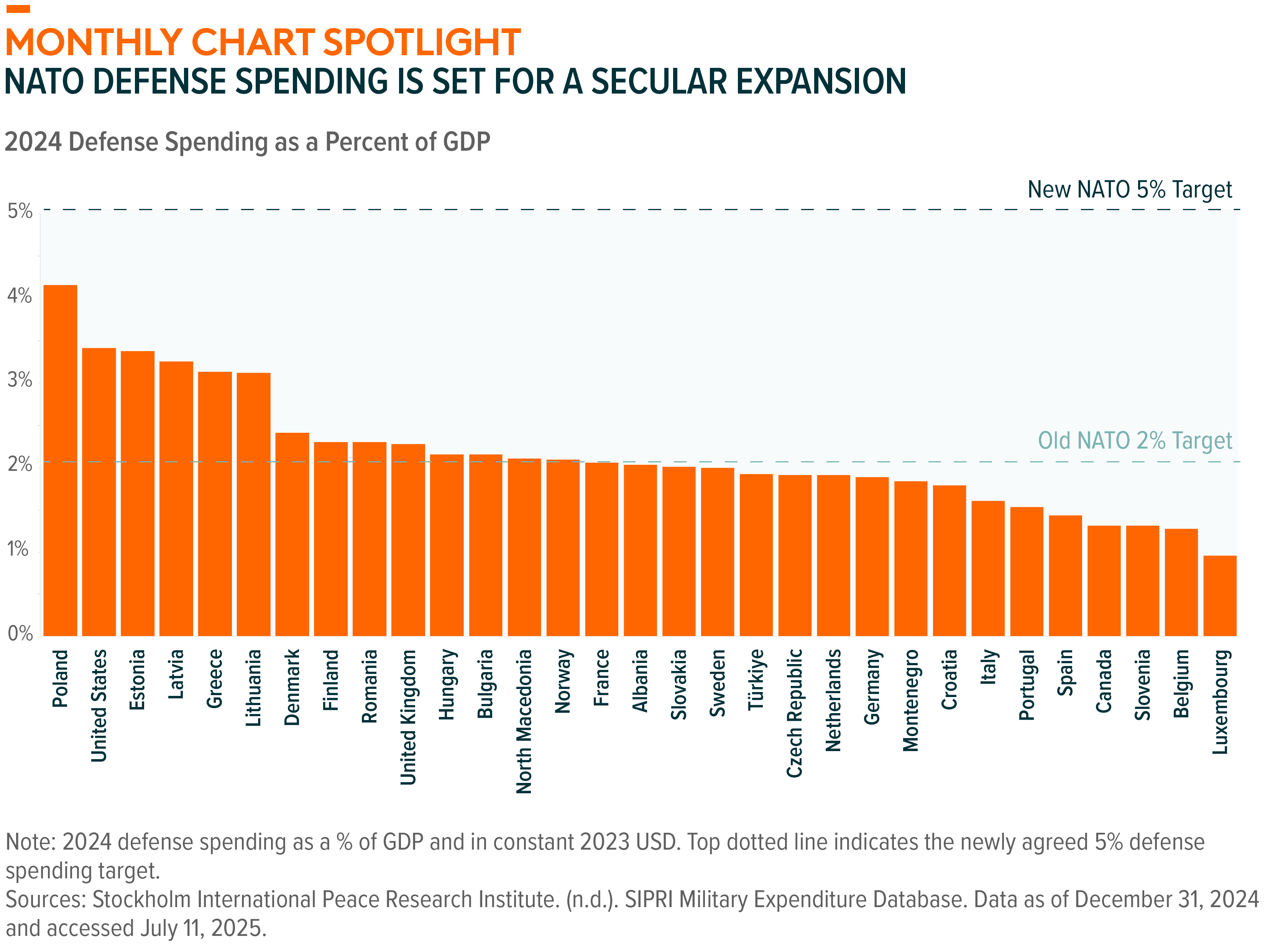

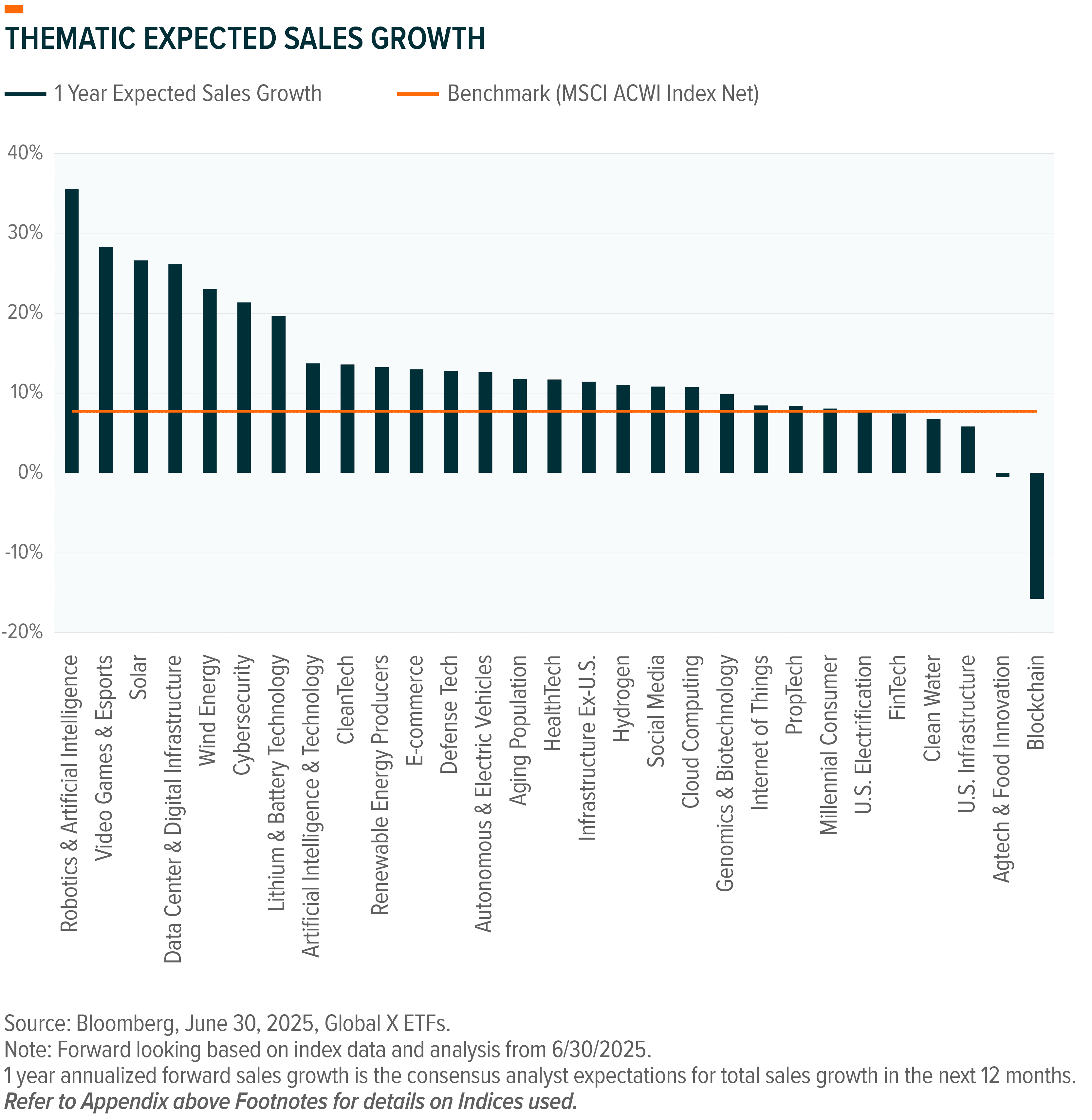

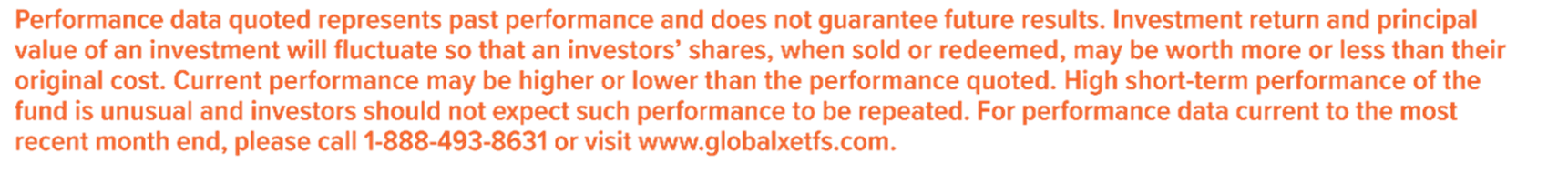

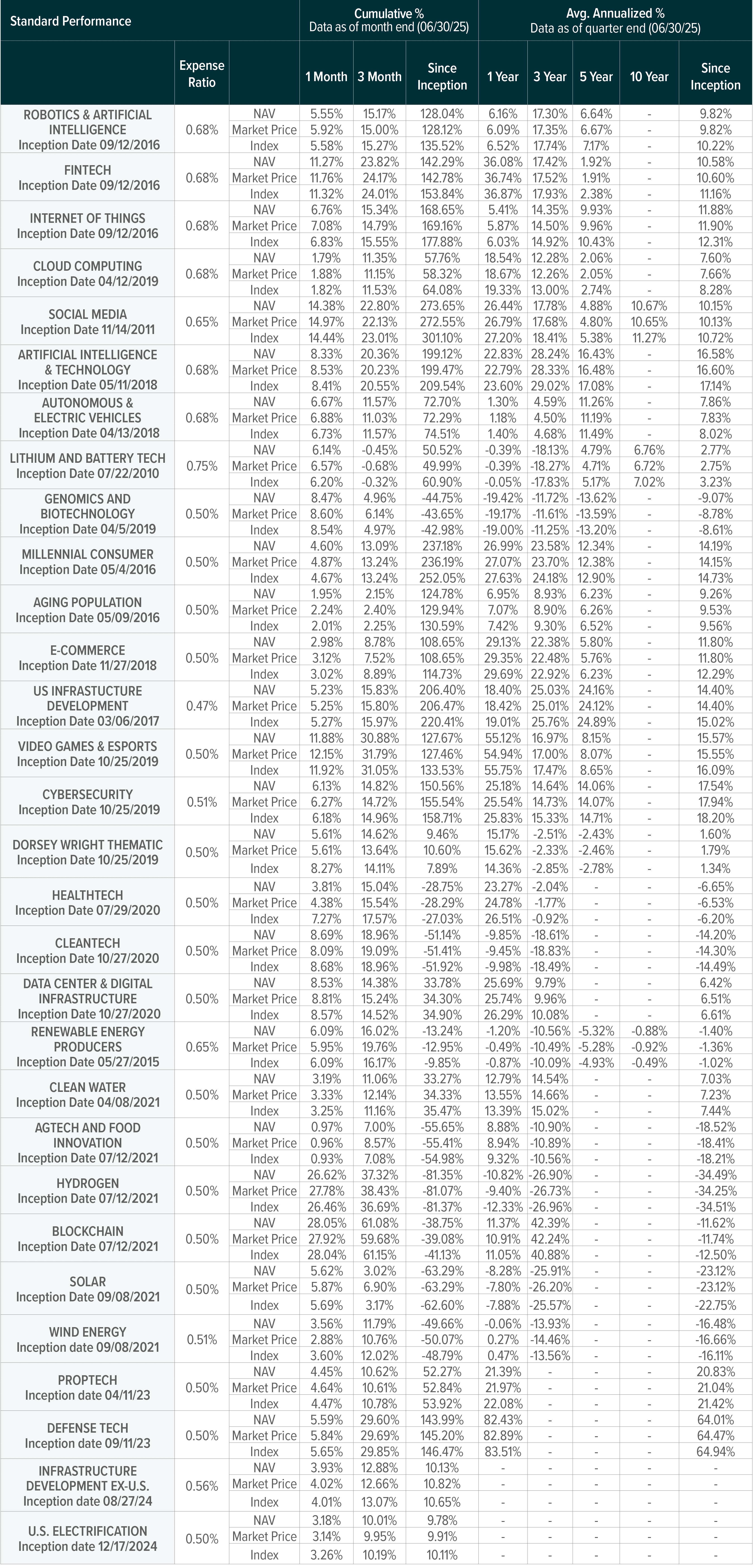

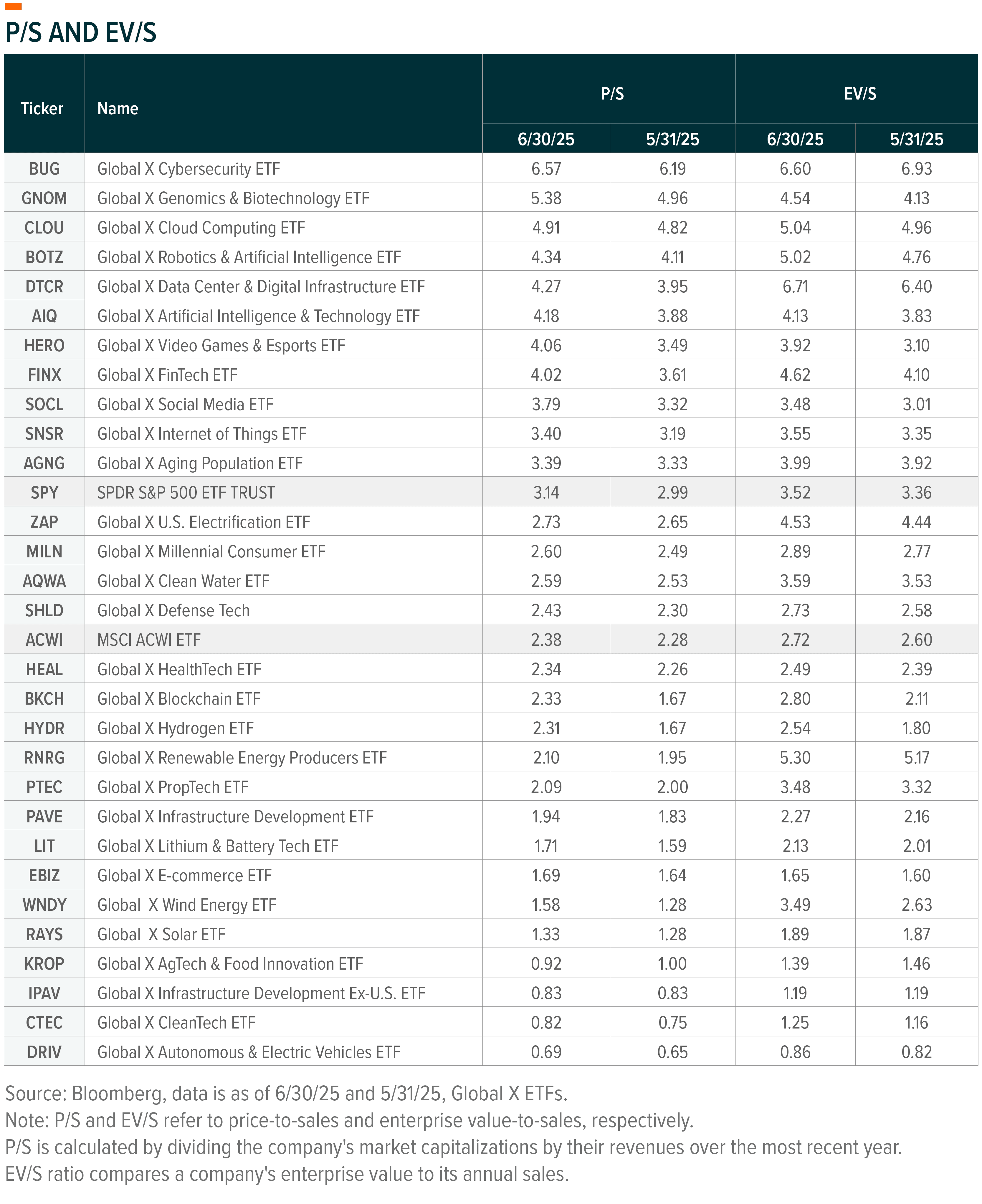

THE NUMBERS

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs or indices.

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- Why Global Infrastructure? Why IPAV?

- A Decade of Change: How Tech Evolved in the Last Five Years and Bold Bets for the Next Five

- 2025 Midyear Outlook

- The Next Big Theme: June 2025

- Why Video Games & Esports? Why HERO?

- Why Defense Tech? Why SHLD?

- Why Cybersecurity? Why BUG?

ETF HOLDINGS AND PERFORMANCE

To see individual ETF holdings and current performance across the Global X Thematic Suite, including information on the indexes shown, click these links:

- Disruptive Technology: Artificial Intelligence & Technology ETF (AIQ), Blockchain ETF (BKCH), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), Data Center & Digital Infrastructure ETF (DTCR), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), PropTech ETF (PTEC), Defense Tech ETF (SHLD), Internet of Things ETF (SNSR), Social Media ETF (SOCL), U.S. Electrification ETF (ZAP)

- Consumer Economy: Millennial Consumer ETF (MILN), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), HealthTech ETF (HEAL)

- Infrastructure & Environment: U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), AgTech & Food Innovation ETF (KROP), Infrastructure Development ex-U.S. ETF (IPAV)

- Digital Assets: Blockchain & Bitcoin Strategy ETF (BITS), Bitcoin Trend Strategy ETF (BTRN)

- Multi-Theme: Dorsey Wright Thematic ETF (GXDW)

Appendix: Thematic Expected Sales Growth Graph Indices

AgTech & Food Innovation: Solactive AgTech & Food Innovation Index

Aging Population: Indxx Aging Population Thematic Index

Artificial Intelligence & Technology: Indxx Artificial Intelligence & Big Data Index

Autonomous & Electric Vehicles: Solactive Autonomous & Electric Vehicles Index

Blockchain: Solactive Blockchain Index

Clean Water: Solactive Global Clean Water Industry Index

CleanTech: Indxx Global CleanTech Index

Cloud Computing: Indxx Global Cloud Computing Index

Cybersecurity: Indxx Cybersecurity Index

Data Center & Digital Infrastructure: Solactive Data Center REITs & Digital Infrastructure Index

Defense Tech: Global X Defense Tech Index

E-Commerce: Solactive E-commerce Index

FinTech: Indxx Global FinTech Thematic Index

Genomics: Solactive Genomics Index

HealthTech: Global X HealthTech Index

Hydrogen: Solactive Global Hydrogen Index

Infrastructure Development ex-U.S.: Global X Infrastructure Development Ex-U.S. Index

Internet Of Things: Indxx Global Internet of Things Thematic Index

Lithium & Battery Technology: Solactive Global Lithium Index

Millennial Consumer: Indxx Millennials Thematic Index

PropTech: Global X PropTech Index

Renewable Energy Producers: Indxx Renewable Energy Producers Index

Robotics & Artificial Intelligence: Indxx Global Robotics & Artificial Intelligence Thematic Index

Social Media: Solactive Social Media Total Return Index

Solar: Solactive Solar Index

U.S. Electrification: Global X U.S. Electrification Index

U.S. Infrastructure: Indxx U.S. Infrastructure Development Index

Video Games & Esports: Solactive Video Games & Esports Index

Wind Energy: Solactive Wind Energy Index