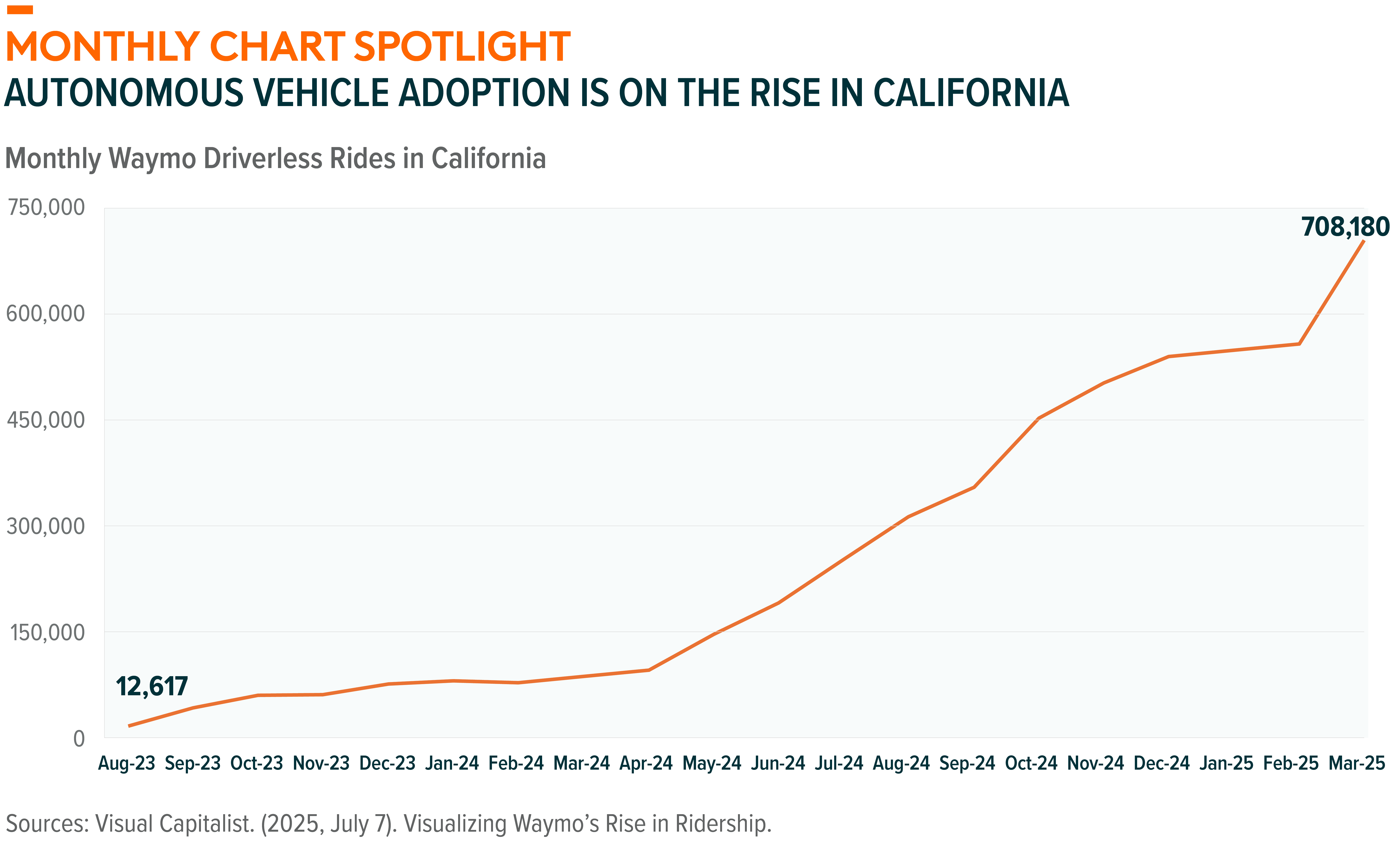

Autonomous & Electric Vehicles

Waymo Secures First New York City Permit as Its Rapid U.S. Expansion Continues

Alphabet-backed Waymo received a permit to test up to eight self-driving cars in Manhattan and Downtown Brooklyn through September 2025, with potential for expansion. The permit is a significant milestone for autonomous vehicle (AV) testing with NYC one of the country’s most complex urban environments and governed by the nation’s strictest AV safety rules. Waymo brings extensive testing experience to NYC, having completed over 10 million autonomous rides across other major U.S. cities and boasting a strong safety track record. The permit builds on Waymo’s nationwide expansion efforts, following its launch in Austin and the growth of its San Francisco operations earlier this year. Waymo also plans to bring AVs to Atlanta, Miami, and Washington, D.C., and begin operations in Philadelphia to expand further into the Northeast market.1

Artificial Intelligence

Record AI Valuations Signal Investor Confidence in the Industry’s Continued Growth

OpenAI is in talks for a secondary stock sale that would value the company at a staggering $500 billion and make it the most valuable private startup company in the world.2 The valuation highlights OpenAI’s dominance in AI, driven by rapid revenue expansion and an aggressive acquisition strategy, which includes the recent $1.1 billion purchase of Statsig, still subject to regulatory approval, to bolster the development of OpenAI’s Applications business. OpenAI rival Anthropic completed a $13 billion Series F funding round, resulting in a $183 billion post-money valuation, nearly tripling Anthropic’s $61.5 billion valuation earlier this year. In just eight months, Anthropic’s run-rate revenue has surged from about $1 billion to $5 billion, fueled by enterprise adoption and the rapid growth of its Claude Code product. Both funding rounds signal sustained investor bets on AI’s transformative potential, equipping these firms with scale, innovation capacity, and strategic resources to shape the next wave of AI-driven enterprise and customer solutions.3

U.S. Infrastructure

Manufacturing and Innovation Get a Supercharge From Apple

Apple added a fresh $100 billion to its American Manufacturing Program (AMP), bringing it to $600 billion. The newly launched program aims to bring advanced component production back to the United States and strengthen supplier networks nationwide. Spanning all 50 states, the AMP supports more than 450,000 supplier and partner jobs and plans for the direct hires of 20,000 U.S. workers, primarily in R&D, silicon engineering, software, AI, and machine learning. Through partnerships with various U.S.-based companies, key AMP initiatives include building iPhone and Apple Watch glass in Kentucky, expanding rare-earth magnet production in Texas, and laying the groundwork for an end-to-end American silicon supply chain, which is expected to produce 19 billion chips by the end of 2025. Apple is also working with Broadcom and GlobalFoundries to develop and manufacture cellular semiconductor components for its 5G communications products in the United States.4 These initiatives will strengthen domestic manufacturing while reinforcing America’s high-tech infrastructure in hardware, design, and innovation.

Robotics & Artificial Intelligence

Nvidia’s New Robot “Brain” Signals a Breakthrough in Physical Automation

Nvidia unveiled its latest robotics chip module, Jetson AGX Thor, designed to serve as a robot’s brain and power the next wave of robotics and physical AI. Built on Nvidia’s most advanced Blackwell graphics processor units (GPUs), the same architecture used in its AI and computer gaming chips, the new module delivers up to 7.5 times the AI compute of its predecessor. This power enables the modules to run generative AI models that can interpret the world around them, which is essential for humanoid robots. Leading robotics and tech firms, including Amazon, Meta, Boston Dynamics, Agility Robotics, and Caterpillar, along with startup Figure, are already using it, while companies like John Deere and OpenAI are evaluating potential applications. By enabling real-time, intelligent interactions at the edge, Jetson Thor supports multiple generative AI models on one platform, making advanced autonomy achievable across industries such as manufacturing, logistics, agriculture, and healthcare.5

U.S. Electrification

Momentum Builds for Nuclear Power and Renewables Amid Data Center Boom

The U.S. Federal Energy Regulatory Commission recently approved a waiver request by utility NextEra to restart its Duane Arnold nuclear power plant in Iowa by year-end 2029. The decision comes amid surging electricity demand driven by data centers. The plant, which was decommissioned in 2020, could bring 600 megawatts (MW) of electricity-generating capacity back online.6 Constellation Energy is evaluating whether to add next-gen nuclear reactors to its Clinton Clean Energy Center in Illinois, which currently has 1,121MW of capacity and will supply Meta exclusively starting in 2027.7 These projects highlight how nuclear and renewable energy producers can be well positioned to benefit from rising electricity and data center demand as tech companies increasingly contract both energy sources to expand and diversify their clean energy portfolios. Amazon, Meta, Microsoft, and Google accounted for 43% of all clean power purchase agreements signed in 2024.8

Cloud Computing

More Multi-Billion-Dollar Cloud Deals as AI Demand Soars

Google secured a six-year, $10 billion-plus cloud computing agreement with Meta, its biggest cloud deal to date. Meta will use Google Cloud servers, storage, networking, and related infrastructure to support its rapidly expanding AI initiatives, including personal superintelligence.9 For Google, the pact adds momentum to its Cloud unit, which is working to gain ground on established rivals such as Amazon Web Services (AWS) and Microsoft Azure. Earlier this year Google also won cloud business from OpenAI, which had previously relied heavily on Microsoft’s Azure infrastructure.10 More broadly, the agreement highlights the scope of AI compute demands, which have rivals collaborating. It also signals that the cloud is not just infrastructure; it’s the linchpin enabling enterprise AI ambitions at scale.

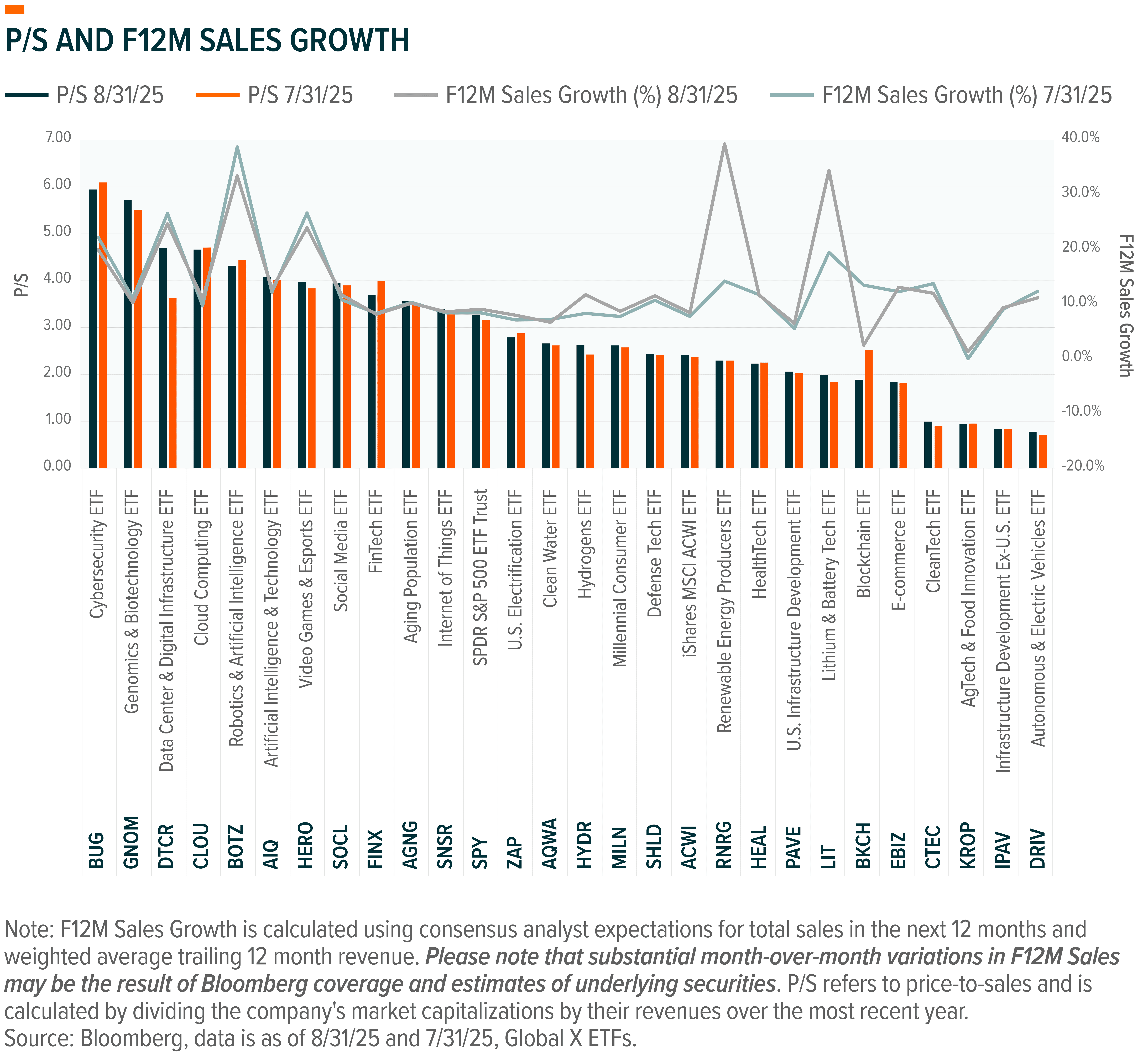

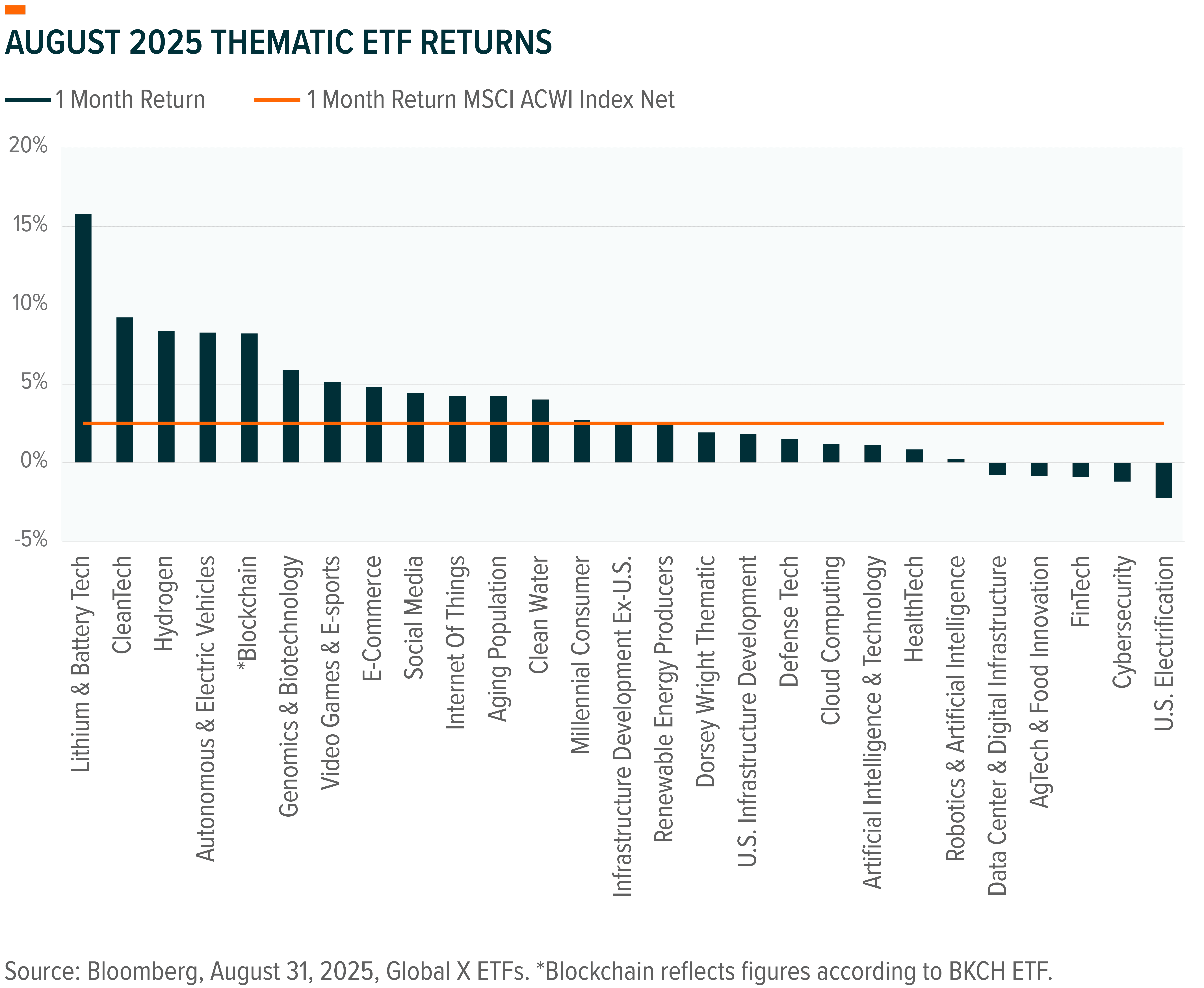

THE NUMBERS

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- The Next Big Theme: August 2025

- Investing in AI: Why Data Centers? Why DTCR?

- Inflection Points: Tales of The Automation Age

- Why Global Infrastructure? Why IPAV?

- A Decade of Change: How Tech Evolved in the Last Five Years and Bold Bets for the Next Five

ETF HOLDINGS AND PERFORMANCE

To see individual ETF holdings and current performance across the Global X Thematic Suite, including information on the indexes shown, click these links:

- Disruptive Technology: Artificial Intelligence & Technology ETF (AIQ), Blockchain ETF (BKCH), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), Data Center & Digital Infrastructure ETF (DTCR), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Defense Tech ETF (SHLD), Internet of Things ETF (SNSR), Social Media ETF (SOCL), U.S. Electrification ETF (ZAP)

- Consumer Economy: Millennial Consumer ETF (MILN), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), HealthTech ETF (HEAL)

- Infrastructure & Environment: U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), AgTech & Food Innovation ETF (KROP), Infrastructure Development ex-U.S. ETF (IPAV)

- Digital Assets: Blockchain & Bitcoin Strategy ETF (BITS), Bitcoin Trend Strategy ETF (BTRN)

- Multi-Theme: Dorsey Wright Thematic ETF (GXDW)