Cybersecurity

Breaches Boom, Governments Respond

Australian telecommunications company Optus came under fire in September after a hacker released personal data on 9.8 million customers, including 2.1 million government identification numbers.1,2 Following the breach, Prime Minister Anthony Albanese’s administration is pursuing reforms, including increased penalties under the country’s Privacy Act.3 In the U.S., the Cybersecurity and Infrastructure Security Agency (CISA) released its request for information (RFI) about mandating organizations to report significant cybersecurity incidents within 72 hours and ransomware payments within 24 hours.4 The European Commission published a draft regulation detailing cybersecurity requirements for products with digital elements (PDEs).

M&A Continues to Surge

With demand for digital defense surging, mergers and acquisitions (M&A) activity remains high within the cybersecurity industry. Crowdstrike Holdings acquired Reposify, which provides external attack surface management (EASM). Qualys acquired Blue Hexagon to integrate artificial intelligence (AI) and machine learning technology onto their platform. Palo Alto Networks is reportedly closing in on a deal to acquire Israeli startup Apiiro, which offers risk visibility and control technology across businesses.5

Electric Vehicles

2022 to Marks New Milestones, Including Record Global Sales

The International Energy Agency’s (IEA) Tracking Clean Energy Progress update highlighted that global sales of EVs are expected to hit an all-time high in 2022, reaching 13% of total light duty vehicle sales.6 At the company level, Tesla delivered 343,830 electric vehicles in Q3, well above the 241,300 units the company delivered for the same period last year. On the policy front, California imposed stricter clean car rules, including a ban on gasoline cars by 2035.7 By then, 100% of new cars and light trucks sold in the state should be zero-emission vehicles (ZEVs), including plug-in hybrid electric vehicles (PHEVs).8 These measures will go into effect starting in 2026, when 35% of automakers’ output must be ZEVs and PHEVs.9

Robotics & Artificial Intelligence

AI Making Strides Across Industries

Tesla introduced the latest prototype of its new humanoid robot, Optimus, at the company’s AI Day. Tesla said the robot should cost less than $20,000.10 Optimus’ functionality stems from its ability to perform mundane tasks that humans may not be available to or want to do. The robot could help Tesla lower operating costs in its facilities, especially on a larger scale. Also, Optimus’ underlying technology could mean progress on Tesla’s autonomous driving software. AI leader Nvidia introduced the Nvidia IGX platform for high-precision edge AI. The goal of the platform is to provide safety and improve human machine collaboration in sensitive industries, such as manufacturing, logistics, and healthcare.

Genomics

Alnylam Seeks Approval for Amyloidosis Drug

Leading RNAi therapeutics company Alnylam Pharmaceuticals announced the latest results from its APOLLO-B Phase 3 study of patisiran, an investigational RNAi therapeutic for the treatment of transthyretin-mediated amyloidosis with cardiomyopathy. The results suggested that patisiran is correlated with positive results on key measures of cardiac stress and injury. Patisrin also performed favorably to the placebo in trials, increasing its legitimacy. The drug is already approved for ATTR polyneuropathy, another subtype of ATTR amyloidosis. ATTR polyneuropathy affects 50,000 worldwide, while the cardiomyopathy subtype affects over 300,000.11 Alnylam wants to file for supplemental FDA approval by year-end.

Metaverse

Companies Advancing the Virtual Realm

Sony announced plans to produce 2 million units of the PlayStation VR2 headset by March 2023.12 This goal is ambitious, but mass production of the VR goggles began in September and has yet to face supply chain constraints. Walmart entered the metaverse with two experiences designed to engage with the newest generation of consumers in a post-pandemic economy. Walmart Land and Walmart Universe of Play will be on Roblox’s gaming platform. Alibaba introduced an interactive luxury shopping experience through its upscale commerce marketplace, Tmall Luxury Pavilion. The company hosted an augmented reality (AR) fashion show in September, during which consumers could acquire a Meta Pass to access deals from designers.

Internet of Things

R&D Deal to Boost U.S. Supply

The U.S. Department of Commerce’s National Institute of Standards and Technology (NIST) signed a cooperative research and development (R&D) agreement with Google to produce chips that researchers can use to develop new nanotechnology and semiconductor devices. NIST will design up to 40 different kinds of circuitry for the chips, which will be open source. With this agreement, academic and small business researchers will be able to use the chips without legal or financial restriction. By sourcing a domestic supply of affordable chips for R&D, researchers can better tap into their innovative potential.13 The new chips will be paid for by Google and manufactured by Skywater Technology.

THE NUMBERS

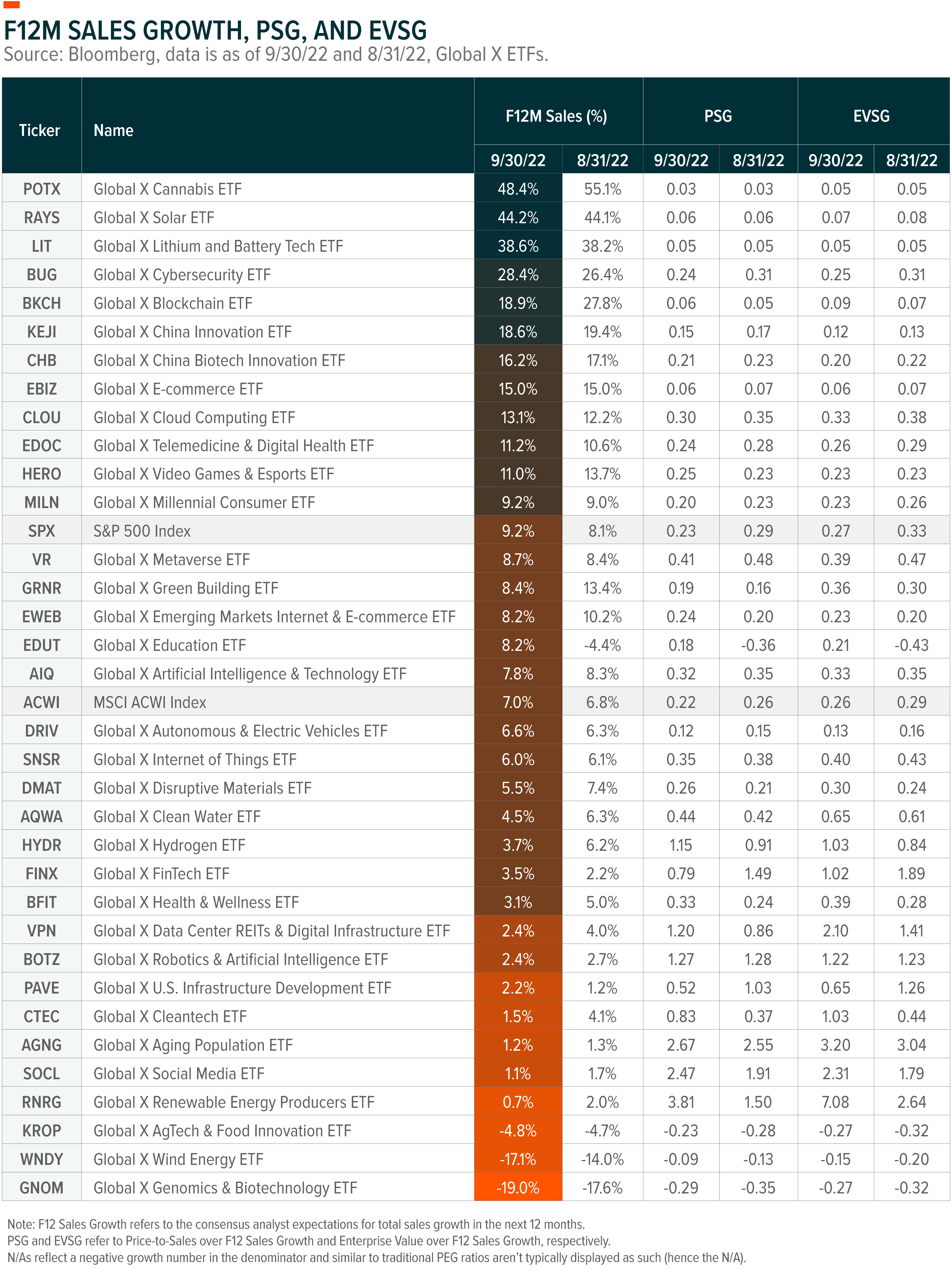

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs.

INTRO TO THEMATIC INVESTING COURSE – ELIGIBLE FOR CE CREDIT

Global X has developed an interactive, self-guided Intro to Thematic Investing course, that is designed to share the latest ideas and best practices for incorporating thematic investing into a portfolio.

This program has been accepted for 1.0 hour of CE credit towards the CFP®, CIMA®, CIMC®, CPWA® or RMA certifications. To receive credit, course takers must submit accurate and complete information on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

For Canadian course takers: This program has been reviewed by FP Canada and qualifies for 1 FP Canada-Approved CE Credit, in the category of Product Knowledge, towards the CFP® certification or QAFP™ certification. To receive credit, course takers must submit accurate and complete information (including Job Title) on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

Questions on receiving CE credit may be sent to: Education@globalxetfs.com

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- Climate Week NYC 2022: “Climate Is the New Beta”

- Global X ETFs Survey: Future of Work

- Is Thematic Growth a Crazy Response to High Inflation?

- Conversational Alpha®: Fintech is Revolutionizing Money

- The Merge: Supercharging Ethereum

ETF HOLDINGS AND PERFORMANCE:

To see individual ETF holdings and current performance across the Global X Thematic Growth Suite, including information on the indexes shown, click the below links:

- Disruptive Technology: Artificial Intelligence & Technology ETF (AIQ), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Internet of Things ETF (SNSR), Social Media ETF (SOCL), China Biotech Innovation ETF (CHB), Data Center REITs & Digital Infrastructure ETF (VPN), Emerging Markets Internet & E-Commerce ETF (EWEB), AgTech & Food Innovation ETF (KROP), Blockchain ETF (BKCH), Blockchain & Bitcoin Strategy ETF (BITS), Metaverse ETF (VR)

- People and Demographics: Cannabis ETF (POTX), Millennial Consumer ETF (MILN), Health & Wellness ETF (BFIT), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), Telemedicine & Digital Health ETF (EDOC), Education ETF (EDUT)

- Physical Environment: U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), Disruptive Materials ETF (DMAT), Green Building ETF (GRNR)

- Multi-Theme: Thematic Growth ETF (GXTG), China Innovation ETF (KEJI)

Tejas Dessai

Tejas Dessai