Artificial Intelligence

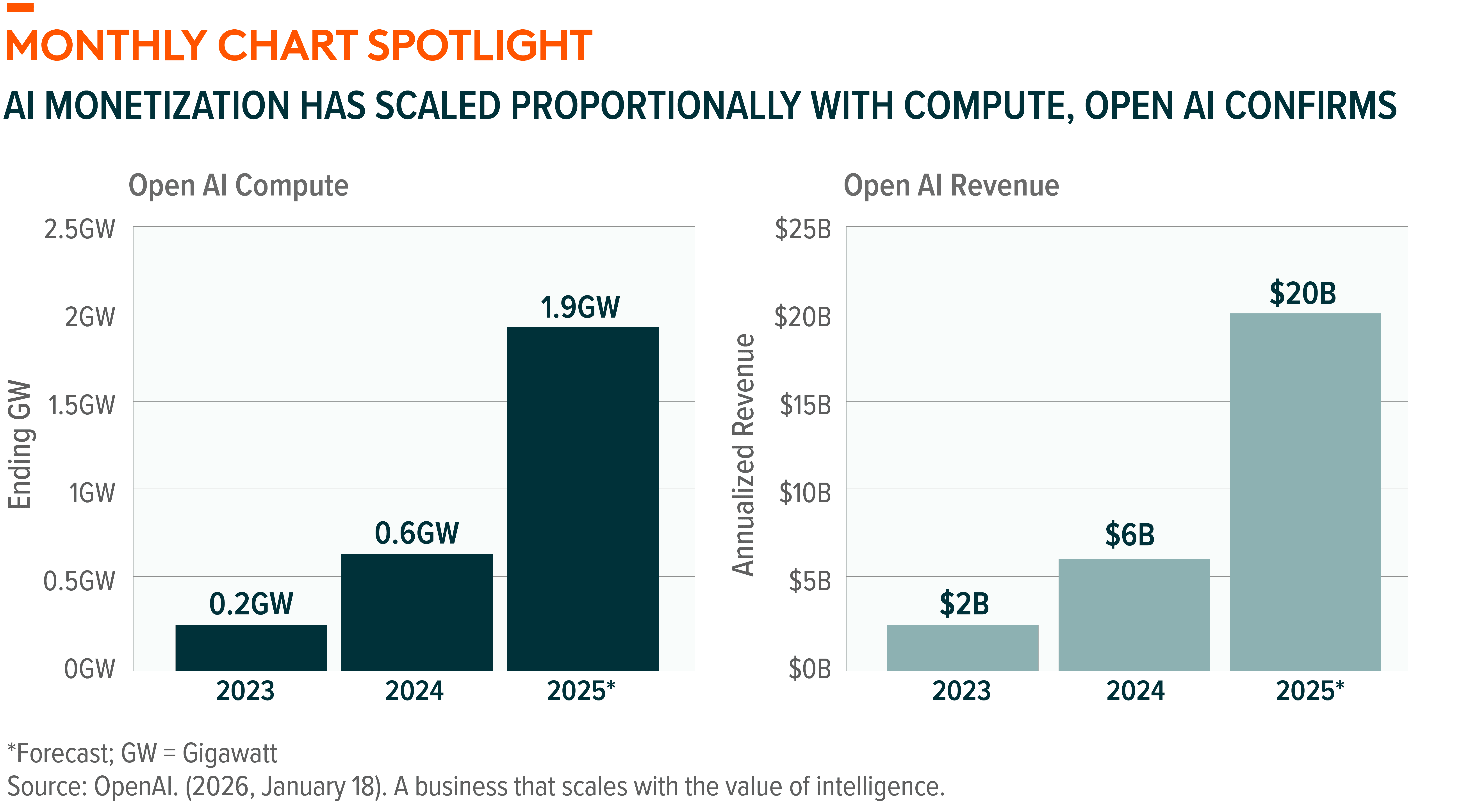

OpenAI Signals AI Monetization Momentum

OpenAI’s recent research highlights clear, quantifiable evidence of AI monetization momentum, showing how usage and revenue have tracked closely with expanded compute capacity — a key metric linking adoption to commercial growth. Over the past three years, OpenAI’s compute capacity scaled roughly 3x year-over-year, growing from 0.2 gigawatts (GW) in 2023 to 0.6 GW in 2024 and an estimated 1.9 GW in 2025. The company’s revenue followed the same trajectory, rising from about $2 billion in 2023 to $6 billion in 2024 and over $20 billion estimated in 2025. This alignment demonstrates that as more compute became available, more users and enterprises adopted OpenAI’s products and generated revenue through consumer subscriptions, team plans, and usage-based APIs tied directly to outcomes delivered. The company emphasizes that monetization scales with real value delivered, meaning pricing grows only as models become more capable and integrated into workflows, a powerful signal of increasing monetization visibility and robust demand for AI intelligence across use cases.1

![]()

Defense Technology

Record U.S. Defense Spending Proposal Prioritizes Advanced Tech

U.S. defense could enter a new expansion phase under the Trump administration’s proposal for a roughly 50% increase in the fiscal year 2027 military budget. At roughly $1.5 trillion, the plan prioritizes modernizing military capabilities, including advanced weapons systems, missile defense, space and cyber capabilities, shipbuilding, and next-generation aircraft. The proposal could also incentivize defense contractors to prioritize production capacity and industrial investment as part of a push to strengthen the domestic defense industrial base.2 The budget increase would further widen the gap between U.S. defense spending and that of other major powers, reinforcing America’s position as the world’s largest military spender. While still subject to legislative approval, the proposal underscores the growing strategic importance of defense, aerospace, and national security technologies, and the potential long-term implications for contractors, supply chains, and capital allocation across the defense tech sector.3

![]()

Autonomous & Electric Vehicles

U.S. Robotaxi Market Advances as Waymo Expands Its Footprint

Alphabet’s Waymo officially launched its fully driverless robotaxi service in Miami, expanding into its sixth U.S. city and strengthening its positioning in autonomous ride-hailing. The initial 60-square-mile service area covers highly populated neighborhoods, though not South Beach just yet. The company plans to expand to highways and Miami International Airport later this year. About 10,000 area residents have signed up for rides, which they will hail through Waymo’s app. The company will invite new users gradually before rolling out broader public access. The launch leverages years of testing and an extensive safety record across other cities, where Waymo has logged millions of autonomous miles and demonstrated a lower serious-injury rate than human drivers. The launch also intensifies competition in the autonomous services space as rivals like Tesla and Zoox advance their own robotaxi programs. Waymo plans to expand to more U.S. and international cities as its network scales.4

![]()

U.S. Infrastructure

Infrastructure Planning Momentum Is Building

The Dodge Momentum Index, a leading indicator of nonresidential construction planning that typically precedes actual construction spending by 12–18 months, grew 7% in December 2025 to 296.8, up from November’s revised reading of 277.4. Both commercial planning (+3.5%), which includes nonresidential projects like warehouses and office buildings, and institutional planning (+14.9%), which includes public buildings like hospitals, contributed to the monthly gain. For the full year, the index finished 37% higher than in 2024, with commercial planning up 35% and institutional up 43%. December’s year-over-year growth was even stronger at 50% higher than December 2024, underscoring broad expansion across segments. The data center industry remains a notable structural driver, with U.S. data center construction approaching $45 billion on an annualized basis. Forecasts suggest that nonresidential construction starts will continue accelerating through 2027, supported by sustained planning momentum and inflationary pressures that bolster nominal activity despite economic risks.5

![]()

AI Semiconductors

AI Demand Is Rewriting the Memory Market

The rapid expansion of AI infrastructure has demand for AI-optimized memory such as high-bandwidth memory (HBM) accelerating sharply. Manufacturers shifting capacity toward higher-value AI workloads has tightened supply in legacy Dynamic Random Access Memory (DRAM), supporting healthier pricing and improved industry economics. Average selling prices for conventional DRAM have increased in 2026. At the same time, elevated investment in AI-driven memory technologies reinforces long-term growth opportunities for suppliers across training and inference workloads. While capacity adjustments will take time, the current dynamic underscores how AI is reshaping memory demand and improving visibility into future pricing and profitability.6 Overall, AI-led demand tailwinds are driving stronger utilization, better pricing power, and a structurally more favorable outlook for the memory market and the broader semiconductor ecosystem.

![]()

Lithium & Battery Tech

U.S. Lithium Processing Capacity Takes a Leap Forward

Tesla began operations at what it describes as the first major lithium refinery in the United States, an important step for the domestic lithium and battery technology ecosystem. Located near Corpus Christi, Texas, the Tesla Lithium Refinery processes spodumene ore into battery-grade lithium hydroxide by using a high-efficiency refining process designed to lower costs and emissions. Roughly two years after groundbreaking, the refinery comes online as demand for lithium continues to rise alongside global electric vehicle adoption and grid-scale storage build-out. Strategically, it should help reduce reliance on overseas lithium processing, strengthening supply chain resilience. The project underscores accelerating investment across the lithium value chain—from raw materials to downstream processing—reinforcing long-term growth prospects for localized battery infrastructure and the lithium producers, refiners, and battery tech providers tied to electrification.7

![]()

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- The Next Big Theme: January 2026

- CES 2026: AI and Robotics Shift from Hype to Deployment

- CES 2026: Autonomous Driving Hits an Inflection Point

- Inflection Points: Five Risks for 2026 Keeping Us Awake

- A Thematic Playbook to Invest in the AI Ecosystem

THEMATIC ETF LINEUP

To see individual ETF holdings and current performance across the Global X Thematic Suite, including information on the indexes shown, click these links:

- Disruptive Technology: Artificial Intelligence & Technology ETF (AIQ), Blockchain ETF (BKCH), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), AI Semiconductor & Quantum ETF (CHPX), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), Data Center & Digital Infrastructure ETF (DTCR), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Defense Tech ETF (SHLD), Internet of Things ETF (SNSR), Social Media ETF (SOCL)

- Consumer Economy: Millennial Consumer ETF (MILN), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), HealthTech ETF (HEAL)

- Infrastructure & Environment: U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers ETF (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), AgTech & Food Innovation ETF (KROP), Infrastructure Development ex-U.S. ETF (IPAV), U.S. Electrification ETF (ZAP)

- Digital Assets: Blockchain & Bitcoin Strategy ETF (BITS), Bitcoin Trend Strategy ETF (BTRN)

- Multi-Theme: Dorsey Wright Thematic ETF (GXDW)