Blockchain

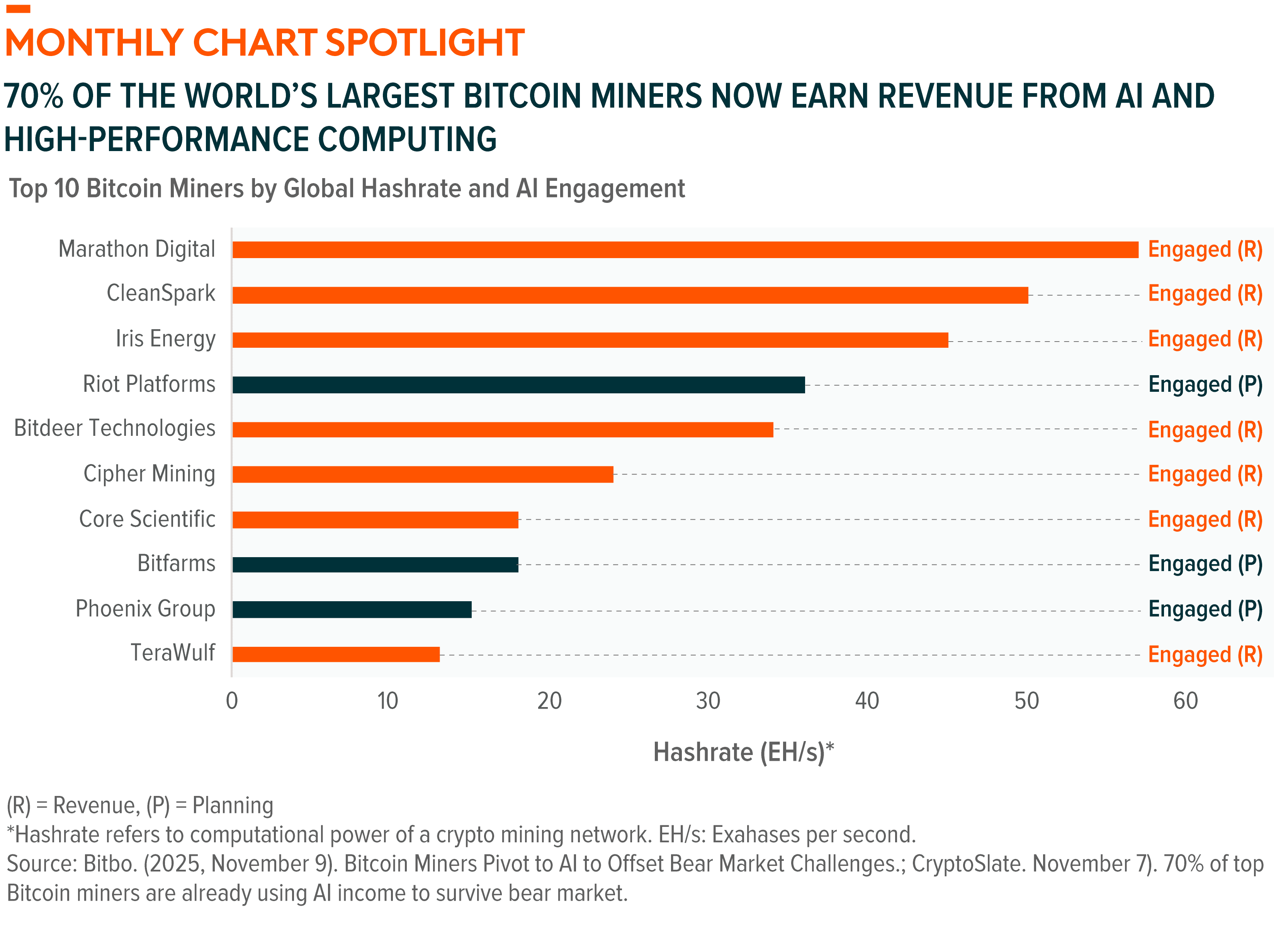

Blockchain Infrastructure Converges with AI, Diversifying Revenue Streams

A major but underappreciated driver of recent blockchain momentum has been the accelerating convergence between blockchain infrastructure and the AI buildout. As demand for high-performance computing (HPC) overwhelms traditional data center capacity, Bitcoin mining firms, which historically focus on energy-intensive, application-specific chips, are pivoting toward graphics processing unit (GPU) chips to support AI workloads. In October, Cipher Mining secured a 15-year, $5.5 billion lease agreement with Amazon Web Services (AWS) to supply 300 megawatts of capacity for AI workloads. The project includes both air and liquid-cooled racks and will be delivered in two phases starting in July 2026, with rent payments beginning the following month.1 Applied Digital also secured a $5 billion, 15-year lease with a nondisclosed U.S.-based hyperscaler for its AI data center campus in North Dakota, marking a significant step in its strategic shift from purely blockchain infrastructure to serving the growing demand for AI and HPC resources.2

![]()

Artificial Intelligence

AI Infrastructure Deals Propel Global Buildout

OpenAI entered a seven-year, up-to-$38 billion agreement with Amazon Web Services (AWS) to purchase cloud services, a significant step in OpenAI’s infrastructure evolution following its recent restructuring. Under the deal, OpenAI will gain access to hundreds of thousands of NVIDIA graphics processors via AWS data clusters, enabling large-scale model training and inference. The deployment is slated to be fully operational by the end of 2026, with the potential for expansion into 2027 and beyond. For AWS, the contract is a major endorsement of its cloud-compute capabilities and has helped lift investor confidence. Meanwhile, OpenAI’s mission to scale frontier AI is underscored by plans to invest roughly $1.4 trillion in computing resources—enough, by its estimate, to power millions of U.S. homes.3 The agreement also signals a shift in OpenAI’s strategy, reducing its reliance on earlier partners and asserting greater operational independence in its march toward AI leadership.

![]()

Cybersecurity

Innovation Builds Around AI Agents

Palo Alto Networks launched Cortex Cloud 2.0, a big step toward automating cloud security with AI. The platform introduces a fleet of autonomous AI agents trained on 1.2 billion real-world responses that can investigate and resolve complex cloud threats in minutes, freeing security teams to focus on higher-value tasks. It also unifies cloud posture and runtime security via a redesigned Cloud Command Center, giving enterprises a single pane for visibility and prioritized risk workflows. The performance-optimized Cloud Detection & Response agent now uses up to 50% fewer resources, making deployment at scale more viable. A new Application Security Posture Management module further enables security teams to detect and fix vulnerabilities during development rather than in production.4 Taken together, these advances show cybersecurity moving beyond manual monitory toward autonomous, AI-driven defense at scale. As cloud risk grows in complexity and volume, innovations like these highlight the momentum behind using AI to transform how organizations protect their infrastructure.

![]()

Data Centers & Digital Infrastructure

AI Data Center Boom Accelerates, Fueled by Tech Titans

In October, the AI infrastructure boom surged into full view as major firms ramped up their data center commitments. Meta Platforms announced a $1.5 billion investment to build a new data center in El Paso, Texas, designed to scale to 1 gigawatt and support AI workloads, making it one of the largest planned U.S. campus-builds.5 The Stargate initiative, involving OpenAI, Oracle, and SoftBank Group, announced that its flagship Texas site in Abilene is now the epicenter of a planned multi-gigawatt build-out across six U.S. campuses. Oracle alone is nearing a record-setting $38 billion debt deal to fund expansions in Texas and Wisconsin.6 In its most recent reported earnings quarter, Microsoft disclosed that it spent $11.1 billion on data centers leases. The company, which had more than 400 data centers at the end of fiscal year 2025, expects to increase its AI capacity by more than 80% through fiscal year 2026 and roughly double its data center footprint within two years.7

![]()

U.S. Infrastructure

Micron’s Megafab Is a Milestone for U.S. Infrastructure

Micron Technology received a key approval for its planned $100 billion semiconductor manufacturing facility at the 1,400-acre park in Onondaga County, New York. The New York State Public Service Commission green-lit construction of a two-mile, 345-kilovolt underground transmission line with eight laterals, linking the existing substation to Micron’s future facility. The approval removes a major hurdle for the largest private investment in the state’s history and accelerates the site’s readiness for construction. The project is expected to create approximately 9,000 direct jobs at Micron, tens of thousands of union construction jobs, and over 50,000 permanent regional jobs over the coming decades, while driving regional economic output to over $16 billion by 2041. More broadly, this development underscores how large-scale infrastructure upgrades, especially in power delivery and utility systems, are advancing manufacturing growth and adding to the momentum in U.S. infrastructure investment.8

![]()

CleanTech

Global Investment Into Climate Tech Is Surging

The climate tech sector has reversed a multi-year investment slump. Global investment into clean technologies, such as clean energy, storage, and electric vehicles (EVs), totaled $56 billion during the first three quarters of 2025, surpassing the $51 billion invested in all of 2024. Notably, nuclear energy captured around one-fifth of all venture capital funding, spurred in part by the AI-driven boom in electricity demand.9 The investment drivers are also shifting, with a greater focus on cost-competitiveness, scale, and geostrategic energy infrastructure, rather than emissions alone. In addition to climate goals, investors are drawn to national-security and energy-independence themes, with major institutional players raising large funds for the clean energy transition. The breadth of the technology—from energy storage and hydrogen to nuclear and EVs—reflects the sector’s maturation and diversification.

![]()

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- Introducing Charting Disruption: Outlook for 2026 and Beyond

- Artificial Intelligence: The Race to Human-Level Reasoning

- Defense Technology: Shielding the Modern World

- Robotics & Physical AI: A New Era of Automation

- Infrastructure Development: Building for Innovation

ETF HOLDINGS AND PERFORMANCE

To see individual ETF holdings and current performance across the Global X Thematic Suite, including information on the indexes shown, click these links:

- Disruptive Technology: Artificial Intelligence & Technology ETF (AIQ), Blockchain ETF (BKCH), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), AI Semiconductor & Quantum ETF (CHPX), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), Data Center & Digital Infrastructure ETF (DTCR), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Defense Tech ETF (SHLD), Internet of Things ETF (SNSR), Social Media ETF (SOCL), U.S. Electrification ETF (ZAP)

- Consumer Economy: Millennial Consumer ETF (MILN), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), HealthTech ETF (HEAL)

- Infrastructure & Environment: U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), AgTech & Food Innovation ETF (KROP), Infrastructure Development ex-U.S. ETF (IPAV)

- Digital Assets: Blockchain & Bitcoin Strategy ETF (BITS), Bitcoin Trend Strategy ETF (BTRN)

- Multi-Theme: Dorsey Wright Thematic ETF (GXDW)